by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning and happy Monday. It’s the 79th anniversary of Pearl Harbor. Equity markets are lower this morning. Our coverage starts with Brexit; negotiations are coming to an end, and the “level playing field” issue appears to be the final sticking point. An update on the EU budget follows. Pandemic news is next. There is an update on China; export data was stellar. Economic news follows. A roundup of news from India, Venezuela, Saudi Arabia, and Russia wraps things up. Here are the details:

Brexit: Where to begin? The EU Commission President von der Leyen and PM Johnson issued a short statement about continued negotiations. The EU chief negotiator Barnier warns that he “cannot guarantee” a deal after 10 hours of talks yesterday. Talks are said to be on a “knife edge.” The GBP fell hard on reports of this friction. There are also reports that the fisheries issue has been resolved, although we still don’t have official confirmation. In the end, the last real sticking point is that the U.K. wants the freedom to make its own regulations and rules; the EU worries that if it gives Britain trade access, it will face an unequal regulatory environment that will give the U.K. an advantage. Thus, the EU wants the U.K. to follow EU rules if it wants access; the U.K. views this as undermining the whole point of Brexit. However, it isn’t just this issue; there are long-standing differences between Britain and the continent that are tied to centuries of history. Reports are that France is hewing to a hardline position. This should come as no surprise. At the same time, a hard Brexit isn’t necessarily the most likely outcome. It should be possible to create mechanisms that allow the EU to apply sanctions if the U.K. engages in regulatory arbitrage. Thus, there is an element of political theater, and we still expect that a deal will be made. Albeit, only at the last moment. At the same time, it doesn’t look like the U.K. is ready for the trade environment that it has already agreed upon. Some degree of disruption is likely even with a deal. If there is no deal, expect a sharp drop in the GBP, to the $1.15/$1.20 area. This won’t last and should be seen as a buying opportunity for U.K. assets.

EU Budget: Budget talks continue with a meeting scheduled for Thursday to get final approval on the €750 billion aid budget. The sticking point is that the law denies fund access to countries deemed to not have an independent judiciary, a rule targeted at Hungary and Poland. Last week, it appeared that Poland may have been willing to make concessions. Over the weekend, the right-wing press thundered about Polexit. We don’t think Poland will leave the EU anytime soon, but it does suggest discussions will be tense. This budget deal is historic; the creation of a Eurobond would be a huge step in making the euro a competitor to the dollar for reserve purposes. Chancellor Merkel’s support for this measure could be her lasting legacy, so we will be watching to see if she can manage to get this budget passed.

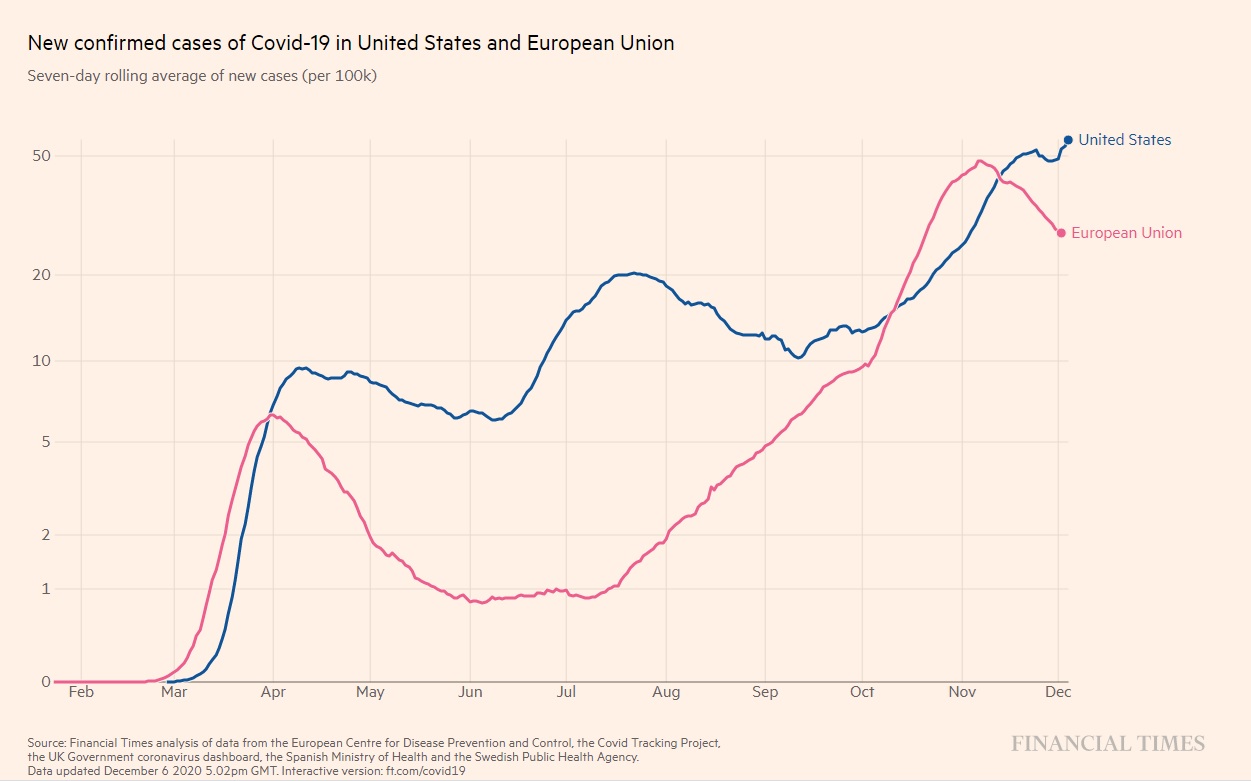

COVID-19: The number of reported cases is 67,178,542 with 1,537,975 fatalities. In the U.S., there are 14,761,542 confirmed cases with 282,345 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. U.S. hospitalizations have hit a new record. The chart below shows that U.S. infection levels are rising, while the EU appears to have peaked.

