Author: Rebekah Stovall

Bi-Weekly Geopolitical Podcast – #9 “Parsing the World’s New Geopolitical Blocs” (Posted 5/9/22)

Bi-Weekly Geopolitical Report – Parsing the World’s New Geopolitical Blocs (May 9, 2022)

by Patrick Fearon-Hernandez, CFA | PDF

For more than a decade, we at Confluence have been tracking and writing about the waning commitment of the U.S. to its role as global hegemon. We’ve shown how U.S. retrenchment and protectionism have helped erode globalization. Factors like deregulation, falling transportation costs, improved technology, and easing geopolitical tensions following the end of the Cold War may have promoted political and economic integration for decades. Now, however, governments across the globe are erecting barriers to trade, investment, and migration, leaving authoritarian strongmen emboldened to assert themselves. The latest example of that has been Russian President Putin’s invasion of Ukraine.

Amid these developments, we’ve argued the world will fracture into at least two main political and economic blocs: a U.S.-led bloc consisting mostly of liberal democracies and a China-led bloc of mostly authoritarian states. This report discusses which nations are likely to join each bloc, which will merely lean toward one bloc or the other, and which may try to stay neutral. Based on our predicted makeup of each bloc, we describe their differing political, economic, and financial characteristics. As always, the analysis also includes ramifications for investors.

Don’t miss the accompanying Geopolitical Podcast, now available on our website and most podcast platforms: Apple | Spotify | Google

Asset Allocation Bi-Weekly – #74 “The Tale of Two Surveys” (Posted 5/2/22)

Bi-Weekly Geopolitical Podcast – #8 “The Russians Respond” (Posted 4/25/22)

Bi-Weekly Geopolitical Report – The Russians Respond (April 25, 2022)

by Bill O’Grady | PDF

In mid-March, we wrote a report detailing the effects of financial sanctions on Russia. And now, about six weeks later, we are seeing the response from Russia. As we noted in our earlier report, Western sanctions on Russia were extensive. Although something similar was deployed against Iran, never before had such sanctions been used against a major country.

The initial response from the financial markets was swift; the ruble (RUB) plunged. However, over the past couple of weeks, the RUB/USD has recovered all of the initial losses. It should be noted that some of the recovery is due to capital controls as Moscow has made it very difficult to move money out of Russia. Exporters who acquire hard currency are required to turn 80% over to the Russian Central Bank. The bank also lifted interest rates to 20%, yet recently reduced its policy rate to 17%. But perhaps the most radical action the government has taken is to demand payment for energy in RUB.

In this report, we will begin with examining the concept of money and the complications that international trade creates, including a discussion of the reserve currency concept. Using this construct, we will apply it to the specific case of Russia. Our contention is that the dollar/Treasury reserve system is, at best, being tested, and at worst, unraveling. We will also include comments about emerging reserve currency blocs and conclude with potential market ramifications.

Don’t miss the accompanying Geopolitical Podcast, now available on our website and most podcast platforms: Apple | Spotify | Google

Keller Quarterly (April 2022)

Letter to Investors | PDF

Well, let’s count the things people are worrying about: we’re over two years into a global pandemic, commodity prices are spiking upward, consumer price inflation has risen dramatically, the Fed is raising interest rates, recession worries are spreading, and there’s a war in Europe. I am asked almost every day, “Why aren’t stock prices collapsing?” It’s at times like these that we need to remember that stock prices don’t measure how you feel, but rather they are an estimation of the value of businesses. Business valuations don’t necessarily go down just because you feel bad. Some businesses are actually worth more when you feel bad, such as the businesses that produce the commodities whose prices are rising.

Nevertheless, there does seem to be a lot to worry about today, and many of these worries are closely related. So, let’s talk about them. As we’ve often said before, it’s important that we worry about the right things. Among the worries listed above, one that we’re worrying less about as each month passes is the pandemic. In the U.S. and the Western world (where most of our companies do business), immunities are building thanks to high vaccination rates and natural immunity from prior infections. COVID-19 is certainly not gone, but hospitalizations in the U.S. are down significantly, even as new variants keep coming along. This is encouraging.

Inflation is a more complicated matter. Consumer price inflation is always the result of high demand combined with a constraint in supply. “Too much money chasing too few goods” is a good working definition. Whether rising inflation is a temporary or long-term problem depends on the factors increasing demand or restraining supply. Despite all the money-printing by the Fed, inflation had stayed very low for over a decade. The reason for that was on the supply side: globalized production, technology, and deregulation kept the supply of goods large and growing. All was well on the inflation front until the supply situation changed, and it changed dramatically.

