by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning and happy Monday! The S&P 500 moved above 4,000 last week, and equity futures are moving further higher this morning. Some of the upward pressure is coming from Friday’s employment data, which we recap in today’s comment. BTW, the IMF meeting is on the docket this week. Our coverage begins with Jordan; it appears there was a coup plot underway that was apparently thwarted. Economics and policy follow, with an update of the pandemic next. We close an international news roundup.

Jordan: At least 20 people have been arrested in what appears to be a conspiracy to overthrow the government of King Abdullah II, king of Jordan. The half-brother of the king and former crown prince, Prince Hamzah bin Hussein, was included in those arrested. He is reportedly under house arrest. Their father, the late King Hussein, had four wives and 11 children, meaning that there are numerous family members with royal linage but no path to power. Prince Hamzah bin Hussein has emerged as a prominent critic of the king, accusing the government of corruption and incompetence. He has developed a strong online following for his comments. He has also fostered strong ties to tribal leaders in Jordan who have considerable informal power. The king has accused the prince of involvement in the coup; the prince is arguing that his arrest is an attempt to silence his criticism. In addition to the prince, there were several high-ranking, and former high-ranking, officials and members of the royal family arrested. The government has suggested “foreign involvement” in the plot, although it is unclear who that foreign power is exactly. Interestingly enough, most of the nations in the region responded with supporting King Abdullah, suggesting the foreign power may be outside the region.

Jordan is a small country with a small economy, but it is a source of stability for the region. The country has an accord with Israel and has mostly been a neutral party in the region’s numerous conflicts. It has housed refugees from the Syrian civil war. Instability in Jordan would unsettle the region, and thus, we would expect a rush of economic support for the king.

Economics and policy: Housing and the infrastructure bill lead the news.

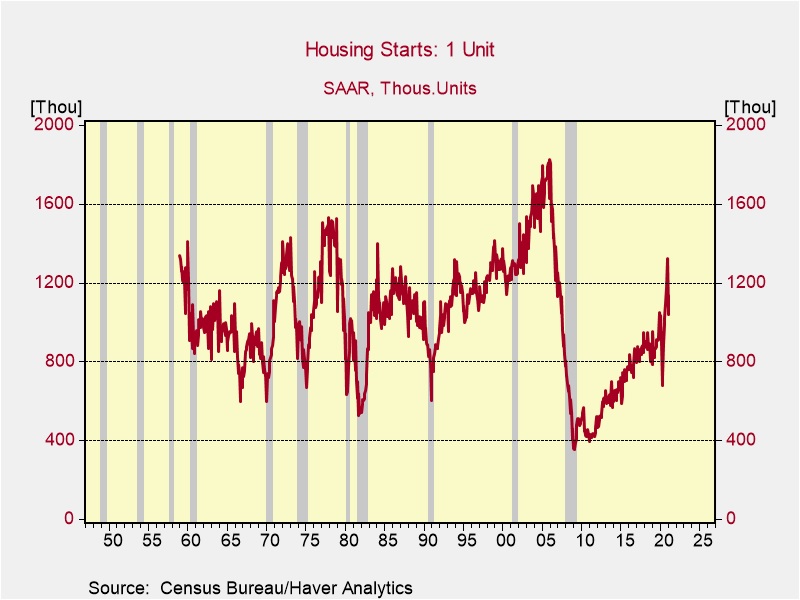

- Strong demand and low supply are rapidly lifting home prices, creating the strongest conditions since the housing bubble. The demand part is being driven, to some extent, by the Millennial generation moving into their home-buying years. The supply problem is caused mostly by two issues. First, boomers are hanging on to their homes longer. The pandemic has stalled the usual generational shift to downsizing. Second, homebuilding is just now reaching normal levels in the wake of the housing collapse in 2006.

The drop in building from 2009 until recently means there is a dearth of supply.

-

- Although such strong conditions naturally raise concerns about a repeat of the housing bubble, so far, lenders are maintaining strong lending standards. By avoiding weaker credits, the likelihood of a replay of the “naughts” is low.

