by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

After consolidating for a month, prices are starting to move higher.

(Source: Barchart.com)

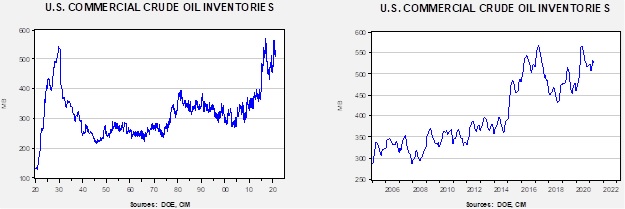

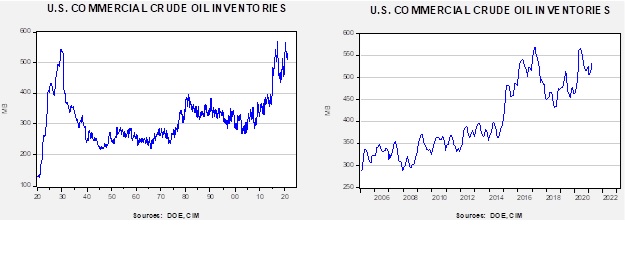

Crude oil inventories fell 5.9 mb compared to the 2.4 mb draw expected. The SPR fell 1.1 mb, meaning without the addition from the reserve, commercial inventories would have declined 7.0 mb.

In the details, U.S. crude oil production rose 0.1 mbpd to 11.0 mbpd. Exports fell 0.9 mbpd, while imports fell 0.4 mbpd. Refining activity rose 1.0%.

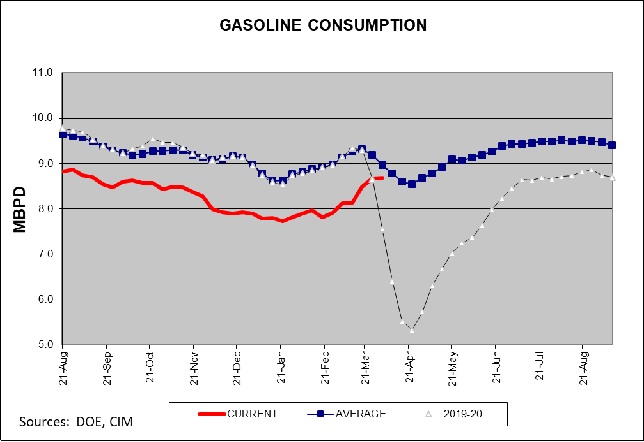

(Sources: DOE, CIM)

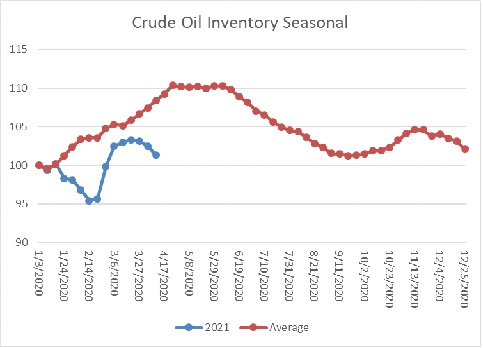

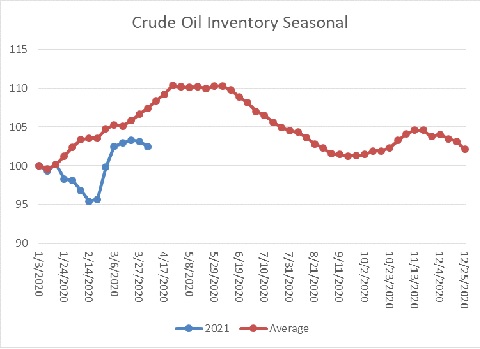

This chart shows the seasonal pattern for crude oil inventories. We are about three weeks to the end of the winter/early spring build season. Until the Texas freeze, we were seeing a counterseasonal decline. This week, stockpiles declined more than forecast. We are currently at a seasonal deficit of 30.3 mb.

