by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Russia-Ukraine war, where Russian forces continue to make only limited territorial gains but have intensified their efforts to Russify the areas they already occupy. We next review a range of international and U.S. developments with the potential to affect the financial markets today. Finally, we wrap up with the latest news on the coronavirus pandemic, including signs of even tighter lockdowns in Beijing that will continue to weigh on economic activity in China and globally.

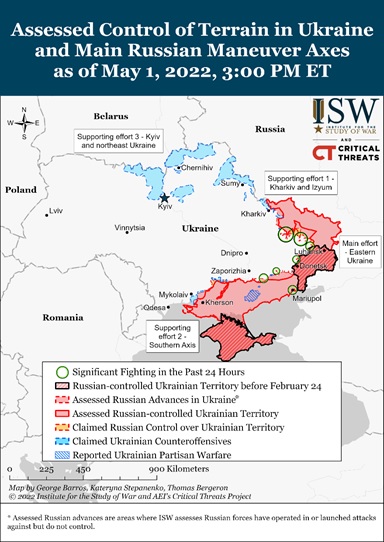

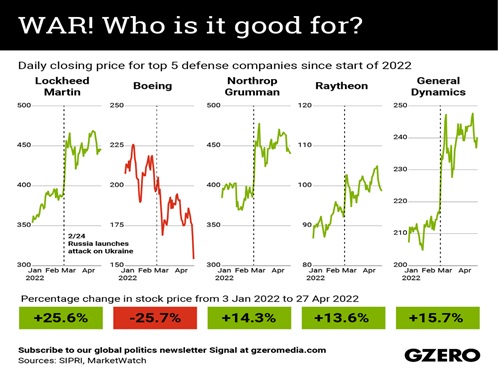

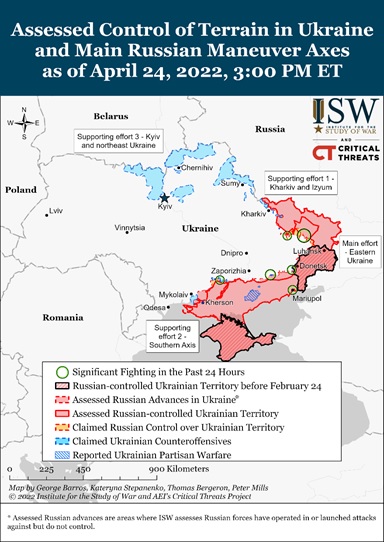

Russia-Ukraine: Russian forces continue to make only limited gains in the eastern Ukrainian region of Donbas and along Ukraine’s southern coast, even as they keep attacking strategic cities such as Kharkiv and Odesa with missiles, artillery, and aerial bombs. Reports also indicate the Russians are increasingly taking steps to incorporate occupied territories into Russia proper. For example, Russian sources said stores in occupied Melitopol and Volnovakha are beginning to transition to using the Russian ruble, and British Defense Intelligence reported the ruble would be used in Kherson starting on May 1 as part of a four-month currency transition scheme enacted by the occupation administration. The measures, which are not necessary or normal in military occupation administrations, suggest that Russian President Putin likely intends to retain control over these areas and that his ambitions are not confined to Donbas. Meanwhile, Ukraine launched a missile attack against a Russian command post in the northeastern city of Izyum over the weekend, killing at least one more Russian general and several other senior officers and reportedly wounding Russia’s Chief of the General Staff Valery Gerasimov. The Ukrainian military also claimed its drones have sunk two small Russian patrol craft in the Black Sea.

- As we have written before, the ultimate risk in the war is if a frustrated President Putin decides to launch either a tactical, battlefield nuclear strike against Ukraine or a strategic nuclear strike against the U.S. and its NATO allies. Perhaps the next-most dangerous risk is if Russia’s currently deployed forces still can’t make headway in Ukraine and Putin declares a general mobilization of Russian society for the effort. Some sources have speculated that Putin may call for such a general mobilization at the May 9 celebration of the Soviet Union’s victory over Nazi Germany in World War II.

- Whether formally or informally, a general mobilization would basically equate to a declaration of war. Contrary to Putin’s current characterization of the conflict as a “special military operation,” such a situation would force Putin to seek maximalist war aims and constrain his flexibility in pursuing the war.

- As in the run-up to World War I, a general mobilization by Russia would require at least Poland and the Baltic states to mobilize as well. And, given that they are all NATO members, the overall alliance also might have to mobilize.

