by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is currently assessing the implications of Republican control over both chambers of Congress. In sports news, the Cleveland Cavaliers are experiencing their best start to an NBA season since 2015-2016. Today’s Comment will cover the impact of the so-called “Trump trade” on cryptocurrency, provide our insights on why the recent market rally could indicate an equity market bubble, and discuss European defense spending. As always, the report will end with a roundup of international and domestic data releases.

Trump Trade Resumes: Risk assets continue to rally as investors price in the impact of a second Trump term.

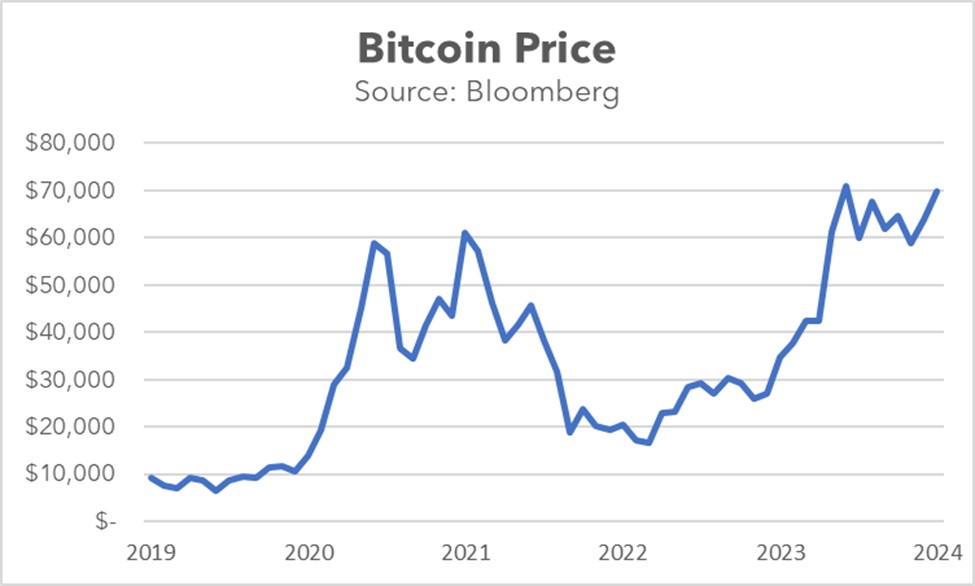

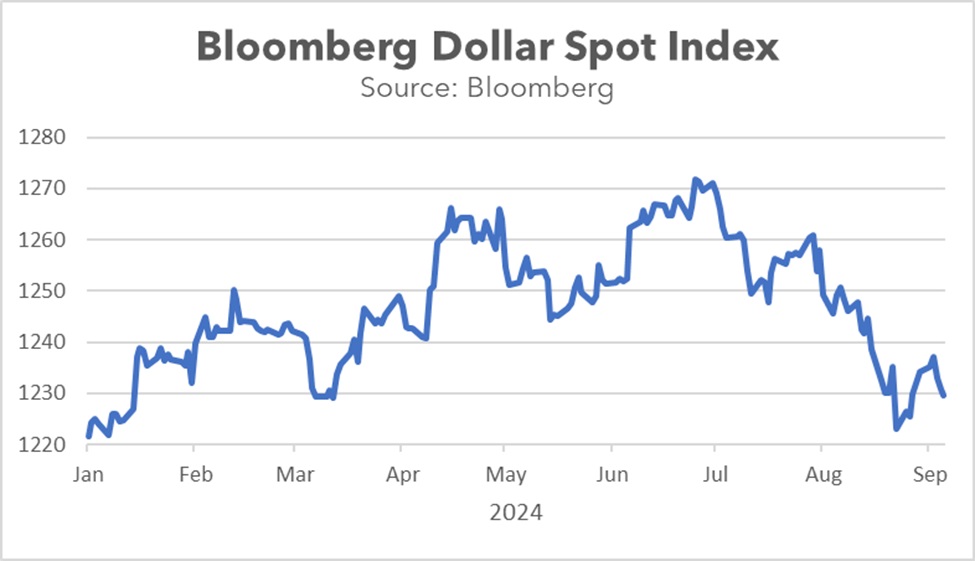

- The news of a Republican sweep has sparked a surge in risk appetite, especially among retail investors, with cryptocurrencies leading the charge. According to the latest results, Republicans now hold 53 Senate seats compared to 46 for the Democrats, and