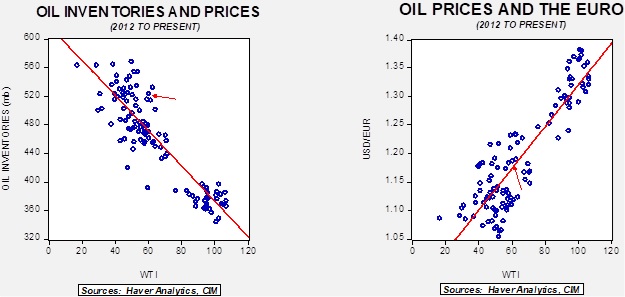

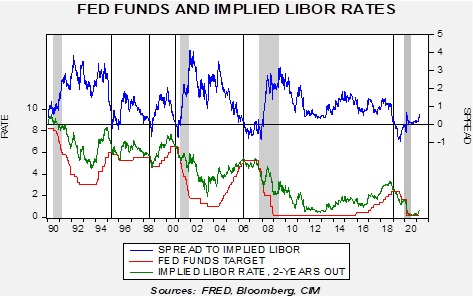

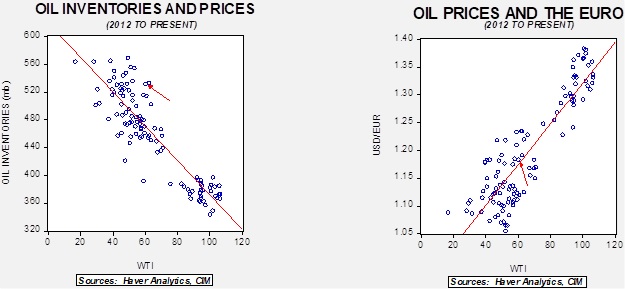

Based on our oil inventory/price model, fair value is $43.89; using the euro/price model, fair value is $64.06. The combined model, a broader analysis of the oil price, generates a fair value of $52.74.

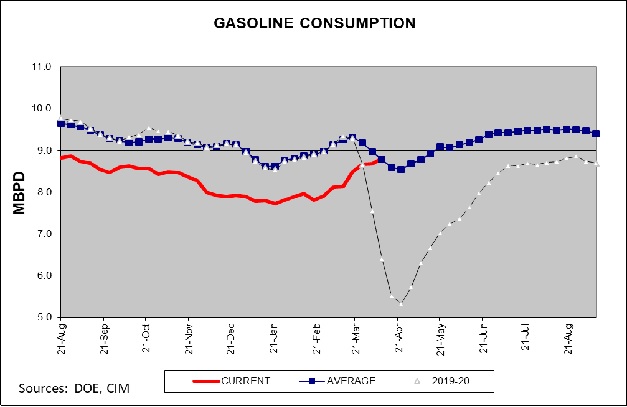

For the first time since December 2019, gasoline consumption has reached the five-year average, further evidence of economic recovery.

Market news:

- The IEA is forecasting oil demand will reach 96.7 mbpd this year, up 5.7 mbpd from last year’s depressed levels. Supply is recovering from the Texas disruption.

- In a similar vein, OPEC is also optimistic about this year’s consumption, citing stimulus programs and vaccinations.

- Saudi Aramco (2222, SAR, 35.60) has made a deal to sell a 49% stake in its pipeline business. The company received $12.4 billion for the sale.

Geopolitical news:

- Iran’s nuclear facility at Natanz was attacked last week. The bombing destroyed some centrifuges for enriching uranium and also disrupted electrical power. The damage was extensive and will set back Iran’s nuclear program. Despite the attack, Iran declared it would enrich uranium to the 60% level for the first time ever. Although this is still below nuclear weapons strength, getting to 60% demonstrates Iran is approaching the nuclear weapons threshold. We suspect Tehran is making this move to enhance its position in indirect negotiations with the U.S. Iran is demanding that the U.S. remove sanctions put in place during the Trump administration. The Biden government has indicated this isn’t going to occur without Iran pulling back from uranium enrichment. We believe that current negotiations to return to the Obama-era nuclear agreement will likely fail; simply too much has occurred since it was established, and trust levels are too low.

Alternative energy/policy news:

- The state of New York is restricting pension investments in oil sands. The goal of the state is to have its investments to net-zero greenhouse gas emissions by 2040.

- The Biden infrastructure package has a $16 billion provision to fund the plugging of abandoned oil wells. These abandoned wells often emit methane, a potent greenhouse gas. Reception for the idea is mixed. The oil industry is mandated to plug wells when they are abandoned. The industry has a habit of selling older wells to smaller, less capitalized firms that often can’t afford to cap the wells. Thus, they abandon them when the wells stop producing. The worry is that if the government pays for them, the industry will have an even greater incentive to shirk its duties. On the other hand, the program would employ former industry workers who often lack other attractive job opportunities, and the wells probably won’t be addressed through normal channels. We would not be surprised to see an attempt to put a user tax on oil drillers to prevent the moral hazard this proposal creates.

- There is an effort by the EU to create a law against “ecocide,” the deliberate and systemic destruction of the government. If approved, it might create a movement to bring ecological destruction to the level of genocide, making it an international crime.

- The U.S. is moving toward the electrification of its transportation system. Making this change will require different materials than internal combustion engine vehicles. Many of these materials fall into the category of “rare earth” minerals. Although the U.S. does have some capacity in this area, China remains the primary source of these goods. It will be years before the U.S. and others can overcome China’s dominance.

- There are increasing concerns that the mining industry might struggle to meet the demand for copper.

- One area of interest is the development of the solid-state battery. It would be safer than current batteries, recharge quicker, and hold a greater charge capacity. A recent decision by South Korean battery groups to settle a legal dispute removes a potential snag in supply.

- The CME is launching a lithium futures contract. The creation of a contract will improve price transparency.