by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Our Daily Comment today focuses on some positive coronavirus developments, including further progress on vaccines and treatments, policymakers’ reluctance to reimpose mass lockdowns, and a broadening economic recovery in China. Those developments go far toward explaining the solid bid for risk assets so far today. However, we also review new developments in the global pushback against the rising Chinese global profile, which remains a risk for the markets.

COVID-19: Official data show confirmed cases have risen to 29,315,282 worldwide, with 929,171 deaths and 19,882,900 recoveries. In the United States, confirmed cases rose to 6,555,384, with 194,547 deaths and 2,474,570 recoveries. Here is the interactive chart from the Financial Times that allows you to compare cases and deaths among countries, scaled by population.

Virology

- Newly confirmed U.S. infections again fell slightly yesterday, bringing the seven-day moving average down to approximately 34,500. The seven-day moving average of coronavirus-related deaths has now fallen to approximately 750. However, authorities remain concerned that infections and deaths could be boosted again following the likely required evacuations as Hurricane Sally makes its landfall early tomorrow.

- Reflecting global policymakers’ reluctance to reimpose mass lockdowns, French Prime Minister Castex said he won’t impose a new nationwide lockdown despite the new resurgence of infections in France. Instead, cities including Marseilles and Bordeaux announced several targeted restrictions, including limits on partying and large events.

- Rapid coronavirus testing machines manufactured by Becton Dickinson (BDX, 235.90) have reportedly produced a significant number of false positives in about a dozen nursing homes. False positive test results are a risk in nursing homes because a resident wrongly believed to have COVID-19 might be placed in an area dedicated to infected patients, potentially exposing an uninfected person to the coronavirus.

- Eli Lilly (LLY, 149.00) and Incyte (INCY, 93.15) said they will seek emergency-use authorization for their rheumatoid arthritis drug Olumiant to treat COVID-19, after a study showed that it helped hospitalized patients recover sooner. When given in conjunction with Remdesivir, a drug from Gilead Sciences (GILD, 66.34), Olumiant shaved about one day off the median recovery time for patients compared with patients who received Remdesivir but not Olumiant.

- The United Arab Emirates has become the first country outside China to approve emergency usage of a Chinese coronavirus vaccine candidate, in a vote of confidence for state-backed drugmaker Sinopharm (SHTDY, 12.58).

- With the winter cold and flu season soon approaching, this article may help you distinguish them from COVID-19. An important takeaway: get your flu shot. Now.

Economic Impact

- In a sign that China’s recovery from the pandemic continues to broaden and strengthen, Chinese retail sales in August were up 0.5% year-over-year, marking their first annual gain of 2020 (see data tables below). Retail sales year-to-date are still down 8.6% from the same period one year earlier, but the strengthening trend suggests the Chinese recovery, which initially came from government support for business and public investment, has now started to encompass consumer demand as well.

- Separately, the data showed August industrial production was up 5.6% on the year.

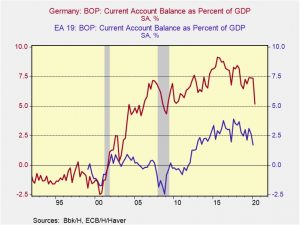

- The continuing Chinese recovery could help pull along the rest of the world unless U.S.-China tensions intervene. Because of Germany’s strong exports to China, the German stock market has recently been performing especially well compared to other European markets.

U.S. Policy Response

- With the White House and congressional Democrats still at loggerheads over a new round of pandemic relief spending, economists are increasingly warning that the U.S. rebound could lose steam in later 2020 or early 2021, creating a drag on the global economy as it tries to recover from the coronavirus.

- It appears that many people have been lulled into a false sense of security by policymakers’ apparent reluctance to reimpose mass lockdowns, the continued economic reopening, huge job gains in recent months, and only limited signs that the current rebound is petering out. However, it’s important to remember that incoming data through the autumn could show a marked slowdown in the recovery.

- The summer resurgence in the virus in some places and the expiration of the federal supplementary unemployment insurance of $600 per week at the end of July has probably just started to weigh on demand in August. The drag from those developments was probably offset, to some extent, by continued economic reopening. However, a key test will be when we start to see the major economic reports for August and September. We’re especially focused on the August retail sales data coming out tomorrow and the University of Michigan’s preliminary September Consumer Sentiment Index on Friday.

- As we’ve argued before (see our Asset Allocation Weekly from August 7, for example), the lack of significant financial aid to state and local governments also creates a risk that they will have to slash their payrolls and spending plans in the coming months, which could offset much of the other economic stimulus being provided by the federal government.

- Of course, a sudden worsening in the economic data could conceivably spur quick action on a new spending bill, but there is limited time before Congress takes a break for the election. In addition, any delay in providing new support runs the risk that many firms will have to close their doors for good, and many workers will drop out of the labor force permanently.

Foreign Policy Response

- Yoshihide Suga, who is expected to be approved as Japan’s new prime minister tomorrow, reiterated that he would initially focus his efforts on curbing the virus and reviving the economy rather than calling for a snap election after taking office.

United States-China: The Trump administration yesterday banned cotton apparel, computer parts, and other imports from several companies and suppliers that allegedly use forced and imprisoned labor in China’s Xinjiang region. The targeted entities include four commercial firms, one training center, and an industrial park.

- The move builds on the bans imposed against four other entities over the last year; it is in response to concerns about Chinese repression of its Uighur minority in Xinjiang.

- Coupled with other recent U.S. moves in the geopolitical, military, trade, and technology spheres, the new bans illustrate increasing U.S. pushback against Chinese policies around the world. We continue to believe that rising U.S.-Chinese tensions are a significant risk to global equity markets.

European Union-China: In yesterday’s four-way video summit between European Commission President von der Leyen, European Council President Michel, German Chancellor Merkel, and Chinese President Xi, the European side delivered a pointed message that China should not see the EU as any easier of a rival than the U.S. The Europeans also stressed that Beijing still has a long list of commitments to fulfill if it wants to complete a long-planned investment agreement. In other words, the summit provided more evidence that other major democracies besides the U.S. are also starting to push back against China.

Germany: Chancellor Angela Merkel and Interior Minister Horst Seehofer have proposed that Germany take in 1,500 stranded asylum seekers after last week’s devastating fire at the Greek refugee camp of Moria. The proposal threatens to reignite the vexing political debate over how the EU should deal with migrants knocking at its doors.

United Kingdom: Parliament last night gave second-reading approval to Prime Minister Johnson’s “internal market” bill by a vote of 340 to 263, despite a rebellion by many in Johnson’s own Conservative Party. Registering their opposition to provisions allowing the government to abrogate its Brexit treaty with the EU in contravention of international law, two Tories voted against the bill outright, while 30 abstained from voting, including former Chancellor Sajid Javid, two former attorneys general, and two former Northern Ireland secretaries. That presents some risk that the government will have to make concessions when the next key votes on the bill are held next week.