the Republicans have surpassed the 218-seat threshold for a House majority, with nine races still undecided. This strong showing has fueled investor optimism, as the Trump administration is expected to face minimal obstacles when pursuing favorable tax policies and regulatory reforms. Bitcoin, the world’s leading cryptocurrency, surged past $88,000 following the result.

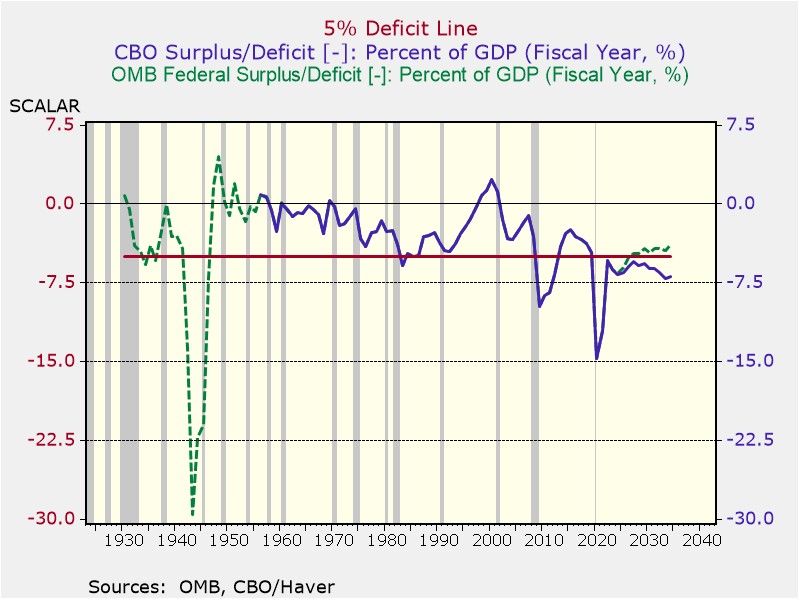

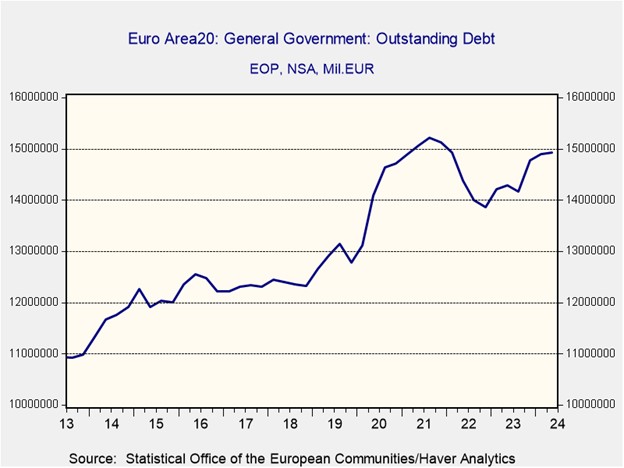

- Crypto is emerging as a potential competitor to gold as the preferred hedge against dollar debasement. While concerns over rising debt and inflation have traditionally driven investors toward gold, bitcoin has surged 20% since the election, while gold has dropped around 4%. This shift reflects growing confidence in bitcoin as a safe haven, especially as trust in government-backed assets wanes. With key figures in the incoming administration likely to champion broader crypto adoption, optimism is mounting that bitcoin could reach $100,000 by year’s end.

