Author: Rebekah Stovall

2022 Outlook: The Year of Fat Tails (December 16, 2021)

by Mark Keller, CFA, Bill O’Grady, and Patrick Fearon-Hernandez, CFA | PDF

Summary:

- We don’t expect a recession in 2022. Real GDP growth will range between 3.0% to 3.5%. Inflation remains elevated, though price pressures will likely subside in H2 2022. We expect the core PCE deflator, the Federal Reserve’s preferred measure of inflation, to decline into a range between 3.5% to 3.0%. Overall CPI will decline into a range of 4.0% to 3.5%. So, inflation will remain elevated but should ease. Labor markets should slowly normalize, with unemployment reaching 4.0% by year’s end.

- The 10-year T-note will end the year with a yield of 1.85%, with an intra-year peak of 2.20%. Our base case is that the Federal Reserve will end its balance sheet expansion by mid-2022, but the first rate hike is more likely to come in Q1 2023.

- The S&P 500 will reach 5000 in 2022, approximately 6.0% higher than the expected 4700 at year-end 2021. Given liquidity conditions, we would carry an upside bias to this forecast. On the negative side, inflation is elevated, multiples are stretched, and bottlenecks and rising labor costs could eventually hurt margins. On the positive side, liquidity is ample, especially in the top 10% of households, and will tend to support equities. We favor value over growth and small caps over large caps. We remain favorable to foreign stocks.

- We still view the dollar as overvalued, but some sort of exogenous catalyst will likely be necessary to change the current bullish sentiment.

- We are bullish commodities and believe we are in the early stages of a broader bull market. Gold is undervalued on a long-term basis but is facing competition from bitcoin.

Daily Comment (December 14, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST] | PDF

Note to readers: The Daily Comment will go on holiday after Friday’s comment and return on January 3, 2022. From all of us at Confluence Investment Management, have a Merry Christmas and Happy New Year!

In today’s Comment, we open with a review of key U.S. news, including an update on the weekend’s tornadoes, the status of President Biden’s latest fiscal program, and the opening of the Federal Reserve’s policy meeting today. We next deal with a range of international news, including the recent U.S. pushback against China’s aggressive geopolitical moves. We wrap up with the latest developments regarding the coronavirus pandemic.

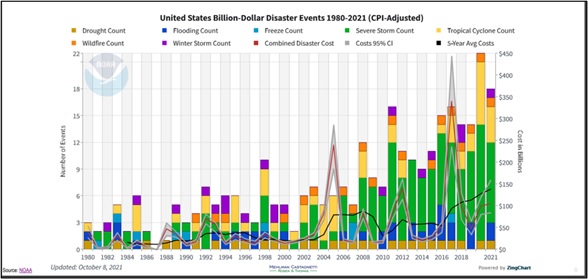

U.S. Tornado Toll: The number of confirmed fatalities from last weekend’s tornadoes rose to 88, with the vast majority of the deaths in Kentucky. So far, we haven’t seen an estimate of insurable loss damages, but it could be high. Although meteorologists believe the unusually powerful storms for this time of year had their origin in extraordinarily warm temperatures, they couldn’t yet tie them directly to global warming. All the same, we note that as global temperatures trend upward, the increased heat in the atmosphere has coincided with a rise in particularly devastating storms, especially over land, as shown in the graph below.

U.S. Fiscal Policy: President Biden lobbied Senator Joe Manchin of West Virginia by phone yesterday in another effort to garner the senator’s support for the Democrats’ $1.75 trillion “Build Back Better” social policy and climate change legislation. However, neither side reported any breakthrough, other than agreeing to talk again in the coming days.

U.S. Monetary Policy: Today, the Fed begins its latest two-day policy meeting. When the new policy statement is released tomorrow, the officials are expected to say they will accelerate the tapering of their bond-buying to end the program by March, which would position them to start hiking the benchmark fed funds interest rate in the first half of the year if they so choose. However, Chair Powell’s abrupt mutation into an inflation hawk has some investors nervous about what the policymakers will actually do at the meeting. Until the decision is out, it could lead to further volatility in the markets as it did yesterday.

