Author: Rebekah Stovall

Asset Allocation Weekly – The Supply Side Worry on Inflation (September 24, 2021)

by the Asset Allocation Committee | PDF

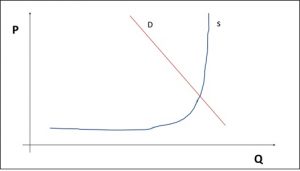

In the 1970s, the U.S. had a serious inflation problem. By the end of the decade, it had become the most critical economic policy issue. Although inflation can be a complicated topic, one way of simplifying it is to see it through the intersection of aggregate supply and aggregate demand.

On this stylized graph, prices levels are rising. In the short run, the most common way to address price levels would be to engage in austerity policies, e.g., raising interest rates, increasing taxes, reducing spending. However, that outcome also reduces output, meaning growth declines.

In the late 1970s, President Carter started implementing deregulatory policies. The goal was to affect the supply side. By expanding supply, price levels would decline and output would rise.

The supply side policies of the Reagan/Thatcher revolution were mostly deregulation and globalization. Deregulation allowed for the rapid introduction of new techniques and new technologies. Globalization naturally expanded the available supply. Both undermined the power of labor to push price increases into the economy.

The recent rise in inflation raises questions about the future path of prices. The FOMC maintains that inflation will be “transitory.” Although the actual definition of the word, at least in the context of policy, is “fuzzy,” it does appear that the rise in prices will moderate at some point.

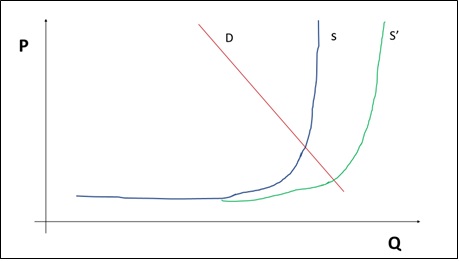

Our concerns are twofold. First, using the second graph, we would argue that the supply situation has moved from S’ to S. Supply chains have been disrupted and supply will remain tight until they are repaired. However, the degree to which inflation is transitory may depend on how these supply chains are fixed. It is important to note that globalization relies on a functioning hegemon that provides global security and a reserve currency. America’s standing as a hegemon has become less certain as Americans appear less willing to engage in the sacrifices required to maintain the role. If that is the case, a return to S’ is less likely.

Another factor is tied to deregulation. In the 1970s, there was clear under-investment and malinvestment. The “rust belt” occurred to reduce the malinvestment that had emerged. To make new investment, saving had to rise and the most effective way to increase saving is to lower taxes on upper income brackets. Although overall saving doesn’t necessarily rise, it becomes concentrated in fewer households which makes it easier to concentrate investment in a similar fashion. However, over time, deregulation has tended to create industry concentration. Concentrated industries may hamper the expansion of supply.

Under conditions of competition, extraordinary profits tend to attract new entrants into the industry. As new entrants enter the market, individual firm profits eventually decline. In addition, the expansion of competition makes it difficult to raise prices. Competition acts as a break on inflation; if higher costs affect the industry, it may simply end up causing a decline in profit margins. But, with concentration, the ability for new competition to enter the market may be thwarted. Consequently, profits may persist. An oligopolist or monopolist might not increase capacity under high prices and may instead just simply accept elevated profitability.

The economic term for this is “market failure,” where the market fails to deliver the best outcome for society. In the 1970s, the supply constraints came from the lack of incentive to invest. Taxes were too high, and regulation increased costs and discouraged investment as well. Our current situation appears to be different. As the world deglobalizes, prices will rise as supply tightens. Ideally, this increase in price levels will trigger a supply response; however, if industry is overly concentrated, the response may not occur to the degree required.

It is too early to tell whether this is the situation we are facing, but the longer transitory price levels remain elevated, we have to entertain the notion that a period of higher inflation may be upon us. We still don’t see signs that we are returning to the 1970s—labor power is still too weak, and inequality favors muted inflation. But just because we are not seeing circumstances that resemble the 1970s, it doesn’t mean we are going to see inflation levels consistent with the last two decades.

Weekly Geopolitical Report – Afghanistan, Part II: Pakistan, India, and Iran (September 20, 2021)

by Bill O’Grady | PDF

Afghanistan is a landlocked nation that sits at the crossroads of central Asia. As our history noted last week, it was part of the “Great Game” in the 18th and 19th centuries when imperial powers Russia and Britain vied for control of the region. It continued to hold that role as the Soviets and now the U.S. have left the country after trying, but eventually failing, to install and support friendly governments. The resurgence of the Taliban marks the return of the historical pattern where outside powers find it impossible to maintain control of the country. At the same time, Afghanistan’s history shows that local control is contentious as well. Although the Taliban is in control for now, there is no guarantee it can govern the country over time.

