by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning! U.S. equity futures are higher this morning as the market digests the continuing Evergrande (EGRNF, USD, 0.40) issue and the Fed meeting. Our coverage begins with the FOMC meeting. Evergrande is up next, followed by China news. We then discuss technology and cryptocurrency news along with economics and policy. We conclude with the international roundup and a pandemic update.

The FOMC meeting: As expected, the Fed didn’t change policy rates. But the bank is clearly signaling that the balance sheet will be reduced soon. In examining the statement, the FOMC has acknowledged that the economy is improving but noted that the pandemic continues to act as a drag on growth. The committee also admitted that inflation is elevated but continues to hold the opinion that it is transitory. The biggest change indicates that “If progress continues broadly as expected…a moderation in the pace of asset purchases may soon be warranted.” There were no dissents.

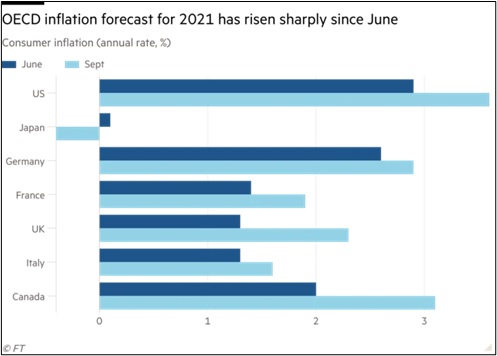

In the median economic projections, real GDP for 2021 was lowered to 5.9% from 7.0%, with next year lowered to 3.3% from 3.8%. The unemployment rate projection for this year was raised to 4.8% from 4.5%, with no change in the out years (the FOMC expected 3.5% by 2023). Core PCE was raised to 3.7% from 3.0% for 2021, 2.3% for next year compared to 2.1% and 2.2% from 2.1% in 2023. The primary message from the projections is that growth is expected to weaken and inflation to rise, but the latter is expected to decline steadily, consistent with the transitory messaging.

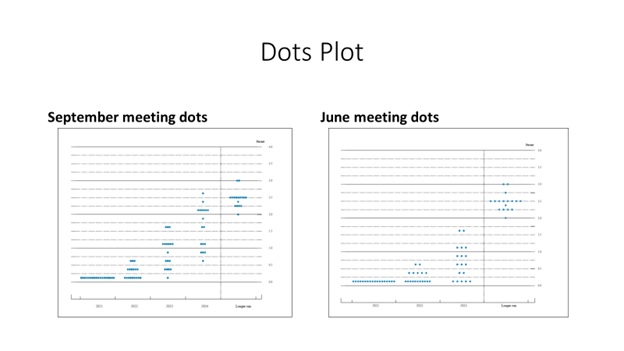

The dots plot has become more hawkish. In June, seven members wanted to raise rates next year, now nine do. So, the 18-member committee is now split on rate hikes in 2022. For 2023, five members expected a steady fed funds rate through that year. Now, only one lonely member expects the policy rate to remain steady.[1]

The financial market’s initial reaction seemed to lean dovish; equities rose, Treasury yields declined, and the dollar fell. This appeared to be quite odd given that the report seemed to be rather hawkish, but perhaps the market thought it would be worse. So far, Chair Powell is managing expectations rather well, but inflation will likely be a greater challenge in the coming months, so will the growth sentiment toward rate hikes in 2022.

On a related note, calls for Dallas FRB President Kaplan and Boston FRB President Rosengren to resign are rising due to their trading activity. This situation bears watching. There has been a call for requiring Senate approval for FRB presidents, and this event might just lead to that outcome.