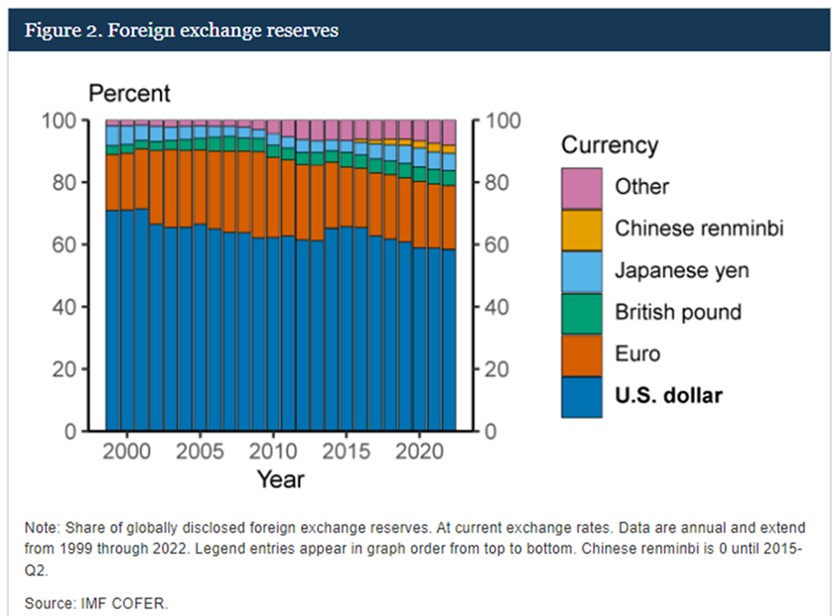

- While Trump’s recent victory is viewed as a win for cryptocurrency, it’s too early to gauge how effectively he will champion digital assets. Despite bitcoin’s growing popularity, its usage remains limited, and benefits of the increased adoption of bitcoin are unclear, particularly with the US dollar still acting as the global reserve currency. Given this uncertainty, investors may be wise to wait and see how the administration approaches the cryptocurrency, as its current valuation appears somewhat inflated.

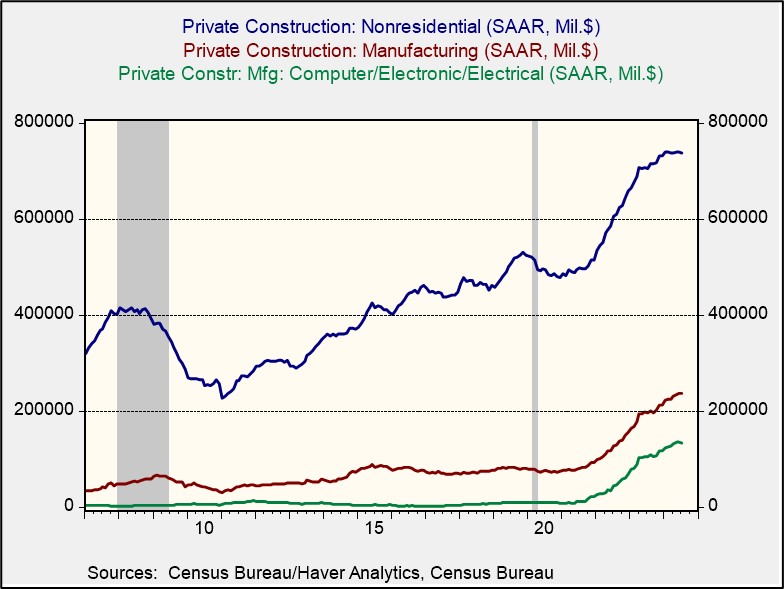

Bubble Brewing: Market euphoria continues to drive equities higher, but concerns about future inflation have led to rising bond yields.

- The S&P 500 and Dow Jones Industrial Average have scaled new heights, surpassing 6,000 and 44,000 points, respectively. This milestone is likely to attract increased investor interest in equities, potentially shifting funds from money markets to the stock market. However, the surge in market optimism has led to a flattening of the yield curve. The two-year US Treasury yield has climbed nearly 10 basis points since the Federal Reserve’s 25-basis-point rate cut last Thursday, while the 10-year Treasury yield has declined 12 basis points.