For regional powers, the potential for instability in this critical area of Asia raises concerns. However, each nation has its own set of worries relative to its individual geopolitical constraints. Over the next three weeks, we will examine the nations around Afghanistan to analyze how they will deal with the new Afghan government. This week, we will cover Pakistan, India, and Iran. In Part III, Patrick Fearon-Hernandez will cover the impact on Russia and the central Asian nations. Thomas Wash will close the report in Part IV with the effects on China and beyond. Part IV will conclude with market ramifications.

Asset Allocation Weekly – #53 “Don’t Call It a Comeback!” (Posted 9/17/21)

Asset Allocation Weekly – Don’t Call It a Comeback! (September 17, 2021)

by the Asset Allocation Committee | PDF

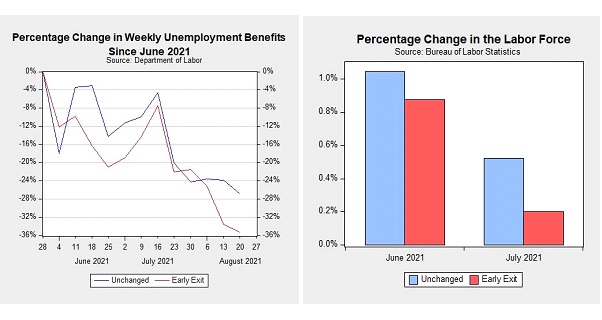

Last week, the federal government’s enhanced unemployment benefits of up to $300 per week expired nationwide. It has been speculated that the end of these benefits could lead to a surge of new entrants into the labor market. However, data from the Bureau of Labor Statistics (BLS) suggests this may not be true. In June and July, roughly half of the states in the country exited the program for enhanced unemployment benefits. Subsequently, the states that exited the program did see a sharper decline in the number of initial claims filed, but they had a slower increase in the number of workers entering the labor force. It should be noted that two months of data is not a long enough time period to draw any decisive conclusions about the labor market. That being said, if this trend continues, it may encourage the Federal Reserve to hasten its withdrawal of monetary stimulus.

The latest jobs report has led to speculation that the Fed could delay the withdrawal of its monetary stimulus. According to the BLS, the country added 235,000 jobs in August. This is less than a quarter of the jobs created in the previous month. The steep slowdown in job creation has led many to call into question the strength of the economic recovery. In anticipation of a possible delay in the withdrawal of monetary stimulus, investors sold off Treasuries and purchased tech stocks. On the day of the report, the NASDAQ closed at an all-time high, while the S&P dipped slightly.

Although the focus on employer payrolls makes sense, it may not be the most material data point when trying to gauge the Fed’s next policy move. St. Louis Fed President James Bullard has downplayed the importance of the payroll numbers in June, arguing that the labor market can still be tight even if payrolls remained below pre-pandemic levels. So far, the data supports this view. The latest JOLTS report showed that there are over two million more job openings than there are people looking for work. Over the last few months, firms have opted to raise wages in order to attract more workers.

The biggest drag on the labor force has come from workers on the extreme ends of the age spectrum. The youngest, excluding 16-19-year-olds, and oldest age cohorts have been reluctant to return to the labor force. Although higher wages may be enough to attract some younger workers, attracting older workers could prove to be more complicated. For these workers, there is no need to rush back into the workforce as they can transition into their Social Security retirement benefits once the pandemic benefits expire. If this happens, it could signal to the Fed that the labor market is too tight. As a result, the decision to wind down monetary stimulus may hinge on the willingness of older workers to reenter the workforce.

With enhanced unemployment benefits ending this month, the Fed will likely be paying closer attention to the labor force. In a recent interview, Bullard argued that the payroll data will likely be choppy from time to time but he expects the country to add 500,000 jobs per month this year. So far, the country is averaging 586,000 jobs per month. He also noted that he expects more people to reenter the labor force following the expiration of enhanced benefits. Given the comments he made in June, we suspect that he and possibly other policymakers may be more concerned with the number of people entering the labor force than the number of jobs created. In the event that workers do not return to the labor force, we expect there will be increased support for the Fed to escalate the pace of its stimulus drawdown. An early exit of its asset purchase program may give the Fed the ability to raise rates in a timelier manner. This outcome should increase interest rates, improving the outlook for shorter duration fixed income.

Weekly Geopolitical Report – Afghanistan, Part I: History (September 13, 2021)

by Bill O’Grady | PDF

The American exit from Afghanistan has created a crisis in the region. For two decades, the U.S. has propped up a government in Kabul. The U.S. withdrawal has led to the rapid collapse of that government and the restoration of the Taliban.

