Author: Rebekah Stovall

Asset Allocation Weekly (May 28, 2021)

by the Asset Allocation Committee | PDF

Gold moved steadily higher from the late summer of 2018 into last August. Prices declined toward 1,700 into March but have been recovering since. In this report, we will update our views on the metal.

We have been holding gold in our asset allocation portfolios since 2018, although we have diversified our commodity holdings by adding a broader commodity ETF alongside our gold position. When we looked at gold in March, we noted that there was a divergence between the short- and long-term fundamental factors.

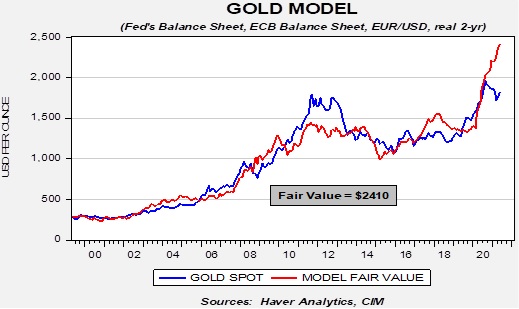

The long-term outlook for gold remains positive. Our basic gold model, which uses the balance sheets of the Federal Reserve and the European Central Bank, the EUR/USD exchange rate, and real two-year T-note yields, along with the U.S. fiscal deficit relative to GDP suggest that prices are significantly undervalued and have become more so since March.

At the same time, like in March, there are several short-term factors that are less bullish than our long-term model. One of these is longer-duration interest rates.

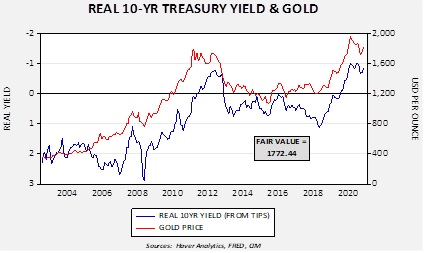

This chart shows the real 10-year yield derived from the TIPS spread against Treasuries. The real yield is inverted on the chart scale. Note that recently the real yield began to decline (become more negative). Regressing the relationship generates a fair value of 1,772.44, which is $55.79 higher than our last update. This fair value is below where gold is trading now. In addition, we have seen gold flows into exchange-traded products merely stabilize, which is inconsistent with the recent rally in gold.

In our last update, 10-year T-note yields were rising steadily. The rise has stopped, and yield levels have consolidated. Our 10-year T-note yield model is projecting a fair value yield of around 1.75%. The stall in yields has played a role in lifting gold prices. However, the most important factor may be the recent decline in bitcoin.

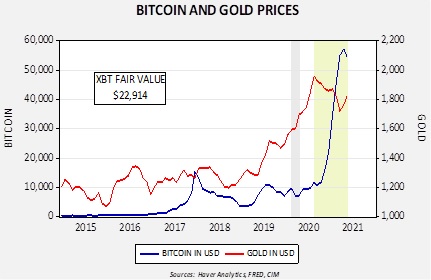

Cryptocurrencies share a similar characteristic with gold; they both provide store of value. Although they are somewhat positively correlated since 2015 (+66%), since August 2020 (shown in light green on the chart), gold and bitcoin are inversely correlated to the tune of 89.1%. This change of sign suggests that the two are now seen as competing products and, until recently, bitcoin was the clear winner. The recent turnaround probably reflects regulatory concerns surrounding bitcoin. Cryptocurrencies are often used in ransomware attacks and other criminal activity. The high-profile Colonial Pipeline event has raised concerns about the inability of police to trace bitcoin payments. If regulators clamp down on bitcoin, investors will likely return to gold for protection against inflation concerns.

Business Cycle Report (May 27, 2021)

by Thomas Wash | PDF

The business cycle has a major impact on financial markets; recessions usually accompany bear markets in equities. The intention of this report is to keep our readers apprised of the potential for recession, updated on a monthly basis. Although it isn’t the final word on our views about recession, it is part of our process in signaling the potential for a downturn.

