by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with news of a concerning computer hack on a public utility in Florida. We discuss more evidence that the Biden administration is focused on building international alliances against Chinese geopolitical aggression, along with more signs of increased regulatory risks that could be negative for technology stocks going forward. As always, we review various other international developments and the latest coronavirus news.

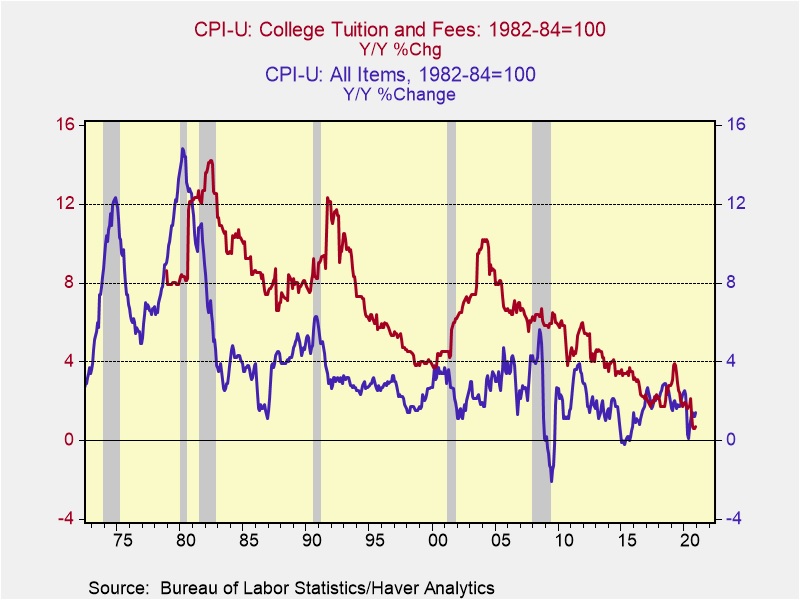

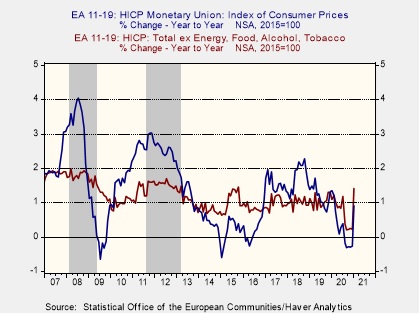

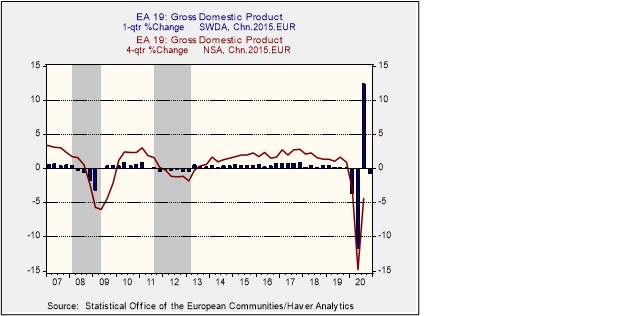

Today, the newest episode from our Confluence of Ideas podcast series is available. In this episode, titled “The 2021 Geopolitical Outlook,” Bill O’Grady and Patrick Fearon-Hernandez examine the five areas of concern discussed in our written report published in mid-December by the same name. These issues are the return of the establishment, the anti-China alliance project, the Middle East, North Korea, and the return of inflation. In addition, we talk about the factors that failed to make the cut, such as Russia, the pandemic, and climate change.

United States: Authorities say a computer hacker got into the systems of a water treatment plant in Florida and briefly increased the amount of lye used to treat water to a dangerous level. A plant operator noticed the alteration Friday and immediately reversed it, avoiding adverse effects on the city’s water supply, but the breach highlights the exposure of utilities to cyberattacks.

