by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning. U.S. equity futures are lower, although off the worst levels of the session. Other assets, like commodities and crypto, have also come under pressure. Our coverage kicks off with the Fed minutes, which roiled financial markets. We follow with a discussion of the cryptocurrency market. An update on Israel/Hamas is up next. Economics and policy follow. China news is up next, with the international news roundup on its heels. We close our notes with a pandemic update.

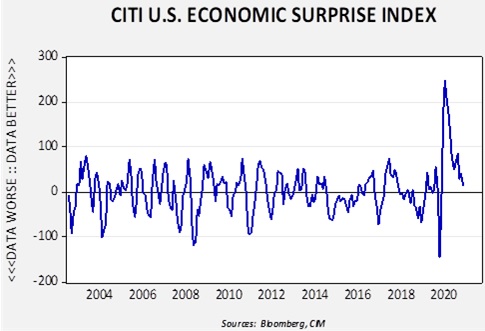

Fed minutes: A reading of the minutes of late April’s meeting of the FOMC reveals a central bank remaining committed to accommodative monetary policy. The market’s reaction to the release of the report shows how sensitive investors are to any of the withdrawal of support.

A number of participants suggested that if the economy continued to make rapid progress toward the Committee’s goals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases.

The bulk of the report showed that most members did not think the economy had recovered enough to remove accommodation. Although some members did express worries that inflation might become a bit more troublesome than public statements from FOMC members would suggest, there wasn’t a lot in the report to suggest that a reversal is imminent. We view the above comment as a “thinking about thinking about” removing accommodation.

However, reading between the lines does suggest that some members are getting a bit worried about staying easy for too long. We have been rather surprised by how unified the FOMC has been on policy. We think we are seeing is a return to normal, which is some degree of dissension. Hawks are starting to emerge, and the financial sensitives, who are worried about financial market dislocation, may also be raising concerns. If Powell intends to keep policy steady into 2023, he is going to have to manage the pressure to raise rates.

It is natural for financial markets to anticipate, so the focus on what may have been a minor phrase is not a surprise. We are taking Powell at his word, which is that we are seeing an end to the Volcker doctrine of stressing inflation control to one that focuses on maximum employment. It should be noted that Volcker also faced strong opposition to his policies within the FOMC. It would not be a surprise that the reversal of Volcker’s doctrine would face opposition. The key point is how he manages the dissent.

Finally, market action yesterday (and into this morning to some extent) highlights just how important monetary policy has been to asset prices for the past 14 months. Historical metrics of asset prices in various markets all look extended. They are mostly justified by the low level of interest rates and high levels of liquidity generally centered in affluent households. For most of the past 13 years, the Fed has undermined cash as an asset class; if cash becomes a desired asset again, it will undoubtedly be bearish for overall financial asset prices. What remains to be seen is how tolerant the Fed will be to falling asset values. To some extent, ignoring financial markets would be an end to Greenspan’s mark on the Fed. Greenspan, from 1987 on, made it clear the Fed would come to the rescue when, during periods of financial turmoil, creating the “Greenspan put.” Ending that policy (if it does end) would be perhaps a bigger deal than focusing on the labor markets over inflation.

Bitcoin: Although the Fed minutes did raise concerns yesterday afternoon, the morning was dominated by bitcoin volatility. A number of factors affected the price of bitcoin. First, the chart has been deteriorating for several weeks.

(Source: Bloomberg)

Although the price rose sharply into March, momentum has clearly been slowing. Falling momentum will tend to encourage some participants to exit. Second, China is cracking down on bitcoin use, essentially making it illegal for firms to price their goods in cryptocurrency. Third, the Colonial Pipeline hack has made it clear that cryptocurrencies have become the payment of choice for criminals; a crackdown on its use seems unavoidable. It may be too late to eliminate them, but forcing exchanges to identify participants may be coming, which would, of course, reduce the attractiveness of the currency to organized crime. Regulation may be the most bearish factor regarding cryptocurrencies. Interestingly enough, it’s not just China that is increasing regulatory scrutiny. The Office of the Comptroller of the Currency is also reviewing its crypto guidance. And fourth, although crypto is marketed as a way to avoid the “middlemen” in the financial system, most institutional buyers use coin exchanges, and, lo and behold, yesterday some of these exchanges didn’t allow holders to liquidate positions, which may have exacerbated the selling.

Until recently, we haven’t been overly concerned about what is happening in crypto assets. Recent reports suggest the Fed isn’t either. After all, price volatility in baseball cards or Beanie Babies didn’t trigger systemic risk. This may be a serious mistake. A recent Odd Lots podcast with Viktor Shvets as guest detailed the systemic risk bitcoin could be creating. He made the point that traders are buying bitcoin with leverage, meaning that as prices fall, margin calls are occurring as well. So far, we haven’t seen any strong evidence of systemic risk. However, as numerous events over the past 25 years have shown, leverage coupled with price volatility can lead to unwelcome outcomes. Yesterday’s price action in bitcoin closely mirrored equities, perhaps signaling that cryptocurrencies are becoming a systemic risk.