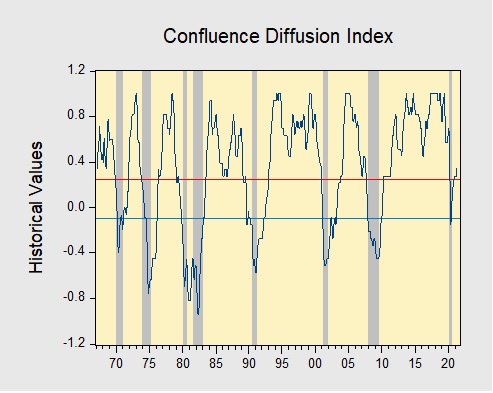

In April, the diffusion index rose further above the recession indicator, signaling that the recovery remains in place. In the financial markets, positive economic data and reassurances that the Fed will continue to support the economy led to a moderation in Treasury yields and a rise in equities. Meanwhile, construction and manufacturing activity slowed as increasing costs for materials are becoming a problem for homebuilders and factories. Lastly, the labor market showed signs of weakness as hiring slowed and the unemployment rate rose. As a result, three out of the 11 indicators are in contraction territory. The reading for April rose from +0.2727 to +0.3484, above the recession signal of +0.2500.

The chart above shows the Confluence Diffusion Index. It uses a three-month moving average of 11 leading indicators to track the state of the business cycle. The red line signals when the business cycle is headed toward a contraction, while the blue line signals when the business cycle is headed toward a recovery. On average, the diffusion index is currently providing about six months of lead time for a contraction and five months of lead time for a recovery. Continue reading for a more in-depth understanding of how the indicators are performing and refer to our Glossary of Charts at the back of this report for a description of each chart and what it measures. A chart title listed in red indicates that indicator is signaling recession.

Weekly Geopolitical Report – Taiwan and the Risk of Deglobalizing the World’s Semiconductor Industry: Part I (May 24, 2021)

by Patrick Fearon-Hernandez, CFA | PDF

(Note: Due to the upcoming Memorial Day holiday, the next report will be published on June 7.)

In our recent WGR series titled “The Geopolitics of Taiwan” (see Parts I, II, and III), we examined Taiwan’s geopolitical position in relation to China and the United States. We described how both China and the U.S. want the island in their camp, and we explored what each country might do to achieve that goal. Any friction between great powers like China and the U.S. can be dangerous, but the struggle over Taiwan is especially fraught because of the island’s unique position in the global semiconductor supply chain. In Part I of this report, we explain why Taiwan and the Taiwan Semiconductor Manufacturing Company (TSM, $111.85) represent a key vulnerability in the global computer chip industry. Part II will discuss the economic and financial implications if Taiwan and the company are forced to deglobalize and join either a U.S. or Chinese economic bloc.

As of the date of this report, certain Confluence Investment Management LLC strategies are invested in Taiwan Semiconductor Manufacturing Company (TSM). Opinions, estimates, and forward-looking statements included in the report are as of a certain date and subject to change without notice. This report is published for informational purposes and is not an offer or solicitation to buy or sell any security. Past company performance is no guarantee of future results.

Asset Allocation Weekly – #39 (Posted 5/21/21)

Asset Allocation Weekly (May 21, 2021)

by the Asset Allocation Committee | PDF

In March, job openings rose to their highest level on record. According to the Job Openings and Labor Turnover Survey (JOLTS), there were over 8.1 million job vacancies, surpassing the previous record of 7.6 million set in November 2018. The surge in vacancies is supported by data from Indeed showing that job postings in the last week of March were 15.7% above their pre-pandemic levels and were 24.2% higher in the following month.

In contrast to the JOLTS report, the most recent employment report from the Bureau of Labor Statistics showed a general slowdown in hiring. Non-farm payroll growth in April came in at a seasonally adjusted 266,000, well below the previous month’s increase of 770,000 and far short of the expected increase of 1,000,000. The gap between job openings and new hires has created angst amongst investors and policymakers alike. There are growing fears that the gap between openings and new hires may reflect flawed policy incentives, such as overly generous employment benefits or a lack of childcare. However, our research suggests that the underlying cause of the gap may be due to people weighing options outside of employment.

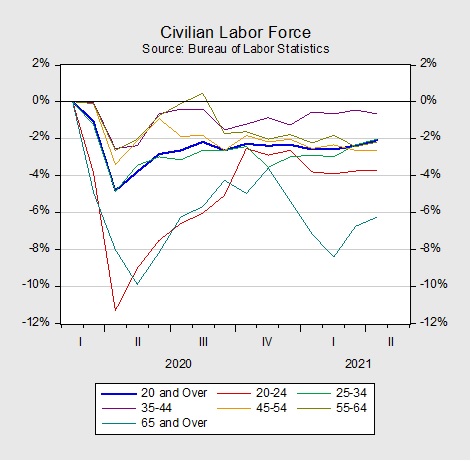

The chart above shows the percentage change in the labor force since February 2020. The civilian labor force, which includes workers that are either employed or looking for work, is 2% below the pre-pandemic levels for all persons 20 years and older. The 35- to 44-year-old age group has been the most eager to return to the labor force and is approaching pre-pandemic levels, while the youngest (20-24 years old) and oldest (65 years and older) cohorts have been the biggest drags on the labor force.

