by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST] | PDF

We have published our latest Weekly Geopolitical Report, which is Part I of a two-part series on the Western Sahara. We also have several other recent multimedia offerings. There is a new chart book recapping the recent changes we made to our Asset Allocation portfolios. Here is the latest Confluence of Ideas podcast. A new Asset Allocation Weekly, chart book, and podcast are also available. This week’s Weekly Energy Update is available. You can find all this research and more on our website.

Good morning, and Happy International Women’s Day! Lots going on today. U.S. equity futures are lower in the face of continued rising long-duration Treasuries. We start with the markets this morning, particularly the 10-year Treasury. Up next is policy; the Senate passed the stimulus bill, with the House expected to confirm the package. As the U.S. expands fiscally, China is pulling away the punch bowl; our China coverage follows. There was a major hack over the weekend, which we cover in the technology section. International news follows, and we close with pandemic news.

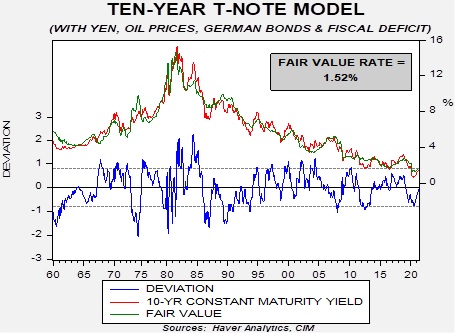

Markets: The 10-year T-note yield continues to move higher on expectations of stronger growth. Although inflation fears are present, the rise in the term premium, which reflects a steepening yield curve, suggests that some of the rise is due to better economic prospects. Although the rise in yields is causing concern in equities, our yield model suggests that what we are seeing is mostly a return to more normal interest rates.

We use monthly average yields for the 10-year T-note. As the model shows, we are back to normal yields. Some degree of overshoot is normal. In the last cycle, we didn’t rise to the standard error level (around 2.25% in the current environment). If we repeat the pattern of the past decade, a rise to 1.90% to 2.00% is likely. Everything we are seeing from the FOMC suggests that policymakers are not very concerned about the rise. What makes the FOMC take steps to halt the rise? The most likely scenario would be a financial crisis. So far, financial markets appear to be functioning, but as the past 25 years have shown, the financial system is brittle, and problems can develop quickly. The key point, however, is that the Fed isn’t going to be preemptive in addressing financial stress. Or, put another way, yield curve control likely comes after a problem, not before.

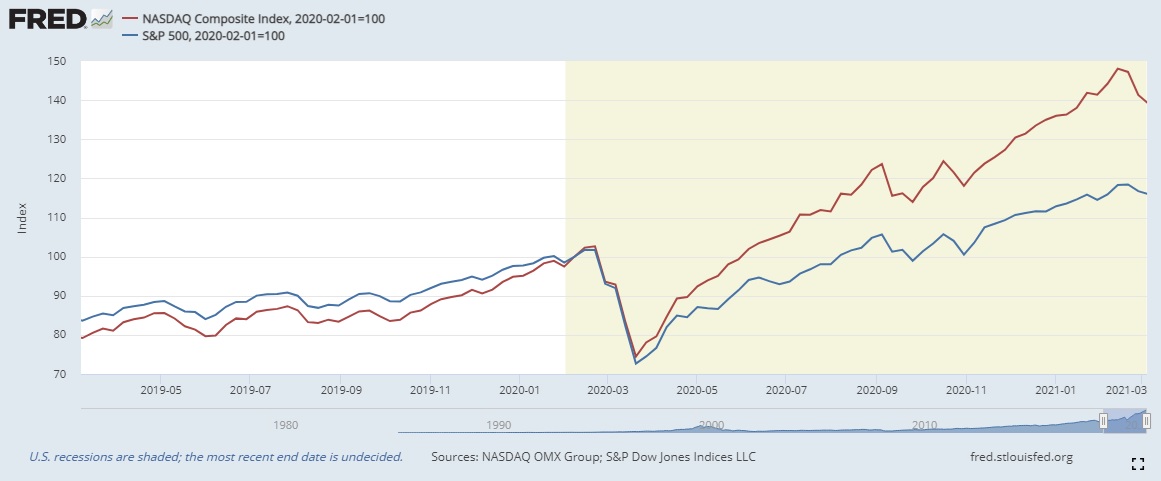

For equities, this policy stance doesn’t look favorable, at least at first glance. But, much of what we are seeing in the major indices is a rotation. Technology, which had been the market leader last year, is faltering, leading to a lower S&P. However, beneath the surface, other parts of the market are surging, meaning that one shouldn’t mistake a weaker index for weaker equities more broadly. Using Friday closing data, the S&P 500 market cap-weighted index is about flat for the year, while the equal-weighted index is up 4.7%.

