by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning and happy Monday, the last one of August. U.S. equity futures are modestly higher this morning after Friday’s rally. Our coverage begins with Hurricane Ida. We then discuss Chair Powell’s Jackson Hole speech, followed by Afghanistan news. Our category coverage begins with China as Beijing continues its broad crackdown. Economics and policy come next, with legislation and supply chains being the primary concerns. Our international roundup follows, and we close with pandemic coverage.

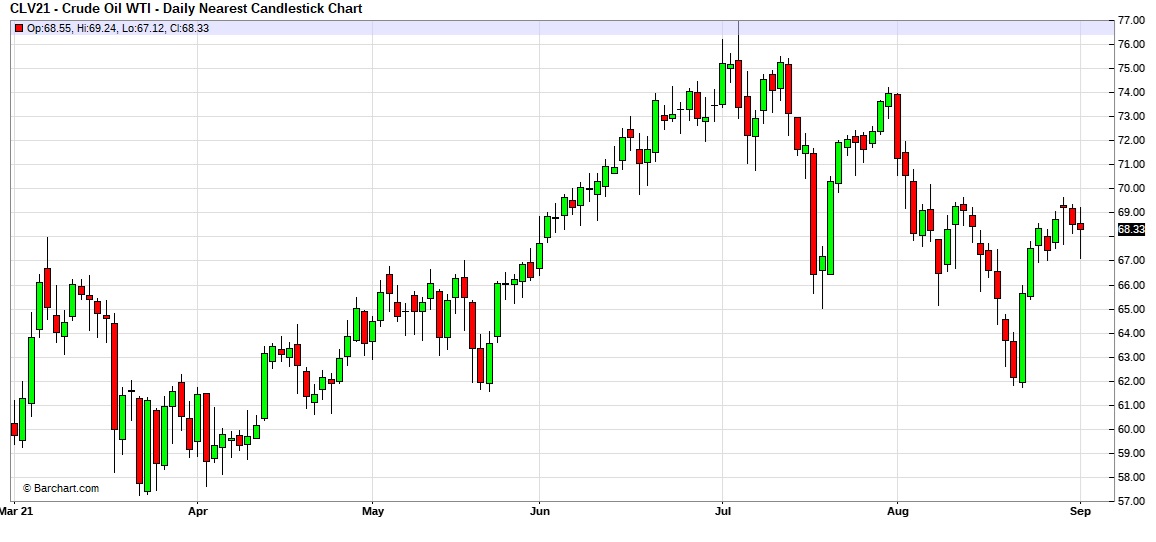

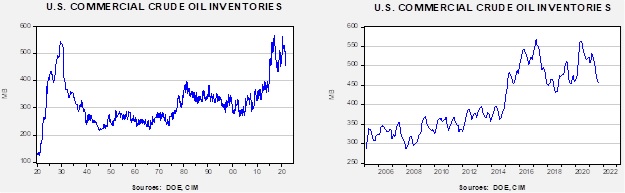

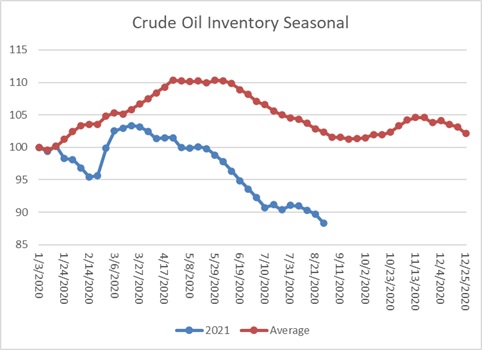

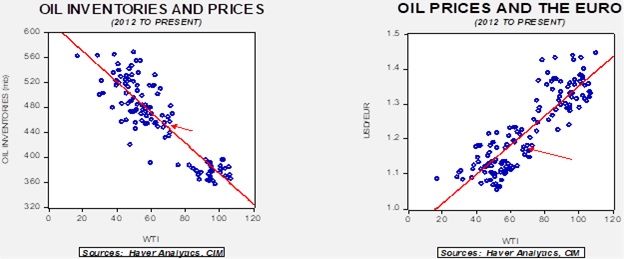

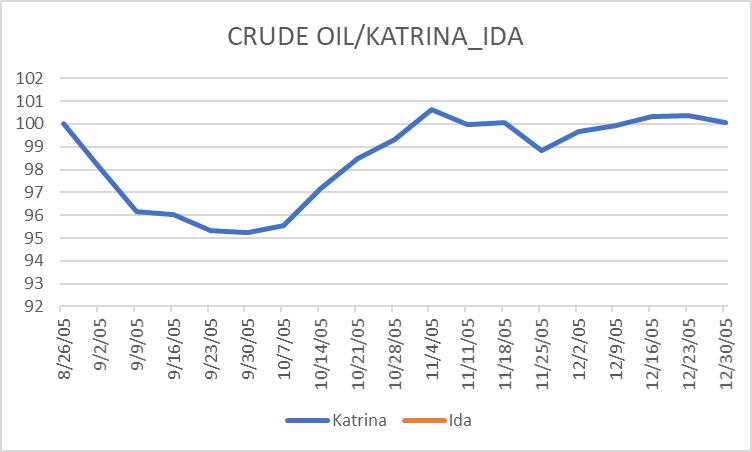

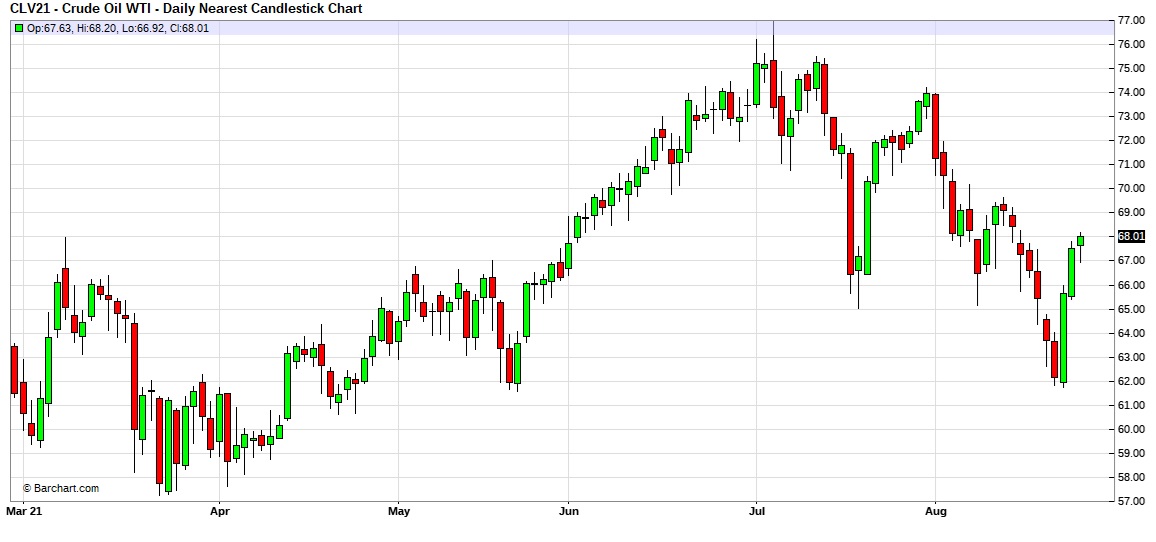

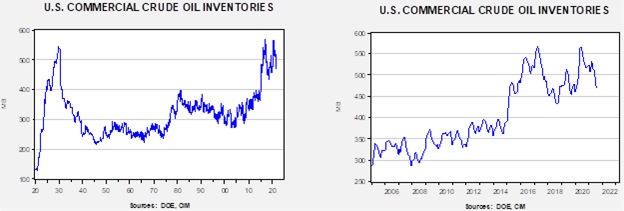

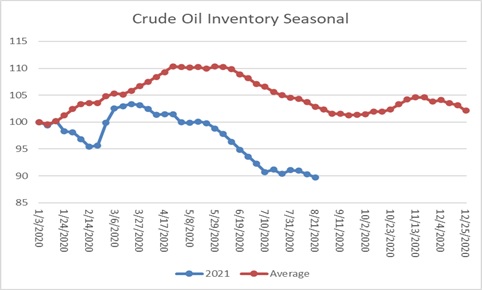

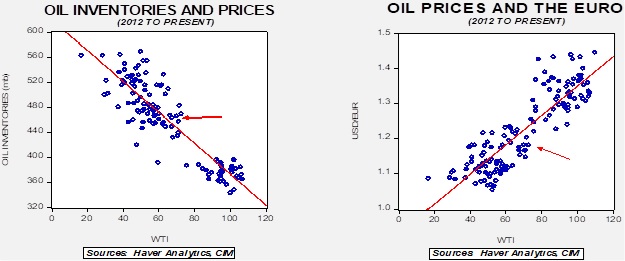

Ida: Ida moved onshore over the weekend, battering Louisiana, leaving nearly a million customers without power. New Orleans was hit especially hard. Much of the oil and gas production in the Gulf of Mexico has been halted. The storm, which landed on the 16th anniversary of Katrina, was a strong one, actually reversing the flow of the Mississippi temporarily. Oil and gas wells in the Gulf will begin returning to production, likely by mid-week. It may take a week or so for refineries to assess the damage and restart production. Currently, about 9% of U.S. refining capacity has been shut in. Although product inventories are adequate, which suggests this event probably won’t lead to significant price hikes, that is only true if refining returns quickly. If damage is severe, we may see a hike in gasoline and diesel prices that lasts a few weeks. We note that oil prices are lower this morning.