The reluctance of older and younger workers to rejoin the labor force may be due to these groups having relatively more alternatives to employment. Workers between the ages of 20 to 24 years have the option of going back to school, while the older generation has the ability to enter retirement. Data suggest there may be some truth to this claim. Although enrollment for bachelor’s degrees in 2020 dropped 2.2% from the prior year, graduate and doctoral degrees have actually increased 5.2% and 3.6%, respectively. Moreover, during the height of the pandemic, there was a surge in the number of people 65 years and older who applied for Social Security benefits. Although this trend has cooled in recent months, the number of baby boomers retiring more than doubled from 1.5 million in 2019 to 3.2 million in 2020.

An increase in labor’s negotiating power may have also contributed to people weighing their options before returning to the labor force. Eager to hit the ground running as the economy begins to reopen, firms have begun reducing their educational requirements for certain positions in order to attract more applicants. As a result, there has been a surge in job postings requiring less than a bachelor’s degree. Additionally, the recent pay increases at major companies such as Amazon (AMZN, $3,174.74), Walmart (WMT, $137.92), and Target (TGT, $209.29) may have encouraged workers to hold out for higher-paying jobs. According to research from Tracktherecovery.org, high-wage and medium-wage employment have either surpassed or are approaching pre-pandemic levels, while low-wage employment is down nearly 30%. This suggests that low-wage earners may want to bide their time before returning to the labor force.

Adverse incentives may be another contributing factor to the labor shortage. The lack of childcare may have made it difficult for single and married workers with children to search for new work, while single people with no children may find the generous unemployment benefits a more attractive option than taking an actual job. This may explain why the labor force for married people with no children has almost returned to pre-pandemic levels. If we are correct, the decision by some states to remove the pandemic booster to unemployment benefits could lift employment. Nevertheless, it may not stop the youngest and oldest cohorts from considering going back to school or entering retirement.

In short, getting back to work may be an attractive option to those who have limited alternatives to employment, have high earning power, or aren’t burdened by childcare costs. For others, the decision to return to the labor market may be more complicated. The prospect of early retirement or continuing one’s education could be more attractive than accepting a job offer. The decision is further complicated by some competing firms offering higher wages. Finally, the lack of childcare and generous unemployment benefits could also be complicating factors. However, all things considered, the labor force shortage will likely work itself out over time. Although older workers may enter or remain in retirement, the younger workers will likely come back to the labor force with more skills. In the meantime, we expect that the labor force shortage could have a mixed yet mild impact on the economy. The longer people stay out of the workforce, the more they must rely on savings to fund day-to-day activities, which cannot be maintained forever.

Weekly Geopolitical Report – The Geopolitics of Taiwan: Part III (May 17, 2021)

by Bill O’Grady | PDF

In Part I of this report, we covered the history of Taiwan along with current relations between the People’s Republic of China (PRC) and the Republic of China (ROC), and discussed the end of strategic ambiguity. In Part II, we analyzed the geopolitical importance of Taiwan and China’s military options. In this final report of the three-part series, we will examine the importance of Xi Jinping’s ascendency to power and how he may react. Lastly, we will conclude with market ramifications.

The “Known/Unknowns”: The Issue of Xi Jinping

After laying out several scenarios in Part II discussing actions that China might take, we determined the quarantine/blockade scenario had the greatest benefits compared to the risks. However, our assessment is from the perspective of an analyst, not from a leader. The calculus of a leader can be different based on the experience of that leader and the political conditions they operate within. In other words, our task now is to assess how Xi will behave in this situation. While we have no personal insight into General Secretary Xi’s decision-making, we can observe his behavior and current circumstances to estimate the risks stemming from his actions.

