by Asset Allocation Committee

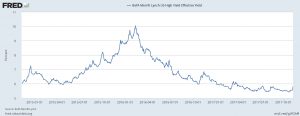

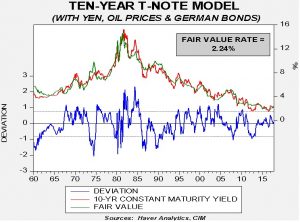

Last week, we discussed our views of the debt markets. However, one item we didn’t examine was the dynamics of the yield curve. The U.S. Treasury market has both a domestic and an international component. While all sovereign debt markets have a domestic component, the international component is especially a factor for the U.S. because the dollar is the reserve currency. In our Treasury model, we use inflation expectations and fed funds for domestic elements. For foreign elements, we use the yen/dollar exchange rate, German bund yields and oil prices. Our model suggests that the dynamics of the yield curve are affected primarily by the domestic component.

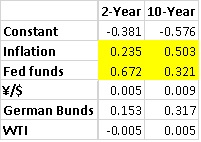

Shifts in the yield curve are driven mostly by a combination of monetary policy and inflation expectations. As a general rule, short-duration instruments are more sensitive to monetary policy and less to inflation expectations. Long-duration instruments have the opposite characteristics. When we model the two-year Treasury and the 10-year Treasury, these characteristics are confirmed.

These are the coefficients of our Treasury model. The impact of the inflation variable has more than twice the impact on the 10-year Treasury compared to the two-year Treasury. At the same time, the impact of fed funds is more than twice as important to the two-year Treasury compared to the 10-year Treasury.

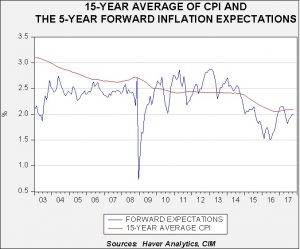

Our inflation variable is really about measuring inflation expectations. We use the 15-year moving average of the yearly change in CPI and developed this variable based on Milton Friedman’s research. He postulated that inflation expectations are formed over a long period of time. This is our proxy for inflation expectations; although this moving average works reasonably well over time, we do realize that inflation expectations can have sudden shifts.

This chart shows the 15-year average of inflation compared to the implied five-year forward inflation rate from TIPS. Although the moving average isn’t a perfect proxy for inflation expectations, it has worked as a measure of central tendency since 2009. And, since the instruments haven’t been around for very long, it’s difficult to know how the average compares over a longer time frame. But, for our purposes, it is a workable proxy.

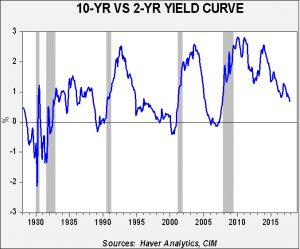

When inflation expectations become volatile, policymakers describe these conditions as times when inflation expectations become “unanchored.” These periods can make the conduct of monetary policy difficult. If inflation expectations rise, policymakers are likely to raise rates aggressively to contain those fears. At the same time, a decline in expectations can be just as problematic. If the FOMC is raising the target for fed funds while inflation expectations are falling, the yield curve will flatten. The FOMC would generally prefer a steeper yield curve. The Federal Reserve doesn’t do a good job of explaining why it wants “higher inflation,” which would seem to be a goal worth avoiding. What it really means is that it wants steady to modestly higher inflation expectations when it is raising the policy rate; otherwise, the yield curve will flatten and increase the likelihood of a recession.

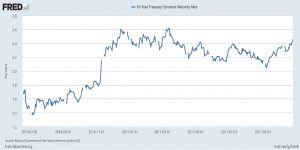

Currently, the two-year versus 10-year Treasury yield spread is above zero but the curve is clearly flattening. If the FOMC continues to tighten into stable (or perhaps falling) inflation expectations, the yield curve could invert and perhaps signal the end of this long business expansion.

The recent flattening of the yield curve suggests that inflation expectations are probably declining. If the Federal Reserve raises rates as much as planned and inflation expectations remain anchored at around 2%, we estimate the yield curve will fall under 50 bps. However, if inflation expectations decline, policymakers could overshoot rate hikes and increase the risk of recession. Our base case is that central bankers will remain cautious but it is a factor we will be watching closely next year, especially as the new composition of the Fed’s Board of Governors becomes apparent.