- As we noted in our Comment yesterday, most major central banks are holding a policy meeting this week, but their expected policy actions range widely. Importantly, the IMF warned in its latest review of the British economy that the Bank of England is already behind on tamping down inflation pressures and must not delay rate hikes, even as the fast-spreading Omicron mutation of the coronavirus has some observers thinking the central bank might punt on rate hikes this week.

- Separately, the Canadian government and the Bank of Canada yesterday agreed to renew the central bank’s mandate to target 2% annual inflation, with a new emphasis on giving the central bank flexibility to address economic challenges and help obtain full employment when conditions warrant.

- Under the renewed mandate, which runs until the end of 2026, the central bank will set rate policy to achieve 2% annual inflation or the midpoint of a 1% to 3% target range.

- The bank will have flexibility in rate setting to achieve “maximum sustainable employment . . . The central bank will utilize the flexibility of the 1% to 3% range only to an extent that is consistent with keeping medium-term inflation expectations well anchored at 2%.”

United States-China: In a major policy speech delivered in Jakarta, Secretary of State Blinken criticized “Beijing’s aggressive actions” against its neighbors and reaffirmed Washington’s commitment to an Indo-Pacific region “free from coercion and accessible to all.”

- Blinken said the U.S. plans to strengthen its treaty alliances with Japan, South Korea, Australia, the Philippines, and Thailand in order to counter China’s aggressive geopolitical moves. In addition, he said the Biden administration is developing a “comprehensive Indo-Pacific economic framework” that would include co-operation on trade, the digital economy, technology, supply chain resilience, and investments in decarbonization.

- Although the speech broke little new ground, it drew a sharp rebuke from the Chinese government, which understands that its effort to build up Chinese power and geopolitical influence could be hemmed in to the extent that foreign nations understand the threat they face from China.

United States-China-Japan: Elaborating on comments he made earlier this month, former Japanese Prime Minister Abe said that any Chinese attack on a U.S. military vessel in a contingency concerning Taiwan could become a situation allowing Japan to exercise the right of collective self-defense, i.e., military action. Pointing out that Yonaguni Island — Japan’s westernmost territory — is only 110 kilometers away from Taiwan, Abe said, “If something happens here, it will definitely become a crucial situation” affecting Japan’s peace and security as stipulated in the country’s security legislation. The statement points to a growing realization in Japan that the country faces a severe security risk from China and needs to strengthen its alliance with the U.S. to counter it.

Norway: NATO General Secretary Jens Stoltenberg said he has applied to become the governor of Norway’s central bank starting next October. Stoltenberg, who formerly served as Norway’s prime minister, and finance minister before that, is a political heavyweight who would likely be a front-runner for the position, along with current deputy governor Ida Wolden Bache.

- Stoltenberg’s supporters have said that having a political heavyweight in the role would be desirable and that few understand Norway’s economy as well as Stoltenberg, who, as finance minister, came up with the spending rule that decides how much government can take out of the oil fund each year. Stoltenberg’s leadership of the central bank would likely be well received by investors.

- In contrast, however, Stoltenberg’s critics argue that the credibility of both Norges Bank and the country’s sovereign wealth fund would be placed at risk by putting a former politician — and one who is close friends with current Labor leader and prime minister Jonas Gahr Støre— in charge.

Global Supply Chains: Data from the OECD indicate corporate capital investment fell in the U.S., Canada, Japan, Germany, South Korea, the Netherlands, and Switzerland during the third quarter, despite the excess of demand over supply that’s driving up prices worldwide. The causes of the slowdown appear mixed. Many businesses cite price rises, supply-chain problems, and uncertainty regarding how long the surge in consumer spending will last.

COVID-19: Official data show confirmed cases have risen to 270,933,004 worldwide, with 5,316,286 deaths. In the U.S., confirmed cases rose to 50,120,820, with 798,722 deaths. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) Meanwhile, in data on the U.S. vaccination program, the number of people who have received at least their first shot totals 239,274,656. The data show that 72.1% of the U.S. population has now received at least one dose of a vaccine, and 60.9% of the population is fully vaccinated.