Powell: Powell’s speech at the virtual Jackson Hole summit hit all the right notes. He acknowledged that inflation hit the Fed’s target and employment was close to the “substantial progress” threshold. It looks like tapering will commence before year’s end. He was successful in separating tapering from rate hikes, and that led to a “usual suspects” rally in financial markets. Equities, commodities, bonds, and gold rallied while the dollar slumped. Powell made his case that inflation should not become persistent and still offered policy support to the economy. Although reducing the balance sheet will have some impact on financial markets, separating tapering from rate hikes is important.

Ben Bernanke reportedly said that “QE works in practice but doesn’t seem to work in theory.” We tend to agree. It appears that balance sheet expansion does quell financial stress, but tying QE to actual changes in the economy is difficult. We think its greatest power is as a signaling device. By engaging in balance sheet expansion, the Fed signals it is running policy accommodation. Bernanke’s failure was that by tapering, the markets believed actual rate hikes were coming next. Powell, at least so far, has the markets believing that rate hikes won’t occur quickly, and thus, the negative impact of tapering is dampened. Obviously, the initial market reaction doesn’t mean the die is cast; having a lead early doesn’t guarantee victory.[1] However, if the market action seen on Friday persists, it would look to us that Powell is a lock for renomination.

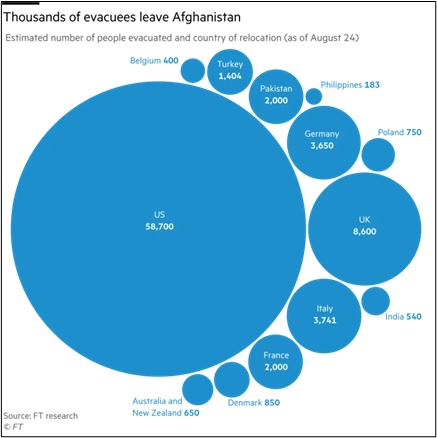

