by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

In today’s Comment, we begin with the latest developments regarding the infrastructure spending bills making their way through Congress and the outlook for the Federal Reserve’s monetary policy. We next review the latest signs of U.S.-China economic decoupling and geopolitical risks surrounding Taiwan. We then turn to a range of other international news items of note, and we end with the latest news on the coronavirus pandemic.

U.S. Fiscal Policy: Separate from the bipartisan “hard” infrastructure bill totaling approximately $1 trillion that is making its way through Congress, Democrats on the Senate Budget Committee are working to finalize their “soft” infrastructure bill, focused on programs like child care and climate change, which they will try to pass without Republican support.

- Rather than the price tag of $6 trillion proposed by Senator Bernie Sanders (D, Vt.), sources say the negotiators are coalescing around $3 trillion to $4 trillion.

- Democrats are also weighing a number of tax increases to help pay for the plan, including raising the corporate tax rate from 21%, tightening the net on U.S. companies’ foreign earnings, and boosting the capital gains rate.

U.S. Monetary Policy: In an interview with the Wall Street Journal, St. Louis FRB President Bullard said he is ready to start slowing the pace of the Fed’s bond-buying as soon as his colleagues are. It is in part because of concerns that the asset purchases risk overheating the housing market. According to Bullard, “We do want to do it gently and carefully, but I think we’re in a very good position to start a taper. I don’t need to get going tomorrow, but I think we’re . . . in very good shape for this.” Naturally, the statement has the potential to reignite concerns about higher interest rates and boost volatility in the financial markets again.

United States-China: Administration officials say that President Biden, in conjunction with issuing new sanctions this week on China for its human rights abuses in Hong Kong and Xinjiang, will warn U.S. firms that it is becoming riskier to operate in Hong Kong because of Beijing’s growing control over the city. In particular, Biden will warn about: 1) the Chinese government’s ability to access any data that foreign companies store in Hong Kong, and 2) a new law that allows Beijing to impose sanctions against anyone who enables foreign penalties to be implemented against Chinese groups and officials. The move would mark the first time a U.S. administration has issued a business advisory relating to Hong Kong.

- The administration’s move clearly intends to make U.S. firms think twice about starting or maintaining business operations in Hong Kong, which in turn would tarnish the prize Beijing got when it took greater control over the city last year.

- More broadly, the move demonstrates that the U.S. has adopted the tactic of hitting China where it is vulnerable, i.e., exploiting its dependency on exports (with tariffs and other trade barriers, for example), its dependency on foreign portfolio capital (by discouraging U.S. investors from buying Chinese stocks, for instance), its dependency on foreign technology (by clamping down on sales of semiconductors, etc.), and now its dependency on foreign direct investment capital and business expertise in Hong Kong.

- Most broadly, the move is yet another step on the road toward economic uncoupling and the establishment of at least two major trade blocs, one centered on China and one on the U.S. As shown by Beijing’s recent moves to block some of its companies from listing on foreign stock exchanges, China is moving in the same direction. The continuing trend will undermine globalization and create a risk that the global economy will become less efficient over time. As we have argued repeatedly, the moves could also impact investors as collateral damage.

Japan-China-Taiwan: The Defense Ministry’s annual “Defense of Japan” white paper has for the first time said that Japanese national security depends on stability in the area around Taiwan. According to the report, “The stability of the situation around Taiwan is important, not only for the security of our country, but for the stability of the international community . . . Our country must pay close attention to this, with an even greater sense of vigilance.”

- The statement follows a range of other Japanese government pronouncements showing it sees vital national interests in Taiwan’s security. This includes a statement by Deputy Prime Minister Aso last month that Japan would have to help the U.S. defend Taiwan in the event it is attacked by China. The message is that Japan will be a key player in intensifying rivalry between the U.S. and China and the geopolitical tensions around Taiwan.

- Of course, the new Japanese white paper has already generated strong condemnation by China. Given China’s traditional strong pushback against critics and threats, the statement is likely to worsen ties between the two countries and could produce economic or financial repercussions for Japanese assets.

Eurozone Monetary Policy: In an interview with the Financial Times, ECB Chief Lagarde warned that the institution’s new “symmetric” inflation target of 2%, which would allow temporary moves above that level, could spark disagreement next week when ECB policymakers meet to consider readjusting their current forward guidance. With the Eurozone’s inflation rate already surpassing the new target earlier this year, some policymakers will likely argue for tighter policy, while some will argue for keeping the current level of accommodation. In any case, any adjustment to the guidance could spark volatility in European bond and stock markets.

Bulgaria: The anti-establishment There is Such a People party, headed by pop star Slavi Trifonov, has reportedly won almost a quarter of the vote in last weekend’s elections, making Trifonov the likely leader of Bulgaria’s next government. However, Trifonov has sent signals that he may try to lead a minority government, which would likely be unstable.

