by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

In today’s Comment, we discuss the latest example of renewed U.S.-Russia military tensions, as well as recent developments in the race to succeed Japanese Prime Minister Abe. Today’s purchasing managers’ indexes out of China and Europe were generally positive, suggesting continued economic recovery from the coronavirus pandemic and helping give a lift to risk assets. However, broader virus news was a bit mixed. We review all the key news below.

United States-Russia: In the second U.S.-Russia military confrontation of the last week, Russian Su-27 fighter jets harassed a U.S. B-52 bomber flying in international airspace over the Black Sea on Friday. The fighters crossed within 100 feet of the bomber’s path and forced it to fly through dangerous turbulence (for Department of Defense video of the encounter click here). Last Tuesday, several American troops operating in northeast Syria were injured when a Russian military vehicle rammed its own.

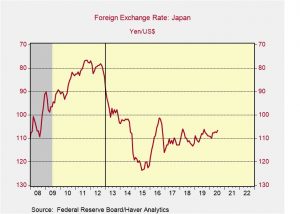

Japan: The ruling Liberal Democratic Party said the election to select a replacement for Prime Minister Abe will utilize an emergency ballot procedure that excludes rank-and-file members. The new party leader will be chosen only by LDP members of parliament and regional party chiefs. That’s likely to be a disadvantage for Shigeru Ishiba, a former minister of defense and regional revitalization, who is popular with the public because of his calls for more income equality, but he is unpopular with national party leaders for his past criticisms of Abe. The frontrunner in the election now is probably Abe’s chief cabinet secretary, Yoshihide Suga, an experienced and unobjectionable political player with little foreign policy expertise.

Argentina: The Argentine government announced it has successfully restructured almost all of its $65 billion debt with private creditors, potentially ending the country’s ninth sovereign debt default. According to Economy Minister Martin Guzmán, 99% of the country’s creditors have accepted the government’s offer, which extends maturities on the debt and lowers interest rate payments from an average of 7% to about 3%.

COVID-19: Official data show confirmed cases have risen to 25,511,385 worldwide, with 851,154 deaths and 16,850,044 recoveries. In the United States, confirmed cases rose to 6,031,525, with 183,602 deaths and 2,184,825 recoveries. Here is the interactive chart from the Financial Times that allows you to compare cases and deaths among countries, scaled by population.

Virology

- Newly confirmed U.S. infections totaled less than 34,000 yesterday, reaching their lowest level in two months. However, because of the spike in cases over the last week, the seven-day moving average of new cases held largely steady at about 41,550. Daily deaths linked to COVID-19 have fallen gradually to less than 1,000 per day.

- Australia and South Korea also seem to be getting the upper hand over their summer infection spike.

- India, on the other hand, continues to see its cases spike. It has now replaced Mexico as the country with the third-highest death count.

- To understand how seriously the epidemic has spread in Latin America, check out this story. On August 22, police raided a nightclub in Lima where young revelers were flouting lockdown restrictions. People rushed for the exit to avoid arrest and 13 were crushed to death or asphyxiated. Almost as shocking were the statistics the Peruvian interior ministry released the next day: of the 13 dead, 11 had COVID-19. Of the 23 people the police arrested, 15 tested positive.

- In Hong Kong, the government has launched a Beijing-backed plan to conduct virus tests on 5 million of the city’s 7.5 million residents, but pro-democracy activists and opposition legislators have called for a boycott of the program.

- The involvement of mainland Chinese testing companies and Chinese medical staff has stoked fears that personal data will be shared with the mainland.

- Adding to the concerns are credible accounts of widespread DNA collection by the Chinese security apparatus in Xinjiang, where millions of Uighurs and other Muslims have been detained in re-education camps.

- As people start returning from their summer holidays, experts worry that weak infection control and imperfect contact tracing programs will lead to a new resurgence of infections in the coming weeks. The concerns are centered on Europe, where many people have traveled internationally. EU member states are therefore exploring how to better coordinate the identification of COVID-19 hotspots and the management of cross-border travel as the continent area grapples with a surge in infections.

- In a survey of 15 major companies collectively employing about 2.6 million people, 57% said they decided to postpone their back-to-work plans because of the summer surge in COVID-19 cases. Among the respondents, many of whom had planned to bring their employees back to the office after Labor Day, only one firm said the surge of infections hadn’t affected its timeline or plans for bringing workers back.

Economic Impact

- New developments in New York and Chicago highlight the risk that plummeting tax revenues and increased costs resulting from the pandemic will force state and local governments to slash spending.

- In New York, Mayor de Blasio agreed to a union request to postpone 22,000 municipal job cuts to gain time to explore other alternatives. De Blasio and union leaders have been lobbying the state legislature for the power to borrow as much as $5 billion, but with no luck so far.

- Separately, officials in Chicago projected the municipal budget will face a record $1.2 billion budget gap for 2021 on top of the nearly $800 million shortfall projected for 2020.

- Proceedings for the eviction of retail tenants are picking up across the country as the economy reopens; courts are reopening and states’ moratoriums on evictions are expiring or getting curtailed.

- If you’re looking for a bright spot in today’s pandemic news, here’s a nice one: several major airlines have announced they will permanently scrap their ticket change fees on most domestic flights in order to help revive demand for their services.

U.S. Policy Response

- California’s legislature passed a bill granting renters who are financially affected by the pandemic a reprieve from evictions until February 1. A previous moratorium on evictions was set to expire on Wednesday.

- The bill passed with supermajorities in both houses of the legislature in the final hours of its two-year legislative session, and addresses what advocates had said was a looming wave of evictions.

- Governor Newsom, who crafted the compromise with legislative leaders, tenant advocates, and landlord groups last week, immediately signed the bill into law.

Financial Market Response

- Reflecting the mantra of “lower for longer” regarding U.S. interest rates and the prospect that mutual EU bonds could make the euro a more viable reserve currency, the U.S. dollar continues to weaken. Early today, the euro rose to within a whisker of $1.20, a level the common European currency hasn’t reached since May 2018. As we’ve been arguing, the falling dollar should be particularly bullish for foreign assets and precious metals.

- Along with consumers’ continued caution about venturing out, delayed office and school re-openings are weighing on crude oil demand. As a result, crude prices per barrel remain stuck in the low $40s.