Virology

- U.K. officials reported the first death of someone infected with the Omicron mutation and the hospitalization of at least ten others. The government continues to raise the alarm about a massive wave of Omicron infections and the potential need to impose strict new lockdowns to combat them. In Denmark, Omicron is already driving record-high infections and is expected to become the dominant strain this week.

- Chinese officials also reported their country’s first Omicron infection. The infection was discovered in a traveler who arrived in the northern port city of Tianjin from overseas last Thursday. Later, state television reported that a second Omicron case was discovered in the southern city of Guangzhou, raising fears that the government might clamp down on factory activity and further snarl global supply chains under its “zero-tolerance” COVID-19 policy.

- In the U.S., an administration official warned that an “explosion” of new COVID-19 cases driven by Omicron is now imminent. Even though most cases won’t be severe, the sheer number will ensure that hospitalizations will surge and put further stress on the nation’s healthcare system.

- In California, the state government will again require masking in all public indoor settings, regardless of vaccination status, as it confronts rising case rates ahead of the winter holidays and uncertainty about the Omicron variant.

- To encourage vaccinations, grocery chain Kroger (KR, $45.63) said it would no longer provide two weeks of paid emergency leave for unvaccinated employees who contract COVID-19 unless local jurisdictions require otherwise. The company will also add a $50 monthly surcharge to company health plans for unvaccinated managers and other non-union employees.

- Based on final trial results, Pfizer (PFE, $55.20) said its antiviral treatment for COVID-19 cuts the risk of hospitalization or death by up to 89% in high-risk patients.

- The trial was held while Delta was the dominant variant, but Pfizer said early lab work suggested the antiviral will continue to work against Omicron, and other studies are underway.

- Pfizer’s apparent success with its antiviral, known as Paxlovid, underlines how the scientific community is broadening its toolkit against the coronavirus. Not only have the vaccines proven to be safe and effective in preventing the most serious illnesses from COVID-19, but now antiviral treatments are starting to prove their worth in managing the disease among those who get infected. Since that provides hope that society can eventually live relatively comfortably with the virus, it’s a positive for the global economy and risk markets, at least as long as a dangerous new mutatios doesn’t arise.

Economic and Financial Market Impacts

- In its monthly report, the International Energy Agency predicted that the Omicron mutation will only modestly reduce global oil demand in the coming months. Coupled with rising output in both OPEC and non-OPEC countries, that should help bring the market back into balance and eliminate the recent tightness that drove up prices earlier this year, according to the IEA.

Confluence of Ideas – #23 “The Regional Threats from the Taliban in Afghanistan” (Posted 12/14/21)

Weekly Geopolitical Report – The 2022 Geopolitical Outlook (December 13, 2021)

by Bill O’Grady & Patrick Fearon-Hernandez, CFA | PDF

(This is the last WGR of 2021; the next report will be published on January 18, 2022. Starting in 2022, we will shift to a bi-weekly publication schedule and will add a new Geopolitical Podcast with each report.)

As is our custom, in mid-December, we publish our geopolitical outlook for the upcoming year. This report is less a series of predictions as it is a list of potential geopolitical issues that we believe will dominate the international landscape for 2022. It is not designed to be exhaustive; instead, it focuses on the “big picture” conditions that we believe will affect policy and markets going forward. They are listed in order of importance.

Issue #1: China

Issue #2: Russia

Issue #3: Germany

Issue #4: The Crisis in Ethiopia

Issue #5: Rising Food Prices

Issue #6: The Energy Transition

Issue #7: The Failure of the Iran Nuclear Negotiations

Odds and Ends: This section is for concerns that may affect the world in 2022 but didn’t rise to the level of an issue on our list.