The pandemic first and now the Ukraine war have delivered many shocks to the supply side, resulting in rapidly rising costs for a host of products. Some of these rising costs will likely recede when the pandemic and war end, but some probably will not. This uncertainty is the reason many are pessimistic about inflation. Production, transportation, and logistics disruptions caused by the pandemic have created product shortages and rising prices, as have labor shortages triggered by the decisions of many older workers to retire or delay going back to work. Thus, inflation did rise.

The war has worsened inflation in two ways. First, the costs of many commodities produced in Russia and Ukraine have risen dramatically due to the direct effects of war-related supply reductions. Such commodities are oil, natural gas, nickel, palladium, neon, titanium, potash, uranium, and wheat. These are basic commodity inputs for many goods, and their rising costs have rippled through the economy. The second impact is an indirect link: the decisions by the Western powers, led by the U.S., to deny Russia access to global trade and the global financial system is accelerating the deglobalization of the world economy. Confluence’s macro team has been writing about this trend toward deglobalization for many years. These trends have been exacerbated by the Ukraine war in many ways. A deglobalized world is a higher cost world since goods might not be produced at their lowest cost location but at their most secure location for movement to market. Undoing the disinflationary benefits of globalization will result, therefore, in higher rates of inflation than would have been expected otherwise.

And then we have the Fed. After many years of stimulating the economy with ultra-low interest rates and actually trying to create inflation, the Fed seems to be in panic mode now that inflation is actually here. Thus, they have begun raising the fed funds interest rate and selling bonds. Unfortunately for investors, the only tool the Fed has is a hammer to reduce demand. That is, they can slow down the economy to match demand with the lower supply. It’s a bit like trying to lose weight by getting sick. You might lose weight, but at what cost? The Fed always thinks they can raise rates just enough to tame inflation, but not so much as to cause a recession. In practice, they have rarely “threaded the needle.” We will watch this closely. It is potentially more of a problem for 2023 than this year.

So, what’s an investor to do? We have seen this drama before; it played throughout the 1960s and 70s. In fact, what we learned from that time period is that equities give investors a better opportunity to battle inflation than most other asset classes. Stocks of two classes of businesses can do well. The obvious class are those companies that produce the commodities and other products that are in shortage during an inflationary cycle. But less noticed are the class of companies that have substantial pricing power in whatever industries they operate as they are better able to pass along costs and maintain profit margins. These companies have always been a focus for Confluence and will remain so going forward.

In summary, inflation is indeed an important obstacle to be overcome by investors. We at Confluence have seen it before and are prepared to battle it on your behalf.

We appreciate your confidence in us.

Gratefully,

Mark A. Keller, CFA

CEO and Chief Investment Officer

Asset Allocation Quarterly (Second Quarter 2022)

by the Asset Allocation Committee | PDF

- In its efforts to combat inflation, the U.S. Federal Reserve has adopted a much more hawkish monetary policy stance through a combination of raising the fed funds rate and reducing its balance sheet.

- Global central banks, in contrast, have varying policy responses ranging from extensively accommodative to increasingly hawkish.

- Given the shifting landscape, the potential for a policy mistake leading to an economic slowdown or even a recession has increased.

- Equity allocations were trimmed across all strategies and are now underweight. Bond allocations were increased in strategies with income as an objective, while exposure to commodities was enhanced in growth-oriented strategies.

- U.S. stock exposure remains heavily tilted to value, with overweights to defensive sectors instead of the prior elevated exposure to cyclical sectors.

- A position in broad-based commodities with an emphasis on oil is employed across the array of strategies as is a position in gold given the advantages it affords during periods of heightened geopolitical risk.

