by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

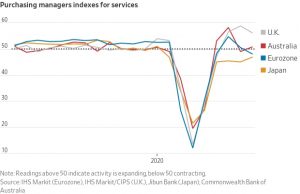

Our Daily Comment today provides more detail on the Bank of England’s possible future move to adopt negative interest rates, which we flagged yesterday before details were available. We also review some good news on Chinese trade statistics, although that is balanced by a number of reports showing global tensions on the rise and resurging coronavirus infections in some places.

United Kingdom: We now have more detail on the Bank of England’s communication with bankers regarding their readiness for negative interest rates, which news outlets reported just as our Daily Comment was going to press yesterday morning. In a letter to British bank chiefs, the BOE requested information on their “operational readiness and challenges with potential implementation, particularly in terms of technology capabilities,” if negative interest rates were adopted.

- The letter said there is no guarantee that negative interest rates would be introduced. Indeed, BOE officials have long insisted they didn’t think negative rates were appropriate for the U.K., although they’ve softened their stance in recent months in response to the economic slowdown resulting from the coronavirus pandemic.

- All the same, the inquiry is being taken as a sign that officials are weighing the merits of the policy despite bankers’ concerns that it would heap problems on a sector already weighed down by COVID-19 and Brexit.

- While negative rates in the U.K. aren’t set in stone, increasing evidence that the BOE is seriously considering them is having an impact on financial markets. Gilts with maturities out to five years already trade with a negative yield on expectations that a subzero policy rate could be in the offing. As more and more signs point to future negative policy rates, British financials are likely to be put under increasing pressure.

China: September imports jumped to a record $203 billion, up a robust 13.2% year-over-year (see data tables below). Exports, bolstered by strong sales of electrical devices and medical equipment, were up 9.9% on the year. The figures illustrate how China’s quick recovery from the coronavirus has the potential to help strengthen worldwide economic growth if it continues apace. The news should therefore be bullish for risk assets, including commodities.

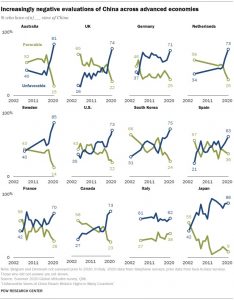

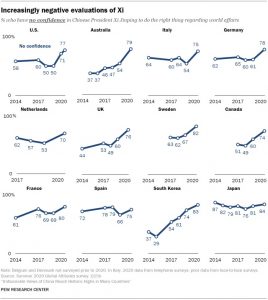

China-Australia: Despite the rise in Chinese imports, some countries or industries facing Beijing’s political ire may not be able to benefit. The Australian government is investigating reports that the Chinese government has issued a verbal communication to state-owned energy firms and steel mills to immediately stop importing Australian coal — a potentially crushing blow to the country’s coal export industry. China has already imposed sanctions on Australian barley, beef, and wine imports following a sharp deterioration in diplomatic relations linked to Canberra’s call for an inquiry into the origins of the COVID-19 pandemic in Wuhan.

European Union-Russia: The European Union agreed to impose targeted sanctions, including travel bans and asset freezes, against Russian officials and entities allegedly involved in the poisoning of Russian opposition leader Alexei Navalny.

Nagorno-Karabakh: Armenian and Azerbaijani forces continue to exchange fire in and around the breakaway Nagorno-Karabakh region, despite international calls for both sides to implement and stick to a Russian-brokered humanitarian ceasefire. Both sides blame the other for violating the ceasefire. The continued fighting has generated an outpouring of support from the large Armenian diaspora in the U.S. Reality television star Kim Kardashian, who is of Armenian descent, announced that she has donated $1 million to the Armenia Fund, which seeks to provide humanitarian relief efforts such as food, shelter, and medical care for those affected by the conflict.

Turkey-Greece: The Turkish government said it will again send one of its seismic exploration ships, the Oruç Reis, to explore for oil and gas near Greece’s eastern-most islands. This is an area recognized as Greek territorial waters under the Convention on the Law of the Sea. The move, which is strongly protested by the Greek government threatens to further exacerbate tensions as Turkey tries to become a player in the burgeoning natural gas fields of the eastern Mediterranean (for more detail on these tensions, see our Weekly Geopolitical Reports published on September 28 and October 5).