The media has been closely tracking the situation in Afghanistan, detailing the events as Afghans affiliated with NATO forces or Western NGOs do their best to flee the country. Although this human drama is important, the broader geopolitical issue is that the U.S. exit from Afghanistan will create a power vacuum that will unsettle the region.

This report will consist of four parts and will be a joint effort from our team. This week, we will cover the history of Afghanistan. Part II will examine how the U.S. exit affects Iran, Pakistan, and India. In Part III, Patrick Fearon-Hernandez will cover the impact on Russia and the central Asian nations. Thomas Wash will close the report in Part IV with the effects on China and beyond. At the conclusion of Part IV, we will discuss market ramifications.

Asset Allocation Weekly – #52 “Powell & Fed Independence” (Posted 9/10/21)

Asset Allocation Weekly – Powell and Fed Independence (September 10, 2021)

by the Asset Allocation Committee | PDF

Chair Powell’s term as leader of the FOMC comes to an end in early February 2022. It appears likely, at this time, that he will be reappointed for another four-year term. Decision markets currently put the odds of another term at 85%. Given all the policy actions that are on the docket for this autumn—an infrastructure bill, the budget, and the debt ceiling—not to mention the political capital lost over Afghanistan, it seems unlikely that the administration has enough bandwidth to push a new Fed chair through Congress. The path of least resistance is to renominate Powell.

However, least resistance doesn’t mean no resistance. Left-wing populists in Congress want a different Fed chair. This group thinks Powell is too lenient on bank regulation and wants someone more committed to climate change policy. Powell has mostly conducted an accommodative monetary policy.

This chart shows the real fed funds rate; Powell’s term is shown by the vertical line. Although he briefly had a positive real policy rate in parts of 2018 and 2019, most of his tenure has seen negative real policy rates. And, his quick reaction to the pandemic has been widely complimented.

Opponents to Powell’s reappointment are really getting at philosophical issues surrounding the central bank. The question really is whether or not central banks should be independent. There is a longstanding difference of position on central bank independence. For those who oppose it, the argument is that the central bank should have monetary policy aligned with fiscal policy. This is what is often called the “whole of government” approach. It makes sense that policy should move in a single direction; it makes little sense for government policy to work at cross-purposes and that outcome is possible with an independent central bank. During WWII, the Fed stabilized interest rates in order to support the war effort. This is a classic whole of government policy. It would have caused problems if the Fed had raised rates to offset the effects of government spending on the war effort.

It appears to us that Powell’s opponents are really pushing for a whole of government approach. The argument seems to be that the issues of inequality and climate change are so critical that normal policy approaches are not justifiable. Instead, the Fed should conduct monetary policy to support government efforts to transform the economy away from fossil fuels and to reduce inequality. Therefore, fiscal spending to reduce the impact of climate change should be accommodated by expanding the balance sheet to provide affordable funding.

Those who argue for central bank independence point out that money is critical to the proper functioning of society. There are essentially two ways that societies have tried to enforce monetary stability. The first is through linking money creation to a commodity, often gold. The idea is that users will have more faith in the store of value function of money if the control of the supply is given to an entity outside of government. Since gold is created through mining, the supply of money is independent of government actions.

The second way that societies have created stable money is through central bank independence. The idea is that if the central bank’s primary job is defending the value of the currency (which ultimately is about stabilizing inflation), and if it can act independently of fiscal policy, then stable money can be created. For the most part, most nations have stopped using a metal standard for money; in practice, metallic standard money was too inflexible. During periods of industrialization, when the supply of goods rose, the supply of gold might not expand fast enough to prevent deflation. History shows that consumers and firms tend to act asymmetrically to deflation compared to inflation. Deflation tends to depress consumption and investment because there is less incentive to spend as prices are declining; the longer one waits to buy, the better the price. So, governments have concluded that moderate inflation is the best outcome for society. Since the 1980s, there has been a consensus that central bank independence coupled with a clear inflation target was the best way to stabilize money.

Policy differences have tended to be constrained within the framework of central bank independence. There have been debates between “hawks” and “doves” about how policy should be implemented. In general, the hawks lean toward maintaining a low inflation target and moving preemptively to ensure the target isn’t violated, whereas doves tend to be more forgiving on violating the inflation target to support economic growth. Recent actions, led by Chair Powell, to make the inflation target less stringent suggest he leans dovish on policy.

