by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning and happy Monday! U.S. equity futures are turning modestly higher as Treasury yields have turned a bit lower this morning. We are seeing a pattern where lower yields tend to lift tech over other sectors. Our coverage begins with international news. Turkey is in turmoil after the central bank head was replaced. We move on to economics and policy, pandemic coverage, and close with China news.

International news: Turkey has a new central bank governor and a weaker currency. Turmoil in Myanmar continues.

- President Erdogan returned to form over the weekend, firing Naci Ağbal, the head of Turkey’s central bank. Ağbal was considered an orthodox central banker; he raised interest rates to contain inflation and arrest a declining TRY. Since November, policy rates in Turkey have increased 900 bps to 19.0%. However, the president ascribes to the idea that raising rates increases inflation and thus ran out of patience with Ağbal. This is the third time in less than two years that Erdogan has fired his central banker. He was replaced by Sahap Kavcioglu, a professor of banking who shares Erdogan’s position on the relationship between interest rates and inflation. As expected, the currency is sharply lower today despite efforts by the new governor to calm markets.

- Turkey also withdrew from an international treaty designed to reduce violence against women. Worldwide condemnation has resulted.

- Before the U.S./China meetings, the defense ministers of the U.S. and Japan agreed to cooperate closely in the event of a military event over Taiwan. Geopolitically, a Taiwan controlled by China would effectively cut Japan’s access to seaborn traffic from South Asia. We would expect the Japanese military to take active measures if China decides to take Taiwan militarily.

- Malaysia has agreed to extradite a North Korean national charged with money laundering. Pyongyang has cut diplomatic ties with Malaysia over this decision. Acquiring money through illegal activities is something of a cottage industry for North Korea; if other nations follow Malaysia’s lead, it will hurt North Korea’s economy.

- Although protests in Myanmar against the military coup continue, the more potent reaction has been a general strike which has mostly paralyzed the economy. It is not clear who can hold out the longest—the lack of economic activity is making life difficult for the strikers, but the government is also suffering. The fact that ordinary workers joined the strike shows how the military misjudged the reaction of the people over the coup.

- The EU continues to struggle. Concerns over vaccine safety have led to slowing vaccinations. Nations are facing a surge in infections, and economies are slowing down as a result. As relations between the U.S., China, and Russia become strained, the EU finds itself caught in the middle and is fearful it will not be able to negotiate a middle ground. We expect these problems to continue. Germany has close ties to China’s economy and wants to complete the Nord Stream 2 pipeline with Russia. Although EU leaders don’t have to deal with the harsh rhetoric of President Trump, the underlying geopolitical issues remain.

- Igor Matovic, the PM of Slovakia, offered to resign (as long as the rest of the coalition does as well) after he faced criticism for unilaterally approving the use of Sputnik V, the Russian COVID-19 vaccine.

- The U.K. and EU are making progress on creating a forum for financial services Although the U.K.’s separation from the EU has been messy, it does appear that there is some common ground for banking.

- SoD Austin made a surprise visit to Afghanistan on Sunday. The U.S. is planning to remove the remaining 3,500 troops from the country on May 1, although we would not be surprised to see that action postponed. Austin’s visit may have been part of the decision processes regarding withdrawal.

- A fire at Renesas Electronics (RNECF, USD, 11.28), a Japanese chipmaker, will further reduce the semiconductor supply for the auto industry.

