by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning and happy Monday! It’s a down day for equities this morning. Our coverage begins with a recap of the situation in Israel, a second look at the retail sales data, and the Atlanta FRB’s GDPNow forecast. Our update on economics and policy is up next, followed by China news. The international roundup is next in line, and we close with the pandemic update.

Israel: Despite international calls for a ceasefire, violence continued unabated over the weekend. For now, Israel says it will continue operations against Hamas in Gaza. The IDF is conducting airstrikes against Hamas infrastructure, targeting its office facilities and tunnels that allow Hamas fighters to find shelter and conduct operations. Hamas has been steadily launching missiles into Israel. An office building used by the Associated Press was hit by airstrikes over the weekend; Israel claims it was also used by Hamas. The usual pattern is for international pressure to increase to the point where Israel calls off the offensive. It is likely that, expecting such pressure, Israel is moving quickly to attack as much of Hamas’s infrastructure as it can before operations end. The U.N.S.C. met over the weekend to discuss this issue, but no action was taken.

So far, this tragedy has not affected financial markets to any significant degree. Geopolitically, we note that outside nations are reluctant to get involved. The Arab states have been mostly quiet. These nations have been normalizing relations with Israel and are not all that fond of Hamas. Its ties to the Muslim Brotherhood make Arab state leaders disinclined to help. Iran has become perhaps the most notable foreign ally, but its ability to assist has limits. Turkey has made negative comments towards Israel, but we doubt Ankara’s actions will go beyond jawboning. The difference this time is that foreign nations are bringing less pressure to bear on Israel, meaning that the current conflict may drag on longer than normal.

