by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s report begins with a brief update on the war in Ukraine. Afterward, there is a discussion on the Federal Reserve’s determination to rein in inflation at all costs. Next, we look at international news, followed by economics and policy. We conclude with our COVID-19 coverage.

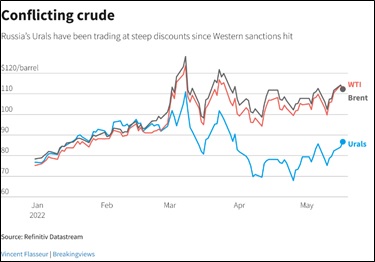

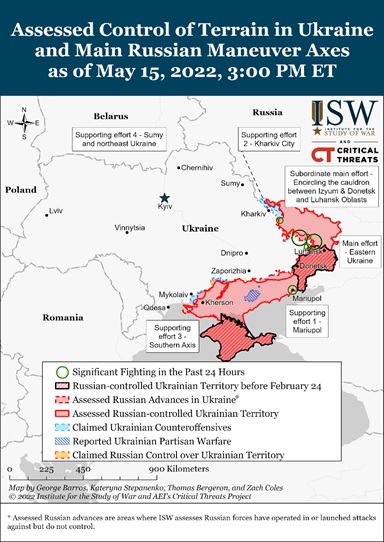

Russia-Ukraine: The situation in Ukraine continues to weigh on the morale of Russian forces and the general public. A lack of army reserves is hindering Moscow’s war efforts. As a result, Russia is changing tactics as it looks to recover from the setbacks incurred in Kharvic. Troops are now focusing their attention on western Donetsk Oblast. An official from the Kremlin said that Russia intends to annex all of the Donetsk and Luhansk regions. Meanwhile, there is growing unrest in Russia over military mobilization. In May, there were several reports of Molotov cocktail attacks on Russian military commissariats. As the war rages on, Russia is finding it more challenging to maintain support for its invasion, while Ukraine is seeing more success and assistance from the West.

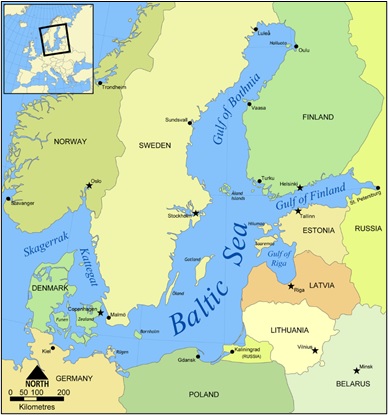

- The Biden administration is trying to provide Ukraine with anti-ship missiles to help remove Russia’s naval blockade in the Black Sea. The new weapons would make the conflict more costly for Moscow, as they will likely be used to destroy Russia’s Black Sea Fleet. On Thursday, Russia dismissed calls from the UN to halt its blockade that is preventing Ukraine from shipping wheat. The UN has warned that the blockade could lead to food shortages and global famine. In the meantime, the U.S. and the UN are considering transporting Ukrainian grain by railway through Belarus to Lithuania.

- Ukraine will receive more financial support from the West. Congress officially passed a $40 billion Ukraine aid package, and the bill is expected to be signed by President Biden on Friday. In addition, G-7 countries will agree to send Ukraine more than $19 billion in additional aid.

- In Europe, there seems to be waning support for Ukraine. Even though most Europeans support Ukraine as it fends off the Russians, many fear the economic costs of a prolonged war. In Italy, a transportation union went on strike on Friday to protest the government’s role in providing Ukrainian forces with weapons. And Germany and France have rejected the possibility of accelerating Ukraine’s admission into the European Union.

