by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

In today’s Comment, we open with some early responses to the G7’s call for a global minimum tax rate on corporations. In a word, it looks like pretty tough sledding for the proposal. Next, we move to U.S. fiscal and regulatory policy developments, with a particular focus on President Biden’s decision to abandon his talks on infrastructure spending with Republicans in the Senate. We then move to various international news items before wrapping things up with the latest items of note on the coronavirus pandemic.

Global Minimum Tax for Corporations: Responding to the G7’s call for a global minimum tax of 15% on corporations, the finance spokesman for Ireland’s second-largest opposition party backed a “small increase” in the country’s 12.5% rate. Yet, the proposal is likely to get significant pushback as the G7 tries to sell it to the broader G20 grouping.

- Even Poland and Hungary have already come out against the plan unless it includes carve-outs for certain businesses.

- And, of course, the idea would face immense hurdles getting through the U.S. Congress.

- Assuming the plan would take the form of a treaty, it would require the approval of two-thirds of the Senate. That would be very difficult to achieve in today’s polarized political environment and the current 50-50 split in the chamber between Democrats and Republicans.

- Senior Republican lawmakers have already lined up to slam the fledgling accord, citing the potential harm to U.S. competitiveness and sovereignty.

- For now, at least, we think the proposal is unlikely to be implemented anytime soon.

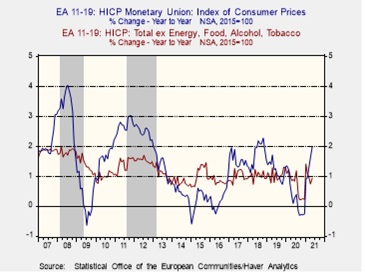

U.S. Fiscal Policy: President Biden called off an effort to craft a bipartisan spending package on infrastructure and other economic initiatives after negotiations with Republicans stalled. Instead, Biden is shifting his focus to a separate set of negotiations with a group of Republicans and Democrats in an effort to salvage a bipartisan deal on the issue. Senate Majority Leader Schumer said Democrats are preparing to pass elements of Biden’s original, $2.3 trillion infrastructure plan through reconciliation, a budget maneuver allowing lawmakers to avoid the 60-vote threshold for most legislation in the Senate. Democrats are probably able to pass some infrastructure spending on their own through the reconciliation process. The amount ultimately approved may be significantly smaller than President Biden’s original proposal, but it could still provide a significant boost to economic activity and inflation pressures.

- Meanwhile, the Senate approved the “U.S. Innovation and Competition Act,” which would provide $250 billion to boost government spending on technology research and development to counter the rising threat from China and other nations.

- If approved by the House of Representatives, the legislation would represent a landmark effort to turn the tide on several long-term trends in U.S. competitiveness, such as eroding federal investment in research and a shrinking share of the world’s semiconductor manufacturing.

U.S. Cryptocurrency Regulation: Hester Peirce, one of the two Republicans on the five-member Securities and Exchange Commission, in a statement to the Financial Times, warned against attempts by her colleagues to regulate cryptocurrencies more strictly, saying that doing so runs the risk of discouraging investors.

- The comments expose a split at the top of the SEC just as Gary Gensler, its chair, spearheads an effort to bring the fast-growing cryptocurrency market more in line with other types of financial assets.

- Separately, El Salvador’s legislative body today passed a law that will make the nation the first in the world to deem bitcoin legal tender.

United States-Japan-Australia-India: White House Indo-Pacific Coordinator Kurt Campbell said the U.S. will host the first in-person summit of the “Quad” countries–the U.S., Japan, Australia, and India–this fall in Washington. At the summit, the countries’ leaders will further discuss strategies to counter China’s geopolitical, military, and economic aggressions throughout the Indo-Pacific region.

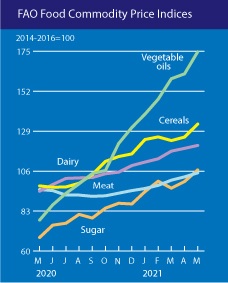

Chinese Inflation: The May producer price index (PPI) was up an astounding 9.0% year-over-year, well above the expected increase of 8.5% and far worse than the April increase of 6.8% (see data tables below). Driven by vast price increases in industrial commodities like crude oil and iron ore, the annual gain in May was the biggest since September 2008. The large rise in costs could help reignite concerns about persistent high inflation around the world.

- However, one important question is the extent to which higher producer costs will be passed on to the consumer.

- China’s May consumer price index (CPI) was up just 1.3% on the year, higher than the 0.9% growth in April but lower than the anticipated increase of 1.6%.

Chinese Housing Market: Fast-rising home prices have also become a problem in China, prompting many local governments to impose new restrictions. Among the most interesting is a move by Shenzhen to publish “guidance prices” for about 3,500 different housing developments. In effect, the guidance prices are taken as a cap on the size of a mortgage that a bank can offer on a property. If a buyer wants to pay more than the guidance price, he or she can do so, but the buyer then needs to make a larger down payment.