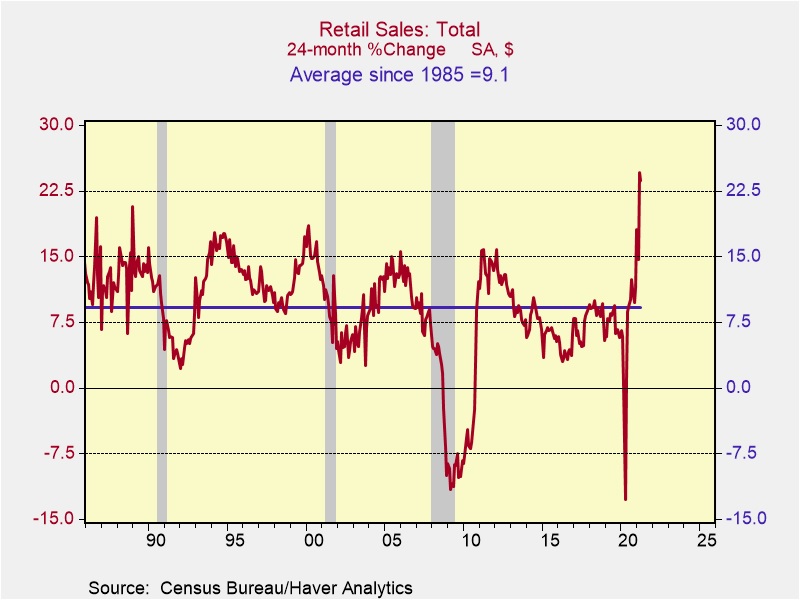

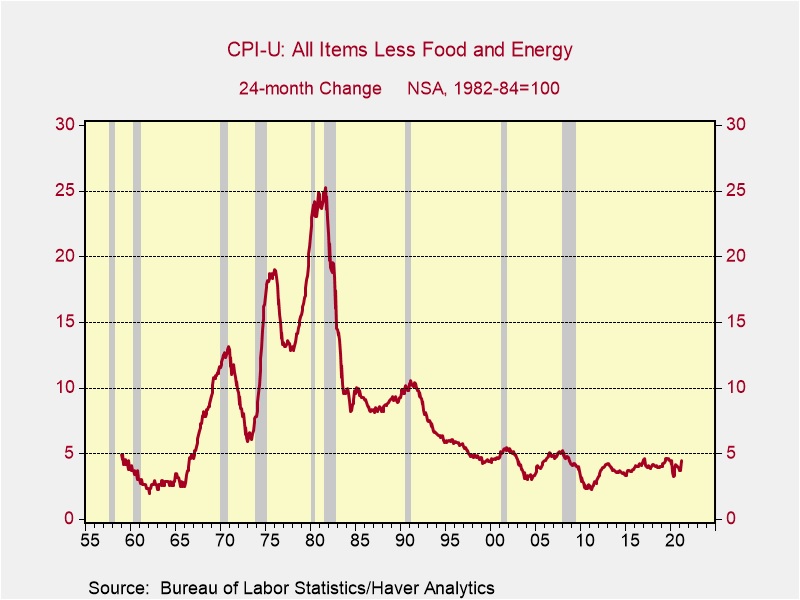

About that retail sales data: For the inflation data, we used a two-year change to avoid the base effect impact on CPI. We did the same thing with regard to the retail sales data, which was flat relative to March. The longer-term look shows that retail activity is robust.

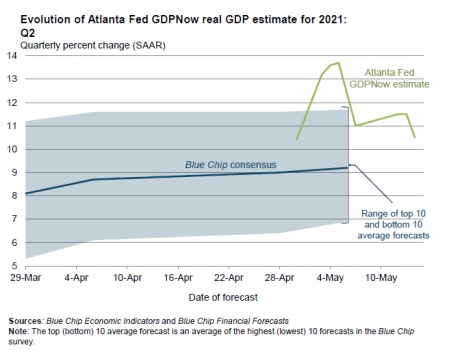

The latest data has the Atlanta FRB’s GDPNow forecast running at 10.5%.

(Source: Atlanta FRB)

Individual data releases have shown wide dispersion recently, but the GDPNow calculation reveals that the economy is doing quite well. Reading too much into individual data releases is probably ill-advised.

Economics and policy: Semiconductor issues will persist, and the fog of data may reduce the likelihood that the president’s tax and spending policies will be enacted.

- Industry analysts warn that the semiconductor chip shortage could last until 2023.

- We have been surprised at the pace of policy coming from the administration, especially given the narrow margins the Democrats have in Congress. However, it is starting to look like momentum is slowing. On taxes, there is a growing pushback against the current tax plans. As the Democratic Party increasingly represents big business, its lobby is growing confident that it can stem the drive for tax hikes. Although “soaking the rich” is still popular among many Democrats, we tend to side with the business lobby. Meanwhile, the current “fog of data” is muddling the political message and making it difficult for the administration to craft a plan forward.

- The expanded childcare credit will be sending up to $300 per month to households with children starting July 15. What is significant about the new credit is that it will be distributed monthly and has the makings of a basic income grant to households with children.