Asset Allocation Weekly – #64 “The Omicron Problem” (Posted 12/10/21)

Weekly Geopolitical Report – Plunging U.S. Service Exports (December 6, 2021)

by Patrick Fearon-Hernandez, CFA | PDF

When people think about a country’s exports, imports, and trade balance, they often focus only on physical goods (sometimes referred to as “commodities” or “merchandise”). That makes some sense, given that physical goods account for the majority of international trade for most countries. Trade in physical goods can also be volatile, and it can have big implications for a country’s domestic politics. All the same, services are also a big part of international trade. In this report, we take a close look at the role of services in U.S. trade. We highlight how U.S. trade in services plummeted as a result of the global COVID-19 pandemic, and how it’s now starting to bounce back. We end with a discussion of how that plunge and budding rebound may affect investors.

Asset Allocation Weekly – #63 “An Update on Gold” (Posted 12/3/21)

Daily Comment (November 30, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST] | PDF

In today’s Comment, we open with highlights from the U.S. labor market, U.S. relations with China and Russia, and a small number of other international developments. However, the bulk of our report deals with the new Omicron variant of the coronavirus, which today has again sparked sharp volatility in the world’s financial markets.

U.S. Labor Market: Against the backdrop of a nationwide labor shortage that is driving up wages and encouraging labor action, an official with the National Labor Relations Board ruled that Amazon (AMZN, 3,561.57) improperly impeded an April unionization vote that ultimately failed and ordered that the vote be held again. The company will have the right to appeal the ruling to the full NLRB, but the body could schedule the re-vote before that happens.

United States-China: Vice Admiral Karl Thomas, commander of the U.S. Seventh Fleet, called for as many as eight U.S. and allied aircraft carriers to be deployed to Asia-Pacific waters in order to deter China and Russia from making aggressive geopolitical moves in the region. That would mark a huge increase in allied carrier deployments in the region, underscoring the seriousness with which at least some U.S. military leaders see the challenge from China and Russia in the coming years.

China: In a sign that the government’s crackdown on big, powerful technology companies has not yet ended, six different regulatory agencies today announced a raft of new rules to rein in the country’s ride-hailing industry. Among other things, the new rules will limit the fees companies can earn from each ride they dispatch, incentivize them to make some drivers formal employees, and urge them to provide benefits such as insurance for their drivers.

NATO-Russia-Ukraine: Foreign ministers from the NATO countries are meeting in Latvia today to forge a response to Russia’s troop buildup around Ukraine, which U.S. intelligence officials have warned could point to a Russian invasion in the coming months. The ministers will need to strike a difficult balancing act between sending a tough warning to Moscow while not over-committing to the defense of Kiev.

Iran Nuclear Deal: At the latest round of talks to re-implement the 2015 deal limiting Iran’s nuclear program, Iranian negotiators yesterday doubled down on the tough demands they would require before agreeing to a renewed deal. For example, the Iranians continued to refuse to talk directly with the U.S. side, and they demanded that any resumption of the deal would require the U.S. to first dismantle all sanctions imposed since it walked away from the agreement in 2018. Prospects for a renewed deal appear slim, raising the prospect of future destabilizing moves ranging from an Iranian break-out to a nuclear weapon or an Israeli-led attack to prevent that from happening.

Barbados-United Kingdom: Barbados officially became a republic today, nearly 400 years after the English first set foot on the Caribbean island. As a result, Queen Elizabeth II is now head of state for just 15 realms, including the United Kingdom, Australia, Canada, and Jamaica.

COVID-19: Official data show confirmed cases have risen to 262,312,703 worldwide, with 5,211,147 deaths. In the U.S., confirmed cases rose to 48,440,107, with 778,653 deaths. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) Meanwhile, in data on the U.S. vaccination program, the number of people who have received at least their first shot totals 232,792,508. The data show that 70.1% of the U.S. population has now received at least one dose of a vaccine, and 59.3% of the population is fully vaccinated.

Virology

- In today’s key virology news, CEO of Moderna (MRNA, 368.51) Stéphane Bancel predicted in an interview with the Financial Times that existing vaccines will be much less effective at tackling the new Omicron variant than earlier strains of coronavirus. Just as unsettling, he warned that it would take months before pharmaceutical companies could manufacture new variant-specific jabs at scale.

- According to Bancel, “I think [the change in effectiveness] is going to be a material drop. I just don’t know how much because we need to wait for the data. But all the scientists I’ve talked to…are like, ‘This is not going to be good’.”

