by Bill O’Grady, Kaisa Stucke, and Thomas Wash

[Posted: 9:30 AM EDT] The news over the weekend was fairly quiet, although there were several things we noted:

The first leg of the president’s trip went rather well: President Trump offered support to authoritarians in Egypt and the Gulf State which was well received. Iran was isolated as the problem state in the region, a shift from the Obama administration. Military and other sizeable investments were announced. And, the president delivered a speech on Islam that was well crafted and delivered. There was a significant break in policy from the previous administration. First, the arms sales were three times larger than what was done over two terms of the previous president. Second, the partial thaw with Iran that President Obama had started is over. So, all in all, the first part of the trip was a success.

The second leg could be a bit more challenging: Israeli leaders are not pleased with President Trump’s decision to share intelligence with Russian diplomats. The massive arms deal with Saudi Arabia will also raise concerns. Although Israel and the Gulf States share a common enemy, Iran, the Israelis rightly fear that arming the Arab states may present a problem for them at some point. Finally, the administration’s apparent decision to at least slow the move of the U.S. embassy from Tel Aviv to Jerusalem is a disappointment to parts of PM Netanyahu’s conservative coalition.

Grants to loans: The Trump administration’s budget proposal will end some of the foreign military grants, converting them to loans. The State Department believes this would affect about $1.0 bn in aid to various nations. Although this proposal is consistent with the platform Trump campaigned on, it may lead some of these nations to cancel the purchase and seek equipment from other nations. It will also make them less amenable to “strings attached” to the use of the equipment if they are buying it rather than receiving it as a gift. This is an old conundrum—if you rely on allies to do your bidding in foreign policy, they may not be easy to control.

U.K. polls are tightening: A week ago, the Tories were holding a 20% point lead over Labour; that lead has narrowed to 9% in the latest polls. The most recent gaffe was a proposed tax on the elderly which would require them to pay most of their support costs until they reach a net worth of £100k. Dubbed the “Alzheimer tax,” it was slammed in the press; PM May has retreated on the policy only to now face criticism that “the lady is for turning” in comparison to Lady Thatcher, who was not for turning. We still expect the Conservatives to win but the mandate to manage Brexit will be compromised if the victory is narrow.

Rouhani wins: Hassan Rouhani won a second term in convincing fashion, taking 57% of the electorate. Although we doubt he will be able to make major changes to liberalize Iran, his win does act as a bulwark against more hardline policies. However, Rouhani may have to move in the hardline direction if the Sunni coalition is able to contain Iran’s regional ambitions, as noted above.

Pedro Sanchez returns: Eight months ago, Spanish Socialists ousted Sanchez when he refused to compromise on the vote to allow PM Rajoy to form a minority government. Sanchez’s return to leadership likely means the previously center-left Socialists will lean left to retake votes from the radical Podemos Party. The polarization of the Spanish electorate is reflected, to greater or lesser extent, across Europe.

Another North Korea missile test: The Hermit Kingdom launched another ballistic missile into the Sea of Japan, flying around 300 miles. Although this was a shorter test than what we have seen previously, the cycle of tests is accelerating which means the country is probably moving up the missile-learning curve faster.

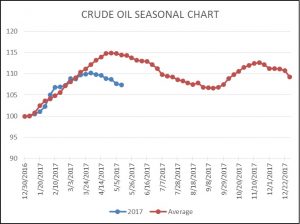

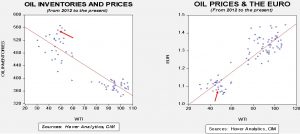

An OPEC deal? Saudi oil officials suggest they have gotten agreements from other cartel members, although there is some trepidation over extending it past six months. There are two factors at play; first, the longer this agreement is in place, the harder it will be to maintain output cuts. If Saudi Arabia wants to keep the price propped up, it will need to continue to make the largest production cuts. Second, the ECB and the Fed may play a bigger role in oil prices; a weaker dollar would be bullish for oil and likely overshadow anything the cartel does in terms of output restrictions.

Thinking about narratives: Earlier this year, Robert Shiller wrote a paper[1] suggesting that data and theory can only carry analysis so far. In addition, it’s useful to understand what people were thinking, in other words, the “narrative” they were using to explain phenomena around them. Since Shiller is an economist, he examines such narratives with reference to markets and economics. In the Sunday NYT,[2] he notes that mere economic data about housing really didn’t do a good job in forecasting the housing bubble. In his report, he notes that pervasive reports about “flipping,” where real estate investors would buy a home, make cosmetic improvements and sell the property quickly to make scads of money, became part of the “narrative” about the strong housing market. The early success of flipping led more investors to get into the market and use increasing leverage to further magnify the gains. Of course, when home prices stopped rising, the leverage became a serious problem. Shiller’s op-ed is related to a similar one in the review section of the same paper reporting that psychologists are beginning to conclude that one of the factors that separates human mental activity from animals is that we project into the future. In fact, it’s almost impossible for us to be “in the moment.”[3] The article suggests that the primary function of memory is to project into the future. We have seen this in the narrative people have about markets; when we go through something painful, like the burst of the tech bubble, we are on guard for that event continually, almost guaranteeing it won’t happen the same way again. This practice, sadly, makes us vulnerable to other “unexpected” outcomes.

Thoughts about trade: This week’s “Odd Lots”[4] podcast interviewed Dave Donaldson, the recent winner of the John Bates Clark medal for the best economist under the age of 40. He conducted a massive study of the Indian railway system under British rule to measure how trade within India changed with better infrastructure. He discovered that once trading expands, specialization develops. This is true of both international and intranational trade. Although this specialization makes the economy more efficient, the improvement from trade is much less welcome to those who used to supply a local market and are then eliminated by a distant competitor.

View the complete PDF

_____________________________________

[1] http://cowles.yale.edu/sites/default/files/files/pub/d20/d2069.pdf

[2] https://www.nytimes.com/2017/05/18/upshot/how-tales-of-flippers-led-to-a-housing-bubble.html?ref=business

[3] https://www.nytimes.com/2017/05/19/opinion/sunday/why-the-future-is-always-on-your-mind.html?src=me

[4] https://itunes.apple.com/us/podcast/odd-lots/id1056200096?mt=2&i=1000385614557