by Bill O’Grady, Kaisa Stucke, and Thomas Wash

[Posted: 9:30 AM EDT] Here are some of the news items we are following this morning:

PM May calls snap election: Reversing her earlier stance, Theresa May has called for a general election on June 8. The previously scheduled election wasn’t due until 2020, but there are rising tensions that will come from Brexit and the Tories lead Labour by 21 points and will likely lift that margin in Parliament significantly. Snap elections have become quite rare; the last voluntary early election was October 1974. In 1979, an election was called after the Labour government lost a no-confidence vote. May will need two-thirds of Parliament to actually get permission to dissolve the government. It looks like that will be a formality. Given that May took control of the government without an election (she took over for David Cameron when he resigned following Brexit), winning an election would give her a more solid mandate. It would also allow her to jettison her predecessor’s policies and put forward her own goals for government. The GBP initially fell on the announcement but has rebounded strongly since; a stronger mandate would be bullish for the currency as it would give May a stronger bargaining position with the EU.

Special election in Georgia: There will be a special election today in Georgia’s sixth Congressional District to replace Tom Price, who resigned the seat to become HSS Secretary. It is generally a strongly red district (Price won it by 23 points in 2016), but it does appear that Democrat Jon Ossoff, a former congressional staff member, will win the most votes. To win the seat, the winner must garner a majority. If no candidate gains a majority, a runoff will be held. There are a number of viable GOP candidates that are splitting the Republican electorate and so it is highly unlikely any of them will threaten Ossoff in the first round. However, Ossoff would be quite vulnerable in the second round. Thus, if the Democrats are going to flip the seat, they probably have to do so in the first round. Although losing the seat won’t change the House, it will be a political embarrassment to the White House.

French elections: The polls are turning into a four-candidate race, with Macron and Le Pen still holding in the mid-20s but Mélenchon (hard-left) and Fillon (conservative) approaching 20%. Undecided voters are still running as high as 20% in some polls so it is possible that the expected Le Pen/Macron second round could have another combination. The NYT[1] reports that Russia is being accused of actively trying to sway French voters; the Kremlin seems to be supporting Fillon and Le Pen. Both are considered right wing and anti-EU.

New BOJ board members: The Abe government named two new members to the BOJ, replacing two whose terms had expired. Takehiro Sato and Takahide Kiuchi are leaving the BOJ; both are hawkish. They are being replaced by Goushi Kataoka and Hitoshi Suzuki, both from the private sector. The former is considered quite dovish while the latter is more neutral. Thus, the composition of the board is considerably less hawkish. This should be a bearish factor for the JPY. Given the recent strength in the currency, we would look for this rally to stall and reverse based on the news.

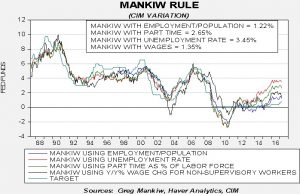

More on Quarles: Yesterday, we noted that there are strong indications that President Trump will nominate Randal Quarles to governor of the Federal Reserve, filling one of the three open spots on the FOMC. Quarles is being appointed to a specific role at the central bank, one concerned primarily with regulation. His views on regulation appear consistent with David Tarullo, who had unofficially taken on this role and recently resigned. He does not favor increasing bank capital but does want to give regulators specific powers to liquidate banks, even those considered “too big to fail.”[2] However, the surprise from Quarles may come on monetary policy. He is, apparently, a proponent of rules-based monetary policy, suggesting that discretion-based policies politicize the central bank and lead to policy mistakes. Although that is true, going to rules won’t necessarily protect the central bank from politicization either; the rules don’t come down from Mount Sinai but are made by people with political agendas. In addition, no rule can cover all circumstances and people will be likely to intervene even in a rules-based environment. Based on his stance, we would likely score him as a two-star hawk with a tendency toward a single-star hawk.

Oil prices: Yesterday’s WSJ[3] carried a report that OPEC’s largest producers are targeting oil prices at $60 per barrel. Bloomberg reported today that Saudi exports have fallen to 6.95 mbpd, the lowest level since May 2015. Compliance has been high among the cartel members. The report carried this interesting quote, “They [the Saudis] need this price [$60] for the IPO of Saudi Aramco.” Although current stockpiles and dollar strength don’t support prices at current levels, it is clear that the kingdom, in what can best be described as “window dressing,” is propping up the price of oil for this IPO. This move will give U.S. shale producers an opportunity to boost output and take share from the cartel, at least until the IPO is priced next year. What happens after that could be problematic but, for now, OPEC action will be supportive. We have serious doubts that $60 can be reached unless the dollar tumbles because the inventory overhang looks to be with us for a while.

Mnuchin speaks: Yesterday, Treasury Secretary Steven Mnuchin granted interviews to the media and indicated that tax reform won’t happen soon and that the U.S. will maintain the “strong dollar” policy. As we noted before, this policy isn’t designed to actively boost the dollar but to avoid exchange rate volatility by threatening to intervene to sway the currency. The dollar lifted on the news as it seemed to suggest that the Rubin strong dollar policy would remain in place.

______________________________________

[1] https://www.nytimes.com/2017/04/17/world/europe/french-election-russia.html?emc=edit_mbe_20170418&nl=morning-briefing-europe&nlid=5677267&te=1

[2] Our position, for what it’s worth, is that this stance doesn’t work in the real world. Regulators are captured by those they regulate and institutions that are too big to fail are too big to orderly liquidate. Assumptions that the government has the power to protect the financial system even from the failure of very large banks embolden banks to take risks and regulators to give too much room to operate for banks on the basis that they can address any crises. Instead, the goal, IMO, is better served by forcing banks to hold more capital.

[3] https://www.wsj.com/articles/saudi-arabia-iraq-kuwait-aim-for-60-a-barrel-oil-price-1492176010