United Kingdom: Citing the results of recent stress tests and lower-than-expected loan losses, the Bank of England has removed restrictions on bank dividends and share buybacks imposed during the pandemic. The BOE determined the sector to be resilient enough to absorb any further COVID-19 shocks, and with the prospect of greater returns of capital, the move is likely to be positive for British financial services stocks in the near term.

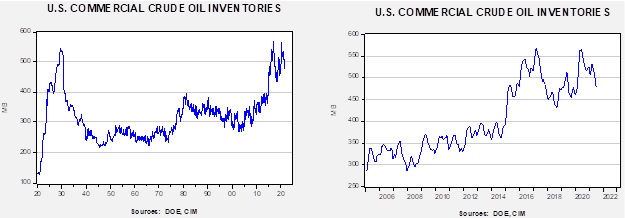

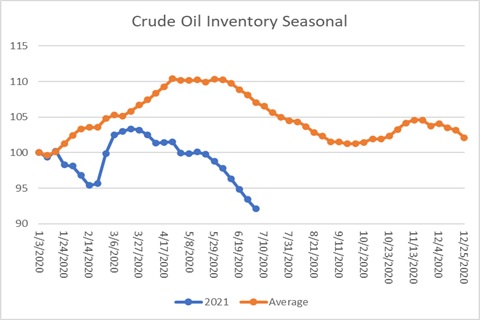

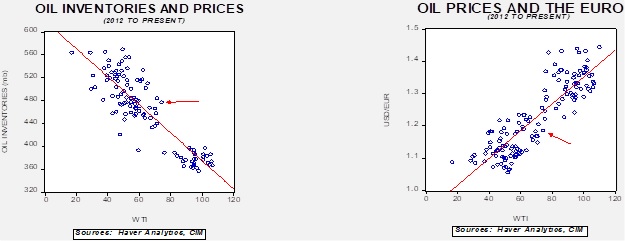

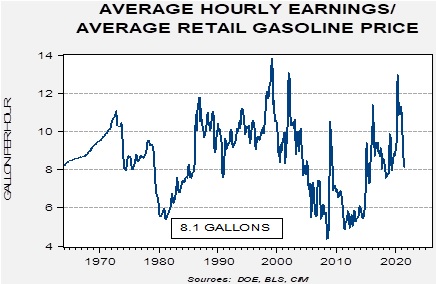

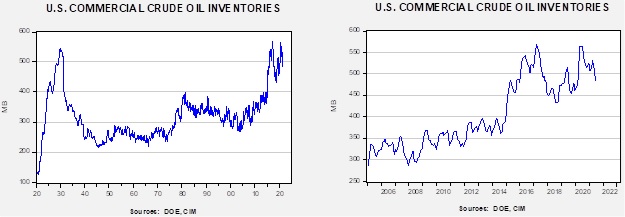

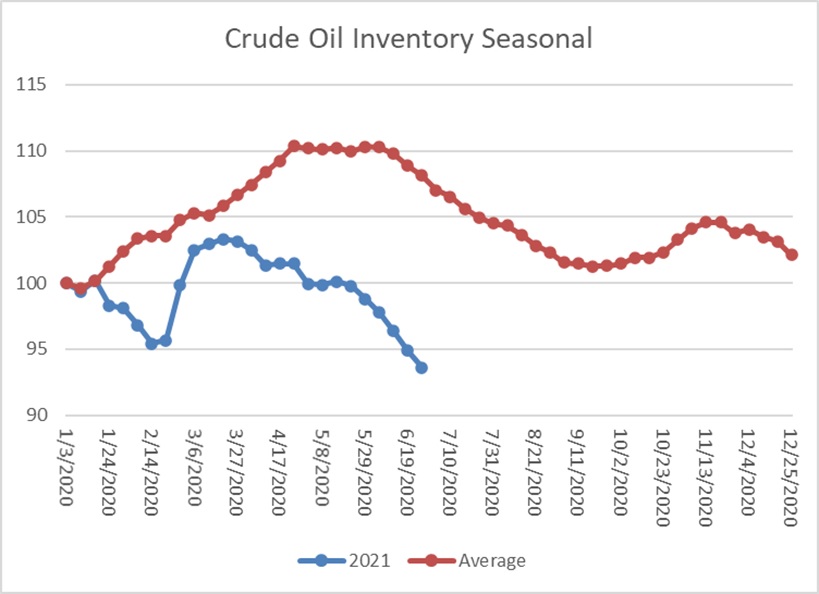

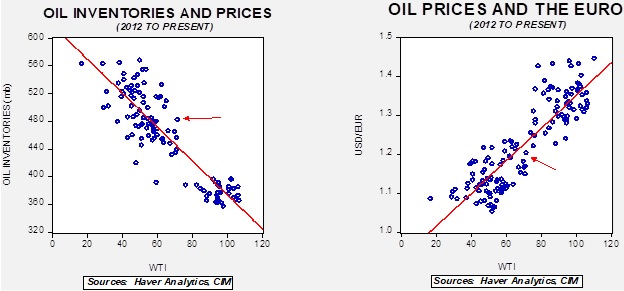

Global Oil Market: The International Energy Agency warned that if the OPEC+ group of major exporters doesn’t soon reach a deal to boost production, global oil markets will tighten “significantly” in the coming months, pushing oil prices higher and putting “a drag on the economic recovery, particularly in emerging and developing countries.”

- According to the IEA, global oil demand jumped by an estimated 3.2 million barrels a day in June to 96.8 million bpd, within about 3% of pre-pandemic levels.

- In its updated forecast, the agency expects global demand to continue recovering in the third quarter. It expects demand to average 96.4 million bpd in full-year 2021 and 99.5 million bpd in full-year 2022, compared with the pre-pandemic peak of about 100 million bpd.

Cuba: As we reported yesterday, protests against economic difficulties broke out across Cuba over the weekend. Yesterday, the government began a sharp crackdown on the demonstrators. The crackdown involved cutting off most communications with the outside world and deploying security forces across the country (including, for the first time, anti-riot equipment like tear gas and rubber bullets). According to activists, police arrested more than 100 people, many of whose whereabouts remain unknown. All the same, if the apparently spontaneous outpouring of anger signals that Cubans have lost their previous fear of protesting, instability could increase on the island.

Haiti: Also in the Caribbean, Haiti is quickly devolving into chaos and criminality after President Jovenel Moïse was assassinated in his home last week. Over the weekend, a group of U.S. officials traveled to Haiti and visited with no less than three politicians who claim they have the right to take power in the country. One ray of hope is that interim Prime Minister Claude Joseph and Prime Minister Designee Ariel Henry are reportedly considering working together to stabilize the country and pave the way for fresh elections.

South Africa: Protests and violence are also spreading in South Africa in response to last week’s jailing of Jacob Zuma, the former president, for contempt of court. The government has deployed the army to help the police control the situation. So far, six people have been reported killed. One thing to watch will be whether the violence disrupts the country’s key mining sector.