Evergrande: It’s now a foregone conclusion that Evergrande is going to default and will need to restructure. In any restructuring, creditors are ranked by their claims and then fight over what remains. In a normal restructuring, bondholders are usually the highest ranked, with equity holders last. That isn’t likely how this one will go. One way that Evergrande financed itself was through pre-sales. Future homeowners would put up a portion of the value of the property and wait, sometimes for years, to take possession. Since much of what Evergrande sold was considered a form of saving, waiting wasn’t seen as an issue. For social reasons, these creditors will be first in line, even though in the West, they would be considered unsecured and farther down the line of claimants. We are not sure who would come next; it might be local governments. We feel rather confident that foreign bondholders will be last in line.

Although the immediate issues surrounding the collapse of Evergrande are front and center, there are longer-term ramifications that are also important. One of the more insightful observers of China is Michael Pettis. His recent missive points out that addressing China’s debt problem most likely means that economic growth is going to be weaker going forward…perhaps much weaker. The growth of China’s debt has been a problem for a while. China’s trend growth is probably 2% to 3%, so any growth above that required investment funded by debt. If that avenue for excess growth is lost, the world will have to cope with much weaker Chinese growth. Since the CPC has made its name by facilitating growth, some other reason for its existence has to emerge. We suspect the growing “cult of Xi” is the substitute. We will see how it works.

The ripple effects of the Chinese debt crisis will be closely watched and could trigger some unexpected downside surprises. Some of this is because of tighter regulations. Another problem will be that debt crises have a habit of unveiling previously hidden problems or triggering new ones. To address the debt problem, for example, overindebted firms will start liquidating assets to raise liquidity. As they dump assets, their prices fall, triggering fears of further declines and causing prices to fall in other parts of the economy. For example, iron ore prices have plunged on fears of falling Chinese property development. We note the PBOC has been aggressively injecting liquidity. Another problem that often develops is that the groups protected in the bailout become a source of moral hazard emboldened to take on more risks due to the perception of safety.

Although we can’t rule out a Lehman-style debt crisis, the odds of that outcome are probably not elevated. The bigger issue is that the world will have to adapt to a China with much slower growth, and the impact on the global economy will be significant.

China news: China pledges to stop building coal plants overseas, and Taiwan wants into the CPTPP.

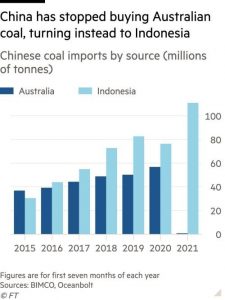

- At the U.N., General Secretary Xi promised to stop building coal-fired electricity plants Although the pledge was welcomed by environmentalists, it isn’t obvious whether China will stop building such plants domestically.

- In what will certainly cause a dust-up, Taiwan applied to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), the successor to the TPP. Taipei made this request soon after Beijing applied to join. If Taiwan were to be approved while Beijing refused, it would cause a diplomatic firestorm. Imagine if California tried to join the TPP after the U.S. pulled out.

- Honor (300870, CNY, 72.00), the smartphone spinoff of Huawei (002502, CNY, 7.48) has not yet been blacklisted by the U.S. Washington is debating how it wants to proceed. In related news, the DoJ is in talks over a plea deal with Meng Wanzhou.

- China is planning to expand its tax crackdown on high-profile entertainers.

- Ant Financial says it will fully share its customer data with the Chinese government.

- Lithuania has been in a diplomatic fight with Beijing over the Baltic nation’s relations with Taiwan. The Lithuanian government is telling its citizens to “throw away Chinese cell phones.”

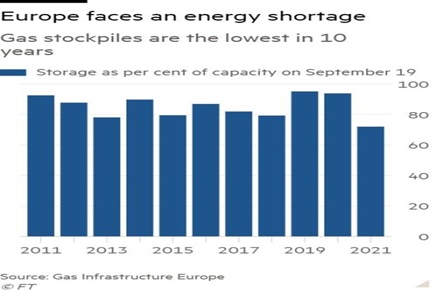

- In our WEU (see link above), we have been tracking the natural gas crisis in Europe. Exacerbating the problem is aggressive Chinese LNG buying, which is tightening supplies further and lifting prices.

