by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning, happy Monday, and welcome to November! It’s going to be a busy week. The ISM manufacturing data is out this morning. The FOMC meets this week and will likely announce its tapering plans. We may also get a vote on the budget and infrastructure package this week. COP26 kicks off today. Our coverage begins with the international roundup, which previews the COP26 and recaps the G-20 weekend meeting. Economics and policy are up next, with inflation and central banks leading the headlines. China news follows, and we close with the pandemic update.

International roundup: The G-20 met over the weekend, and COP26 starts today.

- The G-20 meeting over the weekend was a mixed bag. As we noted last week, the U.S. and EU avoided a tariff spat over steel. However, any hopes of a climate agreement among the world’s largest nations were mostly dashed. All the nations agreed that climate change was a problem, but there was no notable consensus on what to do about it. The U.S. was pushing to end coal usage; all that emerged was an agreement to stop funding international coal-fired electricity Coal producers and consumers opposed the plan to end the burning of coal. President Biden blamed China and Russia for the lack of progress. International environmental goals suffer from the free-rider problem. Simply put, all are better off by adjusting, but a single participant does best by doing nothing and “riding” on the actions of others. If all act in that fashion, nothing gets done.

- There was an agreement on a minimum corporate tax rate of 15%. The agreement also distributes taxes based on revenue generated in individual nations. The goal is to undermine the incentive to “jurisdiction shop” to avoid taxes. The U.S. was successful in getting nations to back away from proposed digital services taxes, which would have fallen heavily on U.S. tech. It should be noted that the tax distribution clause is considered a treaty and thus requires a 2/3 majority in the Senate. There is little chance of that happening. Without the distribution approval, the digital taxes will likely go forward. Thus, GOP senators will be lobbied hard by the tech industry.

- President Biden and President Macron of France met to smooth over tensions triggered by the nuclear sub deal with Australia. It appears the two leaders made up, but the underlying issues remain, specifically, the U.S. is shifting focus to Asia, and the EU is going to be less important to American interests.

- For the next two weeks, the 26th meeting of the Conference of the Parties (COP26) will be held in Glasgow, Scotland. It is an annual climate meeting that was postponed last year. The official business is to monitor the progress of the Paris Agreement on climate goals. As noted in the above discussion of the G-20, there is an almost insurmountable free-rider problem. Every nation wants something done on climate but paid for by someone else.

- The LDP held its majority in legislative elections over the weekend, confirming that Fumio Kishida will remain in power. We will analyze the new PM in an upcoming WGR.

- The fishing wars between France and the U.K. are showing no signs of abating. Paris is trying to drum up EU action against the U.K. on this issue.

- The Persian Gulf Arab states pulled their ambassadors from Lebanon. The current government in Lebanon is seen as supporting Iran, and recent criticism from Lebanon over the Yemen war prompted the withdrawal.

- There has been a coup in Sudan. Large protests against the new government developed over the weekend.

- South Africa is holding local elections today. The ANC has become increasingly unpopular, and this vote will be seen as a test of future support.

Economics and policy: The budget and central banks lead the news.

- There is rising optimism that a vote might come soon on the budget and the infrastructure package. Negotiations have continued to include drug cost containment.

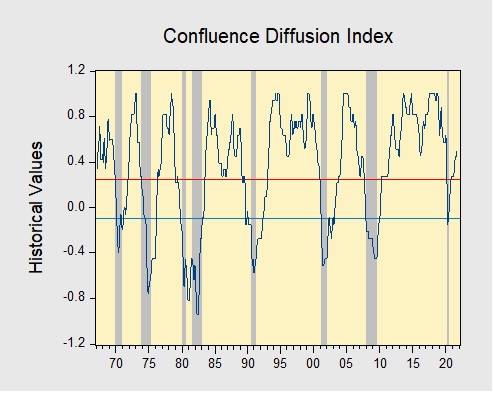

- Financial markets around the world are pricing in central bank tightening. We are also seeing the yield curve flatten, suggesting markets expect the central banks to step in and raise rates; this action will slow economic growth. The latest jump in rates was seen in Australia, where the central bank decided not to defend its previous yield curve control measures, leading to a rapid rise in interest rates. The 3-year Australian sovereign has moved from 20 bps to 100 bps in the past month. The Bank of Canada recently surprised the markets by abruptly ending its QE.

