by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

In today’s Comment, we open with multiple U.S. developments that have the potential to affect the financial markets today, including the latest on the federal government’s debt limit, signs of growing worker clout in the labor market, and new regulatory risks for the technology sector. We next turn to a range of international news, including several developments related to Chinese risks. We wrap up with the latest news on the coronavirus pandemic.

U.S. Fiscal Policy: Senate Majority Leader Schumer scheduled a vote Wednesday on a House-passed bill to increase the federal government’s borrowing ceiling until December 2022. However, Republicans have already telegraphed that they would block the bill, prompting President Biden to accuse them of recklessness by putting the dollar’s status as a reserve currency at risk. Schumer offered no plan on how the Democrats could overcome their lack of the 60 votes needed to pass the measure. The continued uncertainty and risk of a federal default will likely continue to weigh on financial markets in the coming days.

U.S. Labor Market: The International Alliance of Theatrical Stage Employees (IATSE), a union representing over 150,000 behind-the-scenes workers in entertainment, voted yesterday to authorize a strike if there is a breakdown in the ongoing negotiations with film studios and streaming services over working conditions and pay. Fully 98% of IATSE’s members voted in favor of the strike.

- A strike would cripple Hollywood as it is emerging from the pandemic slowdown and bring production to a near-standstill, throwing studio plans for future movies and shows into turmoil and immediately costing millions of dollars.

- More broadly, we are keeping an eye out for any sign of a broader, longer-lasting increase in labor power arising from the pandemic. There are still very powerful political, economic, and social forces favoring capital versus labor. If that changes and workers gain the ability to demand higher wages and more favorable working conditions, it will bolster the case for higher inflation and reduced profit margins going forward.

Facebook: In the latest revelation from whistleblower Frances Haugen, Facebook (FB, $326.23) is accused of misleading investors about the size of its audience and concealing a years-long decline in younger U. S. users. Haugen, a former Facebook product manager, pointed to internal company projections that a drop in engagement from American teens could drive an overall decline in its U.S. daily users by as much as 45% between 2021 and 2023. Given Facebook’s large market capitalization, the accumulating downward pressures on the company’s stock will alone help hold down U.S. market indexes, on top of other recent challenges such as concerns about inflation and rising bond yields.

United States-China: As we previewed in our Comment yesterday, U.S. Trade Representative Tai said in a speech that President Biden will maintain the Trump administration’s trade tariffs against China in an effort to make it comply with the “Phase One” agreement signed by the U.S. and China in early 2020. At the same time, she said, the U.S. would reopen a process for U.S. companies to seek exemptions from the tariffs. For now, she said the U.S. would also refrain from launching the Phase One deal’s dispute mechanism or any broader investigation into China’s unfair trade practices. It will, however, press the Chinese government for a new round of trade talks to address U.S. concerns.

- Tai’s policy statement suggests the Biden administration wants to slow down its approach to China, opening up room for the Chinese to compromise while buying time to further strengthen U.S. alliances against Beijing. The downside is that Republicans in Congress will probably tag the administration’s policy as “soft on China.” Meanwhile, reopening the process for tariff exemptions will likely only benefit a limited number of U.S. firms.

- If the new policy approach succeeds in cooling U.S.-China tensions without ceding too much to Beijing, it could help calm global financial markets. All the same, the broader trend toward greater U.S.-China friction will probably remain, along with its risks to investors that we’ve continually been discussing.

- Separately, in an example of how trade policies can distort global markets, cotton prices have surged approximately 18% over the last ten trading sessions amid growing Chinese demand.

- The surge in Chinese demand reflects U.S. restrictions on importing goods made from Xinjiang cotton.

- To get around the ban, Chinese manufacturers are importing more U.S. cotton, using it to make clothing and other goods, and then exporting those products back to the U.S.

Chinese Debt Defaults: As major real estate developer Evergrande (EGRNF, $0.41) continues to hurtle toward an unsettling default, luxury apartment developer Fantasia admitted it didn’t make a $206 million payment on its international bonds that was due yesterday. Even worse, in recent weeks and days, the company told investors it would make the payment.

- Hours before Fantasia’s disclosure, Fitch Ratings cut its rating on Fantasia by four notches to CCC-, reflecting an extremely high risk of default. The global rating firm said the developer reportedly recently missed another payment on a private bond—which Fitch was previously unaware of—and said the incident “casts doubt on the transparency of the company’s financial disclosures.”

- Not only are Fantasia’s bonds now trading at the same distressed levels as Evergrande’s, but the new disclosure has the potential to further scare investors about other Chinese property developers and China’s broader problem with excess debt.

China-Taiwan: At a recent meeting of China’s top-level Central Military Commission, President Xi reportedly ordered the country’s armed forces to increase their military pressure on southwestern Taiwan. The order was likely behind the recent surge in Chinese aircraft incursions into Taiwan’s air defense identification zone, which we described in yesterday’s Comment. As U.S.-China geopolitical tensions continue to intensify in the region, perhaps the key risk is that aggressive Chinese actions will lead to an accidental conflict. Xi’s order, therefore, should be seen as another important risk for global markets.

China-Australia: Reflecting the severity of China’s current energy shortage, the government has quietly started allowing some Australian coal shipments to be unloaded in the country, despite an official ban imposed last year in retaliation for Australia’s demand that China is investigated for its role in the coronavirus pandemic.

