by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Today’s Comment opens with new developments related to U.S. monetary and regulatory policy. We then turn to a review of some key economic data from China and various other international news. We close with the latest developments related to the coronavirus pandemic.

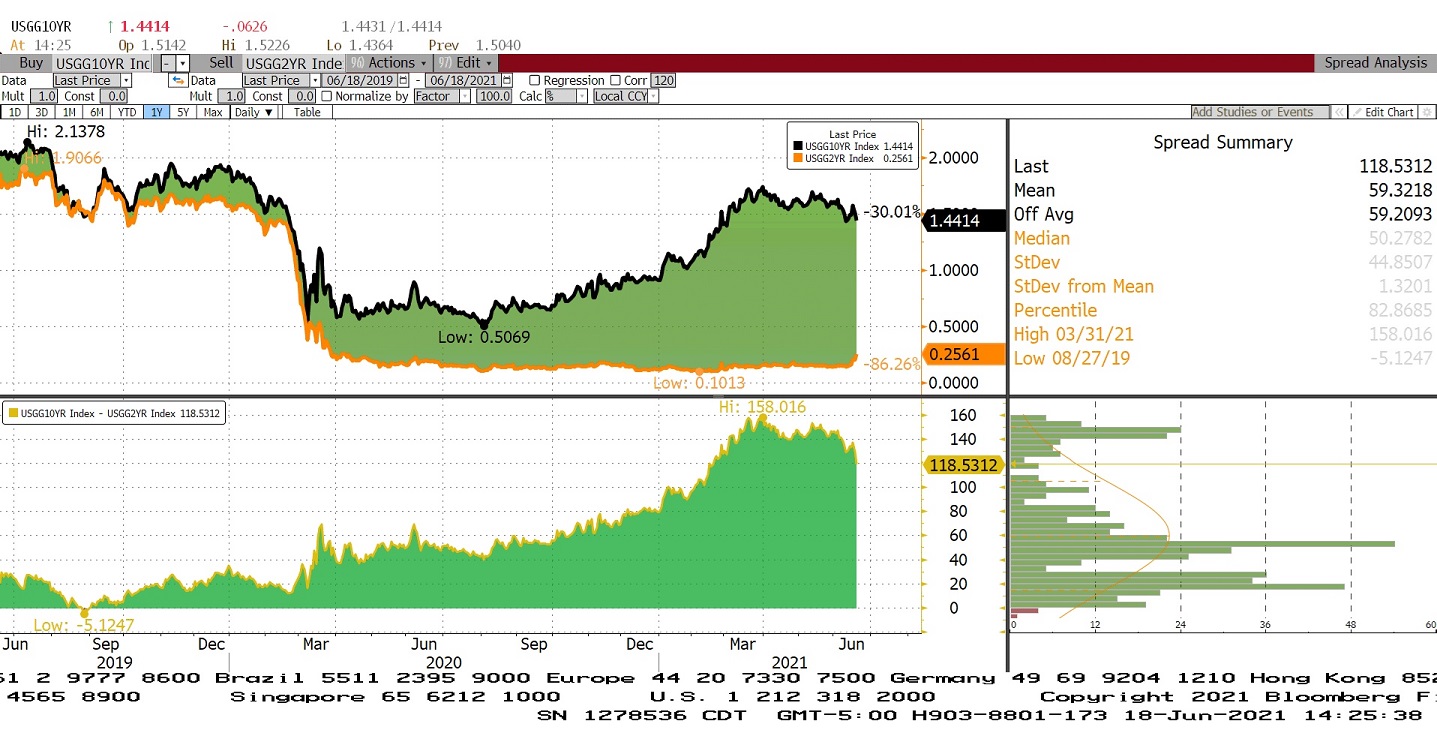

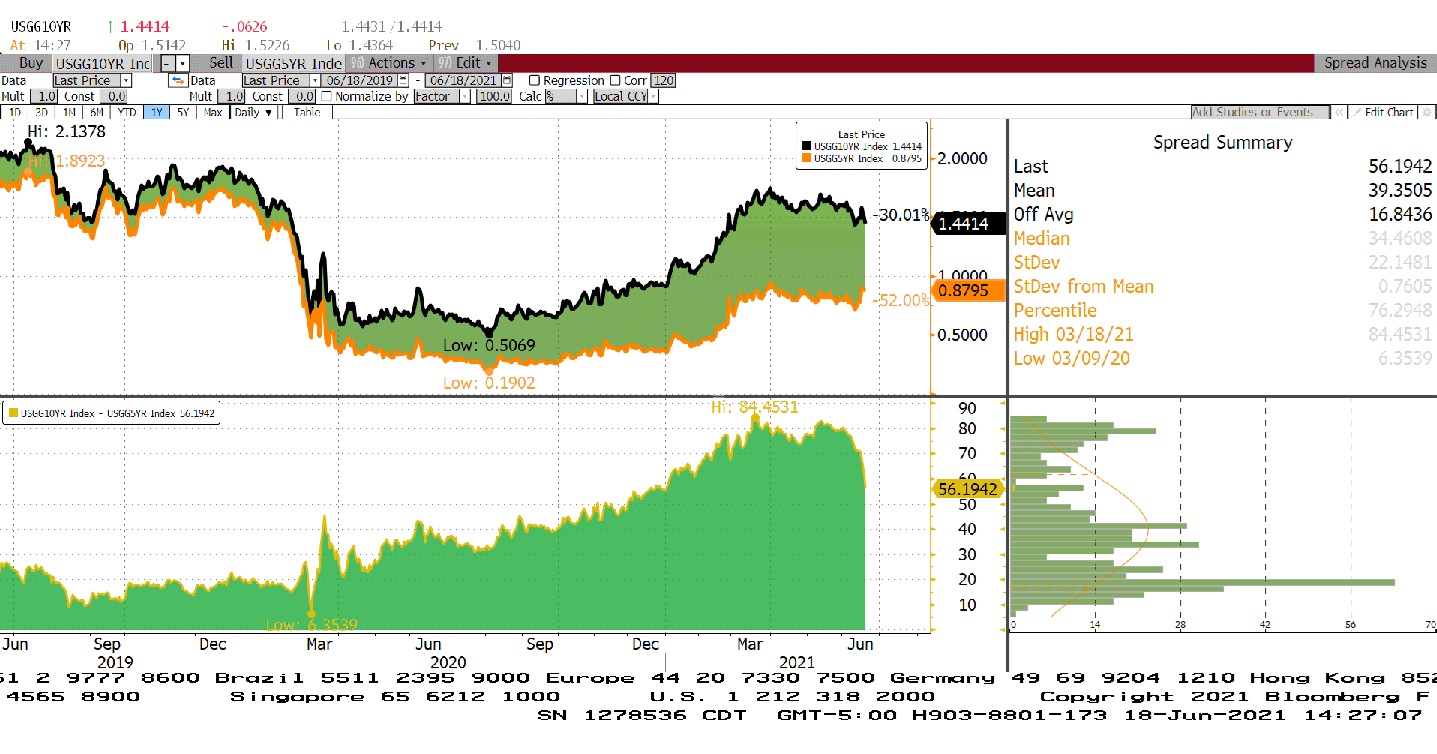

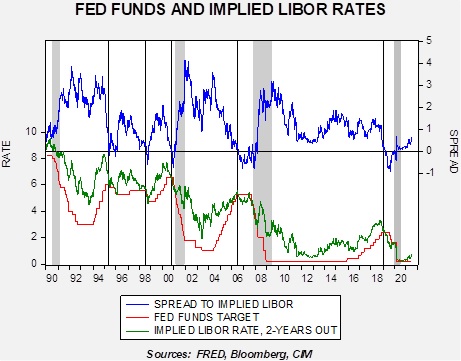

U.S. Monetary Policy: An inaugural survey of academic economists conducted by the Financial Times and the University of Chicago’s Initiative on Global Markets suggests that elevated inflation will compel the Federal Reserve to boost U.S. interest rates at least twice by the end of 2023. That aligns closely with the “dot plot” of Fed officials’ own forecasts for when and how quickly rates will have to rise from their current level that is near zero.

- The new FT-IGM U.S. Macroeconomists Survey polled 52 academic economists on the likelihood that the Fed’s main policy rate would indeed be higher by 0.5% by the end of 2023, as the dot plot indicated. A majority of respondents said the likelihood of a move of that size or more was above 75%, and a large minority put it as high as 90%.

- The findings underline our view that Fed Chair Powell has been unable to make a convincing case for his strategy of prioritizing labor market outcomes by keeping monetary policy loose. Many establishment-leaning, capital-friendly policymakers on the FOMC are in open rebellion and are talking increasingly about the need to tighten policy, albeit gradually. The financial markets seem to be coming to terms with that prospect over the last couple of weeks, but any sign of an even earlier policy tightening will have the potential to disrupt markets once again.

U.S. Competition Policy: According to the Wall Street Journal, the Biden administration is developing an executive order directing federal agencies to strengthen their oversight of industries that they perceive to be dominated by a small number of large companies. Although we’ve been highlighting how big businesses are facing increased regulatory risk in the area of antitrust, the goal of the new executive order would be to broaden the way regulators approach big business and business concentration beyond that area. For industries dominated by a few big firms, for example, regulators might conduct heightened surveillance on fees charged to customers or on their relationships with suppliers.

European Union: Justice Commissioner Didier Reynders has warned that the EU could eventually face a breakup due to a proliferation of legal challenges and rulings by EU member states against the principle that EU law supersedes national laws. It doesn’t appear to be an imminent crisis for the EU, but the report shows that the issue has been building. Brussels has been slow to respond. This will probably have importance for the EU’s functioning and potential effectiveness over time, especially as it implements its new program of common, mutual EU debt issuance.

- In a sign of the perceived threat, the European Commission this month launched legal proceedings against Germany. It is in response to an explosive ruling by its constitutional court last year that the European Court of Justice had acted beyond its level of competence in a case related to the European Central Bank’s bond-buying.

