by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Today’s Comment opens with just one U.S. issue related to cryptocurrency regulation. We then review a number of foreign items that could impact the financial markets today, including news of another apparent Iranian attack on a ship in the Persian Gulf. We close with many new developments related to the coronavirus pandemic.

Cryptocurrencies: SEC Chairman Gensler said in a speech that his agency would make full use of its existing authorities to step up regulation of the cryptocurrency markets, which he described as rife with “fraud, scams and abuse.” In addition, he called on Congress to grant the agency more scope and resources to oversee the sector.

- Gensler’s statements indicate the SEC is likely to become more active in policing crypto trading and lending platforms, as well as so-called stablecoins, as it seeks to protect investors and consumers, reduce crime, promote financial stability, and protect national security.

- Previously, Gensler told House lawmakers that investor protection rules should apply to crypto exchanges, similar to those covering equities and derivatives. Regulated exchanges are required by law to have rules that prevent fraud and promote fairness.

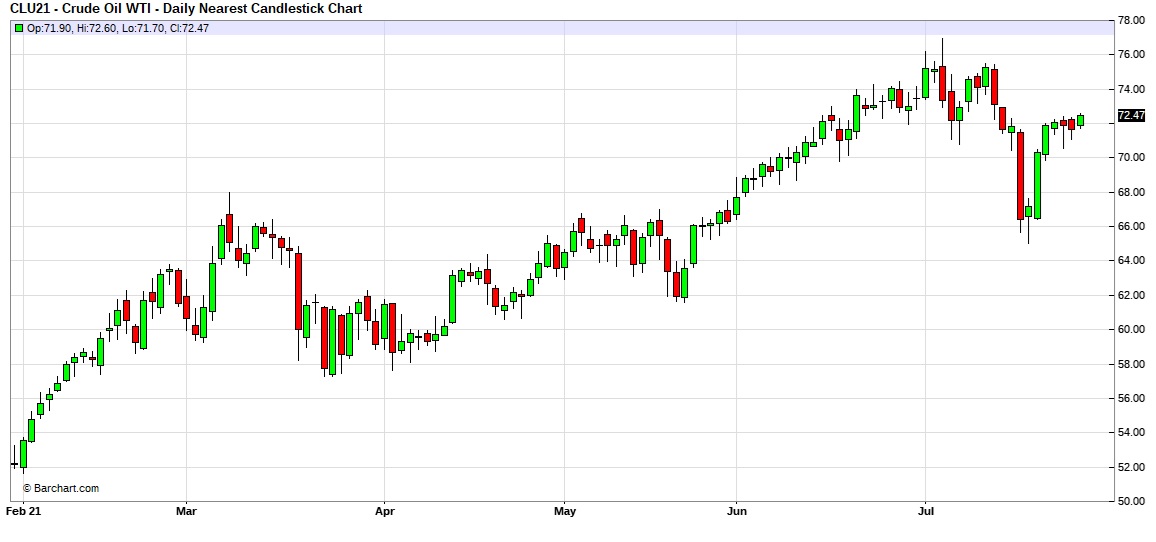

Persian Gulf: Less than a week after a suspected Iranian drone attack killed two crew members on an Israeli-linked oil tanker in the Arabian Sea, suspected Iranian gunmen seized a tanker in the Persian Gulf. Reports this morning say the situation has been resolved, and the gunmen have left the ship, although details remain sketchy. In any case, besides raising tensions in the area and increasing the risk of a military confrontation, the attacks may be putting the final nails in the coffin of President Biden’s effort to revive the 2015 nuclear deal with Iran.

Spain: As electricity prices in Europe surge to a record high, the Spanish government has called on the EU to protect ordinary citizens from the impact of the bloc’s strategy to reduce carbon emissions. Based on an argument that high prices and surcharges could provoke a backlash against the carbon-cutting measures, Spain is advocating for a price ceiling on residential electricity rates.

Pakistan: The Pakistani national security adviser has complained about President Biden’s failure to contact Prime Minister Imran Khan as Washington seeks help to stop the Taliban from taking over Afghanistan following U.S. troop withdrawals. The Pakistanis want a broader relationship with the U.S. that goes beyond simply asking for help in dealing with the Taliban.