Israel and Hamas: President Biden is pressuring PM Netanyahu to end the current campaign against Hamas. So far, the Israeli leader is ignoring the U.S., but we don’t think this defiance will last much longer, simply because it looks like this current situation has about run its course. What we have learned from this event is that the Arab world has mostly abandoned the Palestinian cause. As the U.S. moves out of the region, the Arab states are banding with Israel to oppose Iran. This development was part of the Abraham Accords. It appears that with each flareup of hostilities, Palestinians in Gaza are put in a worse position. We would expect hostilities to wane by the weekend.

Economics and policy: Tariffs are being eased, and rents are rising.

- The EU has suspended its plans to raise tariffs on numerous goods. This was part of the retaliation for the U.S. implementing steel tariffs. So far, the U.S. is maintaining the steel tariffs, at least for now, but there is pressure building to rescind those as well.

- Apartment rents are starting to recover in most markets. Single-family home rents are rising rapidly too. This development could exacerbate current inflation worries.

- As housing prices rise, there is renewed interest in modular homebuilding. Currently, most homes are built on-site. Modular homes are factory build, allowing for assembly line production in a controlled environment. Although most communities have a bias towards site-built homes, cheaper modular homes could become an alternative. At least Warren Buffett thinks so.

- Argentina is banning the export of beef in an attempt to quell domestic inflation. Ranchers are not happy and are planning to strike.

- Taiwan has been hit by a series of maladies. One of them is drought. Semiconductor production uses a lot of water, and the fabs are having to deal with water restrictions. These restrictions will exacerbate semiconductor shortages.

- Russia now holds more gold in its foreign reserves than it holds in U.S. dollars.

- We note that a number of large firms are announcing their own minimum wage hikes. This development will pressure smaller firms to either match the increases or make other arrangements (e.g., work current employees longer hours, add capital to reduce labor, leave vacancies open).

- This is one to watch; the ECB may end or reduce its emergency bond-buying in June. If it does, look for the EUR to rise.

- And finally, here’s a curious situation—bank branches in Japan have been “swamped” by pensioners bringing in U.S. stimulus checks to be cashed. Apparently, some Japanese citizens who worked in the U.S. are getting the checks in error. This situation occurred with the first stimulus last year and has apparently not been fixed.

China: U.S. tech in China is in an uncomfortable position, and cross-border investment is down.

- Apple (APPL, USD, 124.69) is coming under unwelcome scrutiny as the NY Times reports that the firm is sharing its customer data with the Chinese government, a practice it doesn’t do in the U.S. or Europe. It has also taken actions to placate CPC officials, including removing apps from Chinese users. The company is not pleased with the reports. But the reality is that firms operating in China are required to adhere to CPC rules. Globalization encouraged firms to adjust their practices to the local community. That behavior is becoming difficult to justify, and at some point, firms will be forced to choose. We recommend care in that choice.

- Cross-border investment between the U.S. and China has declined to its lowest level since 2009. Some of this drop is tied to the pandemic.

- China continues to ramp up steel production, exacerbating supply issues. Its aluminum production is at record levels as well. The U.S. and Europe are attempting to manage the steel supply, but if China continues to lift output, it will be difficult to work out a deal. The U.S. is facing internal pressure to ease tariffs on steel from manufacturing firms.

- The rise in steel production is increasing iron ore purchases from Australia. The two countries have had frosty relations recently, and Chinese officials have warned Canberra that it intends to “diversify” its sources for iron ore.

- The Biden administration continues to grapple with the Trump era restrictions regarding investment in China and Chinese listed stocks. It has recently delayed a decision on this matter.

- China has bought 37% of next year’s U.S. corn crop. This is aggressive buying and may signal that Beijing is stockpiling corn to protect against supply disruptions. Beijing is apparently worried about rising commodity prices and is considering export controls.

- The U.S. is accusing Beijing of ducking nuclear arms talks.

- China is increasing its efforts to join the Comprehensive and Progressive Trans-Pacific Partnership. This multilateral free-trade zone is the predecessor of the Transpacific Partnership from which the U.S. withdrew. The irony is that the original TPP excluded China, and if China joins the successor, it will have excluded the U.S.

- Huarong, the “bad bank” that grew into a financial conglomerate, may be hampering efforts by Chinese regulators to bring borrowing under control. It has issued $40 billion of debt that is in trouble. Given its size, it will be difficult for the government to allow it to default, but if it bails the company out, it creates a moral hazard problem.

- China’s mutual funds have languished this year, leading to a backlash on social media. Given Beijing’s discomfort with anything that smacks of organized trouble, it will be interesting to see if (a) this gets worse and (b) what China does about it, e.g., prop up equity prices or squelch the complaints.

- China is making it illegal for foreigners to own private elementary schools or for any Chinese school to have a foreign curriculum.

- It looks like the European Parliament is shelving the China investment deal.

International roundup: A rebel leader in Colombia has been killed, and PM Johnson is facing farmer pressure.

COVID-19: The number of reported cases is 164,966,830 with 3,419,446 fatalities. In the U.S., there are 33,027,220 confirmed cases with 587,875 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 349,210,095 doses of the vaccine have been distributed with 277,209,173 doses injected. The number receiving at least one dose is 159,174,963, while the number of second doses, which would grant the highest level of immunity, is 125,453,423. The FT has a page on global vaccine distribution. The Axios map shows unmistakable good news. Forty-nine states are showing steady to declining infection rates.

View PDF