United States-India: President Biden had his first telephone call as president with Indian Prime Minister Modi yesterday, and the official White House readout of the conversation indicates that Biden highlighted strengthening of the “Quad” alliance to improve Indo-Pacific security against Chinese aggression. As we noted in our geopolitical outlook, we think one of the key geopolitical developments this year will be the U.S. effort to revitalize alliances like the Quad (the U.S., Japan, Australia, and India) or build new alliances to counter Chinese aggression in the area.

European Union: Members of the European Parliament working on drafts of the Digital Services Act (DSA) and the Digital Markets Act (DMA) told the Financial Times the laws could be amended as they pass through parliament to require big technology firms to pay for the news they share digitally, just as Australia is currently considering. According to Alex Saliba, a Maltese lawmaker who led parliament’s first report on the DSA, “With their dominant market position in search, social media and advertising, large digital platforms create power imbalances and benefit significantly from news content. I think it is only fair that they pay back a fair amount.” The move represents another in the growing list of global regulatory threats the technology industry is facing.

European Union-Russia: The governments of Germany, Poland, and Sweden said they would each expel one Russian diplomat in retaliation for Russia’s removal of three European diplomats last week for purportedly attending protests in support of jailed opposition figure Alexei Navalny. The Russian action was actually a shot across the EU’s bow as it considers new sanctions against Russia for its treatment of Navalny. As we noted yesterday, Russia’s snub of the EU reflects how little the Kremlin fears the bloc as a political force.

France-China: French Defense Minister Parly said the French nuclear attack submarine Émeraude and the support ship Seine sailed through the South China Sea on a freedom of navigation operation. The action, aimed at demonstrating allied resolve against China’s effort to assert exclusive sovereignty in the Indo-Pacific region, will likely further growing tensions between Beijing and the leading democracies.

United Kingdom-China: The British government warned U.K. citizens in Hong Kong that the territory has stopped recognizing dual nationality and may no longer be able to provide consular services to those who also hold a local passport. The shift in this Hong Kong practice is in line with other efforts to bring the territory closer to the rest of China. Not only will the move further exacerbate U.K.-China relations, but it could also further undermine global goodwill toward China and leave it more politically isolated. In fact, growing anger over Chinese authoritarianism in the leading democracies has even sparked talk of a boycott against the 2022 Winter Olympic Games in Beijing.

China: New data show births plunged by 15% last year to just 10.04 million. The figures suggest the coronavirus pandemic, greater urbanization, and the country’s historic one-child policy will continue to present major demographic headwinds for China in the coming decades. In any case, China’s huge population of 1.4 billion will still be a major geopolitical advantage. However, the U.S. is likely to retain some advantage from its faster population growth rate, which reflects both a natural population increase and immigration.

COVID-19: Official data show confirmed cases have risen to 106,567,454 worldwide, with 2,327,726 deaths. In the United States, confirmed cases rose to 27,098,367, with 465,083 deaths. Vaccine doses distributed in the U.S. now total 59,307,800, while the number of people who have received at least their first shot totals 32,340,146. Finally, here is the interactive chart from the Financial Times that allows you to compare cases and deaths among countries, scaled by population.

Virology

- Newly confirmed U.S infections fell to only about 86,000 yesterday, marking their second day in a row under 100,000. The number of virus-related hospitalizations declined to 80,055, including just 16,174 in intensive care. Meanwhile, new deaths came in at approximately 1,400. Taken together, the figures are now about where they were in late November, before the holiday surge. Meanwhile, vaccinations in the U.S. continue to accelerate, with ten states now having given at least an initial shot to 10% or more of their population.

- The office of Representative Ron Wright, a Republican from Texas, announced that he died from COVID-19 on Sunday, making him the first U.S. congressman to succumb to the disease. Wright had also been undergoing treatment for cancer for the last several years.

- The World Health Organization team visiting China to investigate the origins of the pandemic said the most likely possibility was that the virus spilled over from an animal into humans, either directly or through an intermediary. According to the researchers, it was “extremely unlikely” that the virus escaped from a lab experiment. All the same, the team also said it was possible the virus could have been transmitted via frozen food, a theory heavily promoted by the Chinese government to deflect criticism for its initial stumbles during the crisis.

