by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning. It’s a risk-off day—equity markets are sharply lower on the news of a new strain of COVID-19. We are seeing the usual price action in a risk-off situation. Treasury yields are lower, equity values are down, and the dollar is stronger. We begin today’s coverage with the pandemic. There was some good news; the long-awaited stimulus package has been finalized. Both Houses will vote on it over the next 48 hours and submit it to the White House for passage. China news is next, including the intimidation of Taiwan. We update the Russia hack and Brexit, and we close with economic news. A note to readers—the Daily Comment will go on holiday hiatus starting December 23 and return on January 4. Here are the details:

COVID-19: The number of reported cases is 76,912,340 with 1,695,144 fatalities. In the U.S., there are 17,847,629 confirmed cases with 317,729 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors.

Virology

- An apparent mutation of COVID-19, called B.1.1.7, has emerged in the U.K., setting off travel bans against Britain. The Eurotunnel and Eurostar have closed operations, and the Port of Dover has closed. Travel traffic is snarled in both Europe and the U.K. Although there is hope that the ban will only last 48 hours, we would not be surprised to see it extended.

- Early research suggests the new variant is more transmissible, but there is no evidence to suggest that it is more lethal. Also, there is no evidence that it renders the current vaccines less effective. However, we want to stress that the research is still early, and we don’t know definitively how big a problem this mutation could be.

- A similar variant was found in South Africa.

- Italy has reported the new U.K. strain in a patient.

- Is this new variant a serious problem? Potentially yes, but probably not. Viruses mutate constantly, and, in fact, it is not uncommon that they mutate into a less virulent form. Scientists have anticipated that there would be mutations, so this development doesn’t come as a huge surprise. Although the worry is that this mutation will render the new vaccines less effective, that probably won’t be the case. Even the flu vaccine offers some residual benefit for a couple of years. And, the mRNA technology can be adjusted rather quickly. If a major mutation does emerge, a new vaccine will probably be developed much sooner than in the past. Although this news is disconcerting, it really isn’t a surprise. The broad market reaction may have more to do with extended conditions and thin trading than any fundamental factors.

The stimulus package: At long last, Congress has produced a stimulus bill, which is part of a much larger spending package. Lawmakers combined a $900 billion stimulus bill with $1.4 trillion of omnibus spending and a host of other smaller bills to wrap up the year’s legislative activity. Here is what is in the new stimulus bill:

- Unemployment insurance was supported but was at a lesser scale. Supplemental pandemic benefits were reduced to $300 per week, down from the July package (that has expired) of $600 per week. So, it’s an increase from what was currently in place but less generous than what was available in the initial package.

- A $600 direct payment to individuals making $75 thousand per year or less.