European Energy Crisis: Amid skyrocketing electricity prices and fears of natural gas shortages during the upcoming winter, the governments of France and Spain have joined forces to demand sweeping changes to the EU’s energy market rules. One key demand is to reform the linkage between natural gas and electricity prices. Still, that alone would not address issues like the loss of nuclear and fossil fuel supplies due to their political unpopularity.

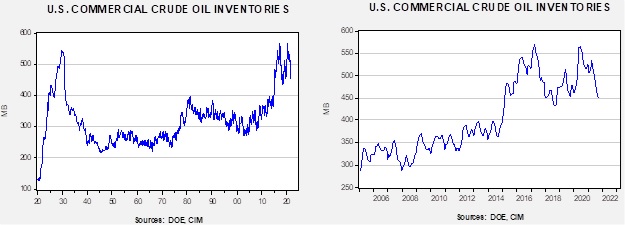

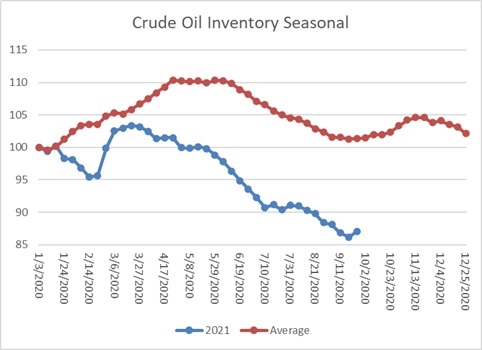

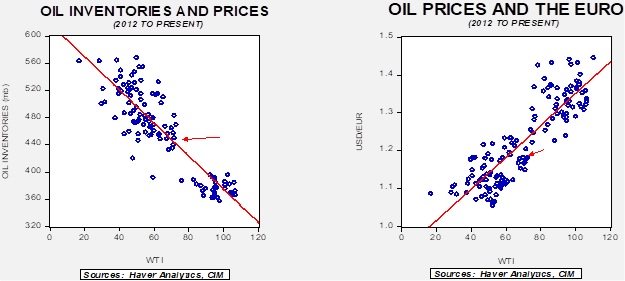

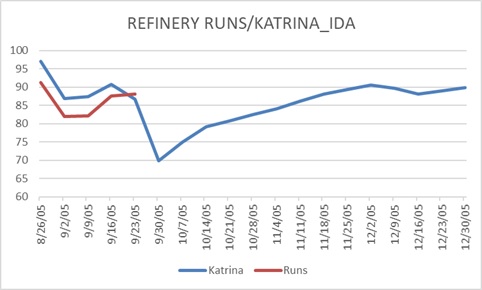

Global Oil Market: OPEC and its Russia-led allies decided at their latest review of global oil markets to keep boosting their collective crude production by a modest 400,000 barrels per day, despite the current high prices.

- The decision gave a further boost to global oil prices, pushing up the key WTI and Brent benchmarks by 2.3% or more to the highest levels in more than three years.

- Against the backdrop of global demand still recovering from the coronavirus pandemic while petroleum exploration, output, and inventories all remain constrained, the OPEC+ decision is likely to keep supporting oil prices in the near term. Naturally, continued high energy prices will help keep alive investors’ fears about inflation.

Japan: Newly appointed Prime Minister Kishida has spooked financial markets with comments suggesting he may seek an increase in the country’s capital gains tax. On top of that, a poll by Kyodo News shows public support for Kishida’s new cabinet stands at just 55.7% compared with the initial support of 66.4% for predecessor Yoshihide Suga’s cabinet last year.

- The benchmark TOPIX index fell as much as 3% during the morning session, before recovering slightly, to avoid narrowly the 2% drop that would bring in the Bank of Japan to support the market by buying exchange-traded funds.

- Until last week, the central bank had only intervened in the stock market three times since April, prompting speculation that it was engaged in a stealth tapering of an ETF-buying program that has run for over a decade.

COVID-19: Official data show confirmed cases have risen to 235,511,364 worldwide, with 4,811,527 deaths. In the United States, confirmed cases rose to 43,853,214, with 703,402 deaths. Vaccine doses delivered in the U.S. now total 478,392,765, while the number of people who have received at least their first shot totals 215,502,382. Finally, here is the interactive chart from the Financial Times that allows you to compare cases and deaths among countries, scaled by population.

Virology

- According to the latest CDC data, 64.9% of the U.S. population has now received at least one dose of a vaccine, and 56.0% of the population is fully vaccinated.

- Now that three new coronaviruses have wreaked havoc around the world in the last 18 years, scientists have redoubled their efforts to develop a vaccine that would work against a broad range of viruses.

- AstraZeneca (AZN, $60.54) said it requested emergency-use authorization for an antibody drug that earlier this year showed strong efficacy in preventing symptomatic COVID-19, offering a potential alternative in evading the disease.

- The company said in August that it would deliver the antibody combination as a shot aimed at preventing COVID-19 symptoms, like a vaccine.

- The primary use, AstraZeneca said, would be for a minority of people with chronic diseases and other conditions that could render vaccines less effective.

Economic and Financial Market Impacts

- Amid the post-pandemic rebound in demand and supply shortages in areas such as container shipping and trucking, retailers are starting to worry that they won’t have sufficient inventory to meet demand during the all-important holiday season.