- With potentially millions of soldiers mobilized and at the ready on both sides of the Atlantic, the risk of miscalculation or accident would increase dramatically. Beyond that, the economic costs on both sides of the Atlantic would spike. For example, the current severe labor shortage in the U.S. and some allied countries would worsen immensely if tens of thousands of reservists and national guardsmen were called up from their jobs. The high economic cost alone could tempt some policymakers to bet on a quick military victory.

- One important lesson may be the situation at the beginning of the Korean War in 1950. At the time, the National Security Resources Board, headed by a former secretary of the Air Force, advocated for large-scale economic mobilization.

- However, President Truman ruled out the idea and instead envisioned only a limited mobilization accompanied by aggressive wage and price controls. The result was the passage by Congress of the Defense Production Act (DPA), which gives the president authority to order private businesses to take specific steps to support the war effort.

- The DPA gives the U.S. a certain amount of flexibility in responding to the economic pressures of supporting Ukraine in the war or mobilizing the U.S. itself. Other countries may not have the same amount of flexibility. In a general NATO or Russian mobilization, high economic costs have the potential to prompt rash military decisions that would present enormous risks for investors.

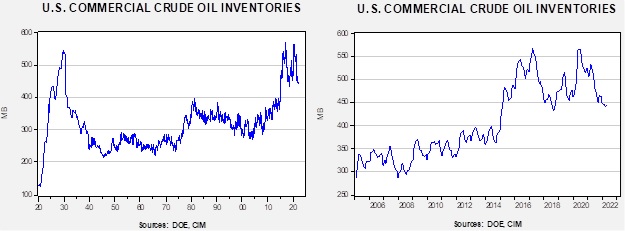

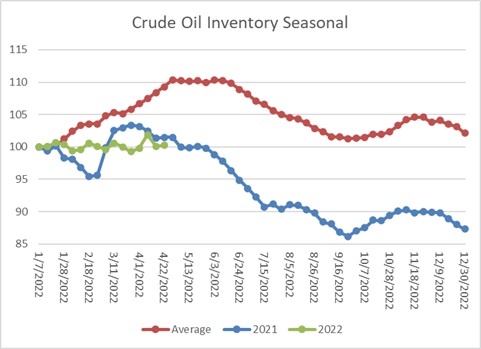

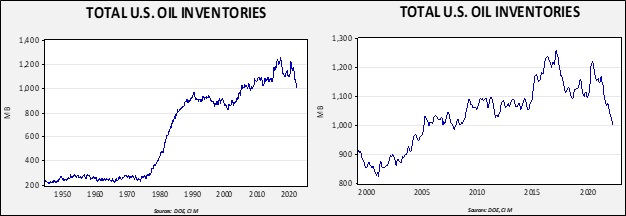

- Separately, the German government said it would now support a ban on Russian oil imports into the EU that would be phased in over several months. Previously, the government said Germany would need a phase-in period lasting to the end of the year.

- Germany’s new stance increases the likelihood that the EU will impose a ban on Russian oil to punish President Putin for his invasion of Ukraine. However, the ban is still not certain, as it would need to be approved by all EU countries. Some of those countries highly depend on Russian energy supplies and will be reluctant to cut them off. In an effort to ease approval of the sanctions when it is released tomorrow, the EU will reportedly offer some exemptions to Hungary and Slovakia, which are particularly reliant on Russian oil.

- Just as important, we note that the ban under discussion would only apply to Russian oil. It would not address Russian natural gas, on which some EU countries are even more dependent.

- EU Economics Commissioner Dombrovskis said EU officials are looking for ways to aid the Ukrainian government further. According to Dombrovskis, the EU hopes to both accelerate the payment of €600 million under the bloc’s existing emergency support plan and bring forward a new round of lending.

Iran Nuclear Deal: Despite the distractions of the Russia-Ukraine war, the EU told Iran that it was prepared to make a renewed push to reinstate the 2015 deal, lifting economic sanctions on Tehran in return for restrictions on its nuclear program. Even though the text of a deal reinstating the program has been virtually finalized, negotiations on it have essentially been frozen since early spring. EU officials say they are still waiting for Iran to respond to the offer.

European Union: European Commission regulators say Apple (AAPL, 157.65) has broken EU competition law by abusing its dominant position in mobile payments to limit rivals’ access to contactless technology. According to the preliminary charge, Apple is preventing competitors from accessing “tap and go” chips or near-field communication (NFC) to benefit its own Apple Pay system.

- Under EU law, Apple could face fines worth up to 10% of global turnover if the charges are upheld.

- The charge highlights our oft-stated concern that big, rich U.S. technology companies face increased regulatory risk both at home and abroad.

France: The traditional May Day labor marches yesterday were reportedly on the raucous side, as protesters warned newly re-elected President Macron that they want higher incomes, lower inflation, and an end to his proposals to raise the country’s retirement age.

