by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

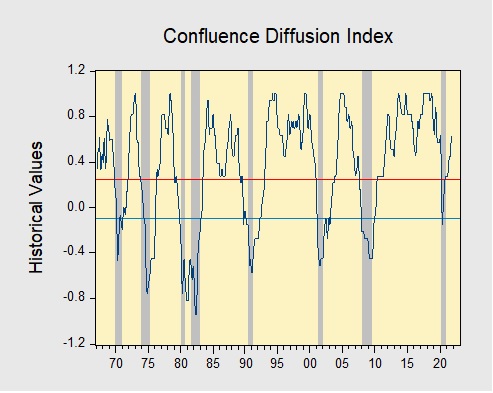

Good morning. Although U.S. risk markets are trying to stage a rally, U.S. equity futures are struggling to hold gains. The pattern for the week has been for overnight rallies to fail. It is a bearish pattern, as rallies seem to bring out selling. We suspect this pattern won’t last. Barring outright policy tightening by the Fed, there is a long-standing tendency for equities to rally into year’s end. We expect something similar this year too. But clearly, the combination of the Fed talking about withdrawing stimulus and the new Omicron variant are hurting investor sentiment.

Our coverage this morning begins with economics and policy. We have comments on the supply chain situation. Up next is China news, with notes on recent comments from Japan regarding Taiwan. Pandemic news comes next, and we close with the international roundup; the turmoil in Turkey continues.

Economics and policy: We lead with comments on the supply chain.

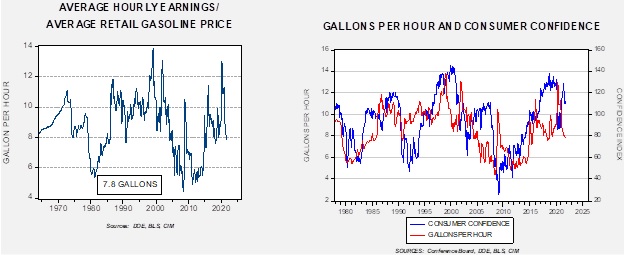

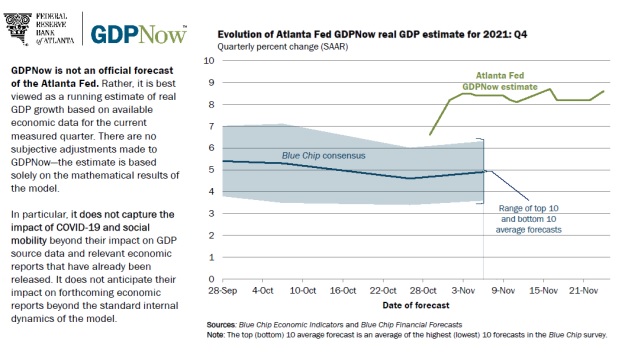

- Supply chain issues remain an important factor in the path of inflation. The rise in prices we have seen is a combination of supply constraints (shifting the supply curve to the left), demand stimulus from fiscal spending, and the wealth effect (shifting the demand curve to the right). We expect policy tightening next year. Although we have our doubts about the efficacy of QE on the economy, there appears to be a wealth effect factor, so ending the balance sheet expansion could adversely affect asset prices. Since GDP is a flow measure, there will be an unavoidable fiscal drag next year; simply put, we are not going to see another $4.0 trillion of emergency spending. Those factors should move the demand curve to the left, at least a bit. On the supply side, it’s not easy to get a clear picture of what is happening. The anecdotal evidence is mixed. There are reports that goods are starting to flow. Our own observations of local retailers suggest fewer out-of-stock labels. On the supply issue, we observe a couple of points.