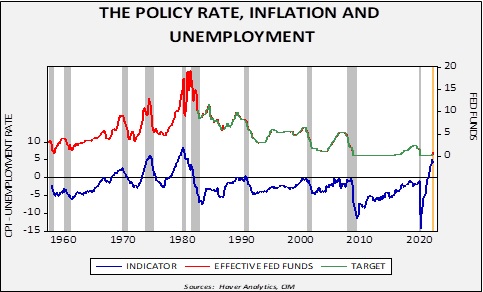

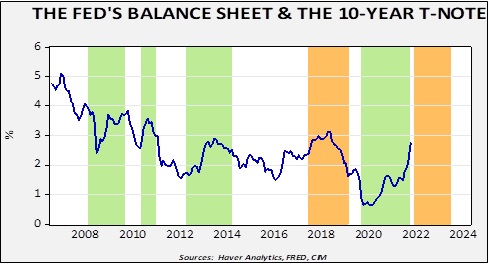

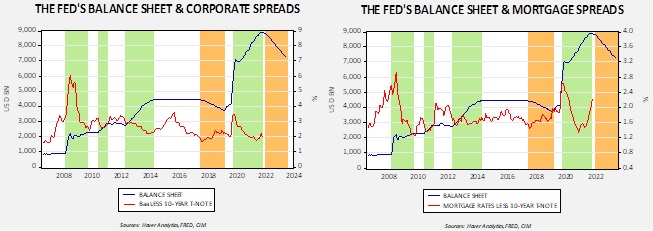

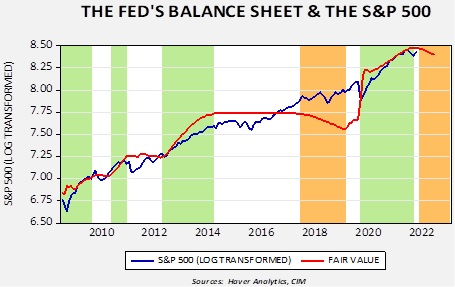

Federal Reserve: On Thursday, Fed officials reminded investors that the recent market rout would not impact its decision to tighten monetary policy. Kansas City Fed President Esther George said the Federal Reserve is not worried about the impact of higher interest rates on financial markets. Minneapolis Fed President Neel Kashkari warned that inflation would not fall without pain. Recent remarks from Fed officials reinforced the view that the central bank will attempt to rein in inflation by slowing the economy.

- Treasury Secretary Janet Yellen rejected the Fed raising its inflation target as prices rise. Although increasing the inflation target is not new—Lawrence Ball proposed raising the inflation target to four percent in 2013—the idea has circled back due to recent surges in the cost of living. The reluctance to change the inflation target is likely related to concerns that could undermine the Fed’s credibility. Nevertheless, we are less optimistic about the viability of a two percent target as the world moves away from globalization and toward regionalization.

International News:

- Canada announced it would ban Chinese telecom manufacturers ZTE (763 HK, HKD, 16.10) and Huawei from its 5G network just three days after lawmakers voted to revive a special committee to study bilateral trade deals. The ban appears to be related to suspicions from Western countries that Chinese telecom companies have close ties with the Chinese military.

- Beijing is looking at alternative ways to stimulate its economy. For example, The PBOC has cut the key interest rate on five-year prime loans by a record amount to boost demand for mortgages and property. The real estate meltdown and the Zero- COVID policy have weighed heavily on the economy. Bloomberg Economics forecasted that the U.S. GDP growth could surpass China for the first time since 1976. If true, this would place a dark cloud over Chinese President Xi Jinping before his re-appointment for a third consecutive term. He has long advocated that China will surpass the West; thus, slower growth would show that the economy has regressed in achieving its goal.

- The annual change in core CPI exceeded two percent in Japan for the first time in seven years. The country has been trying to increase inflation for a while, and the sharp rise will likely not impact the BOJ monetary policy. That being said, the increase in inflation suggests the yen could further depreciate against the dollar. A former BOJ official indicated the central bank might let the currency climb to 150 against the dollar before it becomes concerned. Currently, the yen is trading at 127.86.

US Economic and Policy News:

- The housing market is showing signs of a slowdown. According to the National Association of Realtors, existing-home sales fell to their slowest pace since April 2020. The sales of previously owned homes fell 5.9% from the prior year. The lack of sales is related to rising home mortgage rates and housing prices, making homes more unaffordable for buyers.

- Tether, the most widely used cryptocurrency, reports reducing its reserve of commercial paper and increasing its holding of U.S. Treasury bills. Earlier this month, the company came under scrutiny from regulators after its stablecoin USDT briefly lost its peg to the U.S. dollar. As a result, tether decided to shift its holdings into safer assets, mainly responding to criticism that investments with limited liquidity did not support its peg.

- President Biden is visiting Asia on Friday. On this trip, he is expected to try to persuade Indo-Pacific countries to build closer ties with the U.S. Additionally, Japan and the U.S. are expected to urge China to pare down its holding of nuclear weapons.

COVID-19: The number of reported cases is 524,056,687 with 6,273,624 fatalities. In the U.S., there are 83,060,981 confirmed cases with 1,001,606 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The CDC reports that 739,095,455 doses of the vaccine have been distributed, with 583,221,364 doses injected. The number receiving at least one dose is 258,074,668, the number of second doses is 220,811,434. The number receiving the first booster is 102,524,944, and the number receiving the second booster is 11,835,302. The FT has a page on global vaccine distribution.

- A Centers for Disease Control and Prevention panel recommended a booster dose of the Pfizer (PFE, $50.65) – BioNTech (BNTX, $167.87) coronavirus vaccine for children aged 5-11. The recommendation comes days after the FDA expanded authorization for that age group.