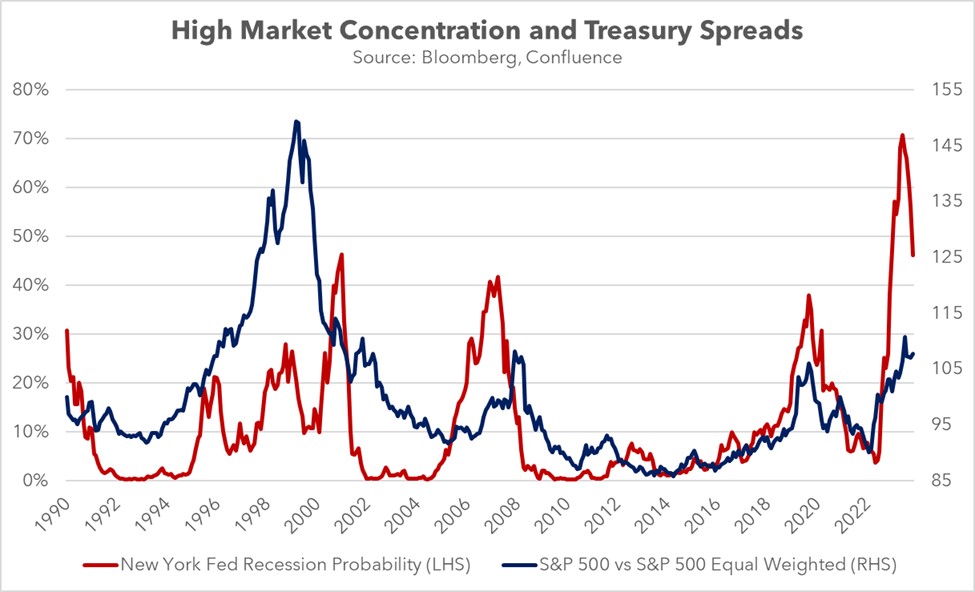

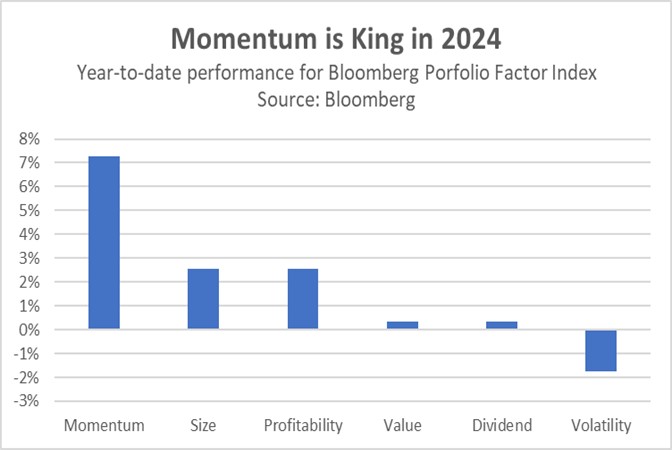

- Concerns about a potential market bubble have resurfaced as the Magnificent 7 tech giants have been the primary drivers of the S&P 500’s performance over the past two years. This trend has continued over the last five days, with these mega-cap tech stocks significantly outperforming the broader market index. This outperformance has led the S&P 500 market cap index to its widest premium over its equal-weight counterpart since the dot-com bubble. The high market concentration has also led to concerns of a potential bursting of the tech-stock bubble.