- The consensus appears to be that the markets will force the central banks to raise rates, and policy tightening will increase the risk of recession. This is seen by the tumult in short-term parts of the yield curve and the lack of reaction on the long end. We are still not convinced that the Fed will bow to market pressure. Powell still wants to get reappointed to Chair, and raising rates won’t help with that goal. But, for now, that is the market’s position.

- A key element to the market’s position is the persistence of inflation. Wage pressures are unrelenting. Much of the low inflation of the past 40 years was based on wage suppression through offshoring, automation, and flexible scheduling (gig work). The ride-sharing companies are forced to lift pay to attract workers. Since these companies are not profitable anyway, the business case for these firms looks rather shaky. The loss of baby boomers to retirement appears to be a key factor in tightening labor markets.

- The strike at John Deere (DE, USD, 342.31) may be nearing an end. The union leadership and the company have come to a deal, but it still needs to be ratified by the rank-and-file. The vote will be held tomorrow.

- The port problems continue. Logistical snarls simply are not improving. The supply chain rested on a large number of low-paid workers, and the lack of available labor is forcing the entire chain to scramble for workers. Higher pay looks like an inevitability.

- American Airlines (AAL, USD, 19.20) canceled over 600 flights yesterday due to the lack of staffing.

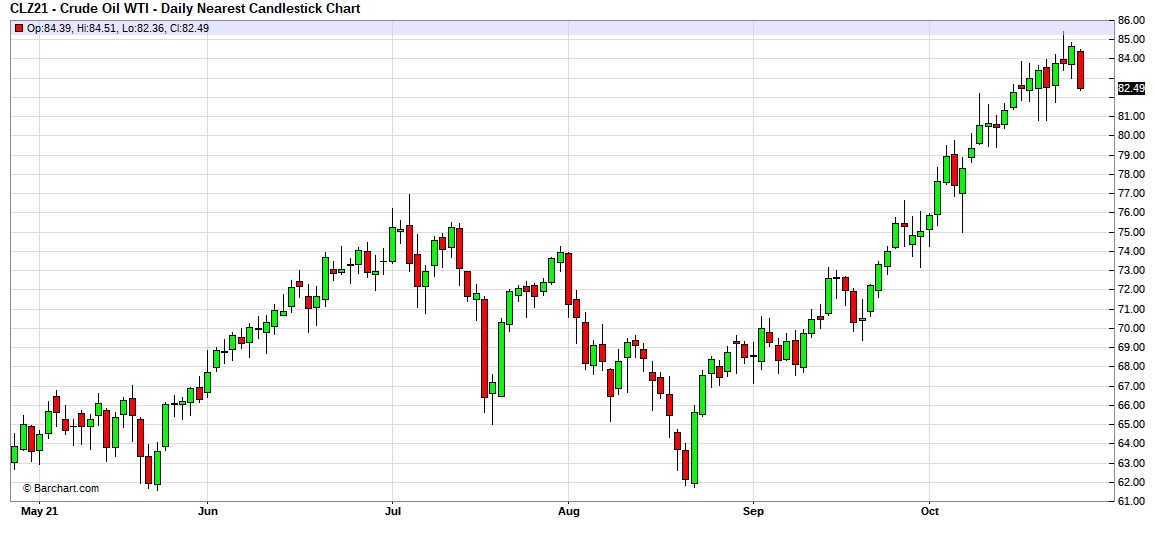

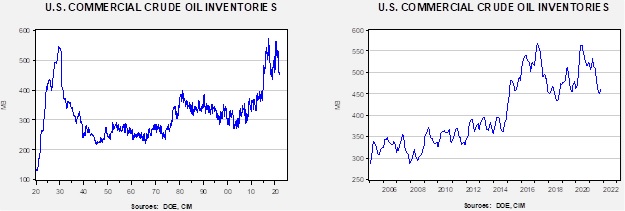

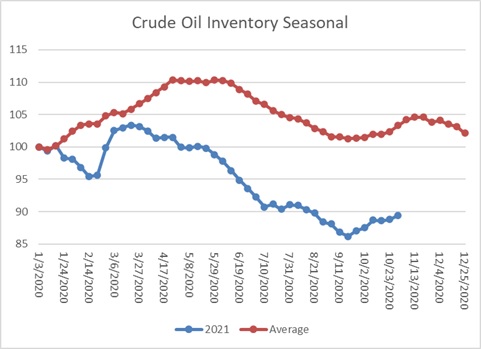

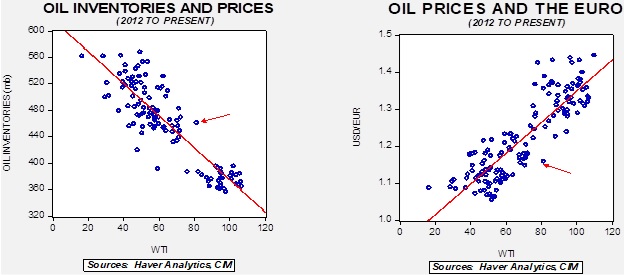

- Inflation has come to breakfast foods. Prices for common items consumed at this meal are at 10-year highs. Meanwhile, DOE Secretary Granholm is blaming OPEC for high gasoline prices.

- As semiconductor chip shortages led to slower production of autos and appliances, firms that supply low-tech materials are seeing their demand decline.

- One of the more interesting op-eds from the weekend comes from the junior senator from Missouri, Josh Hawley (R-MO). His premise is that global supply chains are broken, and something akin to industrial policy will be required to fix them. This means reshoring production and using domestic content rules to ensure that most things are produced in the U.S. The industrial policy used to come from Democrats. We also note that recent comments from Sen. Rubio (R-FL) suggest the GOP should abandon “big business” and focus on the working class. Such proposals have been circulating for some time, but the fact such ideas are coming from GOP senators shows party constituents are in flux.