Afghanistan: Tomorrow is the exit day for American troops.

China: Beijing is becoming increasingly restrictive, hitting celebrities and big tech alike.

- The CPC has been steadily expanding its reach into economic relationships. Now it is moving to the social lives of the Chinese as well. The party has silenced a number of celebrities, removing them from social media. The narrative is that these individuals are corrupting the youth of China by encouraging improper behavior. We suspect it has more to do with being an influence outside the CPC, something increasingly restricted in Xi’s China.

- On the technology front:

- Last week, we noted the concept of “tertiary distribution,” which seems to be that the wealthy are willingly give up some of their largess to help society. This idea appears to be gathering momentum. One of the goals of totalitarianism is to get people to do things “willingly” instead of through direct coercion. Current “donors” really don’t know how much is “enough,” meaning the pressure to donate more will be difficult to resist. This press of redistribution is a threat to the luxury industry.

- A concern surrounding social media and other related technologies is that they tend to operate using algorithms. The primary goal is to police the sites without direct human intervention; it’s cheaper to automate the process. In addition, the process is characterized as fair because a machine, not a person, is making the decision. However, humans write the code, and their biases are embedded in the process. The government is creating new rules to manage these algorithms.

- The courts are telling the tech companies that the “996”’ culture of work[2] is only legal with extra compensation.