- Following news that the vaccine developed by AstraZeneca (AZN, 50.06) may have only limited efficacy against new virus mutations, officials at the World Health Organization argued the shot is still an important weapon against COVID-19. WHO officials, including Dr. Kathleen O’Brien, director of the WHO’s immunization program, suggested the body would still list the vaccine—seen as a cornerstone in the world’s fight against the pandemic thanks to its low cost, high-volume target, and easy storage—for emergency use later this week.

- In Iran, the government has kicked off its vaccination campaign against COVID-19 using the Russian-developed Sputnik V vaccine.

U.S. Policy Response

- House Democrats last night released the biggest piece of their coronavirus relief bill, offering a measure that would extend unemployment insurance payments to$400 per week through Aug. 29 and send $1,400 per-person payments to most households, without lowering the income thresholds from earlier rounds. The proposal should be voted in the House Ways and Means Committee this week.

- In one way, the payments per person have actually been expanded, as this time they will be available for both children and adult dependents (like college students).

- On the other hand, the per-person payments will phase out more quickly. The full amounts would go to individuals with incomes up to $75,000 and married couples with incomes up to $150,000. They would completely phase out at incomes above $100,000 for individuals and $200,000 for married couples.

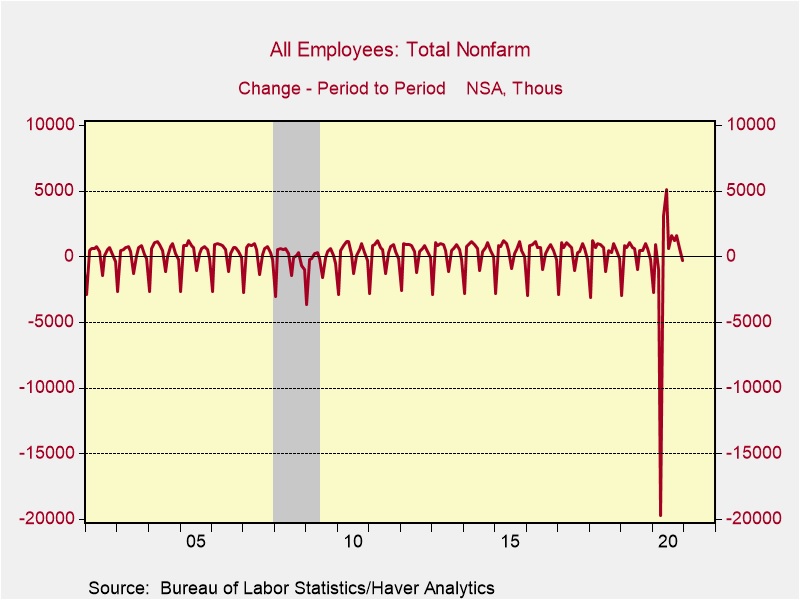

- In an interview with the Financial Times on the impact of loose monetary policy in the U.S., Richmond FRB President Tom Barkin said he expected “short-term price volatility” but stressed that he saw deflationary as well as inflationary risks on the horizon. Barkin said he was keeping his focus on medium-term inflation expectations, saying, “I still think there are a lot of people out of work who need a bridge to the other side, and I am supportive of what we can do to help them.”

Economic and Market Impacts

- According to Indeed.com, the number of help-wanted ads posted on the job-search website at the end of January was up 0.7% from one year earlier. The year-over-year increase adds to evidence that the labor market is continuing to heal from the pandemic. Hiring could accelerate soon from its mid-winter slowdown, which would naturally be positive for stocks.

- Coupled with optimism over the rollout of vaccines and a likelihood of global economic recovery this year, the prospect for continued loose monetary policy and increased fiscal stimulus should auger well for commodity prices. Some analysts are even predicting a long period of commodity-intensive growth that marks a repeat of the “supercycle” of the 2000s.

- Finally, analysts expect a strong snapback in the British property market this year, reflecting not only low interest rates and a post-pandemic economic revival but also the removal of uncertainty now that Brexit is complete and there is a U.K.-EU trade deal in place.