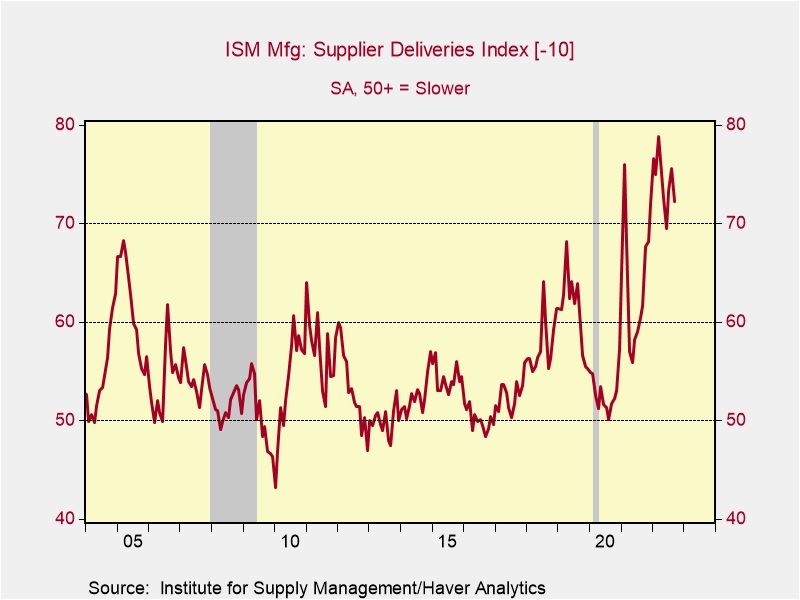

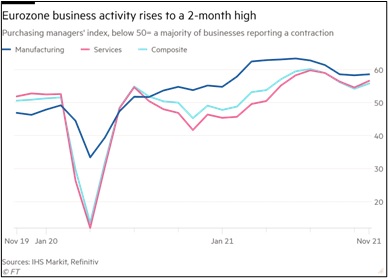

First, the ISM data suggests modest improvement; at least, conditions aren’t getting a lot worse.

Supplier deliveries showed some improvement last month. They are still elevated (we would like to see a number around 52 to confirm we have returned to normal) but are showing some signs of getting better.

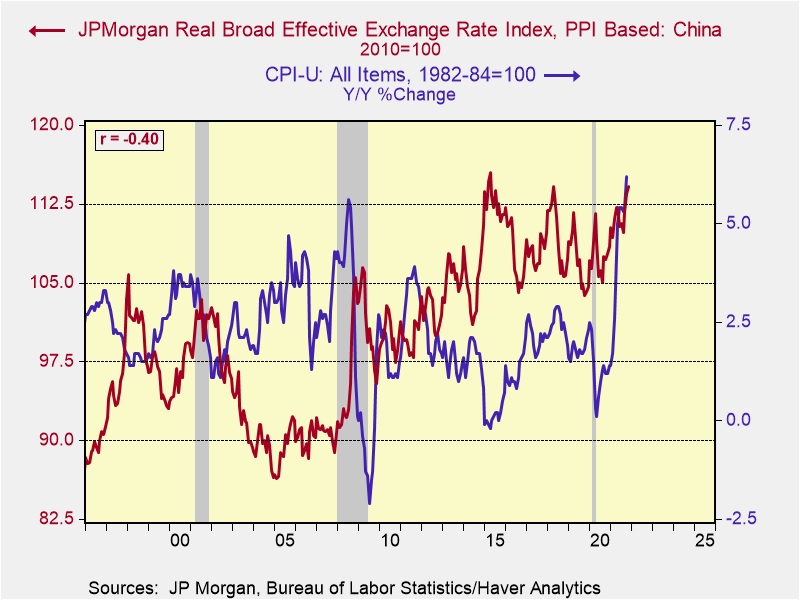

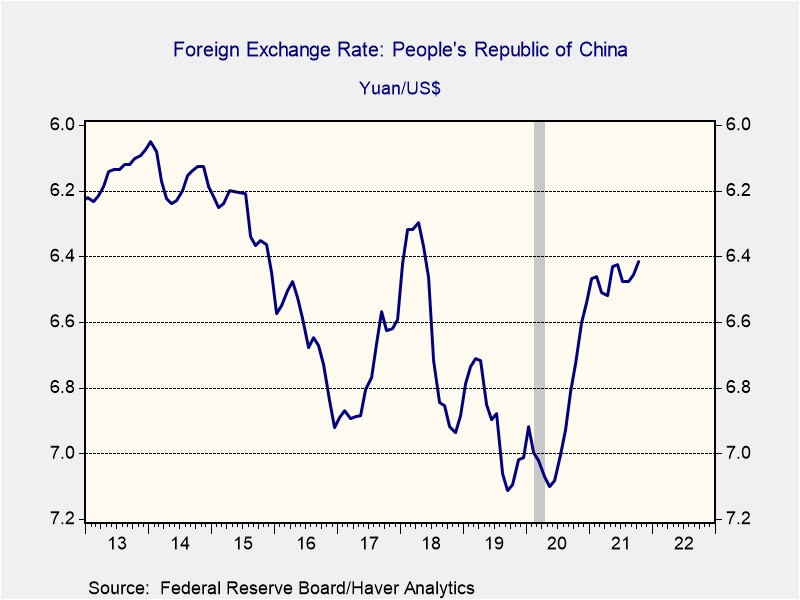

On the other hand, we need to take note of the fact that China’s impact on inflation may be shifting. For years, China exported deflation. It suppressed its labor costs and maintained an undervalued exchange rate. Although this policy played havoc on U.S. manufacturing, it kept inflation under wraps. Recently, the CNY has been appreciating, and there is a modest positive correlation between CPI and the CNY’s effective exchange rate.