- Small business aid of $355 billion

- Medical system support of $69 billion

- School aid of $82 billion

- Rental assistance of $25 billion

- Food aid of $26 billion

- Childcare support of $10 billion

- Forgiveness of a $10 billion postal loan

- Addons of tax extenders and water projects

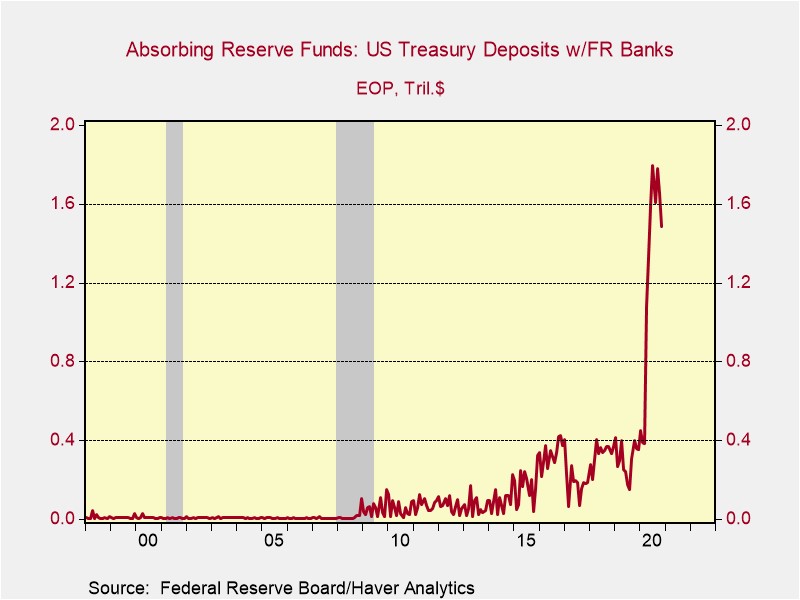

- The Fed issue—the last sticking point was the part of the bill that would have closed the Fed’s emergency lending programs. It appears this was watered down, but it may be mostly strategic ambiguity. The GOP leadership thinks the new language shuts down the program and re-appropriates the funding to the new stimulus bill, full stop. Democrats believe the language is loose enough to allow the Fed to continue the programs without new Congressional approval. We won’t know for sure who is correct until the next financial snag; let’s hope something can be worked out so we can avoid 2008 again.

So, what impact will this have? It certainly will help, but we would not expect a lot of stimulative impacts. Some of the broad market reaction today may be tied to the usual pattern of “buy rumor, sell fact.” In other words, financial markets mostly discounted this outcome, and thus, a passage leads to profit-taking.

China: Jack Ma kowtowed, and there was intimidation of Taiwan.

- As we discussed in November, Ant Group had its IPO delayed after one of the company’s founders, Jack Ma, lambasted regulators for their attempts to apply financial system regulations on his tech company. The government didn’t take that well, and the IPO, slated to the be largest ever, was shelved. New reporting suggests that when regulators met with Ma in the wake of this meeting, he was unusually conciliatory. No matter; the IPO was shelved anyway. One potential outcome is that parts of Ant Group might be nationalized. What this means for investors is that there is an embedded risk of state intervention in Chinese investment.

- China sent one of its two aircraft carrier groups through the Taiwan Strait in a clear attempt to intimidate. The carrier group trailed a U.S. warship that had traversed the strait the day before. Taiwan scrambled its defenses, sending out its own ships. China has been menacing Taiwan recently, perhaps to test the incoming administration or as a precursor to military action.

- China’s behavior is being noted in the region. Japan’s military budget for the upcoming year is at a new record.

The hack: One factor that has emerged in the Russian hack is that the Federal government does not deeply analyze the private-sector software it purchases. Most likely, this policy is designed to maximize efficiency. After all, if the private sector uses the package without incident, why shouldn’t the government. The other extreme would be for the government to create its own software that would emphasize security at the cost of usability. Although this extreme probably won’t be deployed widely, it is clear that this hack highlights the risk of using private-sector software without scrutiny. Another element? Hubris on the part of American cybersecurity officials may have led them to underestimate the power of Russia’s cyber capabilities.

Brexit: Talks continue, but the same issues bedevil negotiators. The new mutation is complicating the situation as households start to hoard and lockdowns tighten. The increasing likelihood of a no-deal Brexit is exacerbating supply problems.

Economic update: Here is a roundup of items we are watching on the economic front.

- Japan PM Suga has indicated that the BOJ and the MOF should not allow the JPY to fall below JPY 100. This move is a mistake on several levels.

- By stating a number, traders know they can appreciate the currency to this level without retaliation.

- A clear indication like this will almost certainly lead to a reaction from the U.S., maybe even a “currency manipulator” designation.

- This could be treated as a hostile act by the incoming administration.

- It is possible Suga is assuming that the U.S. will need Japan to contain China and will overlook this blatant action. That may be a gamble worth taking, but it should also be noted that Japan would not want to contain China alone. During the Cold War, the U.S. often overlooked currency undervaluation as a cost of maintaining the coalition against communism. The U.S. may not be as open in the new world.

- The Treasury is requiring new disclosure rules for cryptocurrency holdings. If there is anything that could take the wind out of the sails of bitcoin, regulation is a primary threat.

- The Fed’s decision to ease buyback rules has lifted financials after banks passed recent stress tests.

- Chris Waller was sworn in as Fed governor.