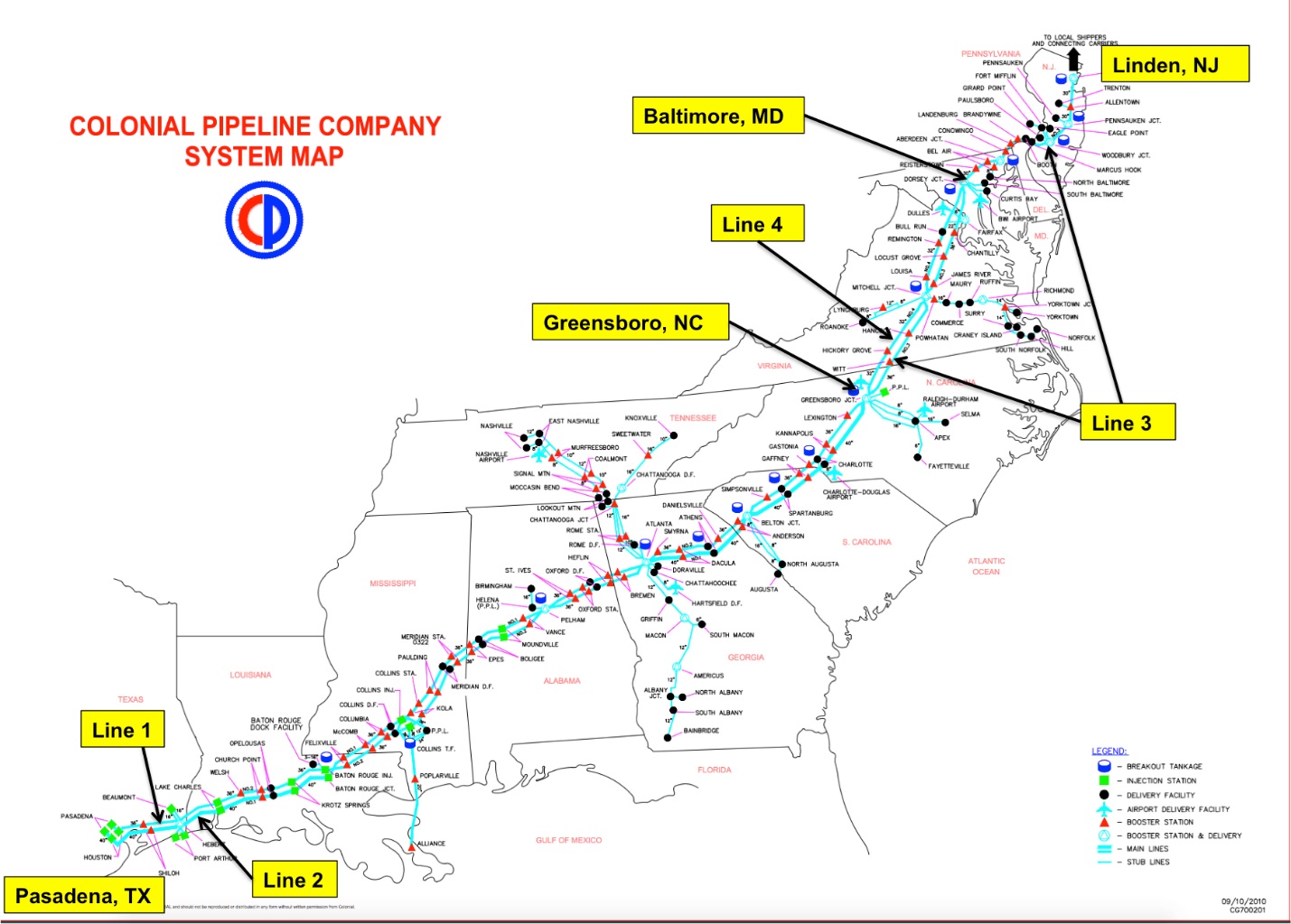

- In the wake of the Colonial cyberattack, government authorities are taking a harder look at cryptocurrencies, which are often used in ransomware attacks. Binance Holdings[1], the world’s largest crypto exchange, is under investigation by the DOJ in a probe of money laundering and tax violations. The IRS is forcing crypto exchanges to provide customer information for tax investigations.

- California is bracing for an extended fire season as drought and early hot weather create ideal conditions for wildfires.

- In the aftermath of the Great Financial Crisis, sawmills consolidated as lumber demand fell. As demand has soared due to strong housing demand, the industry is not boosting investment to any significant degree, concerned about the cyclicality of the industry. This lack of capacity expansion will tend to keep lumber prices elevated. Meanwhile, the administration is facing pressure to reduce tariffs on Canadian lumber.

- Retailers are undertaking extensive training of employees to boost staff productivity.

- Former ECB economists warn that current policy may put the central bank in a debt trap. If the ECB raises rates, its large holdings of sovereign debt will put its balance sheet at risk.

China: The administration is taking a longer look at Chinese disinvestment policy.

