Author: Rebekah Stovall

Asset Allocation Bi-Weekly – #94 “Have Policymakers Solved the Tinbergen Problem?” (Posted 3/27/23)

Bi-Weekly Geopolitical Podcast – #25 “Update on the U.S.-China Military Balance of Power” (Posted 3/20/23)

Daily Comment (March 20, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the global banking crisis, where Warren Buffett has reportedly been in contact with government officials in the U.S., and Swiss authorities have forced a merger of their top two banks. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including signs of continued tensions between the West and China and various items related to the U.S. economy.

U.S. Banking Crisis: Reports indicate that Warren Buffett, the billionaire chief of Berkshire Hathaway (BRK-B, $293.51), has reached out to the Biden administration in recent days, potentially signaling that he is ready to intervene in the regional banking crisis. Buffett has a long history of stepping-in to aid banks in crisis, leveraging his cult investing status and financial heft to restore confidence in ailing firms. As troubled regional First Republic Bank (FRC, $23.03) is trading sharply lower today after its debt was downgraded by S&P, it is possible that Buffet will swoop in to rescue it or some other bank in an effort to shore up confidence in the sector. In any case, we continue to note that despite the sharp price declines for many regional bank stocks, the overall equity markets continue to handle the crisis fairly well, probably at least in part because the crisis has raised hopes that the Federal Reserve will slow, stop, or even reverse its campaign to hike interest rates to reduce inflation.

- Over the weekend, fresh reporting shows that the Federal Reserve had been aware of the risky operations at Silicon Valley Bank (SIVB, $106.04) long before it collapsed and touched off the broader banking crisis. The reports indicate that as early as 2021, regulators from the San Francisco FRB issued six warnings to the bank, but the bank didn’t fix the problems. By July 2022, the bank was in a full supervisory review and was ultimately rated deficient for governance and controls, which precluded it from growing through acquisitions.

- In the European collateral damage, Swiss banking giant UBS (UBS, $18.20) has agreed to buy ailing Credit Suisse (CS, $2.01) for approximately $3.2 billion, under pressure from the country’s regulators. To facilitate the deal and help restore confidence in the Swiss banking sector, the Swiss National Bank will lend over $100 billion to UBS, while the Swiss financial regulator takes other steps to hasten the deal.

- Credit Suisse’s equities today are trading sharply lower, in line with the low price that UBS is paying. Other global bank stocks are being dragged lower as well.

- Interestingly, the UBS-Credit Suisse deal also wipes out billions of dollars of Credit Suisse’s riskiest “additional Tier 1” bonds. That means that those bond holders could actually do worse than the bank’s stock holders and threaten some $250 billion in similar bonds in Europe.

China-Japan-United States: Based on rumors swirling among investors in Shanghai and Shenzhen, it appears the West’s next move to suppress China’s information technology sector will be for Japan to ban China-bound exports of photoresist chemicals needed to produce advanced semiconductors. Chinese investors have responded by piling into the shares of domestic chemical companies that might be able to produce any chemicals cut off by Japan.

- Such an embargo by Japan would be consistent with the way it has been cooperating in the U.S.-led effort to slow Beijing’s military technology development. In another sign of Japan’s stepped-up cooperation with the U.S.’s anti-China efforts, Japanese Foreign Minister Hayashi visited the Solomon Islands yesterday in an effort to help peel its government away from its recent security deal with Beijing.

- If Tokyo does impose its ban on photoresist chemicals, it would mark yet another step in the technological decoupling of the evolving U.S.-led geopolitical bloc and the China-led bloc. That will further boost tensions between the blocs and present headwinds for investors.

China-Russia-United States: On Friday, the U.S. confirmed that Chinese-made ammunition has been discovered on Ukrainian battlefields and has apparently been used by Russian forces to carry out their invasion of the country. U.S. officials say they have notified their allies of the findings, although they stress that they haven’t confirmed that China sent the ammunition directly to Russia. The news comes as Chinese President Xi visits Russian President Putin in Moscow for three days beginning today.