In general, the argument for the whole of government approach is that it makes little sense for government policy to work at cross-purposes. If the economy needs stimulus, why should fiscal policy be eased while monetary policy is tightened? The downside of this approach, as history indicates, is that every government believes its goals are sacrosanct and wants no constraints; this situation will tend to lead to higher inflation. The monetary stability approach, in contrast, suggests that money is too important to be left solely in the hands of the political class. Left to their own devices, the political class will tend to put less emphasis on monetary stability. Thus, either a metallic standard or central bank independence is necessary. Critics of this approach argue that policy can be overly constraining.

What the left-wing populists are proposing isn’t simply a dovish policy but a wholesale change in the conduct of monetary policy. Selecting a different Fed chair probably won’t accomplish that outcome; the Federal Reserve-Treasury Accord of 1951 established the Fed’s independence. It would likely take a broader act of Congress to accomplish what the left-wing populists want.

For investors, this debate is critically important. Although Chair Powell will likely be renominated, the push for a whole of government approach is something that bears watching. Modern Monetary Theory assumes a non-independent central bank and that theory has been in ascendency. A move away from central bank independence increases the odds of higher inflation and less constraint on government policy. Although the Fed remains independent, that policy isn’t scriptural; it comes from Congress and can be removed by that same body.

Asset Allocation Weekly – Are Strong Profits Sustainable? (September 3, 2021)

by the Asset Allocation Committee | PDF

(Note: due to the upcoming Labor Day holiday, there will not be an accompanying podcast episode this week.)

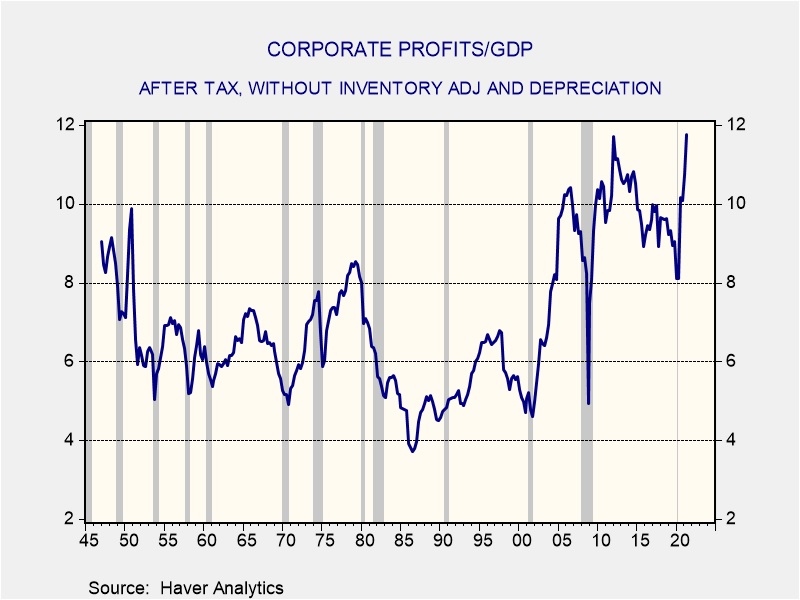

With the first update of Q2 GDP, the Commerce Department released its corporate profits for the economy. Using after-tax profits, which exclude inventory adjustment and depreciation, profits relative to GDP hit a new record.

By this measure, profits were 11.8% of GDP, edging out the previous peak of 11.7% in Q1 2012. The data show that it is not unusual for profits to decline in recessions and rebound in recoveries. However, this recession, though deep, was the shortest on record. The profit/GDP recession trough was the highest in the postwar era; in other words, the usual profit decline, scaled to GDP, was much less than seen in earlier recessions.

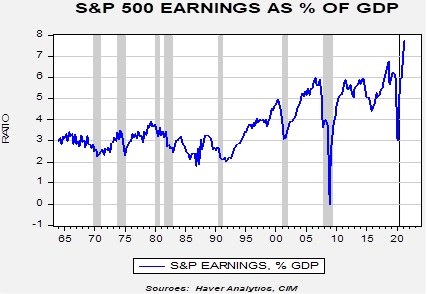

S&P 500 operating earnings relative to GDP have hit a new record as well.

The key question is whether the surge in profits, both on the national level and for the S&P 500, can be sustained. The history of both series suggests that, absent a recession, earnings tend to moderate but remain elevated. So, optimism about future earnings is justified. However, there is a broader issue at work. In the 1970s, when inflation was elevated, corporate profits tended to rise in tandem with prices. Firms, facing higher costs, were able to pass along these costs to their customers. This action exacerbated inflation. Until we see supply constraints ease, inflation will continue to rise unless consumers reduce their spending or profit margins fall. If margins are maintained, either inflation will remain elevated or consumers will have to reduce their spending.