by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] Happy end of quarter day! Q3 comes to a close today and next week we begin the march to Q4. Markets are quiet at quarter end. Here is what we are watching:

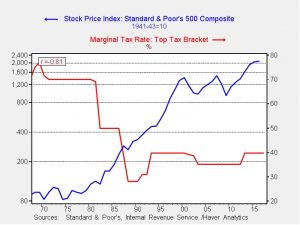

Social media and Russian bears: For the past several weeks, Facebook (FB, 168.73) has spent time in the proverbial barrel, facing rising criticism for facilitating the circulation of information that appears to have come from Russia. Yesterday, it was Twitter’s (TWTR, 16.85) turn.[1] The social media companies are arguing that they are merely facilitators of media and should not be held accountable for the information that others put on their platforms, even if it comes from foreign governments or terrorist groups. There are two problems with that argument. First, as anyone who uses these social media platforms notices, advertisements and articles start appearing on your phone or desktop that seem tailored to your search patterns or what you read. By design, social media companies are not neutral but instead support a user’s bias, which suggests a level of power to persuade that is potentially quite powerful and prone to manipulation. Second, if one’s platform can be used for nefarious activities and the facilitator argues it can’t control the content, it opens itself up for regulation. This is where broadcast media found itself in the 1950s and 1960s and led to “fairness clauses” and the FCC. Information technology has been able to operate in a permissive regulatory environment for decades but if the social media platforms can become conduits for manipulation then regulation is much more likely.[2] Part of what makes tech firms so profitable is the revenue per employee[3]—the heavy use of technology and algorithms eliminates the need for workers. However, it is apparent that the social media firms have been unable to screen for foreign sources, fake accounts and social media bots that would probably require human oversight to discern. Regulations that would force increased hiring would weaken the profitability of these companies. This is an issue that bears close watching in the coming years.

A nuclear dyad? It appears North Korea is working to add a second nuclear delivery method to its arsenal. According to 38 North, North Korea is investing in infrastructure to build a sea-launched ballistic missile.[4] If North Korea does develop submarine launching capabilities, it will give the country a credible “second strike” capacity, meaning it could retaliate against a nuclear strike by a foreign power. Although this is an unwelcome development, we do note that it would also create conditions of Mutual Assured Destruction (MAD) which, paradoxically, tends to stabilize nuclear power relations. A nation that is a nuclear monad faces a “use it or lose it” decision if it thinks it will be attacked. Thus, it has to be more open to using its nuclear weapons under threat. On the other hand, a nation with a nuclear dyad (or, in the case of the U.S. and Russia, a triad) can credibly signal to an attacker that although you may destroy our nation, be assured that we will counter with an equally devastating follow on attack…or, MAD. Currently, North Korea either has, or is near, a nuclear monad. So, if it believed the U.S. was preparing to attack, it would be severely tempted to strike first; although it knows that it would be hit with a devastating attack (Gen. Powell called it “turning North Korea into a briquette”), at least it didn’t come to that fate without launching its own nukes. However, if North Korea had a dyad, it would likely be less “hair trigger” in using its nuclear weapons. This assumes, of course, that North Korea eventually adopts the behavior patterns exhibited by all the current nuclear powers. We suspect it would, not because we have faith in the Kim regime but because this is what game theory suggests would happen and the history of the Cold War shows it works. In other words, the U.S. and U.S.S.R. avoided nuclear holocaust not because of the content of their characters or rationality but because they were locked into an equilibrium that made it stupid to behave otherwise. Even China under Mao eventually followed the same path. Simply put, a nuclear North Korea is terrifying but we may be approaching a balance of terror that characterized the Cold War, which was frightening but remarkably stable.

[1] https://www.axios.com/twitters-reality-check-on-russian-election-meddling-2490707290.html?utm_source=newsletter&utm_medium=email&utm_campaign=newsletter_axiosam&stream=top-stories

[2] https://www.axios.com/the-walls-close-in-on-tech-2473228710.html

[3] http://www.businessinsider.com/top-tech-companies-revenue-per-employee-2015-10/#2-google-1154896-per-employee-11 and http://www.visualcapitalist.com/top-20-tech-companies-revenue-per-employee/