by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning on this August Friday. Equity markets remain under pressure this morning as worries about the economy and monetary policy weigh on sentiment. Our coverage begins with China, where regulatory conditions are changing fast and Taiwan is also in the headlines. Up next is our update on Afghanistan. Economics and policy are next as the FTC returns to tech and the rules for banks regarding gold are changing. Our international roundup follows, and we close with pandemic coverage.

China: The crackdown on tech and big business expands, and credit issues dominate. Taiwan is also in the news.

- We continue to closely monitor activities in the Chinese financial markets, especially focusing on the government’s continued interventions on tech companies and markets. Here are some recent developments:

- Evergrande Group (EGRNF, USD, 0.70) leadership has been scrambling to sell assets and shore up its balance sheet. Representatives from the PBOC and financial regulatory bodies summoned company leadership and told them to resolve its debt issues without destabilizing property and financial markets (how helpful!). About the only way the company can do that is by issuing equity or selling off more assets.

- Meanwhile, Huarong (2799, HKD, 1.02), the “bad bank” that housed defaulted loans from the restructuring that occurred earlier in the century, is getting bailed out by other state-owned enterprises. Huarong is majority owned by the government. Although the company is getting better treatment than Evergrande, the same can’t be said about its former chairman, Lai Xiaomin. He was executed.

- Beijing is issuing new rules for tech companies. First, competition rules are being tightened to prevent market power. Second, today China passed a new data privacy law that looks to us to be designed to reduce the ability of tech firms to access and use data for advertising. These laws dovetail into recent new cybersecurity rules. The privacy rules weaken the business model of tech firms. After all, it’s the promise of targeted advertising that makes these firms attractive.

- Baidu (BIDU, USD, 137.25) has come under scrutiny but that didn’t prevent investors from snapping up new bonds.

- However, equity values of Baidu and Alibaba Group (BABA, USD, 98.78) remain under pressure on fears of increased regulation.

- Chinese regulators are looking to regulate online games, especially those that may not conform to the CPC’s version of history.

- The FBI is warning that China and Russia are turning tech employees into sources of information.

- U.S. firms want auditing on some Chinese goods to prove they were not made with incarcerated labor. The U.S. auditor, Verite, has a Chinese partner; that partner was shut down by Beijing. This means firms will have a more difficult time determining the veracity of claims on Chinese goods.

- Meng Wanzhou’s extradition hearings have finally concluded. A decision will likely occur in October.

- Taiwan continues to be a flashpoint.

- In responding to questions about America’s resolve, President Biden responded with this comment:

STEPHANOPOULOS: You talked about our adversaries, China and Russia. You already see China telling Taiwan, “See? You can’t count on the Americans.” (LAUGH)

BIDEN: Sh– why wouldn’t China say that? Look, George, the idea that w– there’s a fundamental difference between– between Taiwan, South Korea, NATO. We are in a situation where they are in– entities we’ve made agreements with based on not a civil war they’re having on that island or in South Korea, but on an agreement where they have a unity government that, in fact, is trying to keep bad guys from doin’ bad things to them.

We have made– kept every commitment. We made a sacred commitment to Article Five that if in fact anyone were to invade or take action against our NATO allies, we would respond. Same with Japan, same with South Korea, same with– Taiwan. It’s not even comparable to talk about that.

-

- We bolded the word “Taiwan” because it appears Biden was giving a direct security guarantee to Taiwan, which would be a major policy shift. The State Department walked back the comment later, but it does look to us that he probably is now including Taiwan in that security umbrella. If true, that is a big deal and will signal to China that the “one China” policy is over. This issue bears watching; it may blow over as a simple mistake, but the fact that he said it twice makes us think that isn’t the case.

- Deputy SoS Sherman defended Lithuania’s decision to upgrade its ties to Taiwan. Beijing has been critical of the decision.

- SoS Blinken has invited Taiwan to a U.S. democracy summit that will be held in December. This invitation was not taken well in Beijing.

- Japan’s concern about aggression against Taiwan has led Tokyo to accelerate its five-year military spending plans.

- Although Afghanistan is a crisis and a failure, it’s important to note that it isn’t fatal because the country was never vital to U.S. interests. We note that the focus has already shifted toward China. Getting out of Afghanistan, in particular, and the Middle East, in general, is part of shifting the focus of policy on Great Power competition with China.