South Korea: The ruling Democratic Party today said it was trying to regain public trust by asking 12 lawmakers to leave the party over a property scandal that has alienated voters. The insider land trading scandal, alongside skyrocketing home prices and deepening inequality, has contributed to President Moon Jae-in’s approval ratings plunging to record lows and his party’s abject defeat in key mayoral elections in April.

COVID-19: Official data show confirmed cases have risen to 174,060,099 worldwide, with 3,749,148 deaths. In the United States, confirmed cases rose to 33,393,813 with 598,330 deaths. Vaccine doses delivered in the U.S. now total 372,100,285, while the number of people who have received at least their first shot totals 171,731,584. Finally, here is the interactive chart from the Financial Times that allows you to compare cases and deaths among countries, scaled by population.

Virology

- According to the latest CDC data, 51.7% of U.S. residents have now received at least one dose of a vaccine, and 42.3% are fully vaccinated.

- The vaccines developed by Pfizer (PFE, $38.85) and Moderna (MRNA, $213.00) are now reportedly in clinical trials with children under the age of 12 years. If the trials show the shots are safe and effective with that age group, the companies expect to apply for emergency use as early as this autumn.

- Wisconsin pharmacist Steven Brandenburg, a vaccine skeptic, was sentenced to three years in prison yesterday for tampering with hundreds of doses of the Moderna vaccine at the pharmacy where he worked. Working the night shift, Brandenburg would deliberately remove the vaccines from their refrigerator for hours at a time, trying to ruin them.

- The Biden administration has taken the first step towards relaxing the U.S.’s international travel bans related to the pandemic, setting up working groups to advise him on ways to loosen restrictions on arrivals from the U.K., EU, Mexico, and Canada.

Economic and Financial Market Impacts

- A new COVID-19 outbreak in southern China is curbing activity at some of the country’s biggest ports, stoking fears of further disruption to international trade and more upward pressure on prices.

- More than 100 new cases have been reported since late May in Guangdong province, one of China’s most important manufacturing hubs, leading to strict countermeasures from the government.

- Processing at the Yantian container terminal in Shenzhen, which suspended exports for almost a week last month after workers tested positive, has plummeted. There has also been a sharp decline in the number of ships berthing as authorities enforce coronavirus prevention measures.

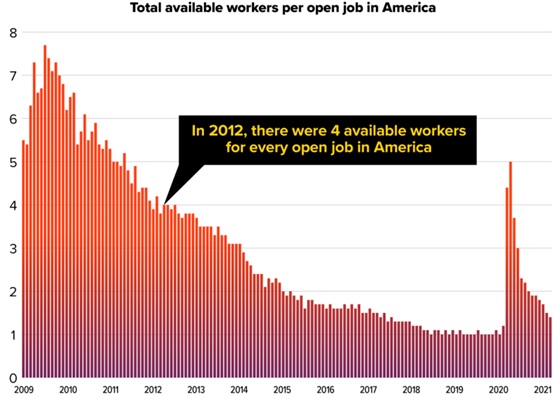

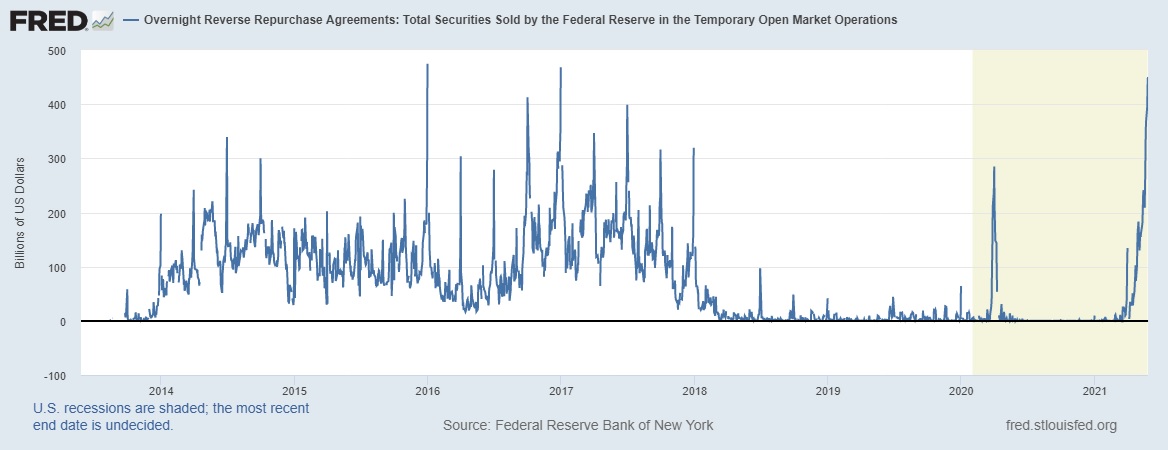

- Despite the new outbreak in China, infections in the U.S. continue to fall, and businesses continue to reopen. Some observers thought the quick U.S. reopening would convince companies to put some of their enormous cash holdings to work, but that isn’t happening so far. Banks are now pressuring some companies to take their cash elsewhere, especially since excess deposits could force some banks to raise extra cash.