- With drug firms warning that the current vaccines might have to be modified to retain control over the pandemic, economic prospects and returns on risk assets are once again in question. As we mentioned in our Comment yesterday, early indications are that Omicron may be more transmissible but less lethal than previous variants, which at some level could be a positive outcome. Scientists probably still need at least a couple of weeks of study to get a decent feel for how Omicron behaves. All the same, Bancel’s comments underscore that the situation remains fluid, and a more negative assessment of Omicron might evolve. As shown by today’s market declines in Europe and Asia, that could leave markets volatile in the coming weeks.

- Similarly, Regeneron Pharmaceuticals (REGN, 654.40) said preliminary tests indicated that its antibody drug cocktail to treat COVID-19 lost effectiveness against the Omicron variant. Outside scientists said an antibody treatment from Eli Lilly (LLY, 254.83) also appeared to lose effectiveness against the mutation. Both findings are preliminary, but they have contributed to today’s market angst regarding Omicron.

- In light of the threat from the new Omicron variant, the CDC yesterday recommended that everyone 18 and older get an additional shot after completing their first course of vaccination. That marked a step up from the agency’s stance earlier this month, when it merely encouraged boosters for those 50 and above and said people ages 18 and above could get an additional dose. Indeed, some experts believe that having a booster may soon become a requirement to be considered “fully vaccinated.”

- Reports indicate that the FDA, as early as next week, may approve use of the vaccine from Pfizer (PFE, 52.40) and BioNTECH (BNTX, 362.52) as a booster in youths aged 16 and 17. As of now, the vaccine is approved as a booster only for those 18 and older.

Economic and Financial Market Impacts

- In testimony prepared for the Senate Banking Committee this morning, Fed Chair Powell says the new Omicron variant could intensify the supply-chain disruptions that have fueled this year’s surge in inflation. The testimony highlights how the new variant could put the Fed in a difficult position in the coming months if it exacerbates inflation, while also holding more workers back from seeking employment, which could lead wages to continue accelerating.

- In an address to the nation regarding the new Omicron variant, President Biden yesterday said the mutation is “a cause for concern, not a cause for panic.” He also said he would unveil a plan on Thursday for tackling the virus this winter “not with shutdowns and lockdowns, but with more widespread vaccinations, boosters, testing, and more.”

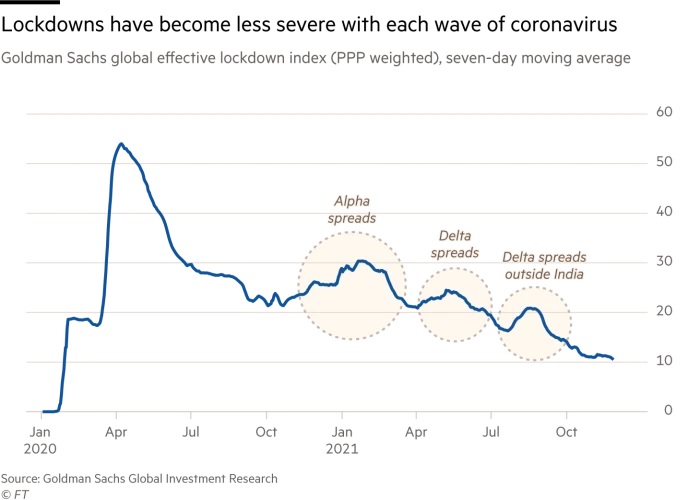

- The commitment to not focus on new economic lockdowns underscores the fact that many world leaders will be politically constrained from using such an approach to battle the Omicron mutation, at least unless it proves to be much more lethal than now known. Not only has the long battle against COVID-19 spawned intense popular backlash against lockdowns, but the rollout of vaccination programs has probably also made lockdowns less necessary.

- New lockdowns could be imposed in some places, as they already have been in some European nations, but for now it looks like we won’t see the widespread, nationwide lockdowns seen earlier in the pandemic. Indeed, global lockdowns have continued to trend downward throughout the period since the pandemic first began, as shown in the chart below.