If China continues to allow its exchange rate to appreciate, its exports will become more expensive. Over time, other nations may undercut China to gain access to U.S. markets. But given China’s size, the substitution impact may not be all the powerful. Although these results are preliminary, they suggest that (a) we will almost certainly see supply chains heal, which will bring down inflation from current levels, and (b) changes in labor markets and trade probably means trend inflation settles in at around 3% instead of 2% in the future.

- The Senate is continuing to struggle to avoid a government shutdown. Current funding will expire at noon Saturday, EST.

- The Fed’s Beige Book report suggests supply snarls are crimping growth.

- The OECD is forecasting higher inflation for the group of industrialized nations.

- The pandemic has caused changes to the economy and markets, and it is still uncertain which changes are permanent and which are temporary. The increase in self-employment has been significant. Technology has probably made this transition easier. It is also possible that the experience of the pandemic has re-sorted priorities. The idea of being one’s own boss has become more attractive. If this change is permanent, it will likely require firms to rethink hiring and processes; a corporation may become a manager of freelancers.

- The FTC has requested information from large distribution firms on supply-chain issues. At this point, the request appears to be more about gathering information and not about an enforcement action. However, it is possible that this study could bring policy recommendations designed to make the supply chain more resilient and likely more costly.

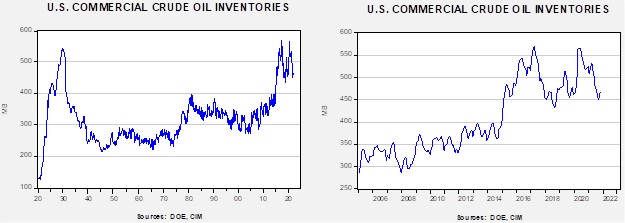

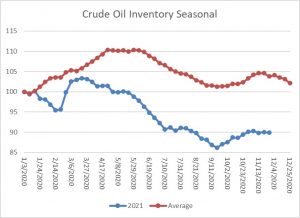

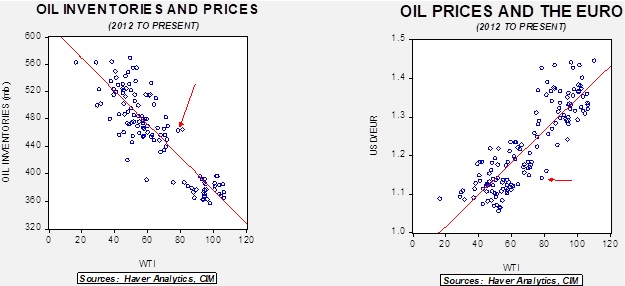

- Although there was speculation that OPEC+ wouldn’t increase production, as previously expected, due to COVID-19 concerns and the SPR release, Russia apparently is pushing to boost output. Oil prices have slid on the news.

- The House Financial Services Committee will host a group of crypto CEOs on December 8.

- Know someone looking for a career in high demand? There are 597,767 unfilled openings in cybersecurity.

China news: Comments from former PM Abe about Taiwan raise hackles, and the future of the variable interest entities is uncertain.

- As readers know, we are very concerned about the situation between China and Taiwan. However, an area that is another risk factor is Japan’s change in its stance on Taiwan. For years, Japan was non-committal on Taiwan; it supported the “one China” policy and generally didn’t question that China would eventually control the island. That is no longer the case. Japan has become increasingly active in defending Taiwan’s independence. This change in stance is partly due to Taiwan’s critical position in Japan’s defense. If Beijing controlled Taiwan, it could easily project power into the island chain, mostly controlled by Japan, which would lead China to the main Japanese islands. As Japan’s position hardens, it raises the risk that simmering tensions between Japan and China, which have been in place for centuries, trigger stronger reactions than currently expected.

- Former PM Abe raised tensions by suggesting a Chinese invasion of Taiwan would trigger an “emergency” for Tokyo.