ECONOMIC VIEWPOINTS

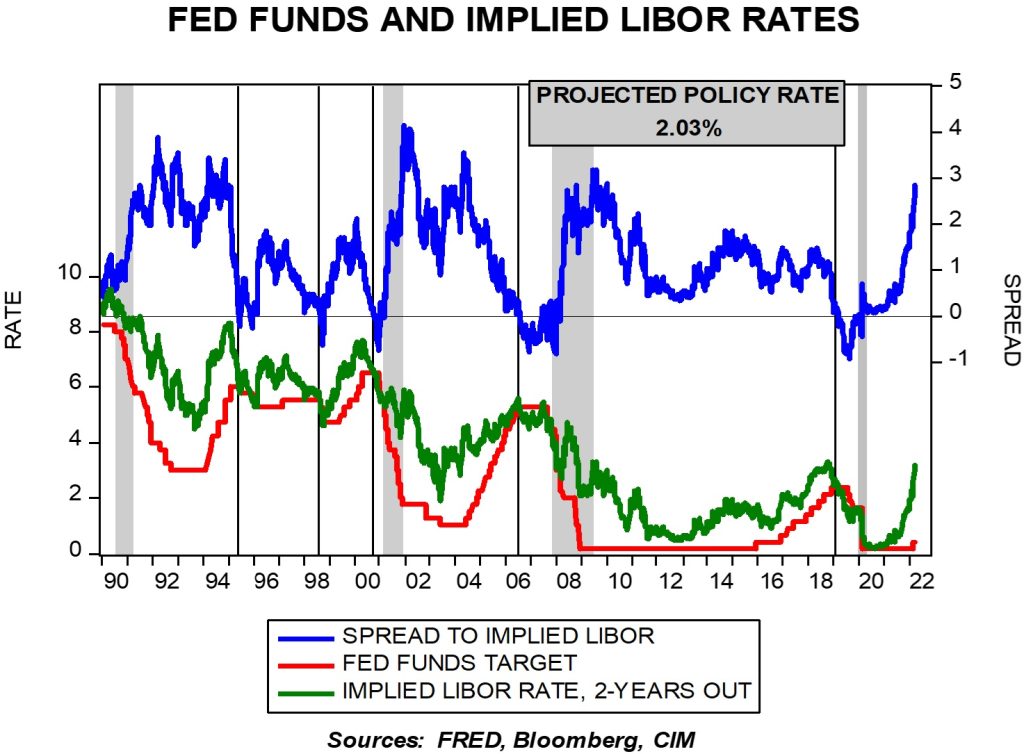

A confluence of events is conspiring to harness the expansion and thereby rattle markets. These include an increasingly hawkish Fed eager to tame inflation by assertively tightening monetary policy, war in Ukraine, elevated energy prices, rising bond yields, U.S. fiscal tightening, continuing recovery from the pandemic, overcapacity in trucking, and deglobalization and supply chain adjustments. Beginning with the Fed, the minutes from the March meeting indicate a balance sheet reduction of $95 billion per month in conjunction with continued increases in the fed funds rate, potentially as much as +50 bps in early May, and they believe the tight labor markets provide the latitude to continue to raise rates rapidly. As of this writing, many expect fed funds to end 2022 at 2.00%-2.25%, with the possibility of further hikes next year. Policymakers’ attempts to staunch inflation carry the risk of being too much too late, leading to the potential for a policy-induced economic slowdown. However, the Fed is certainly afforded the discretion to pause its rate-hiking efforts at any juncture as it assesses the inflationary landscape. Therefore, the current projected policy rate of 2.03% based upon the implied LIBOR rate two years out, as depicted in the accompanying chart, does have the potential to roll over without a recession occurring, as we saw in 1994. While a de facto tightening of U.S. fiscal policy is in process, as COVID relief is largely past, the readjustments in supply chains are underway as evidenced by the related overcapacity in the domestic trucking industry. While the potential for a policy mistake exists, the bond and stock markets seem to have discounted the possibility to some extent through their declines thus far this year.

In contrast to the U.S. Federal Reserve, the European Central Bank [ECB] and the Bank of Japan [BOJ] maintain accommodative monetary policies despite inflationary pressures. Although the ECB still intends to curtail its net purchases for its balance sheet in the third quarter, adjustments to key interest rates will not occur until sometime after the net purchases end. In addition, principal from maturing securities from both the asset purchase program and the pandemic emergency purchase program will continue to be reinvested, further testifying to the ECB’s accommodative stance. Similarly, in mid-March the BOJ furthered its commitment to cap the yield on 10-year Japanese government bonds at 0%. As both banks continue their forms of monetary accommodation in the face of inflationary pressures, the potential exists for further weakness in the exchange rates of their respective currencies. As is customary, central banks in emerging countries produce a mixed bag of policy responses. China, by far the largest, is maintaining its zero-COVID strategy with the resultant negative effects to its GDP. The People’s Bank of China recently unveiled stimulus in the form of a reduction in its reserve requirement for major banks, not only to counteract pandemic policies but also due to weak credit growth and ongoing problems in its property segment. Although the Reserve Bank of India is also keeping its key lending rate at a record-low level, the central banks of Mexico, Brazil, South Korea, and Indonesia are decidedly hawkish.