- We continue to closely monitor the policy shift we are seeing toward “common prosperity,” which looks to us to be the Chinese version of an equality cycle.

Afghanistan: Here is what we are following:

- The Taliban’s rapid expansion of control initially stunned the country and the world. However, we are starting to see some resistance. We reported earlier this week that protests against the Taliban led to members of the group firing on protestors. However, a more potent adversary exists in the north. The old Northern Alliance, which was dominated by Tajiks, may be forming to oppose the Taliban. Ahmad Massoud, the son of Ahmad Shah Massoud, has reportedly been in talks with former Afghan VP Amrullah Saleh. Although the Tajiks could receive some degree of autonomy in return for allegiance to the Taliban, maintaining control of this group could be a challenge. We are also monitoring groups aligned with the Taliban that operate in the southern part of the nation. It is possible the Taliban has become more sophisticated in managing the tribal structure of Afghanistan, or that patina of sophistication may simply be a cover crafted on social media.

- Yesterday was the anniversary of Afghanistan’s independence from Britain in 1919. The flag from this government was prominently displayed during protests against the Taliban.

- The Taliban is reportedly searching for Afghans who worked with NATO forces in the region. Women are said to be going into hiding. The Taliban has been accused of killing the relative of a journalist.

- The Taliban has captured a treasure trove of military assets, although it isn’t clear if they can use them all. That in itself may present a problem. As we noted yesterday, the West is moving rapidly to deny funding to the Taliban government. One way it can generate liquidity is by selling arms. The Taliban, as we noted yesterday, has several sources of funding. A new report suggests that much of their resources come from taxing fuel sales in the regions they control. In effect, the Taliban has been acting like a shadow government for some time.

- Meanwhile, at the Kabul airport, there is still little evidence of order. Part of the problem is the lack of preparedness on the part of U.S. officials for the crush of Afghans wanting to flee the country.

- There are two underlying questions to the collapse in Afghanistan. The first is why the administration didn’t see this coming. Over the past couple of days we have seen a steady stream of reports from intelligence agencies and analysts within departments warning of just this outcome. Here is the problem with such reports—a decision maker never knows for sure if these reports are accurate assessments or an attempt to shape behavior. Since Bush, U.S. presidents have been trying to figure out how to exit Afghanistan. It was clear that the costs of “winning” this war exceeded the benefits. But it is likely that the State Department and the Pentagon didn’t want to leave. Obama did authorize a surge but with a deadline, suggesting he wanted to limit the commitment. Trump wanted out, too. The key unknown is whether these departments limited their preparation, assuming that Biden wouldn’t really stick to his guns. Second, whenever the U.S. leaves a war, it raises concerns among allies about U.S. support for their interests. Although the credibility argument is common among the foreign policy elite, the reality is that the best way to gauge America’s commitment is to frame an area or issue in terms of U.S. interests. Based on this idea, the Far East should not doubt U.S. commitment. If anything, leaving Afghanistan enhances that effort because it frees up resources to focus on containing China. On the other hand, Europe should be worried.

Economics and policy: The FTC returns, and Basel III hits gold.

- The FTC has refiled its antitrust lawsuit against Facebook (FB, USD, 355.39), arguing its “buy or bury” strategy is designed to eliminate competition. This suit has already been rejected in Federal Court. The FTC has added details in the new suit.

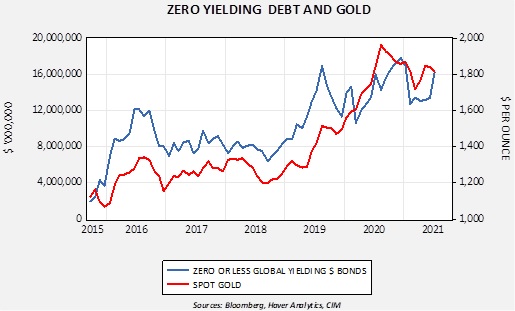

- Here is one we missed earlier. International banking rules are conducted in Basel; they establish how much capital a bank must allocate to various assets it holds. The most recent rules, Basel III, change how banks must allocate capital to their gold holdings. Physical gold—bullion, coins, bars—now get a zero risk rating, meaning that if a bank holds that asset, it no longer needs to allocate capital to it; gold becomes like government bonds or cash. This type of gold is called “allocated.” Unallocated gold, which is gold represented “on paper” such as swaps, futures, ETFs, and forwards, now needs to have capital allocated to it. For most investors, this probably won’t make an immediate difference, but it could, over time, prompt banks to buy more allocated gold and may widen the spread between bullion and unallocated products. It will also make the market less efficient. Now, banks will have to move actual bars instead of swapping paper promises. The rules come into effect in January 2022.

