by Bill O’Grady, Kaisa Stucke, and Thomas Wash

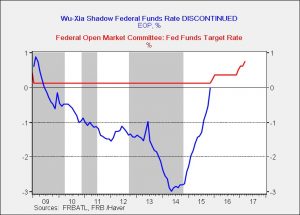

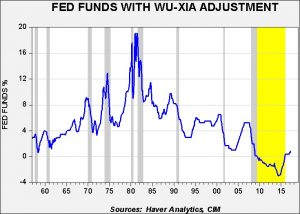

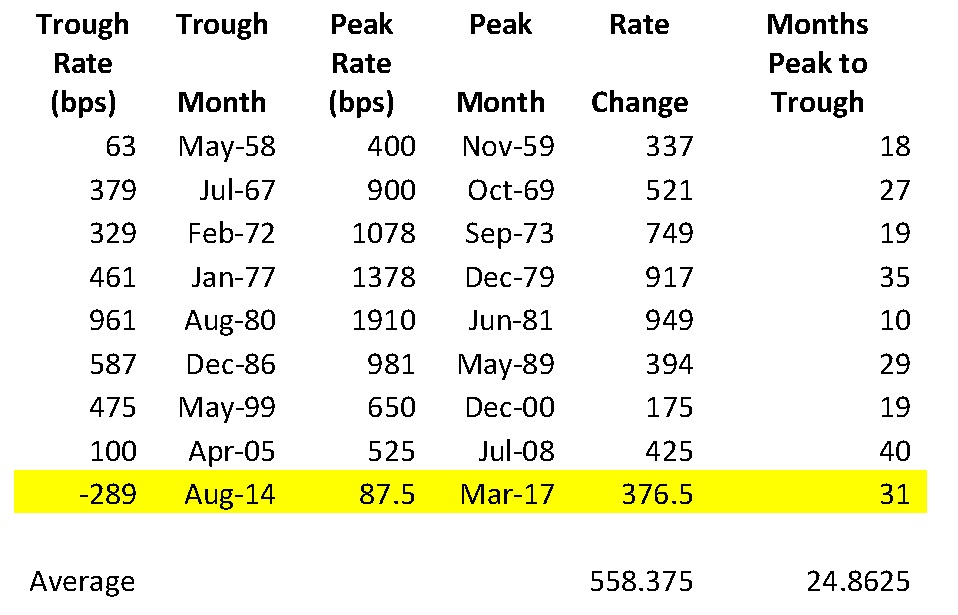

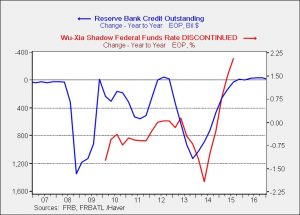

[Posted: 9:30 AM EDT] The Federal Reserve did just about what we expected; it did acknowledge Q1 economic weakness but expressed no serious concern about slowdown, suggesting that it isn’t all that concerned about future growth. We note that fed funds futures are placing the odds of a 25 bps rate hike at the June meeting at 90%, up from the low 81% level before the meeting statement. As long as economic data remains stable, it looks like a second hike is coming in June.

The House is planning to vote on a replacement bill for the ACA; the vote is expected to be close. Usually, the leadership of the House won’t bring an important bill to a vote if they are not reasonably confident of the outcome. If the bill passes, it probably won’t become law in its current form as it is highly unlikely the Senate will pass it without major changes. However, if it fails to pass the House, it will be a defeat of sorts for the White House and perhaps raise concerns that the president is incapable of shepherding anything through Congress. That outcome might undermine hopes of infrastructure spending and tax cuts.

SOS Tillerson gave a speech yesterday at the State Department laying out the administration’s vision for foreign policy. He suggested that the U.S. has been “too accommodating” to emerging nations and allies and “things have gotten out of balance.” We can see the logic of this statement. The U.S. has been unusually generous for a hegemon on two fronts. First, for the most part, we have single-handedly enforced peace in the world’s three “hot zones” of Europe, the Far East and the Middle East by putting troops and bases in these regions. More importantly, we have taken over the security of Europe and Japan, removing the long-standing tensions that led to two world wars in Europe and the constant tensions between China and Japan. We essentially did the same thing in the Middle East. This policy has been quite costly in terms of “blood and treasure,” although we would argue that the costs were worth it since we didn’t fight WWIII. However, without question, much of the world has enjoyed a “free ride” at the expense of American taxpayers and soldiers.