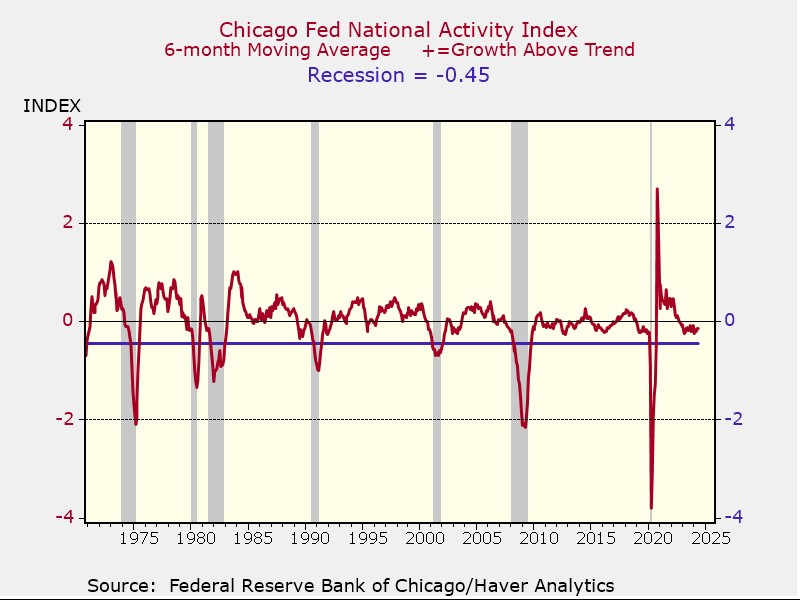

- We remain optimistic about the US economy’s ability to avoid a recession absent a major external shock. However, we believe the market remains overweighted in a few sectors. The recent flattening of the yield curve is a concern, as it has historically been associated with economic downturns. Nonetheless, as long as inflation continues to moderate and corporate earnings remain robust, we expect market concentration to gradually normalize. As a result, we suspect that investors may begin to shift their focus toward sectors offering better value and solid fundamentals over the coming weeks.

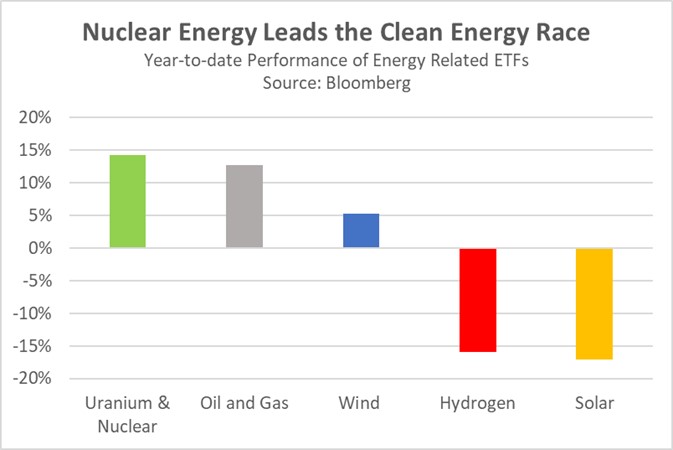

European Defense: Trump’s win of the US presidency has forced the European Union to accept that it will have to drastically increase its defense spending.

- European defense stocks rallied after the European Union opted to relax spending restrictions in anticipation of rising costs related to the Ukrainian conflict and NATO spending following the return of Donald Trump to the White House. The EU intends to reallocate funds previously earmarked for reducing income inequality among member states to directly support defense purchases and military funding. Moreover, these investments will be used to bolster critical infrastructure in Germany, given its geopolitical importance, and in Eastern European countries bordering Ukraine.

- This policy shift has boosted the pan-European Stoxx 600, which closed up 1.1% on Monday, marking its best day in six weeks. Investors are optimistic that increased spending will benefit European defense companies which have already been on a strong run. Many of these defense companies have already reaped record profits from supplying equipment and services to support the war effort in Ukraine. A significant portion of these windfall gains has been used to reward shareholders through share buybacks.

- The push to bolster European defense companies is likely to encounter significant political obstacles. Public sentiment generally opposes profiteering from war, and this could lead to increased scrutiny and potential backlash against defense companies. While the sector is poised to benefit from rising government defense spending, this could also trigger calls for greater corporate responsibility. As a result, these companies may face pressure to contribute a portion of their increased revenue back to society through higher taxes or other forms of public investment.

In Other News: Tesla CEO Elon Musk has started the push to end the Fed following Fed Chair Jerome Powell’s decision not to step down, in a sign that the central bank is becoming more politicized. Germany agreed to hold snap elections on February 23, as the country readies for a no-confidence vote.