- The SEC looks open to approving bitcoin ETF products that are based on futures as opposed to actual bitcoin. There is a race by financial product firms to build these products. A warning to investors—these products, common in commodity markets, have a number of issues. First, there is the “roll yield” problem. If the spread between contract months goes into contango, the investor can be disadvantaged. Second, unless the product is sourced in the Caribbean, it will generate a K-1. Third, firms often use exchange-traded notes for these sorts of products because it is easier to keep the spread between the underlying and the cash market narrower and you avoid the K-1 problem. But, you accept credit risk and these products often have out clauses in the fine print that can lead to automatic product liquidation at the most inopportune time.

International roundup: North Korea and Cuba are in focus today.

- North Korea threatened to retaliate against U.S./South Korea military exercises. Although it appears that nothing occurred, as the war games have come and gone, a small earthquake was reported in Rajin. It is possible that the DPRK tried to conduct missile tests but may have misfired. It has also been noted that Kim Jong Un has taken another holiday as the war games started.

- Cuba, the subject of a recent WGR, has issued new decrees to take more control over the internet and social media. Social media dissent is now a criminal activity. We note that the Biden administration has maintained a hardline policy against Havana.

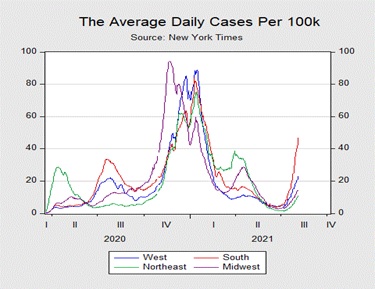

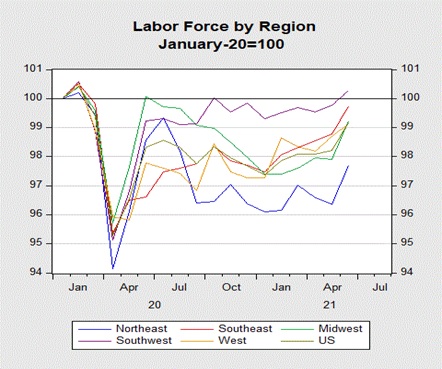

COVID-19: The number of reported cases is 210,108,036 with 4,405,174 fatalities. In the U.S., there are 37,297,023 confirmed cases with 625,183 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high frequency data on various factors. The CDC reports that 422,175,735 doses of the vaccine have been distributed with 359,623,380 doses injected. The number receiving at least one dose is 199,887,548, while the number receiving second doses, which would grant the highest level of immunity, is 169,592,873. For the population older than 18, 62% of this population has been vaccinated. The FT has a page on global vaccine distribution.

- AstraZeneca (AZN, USD, 59.19) is seeking approval for an antibody treatment that reduces the symptoms of COVID-19. This is a non-vaccine treatment; clinical trials suggest it gives protection for at least a year from the virus.[1]

- Although the majority of people who contract COVID-19 survive, the disease has inflicted long-lasting symptoms on some survivors. The medical establishment is starting to work on cures for “long-COVID.”

- The WHO has established a new group to examine the origins of COVID-19. The origin story has become politicized and we have doubts that a new group will get access to Chinese data, which will be critical in determining the actual origins.

- Three senators, all vaccinated, have tested positive for COVID-19.

- Fake COVID-19 vaccination documents are readily available; interestingly enough, Customs and Border Protection report many of them are coming from China.

- On the international front, Australia, which has followed a “zero tolerance” policy on COVID-19 similar to China’s, is locking down again and is pushing faster vaccine distribution. A single case of the virus has led to the shutdown of the Ningbo-Zhoushan Port in China. The shutdown is snarling shipping yet again.

[1] In an interesting twist, no participants in the trial who received the drug died; two receiving the placebo did. This event shows that care must always be exercised when examining the results of treatments.