Argentina: Just two months after reaching a deal to restructure its $65 billion in foreign debt, the country appears to be on course for its seventh currency devaluation in the last 20 years. Argentine bond prices have dropped back to distressed levels, equity prices have collapsed, and the gap between the official and black-market exchange rates is widening. Analysts and investors think that with just $1 billion in liquid reserves to hand, Argentina’s central bank will be forced to tighten restrictions on imports and reset the peso at a new, much weaker value.

U.S. Supreme Court: The Senate Judiciary Committee opened its Supreme Court confirmation hearing for Judge Amy Coney Barrett, but most of the action on the first day consisted of relatively predictable opening statements by Republicans, Democrats, and the nominee herself.

U.S. Elections: As investors internalize the possibility that the Democrats could win control of the House, the Senate, and the Presidency next month, making passage of a massive new fiscal stimulus package likely, yields on U.S. Treasury obligations continue to trend higher. If yields continue to rise for longer maturities, it would eventually force the Fed to decide definitively on whether to impose yield curve control and cap longer-term yields.

U.S. Technology Sector: Illustrating how digital content and distribution are becoming so important to the economy and the future of many companies, Walt Disney Co. (DIS, 123.97) announced a major reorganization meant to give priority to its video streaming services and ensure they get a steady flow of the company’s best content. This shift echoes similar moves by other entertainment giants.

U.S. Energy Sector: Wil VanLoh, the CEO of a private equity firm that through its portfolio companies is the second-largest U.S. driller, has warned that rampant hydraulic fracturing or “fracking” has permanently damaged the country’s oil and gas reserves. According to VanLoh, a key problem is that wells have been drilled too close to one another, which will make it harder to fully exploit the oil and gas underground and sustain lasting U.S. energy independence.

- On the flip side, of course, smaller-than-expected reserves might eventually help support prices if and when demand recovers, although that day appears far off in the future.

- Separately, the International Energy Agency issued a report saying the world’s transition to cleaner sources of energy is gaining speed as the coronavirus pandemic accelerates the shift in investment away from fossil fuels.

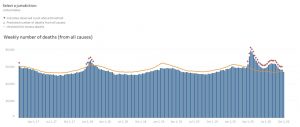

COVID-19: Official data show confirmed cases have risen to 37,867,739 worldwide, with 1,081,746 deaths and 26,315,281 recoveries. In the United States, confirmed cases rose to 7,804,699, with 215,089 deaths and 3,106,728 recoveries. Here is the interactive chart from the Financial Times that allows you to compare cases and deaths among countries, scaled by population.

Virology

- Newly confirmed U.S. infections totaled only about 41,000 yesterday, raising some hope that the resurgent seven-day moving average could start to come down soon. Deaths remained close to their recent average of about 700. However, data show national hospitalizations have recently been rebounding strongly. Despite the rebound in infections and hospitalizations in some localities, authorities are reluctant to reimpose broad, generalized economic lockdowns like they did in the spring.

- Johnson & Johnson (JNJ, 151.84) said it has paused all further dosing in its Phase III vaccine trial after a study volunteer came down with an unexplained illness. An independent safety board is now reviewing the subject’s illness so the company can determine next steps. This is the second time trials for a COVID-19 vaccine have been paused over a safety concern. Last month, AstraZeneca PLC paused clinical trials of its experimental vaccine in the U.K. after a participant had an unexplained illness. The U.K. study resumed, but a large U.S. study is still on hold. The setbacks serve as a reminder that there will be challenges in getting an effective vaccine developed and administered widely, even though there are already dozens of candidates in testing.

- A Nevada man became the first published case of COVID-19 reinfection in the U.S., adding to a number of examples worldwide that patients who have recovered from the disease might still be at risk of getting it again.

- In the U.K., Prime Minister Johnson is facing a potential new political crisis after a sensational document dump from his Scientific Advisory Group on Emergencies (SAGE). In part, the documents reveal the advisory group’s damning critique of the government’s test-and-trace system. Moreover, they also show Johnson’s government rejected advice from its experts to implement a “circuit-breaker” lockdown to get on top of the coronavirus in September. The SAGE minutes from a Zoom meeting on September 21 show in stark terms that Chief Medical Officer Chris Whitty, Chief Scientific Adviser Patrick Vallance, and the government’s other scientific advisers are now publicly at odds with the policy being pursued by Johnson and his ministers.

Economic Impacts

- Because of a surge in remote work, study, and home entertainment during the pandemic, market research firms say worldwide personal computer shipments in the third quarter were up approximately 9% from one year earlier, marking their strongest growth in a decade.