- The next big legal challenge Brussels is bracing for is a decision by the Polish constitutional tribunal, which could come on July 13, on whether certain elements of the EU’s treaties are compatible with the country’s constitution.

China: The National Bureau of Statistics released its official purchasing managers indexes for the manufacturing and nonmanufacturing sectors, with the data hinting at a modest economic weakening as supply constraints weigh on production, export demand softens, and consumers remain cautious amid localized new pandemic lockdowns. As with most such indexes, China’s PMIs are designed so that readings over 50 will point to expanding activity. The details are below (and in the data tables of the .pdf version of this document).

- The June PMI for manufacturing fell slightly to 50.9 in June from 51.0 in May.

- Importantly, the subindex on production declined to 51.9 in June from 52.7 in the previous month, as recent shortages of semiconductors, coal, and power held back output at many factories.

- Meanwhile, the subindex on new export orders fell from 48.3 in May to 48.1 in June, signaling weakening external demand for Chinese goods.

- Separately, the June PMI for the nonmanufacturing sector declined to 53.5 from 55.2 in May.

Russia: Today, President Putin is holding his annual call-in show, where citizens can call in questions to him directly. The call is aimed at showcasing Putin’s willingness to respond to average Russian concerns. The president has already made some news by insisting that last week’s incident off the coast of Crimea, where the British naval destroyer HMS Defender was confronted by Russian coast guard ships and fighter aircraft, was “a clear provocation.” More news could arise as the call continues.

Brazil: President Bolsonaro, who is gearing up for a re-election bid next year but trails former President Luiz Inácio Lula da Silva, is now facing a major scandal because of an apparent attempt to secure kickbacks on a major coronavirus vaccine contract.

COVID-19: Official data show confirmed cases have risen to 181,908,304 worldwide, with 3,940,007 deaths. In the United States, confirmed cases rose to 33,653,105 with 604,476 deaths. Vaccine doses delivered in the U.S. now total 381,831,830, while the number of people who have received at least their first shot totals 179,940,202. Finally, here is the interactive chart from the Financial Times that allows you to compare cases and deaths among countries, scaled by population.

Virology

- According to the latest CDC data, 54.2% of the U.S. population has now received at least one dose of a vaccine, and 46.4% of the population is fully vaccinated.

- In Europe, tourist-dependent countries like Spain and Greece are especially worried that the Delta variants of the virus could again force them to restrict international travelers. Spain, Portugal, and Malta this week have already tightened restrictions on tourists from the U.K., where the Delta mutation is spreading. Earlier this month, Italy required U.K. travelers to quarantine for five days.

- Russian President Vladimir Putin, fielding questions from across the country on his annual call-in show, urged citizens to overcome their hesitancy and get vaccinated against COVID-19 as the country continues to rack up daily records for deaths from the coronavirus. Putin also revealed for the first time that he got the locally developed Sputnik V vaccine, ending months of speculation over which shot he received behind closed doors late last year.

- In Australia, resurgent infections have prompted authorities to lock down four major cities, representing more than half the country’s population. The latest surge will put greater pressure on the government for its sluggish vaccination drive.

- After winning international praise for its initial response to reining in the virus, the government was warned that a slow vaccine rollout would jeopardize those early gains.

- While about 30% of the country’s 26 million people have received at least a first jab, only about 7% of Australians are fully vaccinated.

- The infection resurgence in Australia comes despite the country’s strong efforts at contact tracing.

- Without providing details, North Korean state media said paramount leader Kim Jong Un accused officials in his government of neglecting important party decisions related to the pandemic. He said these officials “caused a grave incident that poses a huge crisis to the safety of the nation and its people.” The statement is being taken as groundwork for the announcement of a pandemic crisis in the country or justification for allowing foreign experts to help vaccinate the country’s citizens.

Economic and Financial Market Impacts

- In an important sign of the post-pandemic recovery in the U.S. real estate finance market, the issuance of single-asset, single-borrower bonds is again surging after dropping by nearly half in 2020.

- In the U.K., new data shows that as the latest lockdown curtailed spending in shops, bars, and restaurants early this year, the first-quarter household saving ratio — the average percentage of disposable income that is saved — rose to 19.9% from 16.1% in the final quarter of last year. As in the U.S., this raises hope that the accumulated cash will boost the country’s economic recovery as businesses reopen.

- Agustín Carstens, general manager of the Bank for International Settlements and the former chief of the Bank of Mexico, warned that developing countries have yet to feel the full economic impact of the pandemic, but they are already close to exhausting their capacity to borrow and to use fiscal and monetary policy to deal with it.

- According to Carstens, the situation for developing countries is especially challenging given that so many developed countries are preparing to withdraw the fiscal and monetary policy support they had been providing to their economies.

Even though our expectations for a weaker dollar would suggest a positive outlook for the so-called emerging markets, Carstens makes a valid point that the shifting policy stances around the world could make this a trickier area to invest in than it otherwise would be.