- The Pentagon has delayed a report to Congress detailing Chinese companies with ties to the People’s Liberation Army. The report, mandated by an executive order from the Trump administration, banned Americans from investing in Chinese companies with military ties. The deadline for implementing the rule is May 27, but the U.S. military says it won’t have the report ready until fall. It appears the Biden administration is inclined to keep the rule but will likely adjust it.

- A Chinese agricultural consultancy mysteriously suspended operations on April 29, and the company’s offices were sealed by security forces. The company, Cofeed, provided price data and analysis of grain and oilseed prices. There is speculation that the CPC wants to keep the information secret, and thus, closed the firm and may have arrested the principals.

- One of the inconsistencies of administration policy is that it wants to reshore investment and jobs to the U.S. while building a coalition to contain China. During the Cold War, an element of coalition-building allowed potential partners access to U.S. consumers. In other words, the U.S. tolerated trade deficits and the loss of jobs to trade for foreign policy purposes. That policy has come under fire in recent years. The Obama administration was unable to move the Trans-Pacific Partnership (TPP) through Congress, and in the 2016 presidential election, both major party candidates vowed to pull the U.S. from the trade pact. The remaining partners in the TPP went ahead without Washington and created the Comprehensive and Progressive Agreement for the Trans-Pacific Partnership (CPATPP). Interestingly enough, the Senate Finance Committee is pressing the USTR Tai to engage in talks to potentially join the CPATPP. The support is based on the idea that the U.S. needs trade to build support for allies in Asia.

- China’s credit rating agencies have been rapidly downgrading Chinese corporate debt. Foreign rating agencies have been critical of the domestic agencies, which have tended to give favorable grades to Chinese corporations. However, as Beijing cracks down on corporate defaults, the rating agencies are also moving in that direction.

- Although China’s industrial sector continues to recover, retail sales have been disappointing. This divergence could lead to higher Chinese exports.

International roundup: Armenia and Azerbaijan are seeing tension rise, and Venezuela moves against the last independent newspaper.

- Armenia has accused Azerbaijan of violating its territory by moving Azerbaijani troops into areas controlled by Armenia. The two sides are in talks, but tensions remain elevated. Armenia is asking for support from Russia, which has tried to mediate the dispute. Last year, Armenia and Azerbaijan had a war, which led to the latter gaining territory.

- The Maduro government seized the headquarters of the last remaining independent newspaper. Ostensibly, the action was to satisfy a court judgment against the paper, but Venezuela’s authoritarian government has been steadily working to control the media for years. The paper El Nacional has been online since 2018 when the government, which controls the supply of newsprint, denied the paper supplies. Although it is hard to conceive of relations between the U.S. and Venezuela getting worse, this action certainly won’t help.

COVID-19: The number of reported cases is 163,112,783 with 3,380,404 fatalities. In the U.S., there are 32,941,053 confirmed cases with 585,970 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 344,503,495 doses of the vaccine have been distributed with 273,545,207 doses injected. The number receiving at least one dose is 157,485,596, while the number of second doses, which would grant the highest level of immunity, is 123,282,685. The FT has a page on global vaccine distribution.

- Although U.S. cases are declining, the rest of the world is seeing infections rise.

- Hong Kong just announced it will require a 21-day quarantine for all arrivals from Singapore; the latter has seen a surge in cases recently tied to its airport.

- Japanese towns are canceling plans to house Olympic athletes due to infection fears. This development could adversely affect training for some teams, as the lack of housing near training facilities could pose a logistical problem.

- Taiwan, which had mostly managed the pandemic well, is implementing social distancing controls in an effort to slow the rise in cases.

- Cases of the Indian variant have been reported in the U.K., threatening plans to relax restrictions.

- A letter signed by 18 scientists in the journal Science argues the fact that COVID-19 escaped from a lab has not been disproven and indicated that further investigation is warranted. This development will likely anger Beijing.

[1] The company is Chinese and has issued a coin that is $603.60.