Second, the other element of hegemony has been to provide the reserve currency, which has led to persistent trade deficits and allowed a model of development designed to boost investment and exports, funded by domestic saving. This topic is under discussion currently in our four-part Weekly Geopolitical Report series. By being the global importer of last resort, we have bolstered global growth. However, the cost to Americans has been a gutting of the middle class that has become clearly evident in the political turmoil observed over the past three elections.

What Tillerson didn’t do was explain how the “rebalancing” is going to occur. Would it be through a reduction of the trade deficit by forcing foreign firms to source production in the U.S., sort of a “tribute” paid to America for access to the dollar? Would it be by forcing allies to pay more for their own defense? If allies pay more, can we still control them? What if Germany rearms and decides to collect bad Greek debt by taking a few islands?

We can see the need for changes to American hegemonic policy. However, a clear path isn’t obvious; in fact, it’s fraught with risk. We are already seeing the results of “thawing” the frozen conflict in the Middle East. The territorial integrities of both Syria and Iraq are mostly broken and we don’t know what will replace them. Islamic State was the first attempt; that wasn’t such a great outcome. An adjustment is necessary. We believe the policies used since WWII have probably become politically impossible to maintain, but it isn’t known what can effectively replace those policies. Until they are replaced, uncertainty will remain elevated.

U.S. crude oil inventories fell 0.9 mb compared to market expectations of a 3.3 mb draw.

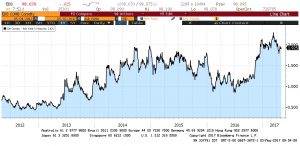

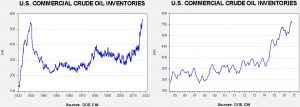

This chart shows current crude oil inventories, both over the long term and the last decade. We have added the estimated level of lease stocks to maintain the consistency of the data. As the chart shows, inventories remain historically high but have started the seasonal withdrawal phase. We also note that, as part of an Obama-era agreement, there was a 1.5 mb sale of oil out of the Strategic Petroleum Reserve. This is part of a $375.4 mm sale (or 8.0 mb) done, in part, to pay for modernization of the SPR facilities. International agreements require that OECD nations hold 90 days’ worth of imports in storage. Due to falling imports, the current coverage is near 140 days. Taking that into account, the draw would have been 2.4 mb, roughly in line with expectations.

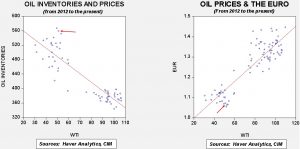

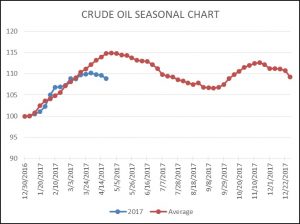

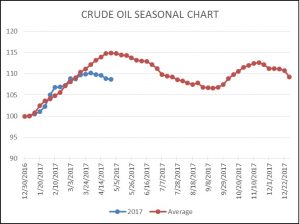

As the seasonal chart below shows, inventories are near their seasonal peak and should begin falling as rising refinery operations lower stockpiles. This week’s decline rise puts us further below normal. Although inventories remain high, this seasonal level is consistent with July, meaning that we may be on the way to an easing of the inventory overhang. Last year, we saw a 45 mb draw from the April peak. Assuming a similar drop from this year’s peak of 566.5 mb at the end of March, we will end up at 520 mb by late September. Assuming a $1.09 EUR and using the model discussed below, fair value is $44.15 for oil prices. Thus, we would need to see a much larger drop to justify current prices.

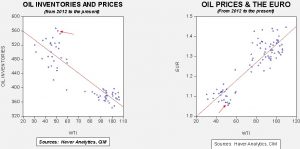

Based on inventories alone, oil prices are overvalued with the fair value price of $31.03. Meanwhile, the EUR/WTI model generates a fair value of $41.57. Together (which is a more sound methodology), fair value is $37.68, meaning that current prices are well above fair value. To a great extent, it appears that the oil market has already discounted a drop in inventory levels and a weaker dollar.