Brazil: President Bolsonaro is facing yet another set of legal challenges after a court opened an investigation into his unsubstantiated warnings of voter fraud in presidential elections next year. The probe could potentially lead to him being disqualified from running.

COVID-19: Official data show confirmed cases have risen to 199,750,828 worldwide, with 4,250,090 deaths. In the United States, confirmed cases rose to 35,242,207, with 614,317 deaths. Vaccine doses delivered in the U.S. now total 401,229,975, while the number of people who have received at least their first shot totals 192,120,576. Finally, here is the interactive chart from the Financial Times that allows you to compare cases and deaths among countries, scaled by population.

Virology

- According to the latest CDC data, 57.9% of the U.S. population has now received at least one dose of a vaccine, and 49.7% of the population is fully vaccinated.

- With the Delta mutation of the virus now constituting the biggest challenge, a new study by the U.K.’s Imperial College has provided better detail on how vaccines work against the variant in a real-life community setting. The new study shows full vaccination reduces transmission by approximately 50% and cuts the number of symptomatic cases by some 60%. Previous studies have shown today’s vaccines to be even more effective in cutting serious illnesses, hospitalizations, and deaths. Overall, the accumulating evidence suggests that vaccines remain a key tool to reduce the impact of the pandemic going forward.

- Despite the U.S. progress on vaccinations to date, the spread of the more transmissible Delta variant and low vaccination rates in some locations continues to drive up cases and hospitalizations. In Florida, COVID-19 hospitalizations have reached a record high of 11,515, compared with only about 2,000 one month ago. According to the Florida Hospital Association’s chief executive, approximately 90% of those hospitalized have not been vaccinated.

- As the Delta variant spreads, some hospitals are now treating more COVID-19 patients than ever, just as patients are finally returning for care related to other ailments. As a result, some facilities and healthcare workers are being overwhelmed.

- Surgeries and treatments for cancer, heart disease, and other common conditions have rebounded this year, filling beds at many hospitals.

- At the same time, other respiratory viruses, such as RSV, have re-emerged with public gatherings, adding to hospital strain.

- With the spread of the Delta variant, rising cases and hospitalizations, and some renewed social-distancing measures, new Harris polling again shows a majority of Americans now think the worst of the pandemic is still ahead of us. About 54% of respondents believe the worst is yet to come, while 46% think it’s behind us.

- The U.K.’s vaccination program will be extended to 16- and 17-year-olds today, bringing the country more closely in line with its international counterparts, such as the U.S. and Israel, which have already jabbed substantial numbers of children.

- In India, rebounding infection numbers after weeks of steady decline are fueling anxieties about a possible third wave in the country, even as it is still recovering from the disease’s last devastating surge during the spring.

Economic and Financial Market Impacts

- We’ve talked a lot about the large cash balances held by households and many businesses because of the pandemic, which should provide added fuel for further economic growth and rising asset prices in the future. Bank executives, however, say that in recent months, their business clients have also ramped up requests for expanded credit lines. Those credit lines could help fuel continued economic growth and better earnings because they can be drawn quickly for spending on inventory, labor, or expansions.

- The Thai baht has gone from being one of Asia’s strongest currencies before the pandemic to one of its worst performers this year as the coronavirus crisis ravages Thailand’s crucial tourism sector. The currency is down more than 9% against the dollar since the end of 2020, placing it among this year’s weakest performers globally alongside peers such as the Turkish lira and Peruvian sol.

U.S. Policy Response

- Responding to pressure from progressive Democrats and President Biden, the CDC issued a new federal eviction moratorium covering the 80% or so of U.S. counties experiencing “substantial or high” levels of COVID-19 transmission. According to the president, the new moratorium may not pass constitutional muster, but even if a legal fight over it ensues, it will buy time for state governments to distribute the $47 billion in rental assistance still available under recent pandemic relief laws.

- The CDC said its new order would last through October 3, “but is subject to further extension, modification, or rescission based on public health circumstances.”

- Even if the new federal moratorium is deemed unconstitutional, states representing some 80% of the U.S. population have their own moratoriums in place.

Foreign Policy Responses

- According to British officials and bankers, as much as £5 billion of state-backed government emergency loans to U.K. businesses are at risk of not being repaid. However, defaults at that level would be much lower than initially feared.