by Bill O’Grady, Kaisa Stucke, and Thomas Wash

[Posted: 9:30 AM EDT] There were five news items worth noting overnight:

Carney goes dovish: Last week, the BOE voted to keep policy steady but had three dissenters. In a speech today, BOE Governor Carney focused on the economic problems that could be triggered by Brexit and suggested it wasn’t time to raise rates. The GBP fell on his comments. Britain is rapidly heading to a point where it will be forced to decide which policy problem it will address—inflation or weak growth? A Dutch economist, Jan Tinbergen, suggested that policymakers need to have an equal number of tools for an equal number of problems. In other words, if a nation faces weak growth and rising inflation, it needs to address each problem with separate policies. Usually, in this case, the ideal policy mix would be to use fiscal policy to address weak growth and tighter monetary policy to deal with inflation. Given the political turmoil in the U.K., the BOE is likely on its own. Thus, it must decide if it will raise rates to deal with inflation or keep rates low to support the economy. Carney indicated his choice would be the latter and so the GBP is falling this morning. It isn’t clear whether the rest of the Monetary Policy Committee will go along with this sentiment.

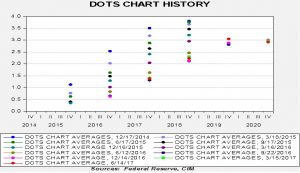

More Fed hawks than doves: Boston FRB President Rosengren, who has been a reliable dove over the years, gave a fairly hawkish speech in Europe this morning. He is suggesting that easy monetary policy could be leading to inflated asset markets and, if so, the Fed should raise rates to prevent excessive valuations and the potential market risk such valuations might bring. Although other FOMC members have made such statements in the past (Jeremy Stein, most notably), such views are not predominant among members because it smacks of setting policy based on asset markets. Although theoretically defensible, such positions are fraught with political risk. Alan Greenspan briefly touched this “third rail” once, with his famous speech in 1996 when he coined the phrase “irrational exuberance.” He faced severe criticism on the idea that the Fed would raise rates because equity valuations were “too high.” Although we don’t expect Rosengren’s views to sway policy, he is joining others on the FOMC who hold more hawkish views on expectations of higher inflation. In the end, regardless of viewpoint, the outcome is tighter policy. We note that NY FRB President Dudley made hawkish comments yesterday as well. By the way, the WSJ has an article today about the FOMC’s poor record on soft landings.[1]

Special election in Georgia: The state of Georgia is holding a special election to fill the Congressional seat of Tom Price. This is usually a safe GOP seat (the party has held it for nearly four decades), but the race between Democrat Jon Ossoff and Republican Karen Handel is close. The Democrats have poured money into this race, suggesting it is a referendum on the Trump administration. In fact, this has become the most expensive Congressional race in U.S. history.[2] Ossoff has eschewed the Sanders platform, running as a centrist; it should be noted that Trump narrowly won what is usually a reliable GOP state. If Ossoff wins, the establishment Democrats will use it to argue that the Sanders/Warren wing doesn’t win elections. If Handel wins, the hard left will argue that the Democratic centrists can’t win. Our view is that there will probably be few takeaways regardless of the outcome, although the pundits will try to use the election as a harbinger for 2018.

Otto Warmbier dies: The UVA student who was recently incarcerated by North Korea died yesterday. Our condolences and prayers go out to his family. We are in the middle of a two-part examination of the possibilities for war with North Korea. His passing won’t necessarily increase the odds for war but it does reduce the chances of any sort of negotiated settlement and that, by itself, could lead us into a conflict.

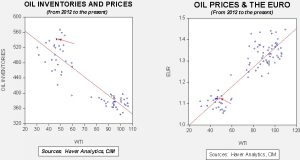

Saudi Navy captures three Iranian Republican Guard Corp troops: The Saudi Navy captured three IRGC members in the Persian Gulf Friday. The Saudis claim the three were manning a vessel loaded with explosives and headed toward a Saudi offshore oil rig. The Iranians claim they were civilian fishermen and claim that the Saudis killed one of the Iranians. We don’t know who is telling the truth here but it is part of a broader trend of rising tensions in the region. So far, oil prices are clearly unconcerned about these tensions but that position is probably underestimating the potential for supply disruption.

________________________________________

[1] https://www.wsj.com/articles/the-feds-poor-record-on-soft-landings-1497890842 (paywall)

[2] http://www.politico.com/story/2017/05/06/georgia-special-election-spending-record-238054