Virology

- We are watching the rollouts of vaccines around the world. It is our first look at how the distribution is working in real-time.

- In the U.K., nursing homes are getting the first cut while the medical staff is left to wait. Britain moved early to approve emergency use for the vaccine.

- Russia is starting mass immunizations using its vaccine. The West considers the Russian vaccine untested, so we will be watching for adverse reactions.

- In the U.S., nursing homes could receive the vaccine by the end of this month.

- Sweden, which had implemented mostly voluntary guidelines for managing the pandemic, has moved to mandatory restrictions as infection rates soar.

- There has been some preliminary analysis regarding whether early exposure to other coronaviruses granted some level of immunity to COVID-19. This sort of thing isn’t unusual; the early vaccinations for smallpox came from cowpox. The focus is on East Asia, which dealt with SARS in 2003. There is speculation that this exposure gave some level of immunity, and thus, has led to lower death rates.

- Fernando Gaviria, a Colombian professional cyclist, has confirmed a COVID-19 reinfection. His first infection was severe enough to put him in the hospital for two weeks. The story is good and bad news. The bad news is that he tested positive for the virus; the good news is that he was asymptomatic. Reinfection is a problem. If it becomes common, it would mean the virus would become endemic, meaning that even with a vaccine, it would still circulate. It may also mean that repeat infections may not be as severe.

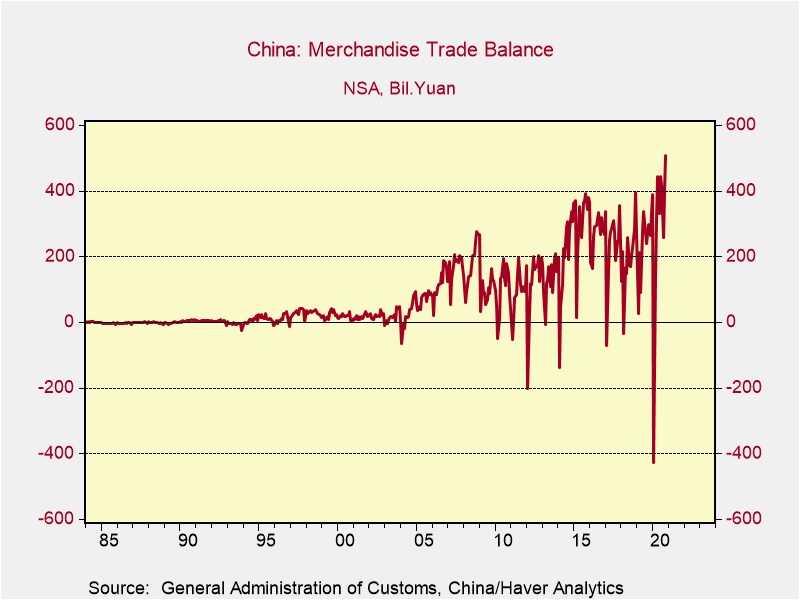

China: Exports rose sharply in November, up 21.1% from last year in dollar terms. Imports rose by 4.5%.

On a non-seasonally adjusted basis, this is a record trade surplus. Goods demand has been elevated while services have been depressed, which boosted China’s exports.

- FTSE-Russell is pulling listings that have been banned by the U.S. for their ties to the Chinese military. Other providers are considering a similar move.

- The TikTok deadline has passed; the app apparently still works, as the U.S. is still in talks to allow it to remain available.

- In further evidence that the U.S. is preparing for a Cold War with China, Congress is creating a new framework for dealing with China that will better coordinate efforts to deal with Beijing.

- Washington is preparing new sanctions on Chinese officials over the recent decision by Beijing to disqualify elected opposition legislators in Hong Kong.

- China continues its efforts to argue that COVID-19 didn’t originate in China.

Economics and Policy: It’s a busy week for policymakers.

- By December 11, Congress will need to pass a short-term budget measure to fund the government for a week. This will allow for more substantial talks for a longer-term measure. There are also ongoing talks for pandemic relief. There is bipartisan support for pandemic relief, but it isn’t clear if the leadership is willing to accept the current measure.

- Chick-fil-A is suing major poultry producers, accusing them of price-fixing.

- A new breed of “buy now, pay later” firms are emerging that allow purchasers to order items online and pay them off in installments with no interest. The firms make their money through merchant fees. It would appear that these firms are a threat to the credit card issuers; if they are, we would expect a flurry of mergers.

Foreign roundup:

- Indian farm protests continue; small farmers are worried that deregulation will lead to consolidation and push them off their land. We suspect this is exactly the goal of deregulation, as additional larger farms would boost productivity. Farmers have been lighting bonfires with chaff to wage their protests.

- Saudi Arabia has been engaged in a flurry of negotiations. It has been working to end the blockade of Qatar, and there are reports of backchannel negotiations with Israel. The pushback has started; over the weekend, Prince Turki al-Faisal, the former intelligence chief with close ties to King Salman, slammed the idea of a deal with Israel. Our read? The old guard in Saudi Arabia is reluctant to make a deal with Israel; CP Salman, the son of the king, is likely more open to such a deal, as it will be necessary to create a bulwark against not just Iran but Turkey as well.

- The U.S. deployed cyber operatives in Estonia last month to monitor Russian activity surrounding the election.

- Legislative elections were held in Venezuela yesterday, and it is very likely Maduro’s coalition will dominate the body. It had been held by the opposition, but parties opposed to Maduro decided to boycott the election, ensuring Maduro will get control.