- Unfortunately, the combination of high prices and tight lending standards are pricing out less affluent buyers. This situation may lead them into home renting, and residential real estate has captured the attention of the capital markets.

- There are reports of rising delinquencies on subprime auto loans. We will be watching to see if the aid payments address this issue.

- The White House’s infrastructure package is facing criticism from various parts of the political spectrum. We are watching centrist Democrat opposition to corporate tax hikes. It would not be a surprise to see a tax rate compromise coupled with a lift in the gasoline tax.

- One of the criticisms of raising the corporate tax rate, along with other proposed measures, is that it would make U.S. corporate taxes among the world’s highest again. A way to resolve this issue would be to moderate the rate hikes or the other taxing provisions. Another way would be to encourage other nations to raise their corporate taxes as well. It appears Treasury Secretary Yellen is quietly pushing the second option.

- As we have noted for some time, the affiliations of the political parties are in flux. Capital owners have traditionally been Republicans, although the Democrats made inroads into the group in the 1990s. Now, as the GOP adopts a more blue-collar appeal, corporate interests are finding they are less influential in the party.

COVID-19: The number of reported cases is 131,401,449 with 2,854,727 fatalities. In the U.S., there are 30,706,531 confirmed cases with 555,001 deaths. Both cases and fatalities in the U.S. are declining. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 207,891,295 doses of the vaccine have been distributed with 165,053,746 doses injected. The number receiving at least one dose is 106,214,924, while the number of second doses, which would grant the highest level of immunity, is 61,416,536. Around 3 million Americans are being vaccinated daily. The FT has a page on global vaccine distribution.

Virology

- The COVID passport issue isn’t just an American one. PM Johnson is also facing criticism on this issue, but it isn’t stopping a pilot project. Israel has created a “Green Pass,” a document designed to carry on a smartphone. It has become the document that allows its holder to participate in mass events, e.g., concerts, sporting events, religious gatherers, etc. Although political resistance to such passports remains strong, meaning it is unlikely that governments will force their adoption, we think it is highly likely that the private sector will insist, meaning that for practical purposes, the vaccination card in the U.S. will become the de facto

- Meanwhile, in Europe, a third wave of infections is underway. New variants and the lack of vaccination progress are leading to lockdowns and another downturn in economic activity.

- In vaccine news:

- There are additional reports of blood clotting being tied to the AstraZeneca (AZN, USD, 49.53) vaccine; these reports are coming from the U.K.

- A study of the Pfizer (PFE, USD, 36.30) vaccine shows it to be effective against the South African variant.

- The pandemic has fueled a teacher shortage. The pandemic led to early retirements and a decline in the population of substitute teachers. There are rising concerns about the future impact of those students affected by the past year.

China and international news: A roundup.

- For the past decade, we have seen China move through a cycle of credit restrictions, a consequent drop in growth, and a resurgence in borrowing to offset the slower growth. We are moving into another credit crunch cycle. China has a serious debt problem, but it can’t really address the debt issue without accepting slower growth. Since it hasn’t been able to accept slower growth, the debt issue continues.

- Western multinationals are facing a dilemma; to maintain their business in China, they must adhere to Beijing’s protocols. However, by doing so, they run afoul of Western mores and restrictions. Companies will likely try to avoid the limelight so as to continue current operations, but eventually, they will be forced to choose.

- The U.S. is scheduled to pull its remaining troops from Afghanistan on May 1. American negotiators are trying to create conditions that will allow that withdrawal to occur.

- The U.S. and other signatories to the Iran nuclear deal are set to meet next week to discuss two goals. First, the Europeans want the U.S. to remove Trump-era sanctions, and second, Iran must roll back its nuclear activities to bring it back into compliance. American negotiators won’t be in the formal talks but will be in the background. We doubt much will come of this. Iran has little reason to trust that the U.S. will continue to maintain the arrangement, and the political cost of easing sanctions for the White House will be high.

- Cuba has been seeing a rise in political dissent. The latest is a hunger strike where dissidents have been using this method to protest the government’s actions.