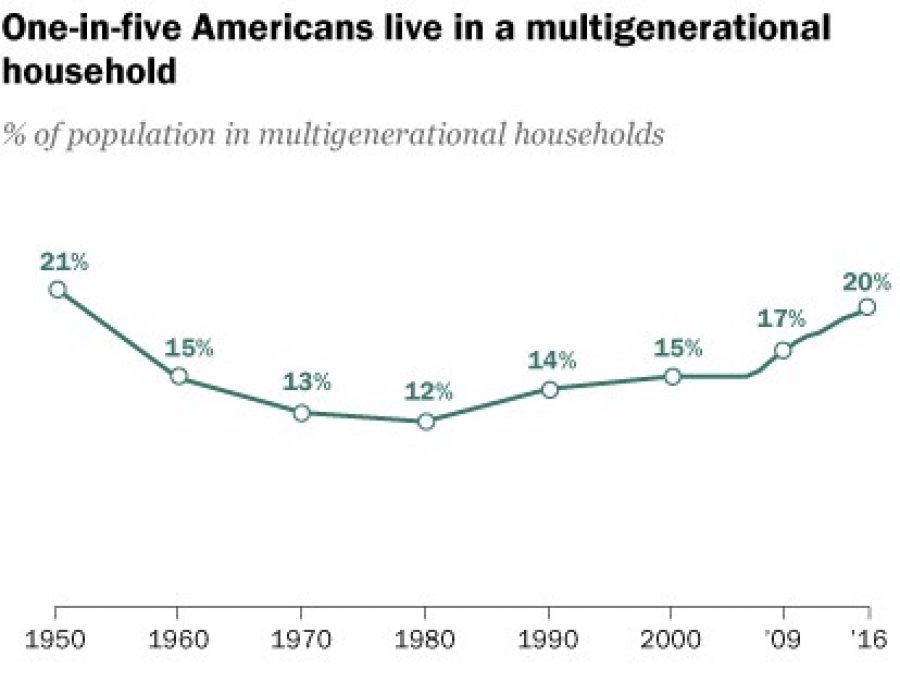

Economics and policy: Generations are moving in together in response to high home prices and concerns over elder care.

- Elevated home prices and the pandemic are increasing, a trend that started after the Great Financial Crisis, multigenerational housing. After the Great Depression and the advent of Social Security, multigenerational housing became less frequent.

However, as the above chart shows, although it has been rising since 1980, the trend has accelerated this century. Reports indicate that families are pooling their resources among parents, grandparents, and children to buy homes. Such trends may reduce the number of homes sold, but they will tend to support larger homes and remodeling. On the other hand, it isn’t a welcome trend for nursing homes and assisted living facilities.

-

- There is a growing lumber shortage in the U.S.; a pine beetle in western Canada is contributing to the problem.

- Visa (V, USD, 206.90) is facing anti-trust investigations over its debit card actions. The DoJ has become increasingly hostile to industry practices that require concentration to function.

- Multinational trade deals have fallen from favor in the U.S. The lack of participation does not favor American industries that rely on trade, such as meat.

- In light of reports that the Biden administration is considering raising taxes, a new paper by the NBER suggests that underreporting by the highest earners may be more than 20%. Although better compliance would increase revenue, the bigger part of this story is that it gives political fodder to the goal of increasing marginal tax rates at the upper end. After all, if they are cheaters, they should pay.

- As stimulus checks arrive, the “known/unknown” is what households will do with the money. There is evidence that most of what has been distributed was saved, at least initially. There is also evidence that some debt reduction occurred. If this pattern continues, economic growth forecasts are probably too high, but the improvement in balance sheets will be positive for long-term growth. There is also some evidence that the relief checks will end up in equities.

- Big tech is facing an increasingly hostile regulatory environment. Both the populist right and left are turning on the industry, although for different reasons. The industry is turning to the few remaining libertarian-leaning legislators for help.

COVID-19: The number of reported cases is 123,287,417 with 2,716,696 fatalities. In the U.S., there are 29,819,108 confirmed cases with 542,359 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. Over the past two weeks, case counts in the U.S. are down 8.8%. The CDC reports that 156,743,555 doses of the vaccine have been distributed with 124,481,412 doses injected. The number receiving at least one dose is 81,415,769, while the number of second doses, which would grant the highest level of immunity, is 44,141,228. The FT has a page on global vaccine distribution.

Virology

- The U.S.-based clinical trial of the AstraZeneca (ASN, USD, 49.21) vaccine showed 79% efficacy against symptomatic disease and 100% efficacy against severe disease. And, the study indicated it was effective for all age groups. Although the vaccine has been controversial, this study should ease concerns and lead to emergency use approval in the U.S. soon.

- Denmark has reported a death and a critical illness after two AstraZeneca vaccinations.

- The EU is refusing to ship this vaccine from the Netherlands to the U.K., despite contracts by Britain to purchase it. PM Johnson is asking the EU to reconsider. Vaccine nationalism remains a problem.

- Pakistan’s PM, Imran Khan, has tested positive for COVID-19.

- India is facing a new wave of infections from rising vaccine skepticism.

- To overcome vaccine hesitancy, companies are starting to offer giveaways to recipients. Companies are also offering bonuses to vaccinated employees.

- Meanwhile, U.S. vaccine production is increasing rapidly, which should lead to higher distribution.

- So far, the U.S. has focused on acquiring vaccines for Americans, but as distribution improves, we would expect the U.S. to push international distribution. America is lagging behind China and Russia on vaccine diplomacy.

China news:

The U.S. and China meeting was strained. We wonder if American officials looked at each other after this weekend’s meeting with Chinese officials and said, “that went well, right?” The meetings were difficult, to say the least. The public presentations were fiery, although it does appear that the closed-door meetings were less fractious. Although relations have been deteriorating for some time, it is clear China will not easily accept America’s plans to isolate it.