The fractures and fissures created by the varying responses of central banks to the shifting economic tectonic plates increase the likelihood of a slowdown from the rapid global economic growth enjoyed over the past two years. In the extreme, the potential for a single or even multiple policy errors raise the odds for a global recession. Accordingly, we felt it was necessary to conduct an extensive examination of risk and adjust risk assets in our Asset Allocation strategies this quarter.

STOCK MARKET OUTLOOK

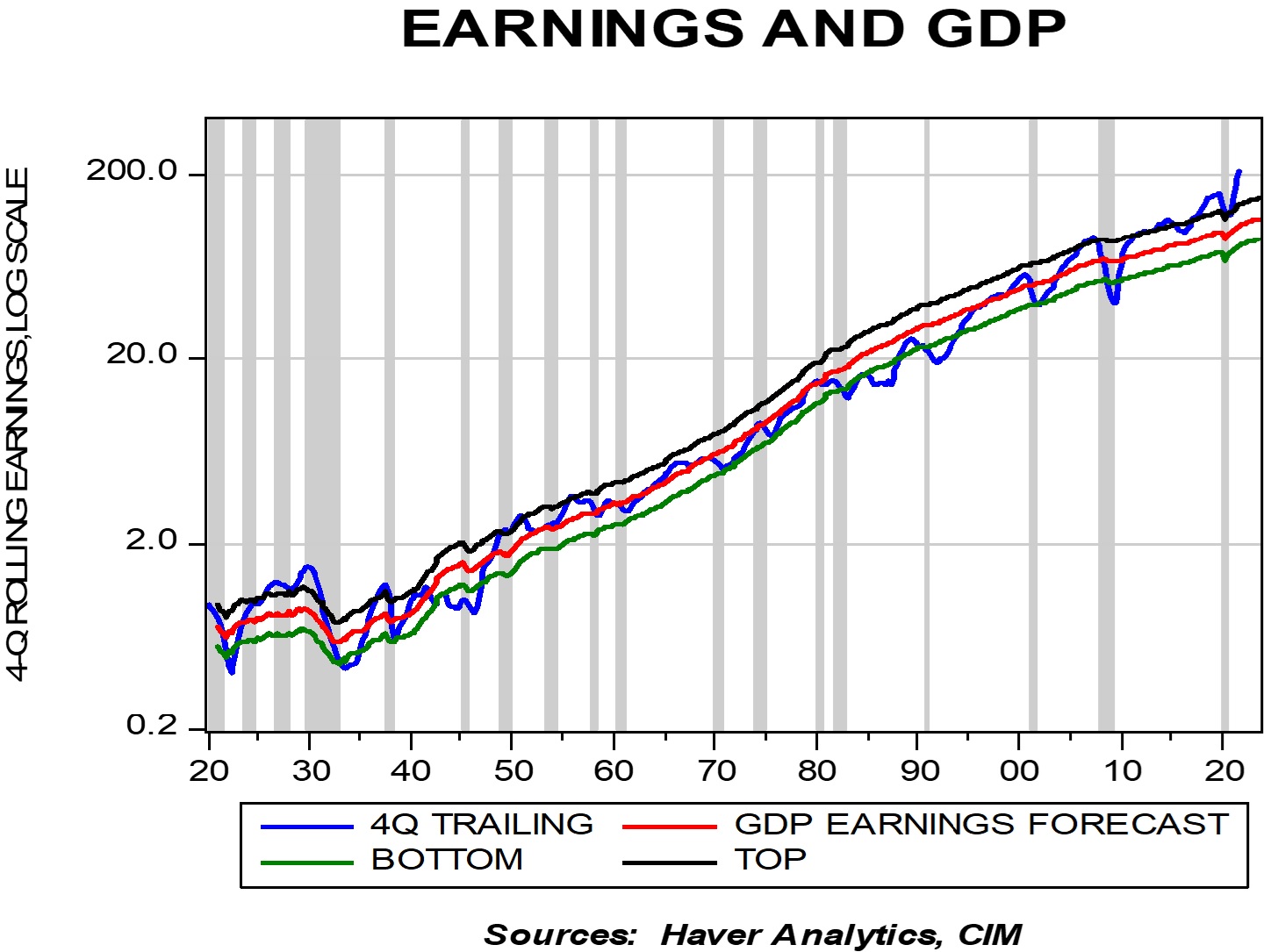

An inflationary environment fraught with the potential for policy error casts a shadow on equity prices. Adding to an already murky picture for equities are the Ukraine war, COVID shutdowns in China, and supply chain reconfigurations, among other issues. Moreover, earnings of U.S. companies relative to GDP are high by historical measures (see chart). While these concerns may combine to flash a cautionary light on equities, several fundamental forces could help buoy prices and advance returns over our three-year forecast period. First, a substantial amount of cash remains on the sidelines among investors, both institutional and retail, and household balance sheets are healthy. Second, while P/E levels are currently elevated and have been prone to compress in the past during bouts of inflation, in several instances the P/E on the S&P 500 has been much higher and rose further over several years prior to falling. Additionally, while P/E compression may often be caused by a lowering of the numerator in the equation, in a number of sectors inflation will assist in raising the denominator. Third, the adage that the stock market usually climbs a wall of worry may be apt as an increasing proportion of market participants are expecting a recession. Finally, while the Fed is currently determined to thwart inflation, it has repeatedly displayed very accommodative monetary policies in the past when financial conditions have deteriorated.

Although an outright deep recession is not a part of our consensus forecast over the next three years, a significant economic slowdown carries a high probability. Whether such a slowdown is accompanied by persistent inflation in some segments or by a period of deflation is obviously yet to be determined and to a degree dependent on the tenacity of the Fed and business and consumer sentiment. In either event, the equity positioning in our strategies reflects a reduction in risk, both through decreased allocations and our selection of exposures. We maintain a significant bias of 65% to value stocks as they tend to outperform as economic growth wanes. In addition, the concentration among top names is much lower as evidenced by the top five companies in the S&P 500 Growth Index accounting for 45.5% versus 11.6% in the S&P 500 Value Index. To complement the value skew, there is now an overweight to the defensive segments of Health Care and Consumer Staples as well as Energy. The overweights to the more cyclically oriented sectors of Materials, Financials, and Housing were eliminated. Finally, we believe the Ukraine war has advanced the timetable for an increase in defense expenditures among numerous countries, and therefore we have initiated a position in the aerospace and defense industry.