The other area getting attention is the dollar. The rise in yields has lifted the dollar, with the dollar index challenging resistance. Don’t be fooled. History shows that since 1990 there has been a pattern that the dollar tends to follow the fiscal deficit with about a two-year lag. During the Reagan years, the dollar soared in the face of rising deficits, but that was a function of tight monetary/loose fiscal policy. That isn’t the case now. We don’t expect the dollar’s strength to last.

Here are some other market stories we are following:

- LIBOR is entering its final chapter. Over the next 18 months, the phase-out of LIBOR will accelerate.

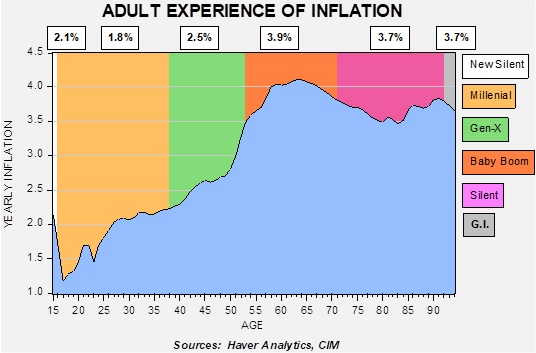

- Rising costs of commodities are likely to find their way into finished goods prices in the coming months.

- The fiscal charge (see below) is expected to make the U.S. the driver of global growth, especially with China retrenching (see below).

- The ECB is trying to cope with the rise in U.S. rates. They meet on Thursday, so we will hear more about this later in the week.

- The U.S. and the EU have agreed to suspend aircraft tariffs.

- At the end of March, a provision that exempted U.S. banks from counting Treasuries in their supplementary leverage ratio will end. Banks have been major buyers of Treasuries over the past year, and if the provision ends, that buying will likely cease. The buying was especially pronounced in the big banks. There is talk that the provision will be extended. Although we have doubts that the banks’ appetite for Treasuries would continue at the same pace, ending the provision will likely be a short-term negative for bond prices.

Economics and policy: The stimulus bill passed the Senate; House approval is likely.

- One reason discretionary fiscal policy fell from favor is that legislative time is different from economic time. In other words, when lawmakers are considering a fiscal boost, by the time they finally act, the need has usually passed. To some extent, that pattern is being repeated with this bill. Yet, there are underlying problems that this bill will help, mostly with rent assistance and reopening schools. The money to households will be welcome. We will be watching to see what happens with those funds, but don’t be surprised if the money is saved for a while or used to reduce debt.

- Now that the stimulus bill is passed, the most important senator, Joe Manchin, is making it clear that he won’t support an infrastructure bill in reconciliation. That means the White House will need to make a bill that the GOP will back, which could be a tall order.

China: CPC meetings are wrapping up.

- China will target 6% GDP growth for 2021, which is a bit slower than the 8% that has been the normal target, but likely still too high to prevent more debt growth.

- China will lend $62 billion to fund tech innovation, part of China’s drive for tech self-sufficiency.

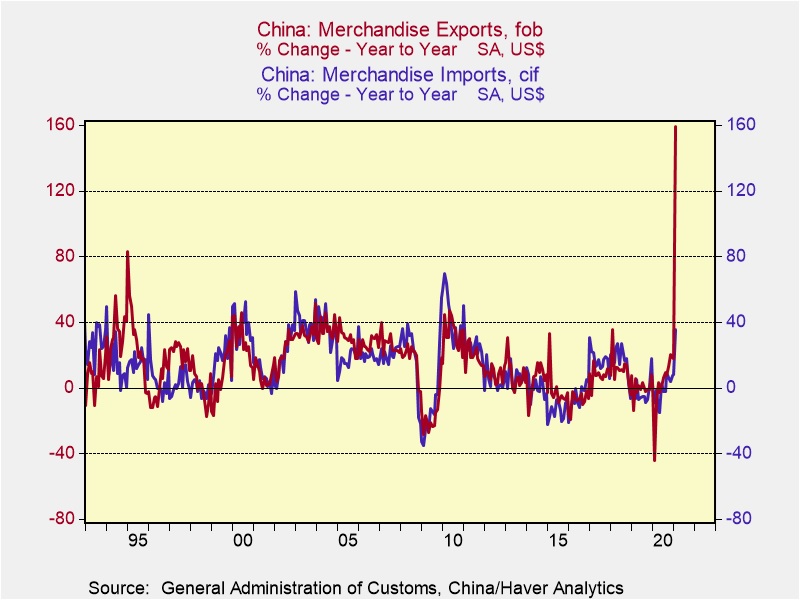

- China’s exports soared in February as the global economy began to recover.

