by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning and happy Friday! The Olympics officially open today (although the competition has already started). Sadly, for the organizers, things are not going all that well. The pandemic has led to empty arenas, the opening music has been scrapped over a scandal, and the opening ceremony director has been fired. In the financial markets, U.S. equity futures continue to move higher, while bond yields are up a bit as well. In today’s report, we update a few things from yesterday, including the ECB announcement, more on the fallout from the Nord Stream 2, and a few comments on home prices. The coverage begins with economics and policy, with the international roundup next. China news follows, and we close with pandemic coverage.

Economics and policy: The ECB and home prices are today’s focus.

- Yesterday, the ECB announced what appears to be a flexible inflation target. The mechanism was left vague, much like what we saw from the Fed on this topic. Central banks want to preserve flexibility and don’t want to be held to some sort of formula. Of course, analysts want to predict their behavior and try to create models that will do just that. However, there is another reason central bank leaders keep targets “fuzzy.” It can reflect the fact that there is dissension on the governing boards. A hard target will make some members unhappy, so having a soft target is a way of managing dissent. In the end, the ECB has promised to keep policy accommodative for a long time.

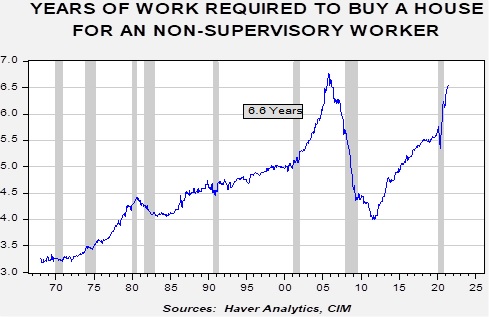

- Yesterday, we learned that existing home prices reached a new record. There is growing speculation that home prices might be the trigger for tighter monetary policy. On the one hand, the Fed is rightly concerned about another housing bubble. Prices scaled to wages suggest we are near bubble highs.

This chart divides the seasonally adjusted median existing home price by the hourly wage and calculates how many years of work a person would need to buy that house. We are currently at 6.6 years, just below the high of 6.8 years set in May 2005. However, we do not see the type of risky behavior seen in the last bubble. For example, 61.5% of refinancing is done at the same loan amount; in 2005, that percentage was 9.4%. The median credit score on new mortgages is 787, a record high; in Q4 2006 it was 709. In Q1 2007, $113 billion of mortgages were originated with a credit score of less than 620; currently, that is $17 billion. So, the signs of froth are not evident.

- Meanwhile, the administration is trying to expand assistance for mortgage borrowers who may face foreclosure through modification. Evictions may begin in earnest soon as state and local governments struggle to distribute assistance. Paradoxically, in the face of evictions, rent increases are emerging, complicating the inflation picture.

- We are also starting to see potential buyers balk at current prices.

- Although lumber prices have fallen from their recent peaks, wildfires are restricting supply and may bring another round of price hikes.

- On the inflation front, there are reports of companies testing high prices to see how consumers react. A ploy used during the 1970s, the “incredible shrinking package” is also back. The latest metal to see higher prices is tin.

- Worker shortages continue, with railroads being the most recent industry to report problems. Industry treated workers similar to the way it treated inventory in recent years. Staff redundancies were rare, and as the pandemic led some workers to retire, companies are scrambling to find employees.

- Intel (INTC, USD, 55.96) warns that the semiconductor chip shortage could last into 2023. This news contradicts earlier reports that the supply situation might improve soon.

- On the regulatory front, the SEC is taking a second look at the swaps market. Increasingly, distributed finance, which uses technology to create financial markets, is moving offshore to avoid regulation. In our opinion, DiFi is nothing more than regulatory arbitrage, doing to finance what ride-hailing did to taxis. However, the history of finance shows that eventually, somebody gets overleveraged and defaults. In the DiFi world, there is no lender of last resort.

- And, on a weekend note, several grill manufacturers are looking to list.

International roundup: Nord Stream 2 problems continue, and U.S. forces look to leave Iraq soon.

- The fallout from Nord Stream 2 continues. Although the U.S. and Germany have a deal, it can’t be fully implemented without the cooperation of Russia and Ukraine. That looks like a long shot. There are growing concerns that since Russia has an outlet for natural gas that avoids Ukraine, will Moscow try to extend its influence? In other words, increasing the conflict with Ukraine is now less risky.

- As the U.S. finishes the troop withdrawal from Afghanistan, it appears Iraq is next. Our take is the U.S. is moving on from the Middle East. We continue to watch developments.

- The EU has told the U.K. that it won’t renegotiate the Brexit deal.

- Poland is threatening to pull the broadcast license on a U.S. news outlet.

China: Hong Kongers look to leave, and Wendy Sherman spends the weekend in China.