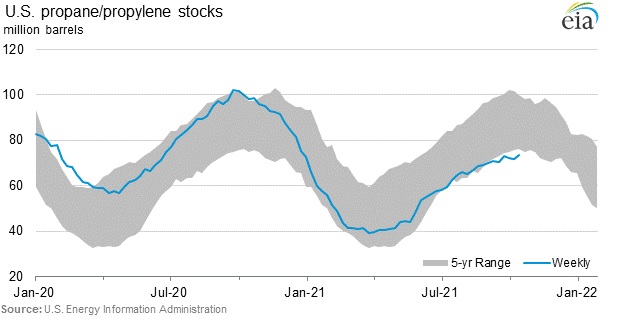

- Last week, natural gas prices in Europe fell on reports Russia was going to boost production. However, we note that Russia reversed the flow of a natural gas pipeline to Europe, which led to a withdrawal of gas from the EU.

China news: PMIs were soft, and real estate remains a worry.

- Manufacturing PMI data for October show continued slow economic activity. The data are not signaling a recession, but growth is barely at trend. Power problems and the ongoing issues in real estate are plaguing the manufacturing sector.

- Evergrande (EGRNF, USD, 0.31) made another bond payment, staving off default yet again. However, there is no indication that this process can continue. Local and provincial governments have funded themselves with land sales. As that source is cut off, bonds issued by these entities will likely come under strain.

- The U.S. is moving forward on delisting Chinese stocks from U.S. exchanges.

- China is reportedly rationing fuel supplies at gas stations. If the U.S. experience is any guide, expect unruly crowds and shortages.

- China’s EV sales in Europe are rising.

COVID-19: The number of reported cases is 246,815,047, with 5,001,932 fatalities. In the U.S., there are 45,971,267 confirmed cases with 745,836 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 518,696,735 doses of the vaccine have been distributed, with 422,070,099 doses injected. The number receiving at least one dose is 221,520,153, while the number receiving second doses, which would grant the highest level of immunity, is 192,453,500. For the population older than 18, 69.6% of the population has been vaccinated. The FT has a page on global vaccine distribution.

- Declassified U.S. intelligence reports build a circumstantial case that poor security could have led to the creation and distribution of COVID-19.

- We are seeing accumulating evidence that lockdowns caused significant mental health problems.

- The FDA is investigating the Moderna (MNRA, USD, 345.21) vaccine to determine whether it causes myocarditis in children 12-17 years old. Although the side effect appears to be rare and reversible, the investigation will likely delay its distribution among children.