- Beijing will cut the number of legislative members in Hong Kong as the CPC moves to gain control of elections.

- The U.S. will hold a summit with representatives from India, Japan, and Australia in a bid to revive the anti-China alliance.

Technology: Hacks and policy dominate the news.

- Microsoft (MSFT, USD, 231.60) has been hit by a massive hacking campaign centered on the firm’s email software. Chinese government hackers are being implicated.

- Meanwhile, the fallout continues from the SolarWinds (SWI, USD, 16.13) hack, which originated in Russia and Eastern Europe. The latest firm affected is privately held Accellion, a firewall company.

- The Biden administration has appointed Tim Wu to the post of advisor on competition policy. Wu is a proponent of the pre-Bork antitrust model that targets size alone. His appointment is potentially bad news for the largest tech firms.

International news: KSA oil facilities are hit by rockets and drones, the U.S. and South Korea make a deal, and the latest from the EU.

- Over the weekend, Houthi rebels attacked the oil port of Ras Tanura, the world’s largest oil port and the KSA’s biggest refinery. It doesn’t appear the attack was very successful, but it did send oil prices higher over the weekend. As has been the pattern of rallies off such news, the gains have failed to hold.

- The U.S. and South Korea have reached a burden-sharing agreement. This issue had been a sticking point for the Trump administration, which was seeking a large increase in funding. No details of the arrangement have emerged.

- It appears the U.S. will withdraw troops from Afghanistan in May as scheduled.

- Germany is planning legislation that would make German firms responsible for screening suppliers for human rights and environmental violations. Needless to say, corporations oppose the effort.

- Sweden is stepping up its efforts to contain Russian aggression. This report profiles the woman in charge of the effort.

COVID-19: The number of reported cases is 116,911,000 with 2,594,813 fatalities. In the U.S., there are 28,999,540 confirmed cases with 525,813 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 116,363,405 doses of the vaccine have been distributed with 90,351,750 doses injected. The number receiving a first dose is 58,837,710, while the number of second doses, which would grant the highest level of immunity, is 30,686,881. The FT has a page on global vaccine distribution.

Virology

- Hospitalizations are down to 40,212, the lowest level since October 20, 2020. They are down 70% from the January peak. To some extent, this is the most critical number as hospitalizations measure the burden on the health care system.

- The debate over the Wuhan Institute of Virology continues. The WHO is scrapping its initial report on China as Beijing and Washington feud over its contents. A group of scientists is calling for a new investigation. It has emerged that diplomats expressed concerns over lax biosecurity measures at the Wuhan laboratory in 2017. We doubt China will ever allow a full accounting of the virus’s emergence in its bid to control the narrative, even if the Wuhan laboratory is not implicated.

- Russia is engaging in a disinformation campaign to undermine confidence in Western vaccines.

- The EU is asking for U.S. vaccines to help cover its shortfall.

- Much of the pandemic news is positive. Vaccine distribution is starting to accelerate, and there is growing evidence that the worst is behind us. However, not all is rosy. The EU, whose vaccination program has left much to be desired, is seeing a rapid increase in infections from new variants. Even more unsettling is the news from Brazil, where a new variant is not only spreading more rapidly but is re-infecting those who have already contracted the disease. Brazil is mostly using Chinese vaccines, which may not be as effective against these new variations.

The mutations of the virus are likely to mean that we are moving from pandemic to endemic. Simply put, COVID-19 will be with us, like influenza, for good. That means that it will need to be managed. This could mean that annual or periodic boosters are required, and perhaps more aggressive prevention measures during “COVID season,” which will probably coincide with flu season. Two areas of further action are likely. First, it is clear that some people suffer greatly from the virus, while others are asymptomatic. For the most part, we have determined a set of comorbidities that seem to predict the impact of infection. We would expect to see a finer set of factors be established over time, down to the genetic level. Second, although most of the focus has been on vaccines, anti-viral drugs will also be important when it comes to adjusting to an endemic condition.