- The crackdown on corruption continues. The latest to be arrested is Dong Hong, a former aide to Wang Qishan. Dong was a member of the Central Commission for Discipline Inspection, the chief anti-corruption element of the bureaucracy. He is accused of taking more than $70 million in bribes over two decades as a public servant.

- Evergrande, the troubled property developer (EGRNF, USD, 0.57), continues to sell assets in an attempt to stave off bankruptcy. The company has $300 billion in debt to various creditors and is trying to sell assets to reduce its exposure. However, as the company tries to sell assets, valuations are falling as buyers seek discounts. Beijing’s crackdown on excessive borrowing in this sector is starting to affect the broader financial system.

- A Chicago Council on Global Affairs poll shows that half of Americans favor defending Taiwan if the island is invaded. Another poll shows South Koreans dislike China more than they dislike Japan (which is remarkable).

- We recently remarked that China and Israel have been increasing their economic ties. Israel does have a strong security industry, and China has apparently been an avid buyer of the software and hardware produced by Israel.

- For the first time under this president, the Pentagon is holding talks with the Chinese military.

- Beijing has forced steelmakers to curtail production for environmental reasons. There is uncertainty over how long this policy will remain in place. In the past, the leadership tended to “blink” as economic growth declined. The production drop has tanked iron ore prices.

Economics and policy: The debt ceiling, money market regulation, and corporate taxes lead our coverage.

- We continue to watch the path of legislation. Of growing concern is the debt ceiling, where the Democrats are planning separate legislation to raise the limit, while the GOP says it won’t support it without spending cuts. The Democrats could wrap the increase into the budget but want GOP participation to prevent the issue from being used in the midterm campaigns. The risk is that we have another government shutdown.

- Although there has been a great focus on China’s crackdown on big tech, Washington isn’t sitting idle. The major U.S. firms are facing a myriad of regulatory threats.

- Money markets remain a major area of concern for regulators. They were part of the last two financial crises and essentially failed in 2008. Since then, regulators have been trying to devise regulations that will make them safe and yet profitable enough to remain in business. We remain skeptical that this can be accomplished; the best outcome would be for these funds to no longer be seen as cash equivalents, and thus, “break the buck” on occasion. The industry likely fears that this outcome would reduce their assets.

- Part of the current budget proposal has a series of changes to corporate taxes. One of them attempts to equalize taxes across the G-30 by setting a minimum tax rate. Moderates in the House are worried that the measures may be too extreme and will put American businesses at a disadvantage. If these concerns are addressed, it may reduce the revenue raised in the budget and either trigger larger deficits or require higher revenue raises in other areas.

- Evictions are likely to start as the Supreme Court disallowed the most recent eviction extension. Sadly, billions of dollars have not been distributed by state and local governments, which would have averted this outcome.

- In our recent research, we noted that the youngest and oldest workers have been the slowest to return to work. The oldest probably aren’t going back, as they have moved into retirement. The youngest almost certainly will, but it may be a while as this group is reportedly reassessing career paths, and some are opting for new directions.

- It’s not that there aren’t ample supplies of aluminum in the world; it sits in Asia, and the need is in the Western hemisphere and Europe. The problem is that shipping capacity to move the metal is lacking, sending aluminum prices soaring.

- The SEC is reviewing the game aspects of stock trading apps.

- Although the broader data doesn’t confirm the anecdotes, there is evidence that there is a growing level of unfinished inventory as manufacturers await parts to complete products. We also hear reports that homebuilders are putting in used appliances to complete homes with the promise of replacing them when the new products arrive (word to the wise—get it in writing!).

- The global supply chain continues to face disruptions. The latest area of concern is Vietnam. A jump in COVID-19 cases has led to lockdowns which are closing garment factories. It is evidently disrupting clothing supply chains. Something similar is being seen in semiconductors. Malaysia is where chips are tested, and a surge in cases is leading to backlogs.

- Shipping woes have led desperate companies to opt for air freight, the most expensive of all shipping. Usually, air freight is deployed for high value to weight items, such as semiconductors. However, in the rush to get materials, firms are turning to this option. The industry says it is running at 90% of capacity. Airlines are refitting passenger aircraft for freight. Normally, air freight costs about five times that of ground transportation; it’s currently running 12 times higher. All this activity is driving costs higher.

- One barrier to effective medical system reform is the lack of transparent pricing. A recent report in the NYT highlights the difficulty in deciphering the reason price differences exist for the same procedure. One issue is clear; medical systems are clearly trying to avoid price transparency.