The risk reduction also applies to the international exposures as we decreased allocations in three strategies and changed the composition. Although we find valuations in developed market stocks to be more grounded compared to U.S. counterparts, the broad-based exposure is no longer augmented by overweights to continental Europe and the U.K. In lieu of these positions, we now hold an overweight to Japanese equities with a currency hedge due to the attractive pricing of Japanese stocks coupled with BOJ policies contributing to a depreciating yen. Emerging markets are now absent from all strategies.

BOND MARKET OUTLOOK

With the Fed intent upon stamping out inflation, we expect Treasury yields within five years of maturity to react directly with the increases in fed funds. Although we find longer-term issues to be somewhat anchored by demand from liability-driven investment pools, we anticipate a clouded supply/demand outlook created by the runoff from the Fed shrinking its balance sheet, economic sanctions on Russia affecting appetites for longer-dated Treasuries from other global central banks, and lower supply from the Treasury as the deficit narrows. While we recognize that the Fed has the potential to spark a downturn within the next 12-18 months, over our three-year forecast period we expect positive total returns from the intermediate bond segment stemming from higher coupons more than compensating for potential weakness in bond prices. Echoing our cautious positioning in equities, the bond allocations are largely in the intermediate-term segment or shorter in strategies that have an element of income. We find this appropriate in an environment where the Fed is aggressively tightening. Our consensus view on corporate bonds calls for a widening of spreads as the economy weakens; however, we find speculative grade bonds hold advantages as equity surrogates as they are higher in the capitalization structure on corporate balance sheets. Accordingly, speculative grade bonds are positioned in the strategies that have income as an objective, though the exposure is in bonds rated BB in order to avoid risks inherent in lesser rated, marginal companies should the economy contract.

OTHER MARKETS

We continue to find that REITs in the aggregate are close to being fully valued. Although REITs have historically fared well when faced with elevated inflation, their high relative valuations coupled with the notion that REITs can come under pressure in the early stages of a rising rate environment reinforce our view that the potential risk/return is more attractive elsewhere.

Commodities remain elevated and are even increased in the more growth-oriented strategies given the utility they offer as portfolio stabilizers as the potential for risk increases. Gold is retained across all strategies given its benefits as a haven from heightened geopolitical risk. A broad basket of commodities, with an emphasis on energy, is employed across all strategies and represents the majority of the commodity exposure in the strategies designed for growth. As the globe grapples with new routes for oil and its derivatives, we find this positioning to be potentially advantageous.