- Meanwhile, we’ve seen reports that Turkey may be backing away from its support of Russia over the course of the war.

- For example, the unconfirmed reports suggest Ankara has now clamped down on sanctioned exports to Russia, has stopped servicing Russian airliners, and has prohibited its businesses from buying fuel from Russian entities.

France: President Macron, over the weekend, faced burgeoning protests and riots across the country over his decree from last week to raise the country’s retirement age. According to the Interior Ministry, some 70,000 protestors participated. Macron’s government also faces a vote of no confidence today, although losing the vote itself wouldn’t necessarily push Macron from power or force the cancellation of the hike in the retirement age.

Thailand: Prime Minister Prayuth Chan-o-cha has issued a decree to dissolve parliament, paving the way for elections in May. Prayuth, a former coup leader who rules with the military’s backing, is deeply unpopular because of last year’s consumer price inflation. In theory, he’s also prevented from being reelected because of constitutional term limits. All the same, Prayuth is hoping he can be reelected on the strength of his post-pandemic stimulus measures, a rebound in tourism, and the formation of a new, conservative royalist-military party created to get around term limits. That sets up a likely period of political uncertainty in Thailand over the coming months.

South Africa: The country is preparing for a national strike today launched by the radical opposition Economic Freedom Fighters in a bid to unseat President Cyril Ramaphosa. Since South Africa is a major producer of mineral commodities, a successful strike that impinges on output could potentially boost commodity prices.

Latin America: The new chief of the UN Economic Commission on Latin America and the Caribbean, José Manuel Salazar-Xirinachs, warned that the region’s economic growth in the decade to 2023 will come in at an average of just 0.8% per year, even worse than the 2.0% growth rate in the “lost decade” of the 1980s and far below the 5.9% growth rate in the 1970s.

- Salazar-Xirinachs ascribed the poor performance mostly to weak investment, low productivity, and inadequate education.

- Of course, individual firms in the region can still offer attractive investment prospects, but the statement does highlight the economic and financial challenges facing the region.

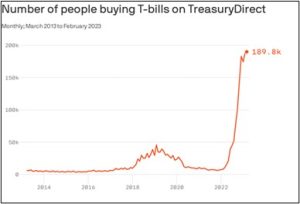

U.S. Fiscal Policy: The Treasury Department reports that the number of people buying Treasury bills directly from the government on TreasuryDirect.gov is skyrocketing (see chart below). The surge is exactly what you would expect with T-bills yielding approximately 5% and banks offering far less than that on deposits. As Democrats and Republicans in Congress prep for a battle over raising the federal debt limit in the coming months, the surge of direct T-bill holders creates a new constituency of individuals who would be angered by a debt default, potentially reducing the risk of a default happening.

U.S. Monetary Policy: The Federal Reserve will hold its latest policymaking meeting this week on Tuesday and Wednesday, with its decision due on Wednesday afternoon. Despite the strong economic data for January and February, we suspect the recent banking crisis in the U.S. and Europe will keep them from hiking their benchmark fed funds rate by anything more than a modest 25 basis points. Many investors and observers are even expecting them to hold rates steady.

- To maintain global dollar liquidity as the banking crisis boils, the Fed and five other major central banks said they would immediately launch daily currency swap lines. The swap lines will run at least until the end of April.

- However, reporting so far this morning suggests there has been little demand for dollars through the swap lines. That’s a positive sign that the crisis remains relatively contained.

U.S. Labor Market: The nation’s major movie studios and the Writer’s Guild of America, which represents 11,500 screenwriters, will launch negotiations today for a new contract to replace the one that expires May 1. Because of expected frictions over pay, including royalty payments in the age of streaming, the negotiations have spurred concern about a possible strike like the one in 2007, in which screenwriters walked off the job for more than three months.