- In April, the Hong Kong legislature passed several bills restricting the right to protest and leave the former colony. The exit ban goes into effect next month, and Hong Kongers are scrambling to leave. According to reports, the police have watch lists and will arrest anyone on these lists who tries to leave. The lists, though secret, are said to be populated with activists and journalists who are currently out on bail and awaiting trial. On cue, Senate bill S.295, the Hong Kong Safe Harbor Act, has been introduced by Sen. Rubio (R-FL). It has 13 co-sponsors, nine Democrats, and 4 Republicans. Although this bill offers hope, it probably won’t pass fast enough to offer a path for Hong Kongers affected by this travel ban.

- Wendy Sherman goes to Beijing over the weekend. Expect a frosty reception.

- The death toll from recent flooding continues to rise.

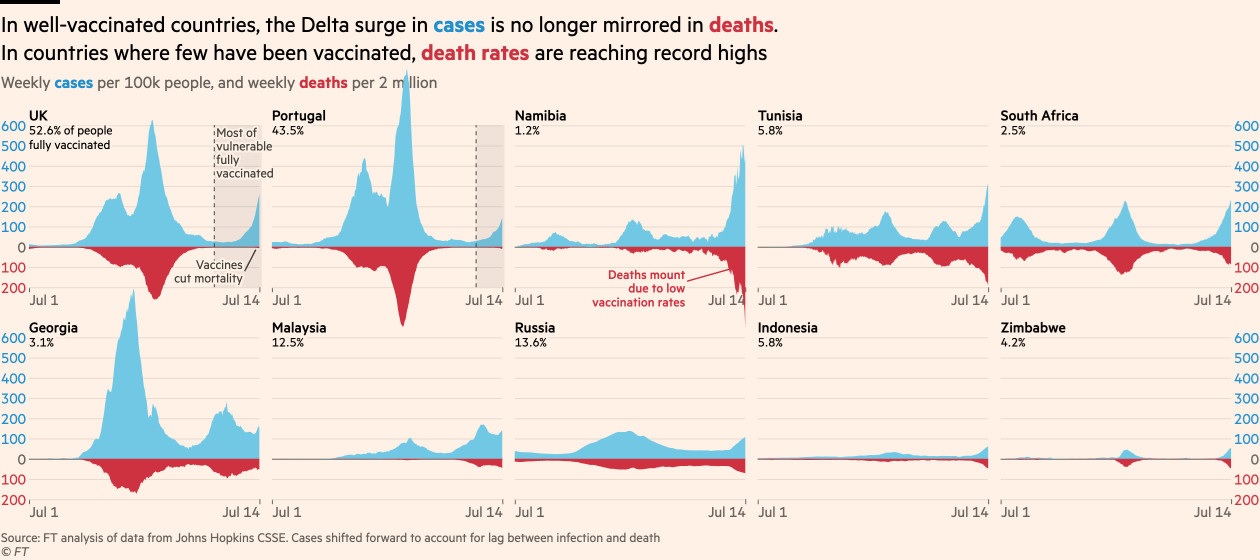

COVID-19: The number of reported cases is 192,699,963 with 4,138,605 fatalities. In the U.S., there are 34,284,455 confirmed cases with 610,192 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 391,998,625 doses of the vaccine have been distributed, with 339,763,765 doses injected. The number receiving at least one dose is 187,216,168, while the number of second doses, which would grant the highest level of immunity, is 162,174,165. The FT has a page on global vaccine distribution.

- Although the global economy continues to improve, worries about the impact of the Delta variant are increasing. For example, PMI data from Australia have slipped as lockdowns have been implemented.

- China is continuing to reject WHO requests to investigate the lab-leak hypothesis.

- Medical researchers are increasing their work on “long COVID,” a set of symptoms that have affected up to 30% of those infected by the virus. Symptoms include persistent muscle aches, shortness of breath, sleep difficulties, and “brain fog.” There is some evidence that COVID-19 causes an autoimmune response that is behind these persistent symptoms.

- Media companies in the past provided content which attracted viewers or readers. The companies would then sell advertising along with their content. The ingenuousness of social media is that users provide the content; social media companies don’t have to pay for making content and can still sell the advertising. The downside is, as is true of all media, the most lurid is what attracts attention. Broadcasters, because they used the public spectrum, were regulated by the government. Print could avoid that oversight but was still subject to libel rules and social constraints. But the social media firms were mostly left with no constraints and created algorithms designed to push the worst material to the most people because that’s what they wanted to see. The impact on society has become problematic, and we have been watching to see how the firms will eventually become regulated. We note that Sen. Klobuchar (D-MN) has introduced a bill that would remove protections from lawsuits over the platforms hosting misinformation on public health emergencies.