Technology: Facebook (FB, USD, 343.21) has been facing a spate of reports that put the company in a bad light. The WSJ had a series of investigative reports on the company’s actions, for example. Apparently, it is fighting back by planting reports in Facebook’s news feed that put the company in a favorable light.

Cryptocurrencies: Increasingly, regulators are moving to regulate the crypto market. Of particular concern are stablecoins, which may be prone to bank runs. There are increasing signs that regulators are going to move against stablecoins, which, if true, will weaken the ability of that market to function. When holders of bitcoin or other cryptocurrencies want to “cash out,” they often purchase stablecoins, avoiding the traditional financial system. The SEC’s Gensler is taking a particularly dim view of crypto, suggesting it is similar to the private wildcat banking of the 1800s. Another area of concern is the use of crypto for ransomware payments; the U.S. is building regulations against such payments.

Economics and policy: Talks on the budget and debt ceiling continue, and the administration nominates a professor for the position of Comptroller of the Currency.

- Budget negotiations and debt ceiling measures continue. Yesterday, President Biden met with Congressional moderates to try to work out a deal that will be acceptable to progressives. Both sides are threatening to not vote for the other’s goals. Meanwhile, the House passed a spending bill that will avoid hitting the debt ceiling. It is unlikely that the bill would pass the Senate with 60 votes, although the GOP might not filibuster it. After all, merely forcing the Democrats to vote on the debt ceiling gives them the political fodder they want without running the risk of a debt default.

- This one bears watching closely! The administration has nominated Saule Omarova, a Cornell law professor, to the position of the Comptroller of the Currency. She supports a plan to create something similar to Japan’s Postal Saving system, where the Fed would provide households with deposit accounts, essentially moving retail deposits from commercial banks. Such plans have been knocked around in Washington for years. Creating this system would end the problem of the “unbanked,” the situation where low-income households can’t get workable banking services from the private sector. This action might be the end of community banking. Although large banks don’t really need deposits to fund themselves, small banks do. We doubt she will pass through the nomination process, but the fact she was nominated at all is important. If we see CBDC emerge, something similar to this would be possible.

- Inflation ripples continue to pass through the economy. General Mills (GIS, USD, 59.92) is expected to raise prices across a whole host of goods.

- Ireland appears to be softening its stance on a minimum OECD corporate tax. If Ireland complies, it increases the odds of a hike in the U.S. corporate tax.

- It is becoming increasingly evident that the U.S. needs increased home building.

International roundup: Washington and Paris are trying to make up.

- The U.S. and France are trying to patch up the recent row over nuclear submarines.

- The U.K. is interested in some sort of trade deal with the U.S. Washington will tend to push Westminster to make a deal on Northern Ireland.

- There was an assassination attempt on a key aid to Ukrainian President Zelensky.

- The Norwegian central bank, Norges Bank, became the first major central bank to raise rates.

- Islamic State is becoming a key threat to Taliban rule in Afghanistan.

COVID-19: The number of reported cases is 230,189,529, with 4,721,127 fatalities. In the U.S., there are 4,182,893 confirmed cases with 681,222 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 468,248,675 doses of the vaccine have been distributed with 387,493,716 doses injected. The number receiving at least one dose is 212,545,360, while the number receiving second doses, which would grant the highest level of immunity, is 182,387,840. For the population older than 18, 66.1% have been vaccinated. The FT has a page on global vaccine distribution. The Axios map shows that the South is seeing a decline in cases. As temperatures cool in the North, cases are rising.

- The FDA has approved Pfizer (PFE, USD, 43.95) booster shots of its vaccine to older and at-risk patients.

- Rising COVID-19 cases is leading to partial lockdowns in the northern Chinese city of Harbin.

- 2020 saw a surge in the U.S. murder rate, likely a result of the stresses caused by the pandemic.

[1] Our guess? Neil Kashkari, the Minneapolis FRB president, is likely the “lonesome dove.”