COVID-19: Official data show confirmed cases have risen to 187,412,467 worldwide, with 4,043,222 deaths. In the United States, confirmed cases rose to 33,890,840 with 607,445 deaths. Vaccine doses delivered in the U.S. now total 387,006,120, while the number of people who have received at least their first shot totals 184,365,333. Finally, here is the interactive chart from the Financial Times that allows you to compare cases and deaths among countries, scaled by population.

Virology

- According to the latest CDC data, 55.5% of the U.S. population has now received at least one dose of a vaccine, and 48.0% of the population is fully vaccinated.

- In France, the government has responded to the fast-spreading Delta variant by imposing a fresh set of restrictions on people who aren’t yet vaccinated or haven’t recently tested negative for COVID-19. Those people will not be allowed to enter businesses such as bars, restaurants, shopping malls, concert halls, and hospitals. Vaccinations will also be made compulsory for all health workers. The new restrictions highlight the economic risks arising as the Delta mutation spreads around Europe and many other regions.

- With the dangerous Delta variant spreading around the world, the Israeli government this week will begin offering third doses of the vaccine from Pfizer (PFE, $39.76) to adults with serious pre-existing medical conditions. Israel will therefore become the first country in the world to officially offer a so-called “booster” of the company’s jab. Other countries are also considering booster shot programs.

- The FDA ordered that the vaccine from Johnson & Johnson (JNJ, $169.48) carry a label warning that the shot has been linked to a very small number of cases of Guillain-Barré syndrome. Guillain-Barré syndrome is a rare neurological disorder in which the immune system attacks nerves, causing temporary but potentially severe paralysis. The risk is a known one with vaccines, including some influenza vaccines and a leading shot to prevent shingles.

- The vaccines from Johnson & Johnson and AstraZeneca (AZN, $60.50) have also been linked to a very small number of blood-clotting issues, although officials continue to argue that the benefits of the vaccine outweigh the risks involved with it.

- Johnson & Johnson, AstraZeneca, the University of Oxford, and other outside scientists are conducting early-stage research into whether potential modifications of their vaccines could reduce or eliminate the risk of those blood clots.

Economic and Financial Market Impacts

- As governments continue to grapple with the pandemic, their increased spending continues to drive up borrowing and debt levels, potentially creating economic risks down the road.