- Late last week, the White House doubled its forecast for inflation but does expect it to fall rapidly as 2022 wears on.

- Although cryptocurrencies are followed mostly for their price action, in reality, their real promise is to reduce costs and improve efficiency in payment systems and money transfer. Currently, crypto providers who want access to the Fed’s payment system must partner with a bank. The crypto firms want to go directly to the Fed. Banks are not pleased. Crypto is a serious threat to the bank’s money management business, and getting access to the Fed system would increase the threat.

- Canadian home prices have been soaring. With elections looming, the political parties are getting behind a novel concept—build more housing to dampen prices. Although this response seems rather obvious, in practice, it’s hard to do. Why? Because current homeowners will see their asset values stagnate with the increased supply, and they resist zoning changes to build more homes. This is the classic NIMBY problem. It will be interesting to see if politicians face a backlash for this policy proposal.

International roundup: Elections in Europe dominate the news, and North Korea won’t be ignored.

- The leading candidates for the next chancellor held a debate over the weekend. The general consensus is that none of the candidates did particularly well, although the SDP’s Scholz was generally thought to be the winner. Currently, the SDP and CDU/CSU are tied in the polling averages.

- The Czech Republic will hold elections in early October, and it is looking like the Pirate Party could garner enough votes to enter government in a coalition. The party, which began as a free internet party, has become known for its opposition to corruption.

- We warned earlier this year that North Korea was likely to cause problems; Pyongyang usually tests a new administration. There are reports the DPRK has restarted its nuclear reactor at Yongbyon, which is a violation of U.N. resolutions. Most likely, North Korea is viewing the turmoil facing the Biden administration and is moving to take advantage.

- Ukraine President Zelensky will visit the White House this week.

- India is considering legislation designed to reduce family size. China deployed similar policies in 1980 and is trying to reverse them now to little avail. When a developing nation with a large population reduces births, it gets a sizeable demographic benefit; the dependency ratio falls until the population ages to retirement. Then, as China is seeing now, the dependency ratio rises. Such policies are always controversial, but in India, there is the idea that the Hindu government is using the policy to slow the rise of the Muslim population.

COVID-19: The number of reported cases is 216,520,662, with 4,503,623 fatalities. In the U.S., there are 38,793,329 confirmed cases with 637,539 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 440,028,085 doses of the vaccine have been distributed, with 368,863,734 doses injected. The number receiving at least one dose is 204,435,968, while the number receiving second doses, which would grant the highest level of immunity, is 173,520,211. For the population older than 18, 63.3% of the population has been vaccinated. The FT has a page on global vaccine distribution.

- As we have documented recently, China’s vaccines have proven to be less effective than those produced in the West. The U.S. is starting to provide vaccines in Southeast Asia, and nations are taking Washington up on the offer. This outcome is a diplomatic win for the U.S.

- In the U.S., we are seeing a rise in vaccine administration in states with low inoculation numbers.

- Across several states, ICU capacity is under strain. In the South, in several states, around half of the beds are occupied by COVID-19 cases.

- As hospitals are filling with COVID-19 patients, ambulances are forced to wait to deliver their patients. Nurses are seeing spiraling signing bonuses as hospitals try to secure scarce nursing talent.

- The U.K. is beginning a series of challenge trials, which is a form of human experimentation. Thirty healthy unvaccinated people have volunteered to be exposed to the virus so researchers can monitor the development of the virus. The U.K. has developed strains that are highly contagious specifically for these trials. The participants will remain hospitalized so researchers can monitor the development of the disease.

- Israel is extending booster shots to everyone 12 years and older.

- The EU is reintroducing travel restrictions for U.S. visitors.

- When I was a missionary in Belize in the early 1980s[3] state radio would read off obituaries in the mid-afternoon. It was done as a service to the citizens. Telephones were not universal, and newspapers were not widely distributed. The most efficient way to inform loved ones that a family member or friend had died was via radio broadcast. This procedure was not unique to Belize but was common in the region. The French Caribbean islands apparently use a similar broadcast method, and due to COVID-19, the programs are now taking up to an hour a day to read the names of the dead.

View PDF

[1] As exhibited by a recent Pirate win over the Cardinals.

[2] 9:00 am to 9:00 pm six days per week.

[3] Obviously, this is Bill speaking.