- Macron faces his first major challenge in June as he tries to win another parliamentary majority in legislative elections that would enable him to pass his reforms.

- Parties on the left and right are exploring potential alliances to deprive him of that power.

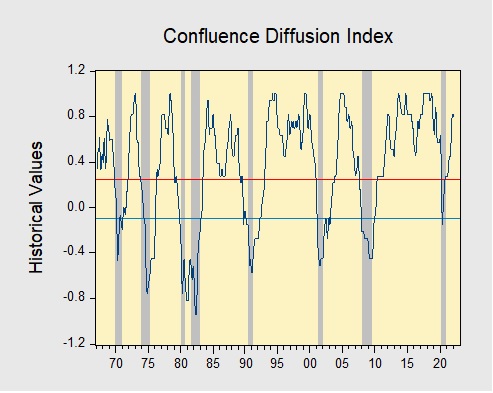

U.S. Monetary Policy: Federal Reserve officials this week will hold their latest two-day monetary policy meeting, in which they are expected to announce an aggressive 50-basis-point hike in the benchmark fed funds interest rate and detail a relatively quick run-off of bonds on the central bank’s balance sheet.

- We have no doubt the Fed will embark on an aggressive tightening of policy, just as the officials have indicated.

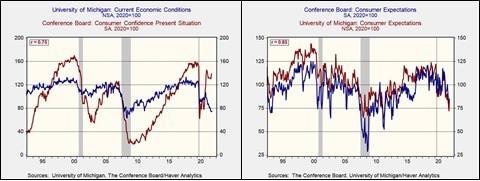

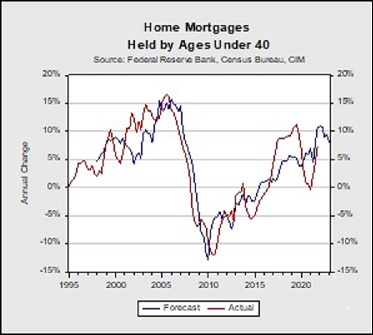

- However, as we’ve mentioned before, we remain skeptical that the Fed can continue with its entire program of tightening without causing financial market disruptions or contributing to a sharper-than-planned slowdown in the economy.

- Considering factors like sky-high inflation, fiscal tightening, continued supply chain disruptions, and the blow to confidence from the Russia-Ukraine war, we believe there is an elevated risk of a sharp economic slowdown, recession, or financial market volatility in the next 12 to 18 months.

Global Green Energy: One little-noticed alternative source of “green” energy is naturally occurring hydrogen, which small, start-up energy firms are already exploring for, or even producing in places like Australia and Africa. While the gas isn’t renewable, boosters say burning it carries few of the environmental concerns of burning natural gas or other fossil fuels.

COVID-19: Official data show confirmed cases have risen to 513,890,808 worldwide, with 6,236,772 deaths. The countries currently reporting the highest rates of new infections include South Korea, Germany, France, and Italy. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) In the U.S., confirmed cases rose to 81,365,218, with 993,733 deaths. In data on the U.S. vaccination program, the number of people considered fully vaccinated now totals 219,729,731, equal to 66.2% of the total population.

Virology

- In the U.S., the Omicron BA.2 variant continues to spread, but it is still causing relatively few serious illnesses or hospitalizations. The seven-day average of people hospitalized with confirmed or suspected COVID-19 came in at 17,248 yesterday, up 16% from two weeks earlier. Because of the low level of hospitalizations and general fatigue with the pandemic, the new outbreak is generating few new policy responses.

- In China, newly reported infections in Beijing only rose to 41 yesterday, but that was more than enough to prompt officials to ratchet up social restrictions under President Xi’s ultra-strict “zero-COVID” policy. City officials closed gyms and cinemas and raised testing requirements in an effort to avoid replicating the situation in Shanghai, where tens of millions have been restricted to their apartments, sparking protests.

Economic and Financial Market Impacts

- In a report over the weekend, China’s official April purchasing managers’ index (PMI) for manufacturing fell to a seasonally adjusted 47.4, versus 49.5 in March. As with all major PMIs, the China gauge is designed so that readings under 50 point to declining activity. The reading for April was the lowest since February 2020, largely reflecting Xi’s “zero COVID” policy and its strict economic lockdowns. Reports say some Chinese officials are now criticizing the policy, in private, for its negative impact on the domestic and global economy.

- The official nonmanufacturing PMI plunged to 41.9 in April from 48.4 in March.

- Nineteen out of 21 surveyed industries, including transportation, accommodation, and catering, recorded contractions in activity, the statistics bureau said.