- Variable interest entities (VIE) have been used by Chinese firms to list on U.S. markets. The structure creates a vehicle that gives the holder most of the rights of direct ownership but avoids Chinese rules about foreign ownership. Yesterday, there were reports that Beijing was going to end this practice, although officials in China denied that the VIEs were being eliminated. There is a chance China will prevent firms from using this tool to list in the U.S., but we suspect yesterday’s conflicting reports were a trial balloon from Beijing.

- Beijing has unveiled new rules on ride-sharing and tech advertising that suggest a deepening crackdown.

- Online fraud in China is growing rapidly.

- As readers know, we have been closely monitoring the growing divide between the U.S. business community and the political community over China. The former clearly wants to continue to do business in China, while the latter is moving headlong into separation. China has been trying to exploit this difference. Beijing’s most recent action is to encourage business leaders to oppose a boycott of the winter Olympics. Meanwhile, Ray Dalio has been making very public statements supporting investment in China. This position looks at odds with the general trends in public sentiment.

- The WTA has made it clear that professional tennis is willing to oppose China; the group has suspended tournaments in China over the Peng Shuai situation.

- China Electronics Corporation (BMG2122L1054, HKD, 0.71), an SOE, released a new messaging app that is designed for government agencies. Recently, the government told its workers to stop using private messaging services over security concerns.

- For years, Chinese students wanted to acquire a western college degree. It seemed this was the path to better jobs. That is apparently no longer the case, which is bad news for U.S. higher education.

- Reports suggest Chinese authorities are extending their surveillance of Chinese students in America, restricting their activities.

- China’s digital CNY is struggling to gain acceptance.

COVID-19: The number of reported cases is 263,655,098, with 5,227,696 fatalities. In the U.S., there are 48,692,582 confirmed cases with 782,100 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 575,721,925 doses of the vaccine have been distributed, with 462,263,845 doses injected. The number receiving at least one dose is 233,590,555, while the number receiving second doses, which would grant the highest level of immunity, is 197,363,116. For the population older than 18, 71.2% of the population has been fully vaccinated, with 59.4% of the entire population fully vaccinated. The FT has a page on global vaccine distribution.

- The Omicron variant has been detected in the U.S. The good news is that the infected person suffered a mild case. The person had been vaccinated but had not received the booster. Although authorities warned the new variant was likely already in the U.S., the news sent risk markets lower yesterday.

- Reporting from the WSJ details an expected tradeoff; states that had stricter rules in dealing with the virus had fewer fatalities but weaker economic growth. States with looser rules had more people die but their economies did better. Although this tradeoff makes intuitive sense, the data in this article confirms the tradeoff notion.

- The OECD is warning that the Omicron variant may affect supply chains.

- The U.S. will require foreign visitors to have WHO-approved vaccines. International travelers will face new test requirements, and the mask mandate has been extended. The U.S. will also reimburse for home test kits for COVID-19.

- Germany is tightening restrictions to contain the new virus.

International roundup: Turkey’s turmoil deepens, and the U.S. and EU try to contain Russia’s threats against Ukraine.

- Yesterday, Turkey’s central bank intervened to slow the decline of the TRY’s depreciation. The currency is falling again this morning after the country’s finance minister, Lutfi Elvan, resigned and was replaced by regime loyalist Nureddin Nebati. Nebati is close to President Erdogan’s son-in-law and former finance minister Berat Albayrak. Elvan was the last orthodox holdout. By replacing him, Erdogan has eliminated all opposition to this unorthodox policy of cutting interest rates to reduce inflation.

- U.S. and EU security and international relations officials are meeting over the situation in Ukraine. SoS Blinken is warning Putin over his aggression and calling to defuse the current tensions. What does Putin want? It appears he wants a rollback of NATO away from Russia’s borders. Russia’s geopolitics revolve around creating buffers to force invaders to march long distances and then allow the Arctic winter to end offensives. Preventing Ukraine from joining NATO is likely the goal.

- The EU is restricting asylum rights on the Belarus border, likely to discourage refugees from lingering in Belarus.

- Russia and the U.S. are expelling diplomats. In June, the U.S. expelled 50 Russian diplomats over hacking and election interference. These actions usually result in a similar action by the Russians.

- The U.S. and South Korea are updating war contingency plans over South Korea. The action appears tied to recent short-range missile tests by North Korea.

- The EU has revealed its response to China’s belt and road project, with a €300 billion program to support development.

- The U.S. and U.K. have not resolved steel tariffs, but underlying this inaction is the U.S. reluctance to make a trade deal with Britain, worried that the U.K. will break the Good Friday Agreement regarding the border with Northern Ireland.