Asset Allocation Weekly – #38 (Posted 5/14/21)

Asset Allocation Weekly (May 14, 2021)

by the Asset Allocation Committee | PDF

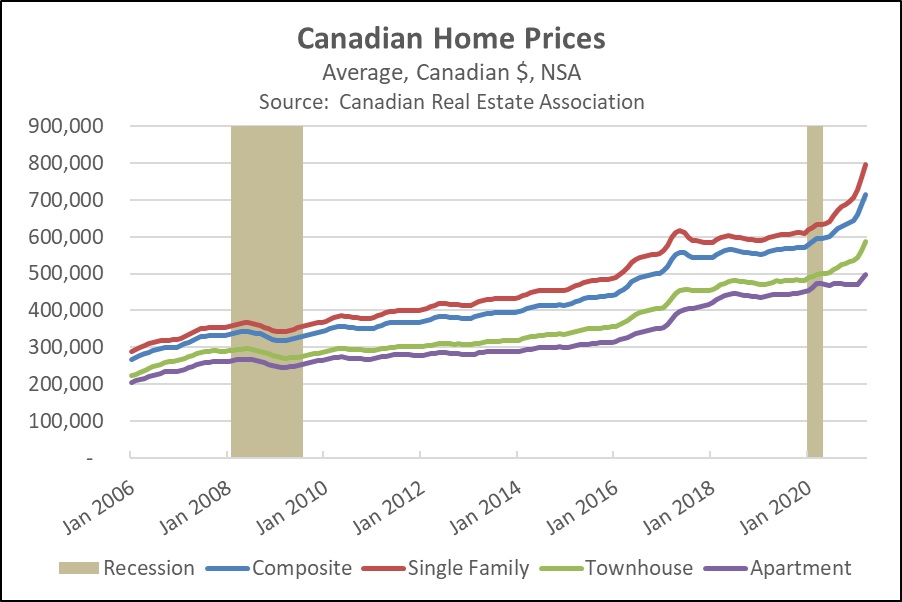

Since the Great Financial Crisis of 2007-2008 (GFC), any rapid rise in home prices has tended to spark fears of another bubble bursting. U.S. home prices have recently been up more than 10% from one year earlier, marking their strongest gains since the recovery period right after the GFC. However, those gains have been overshadowed by the even bigger increases in Canada. Home prices north of the border rose 13% in the year ended December 2020, and they were up an even stronger 20.1% in the 12 months ended March 2021 (see chart). Does that mean the Canadian housing market is in a bubble? What’s the risk that Canadian home prices will crash back to earth, dragging down the financial system and Canadian stocks?

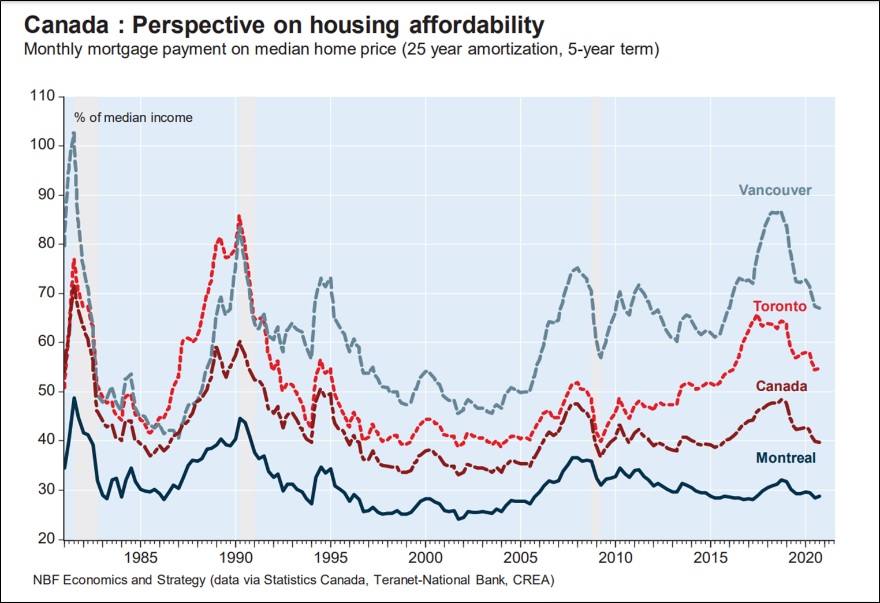

One reassuring sign is that Canadian homes are still affordable despite the recent price surge. Based on today’s median home price, mortgage interest rates, and typical Canadian mortgage terms, a homebuyer’s monthly mortgage payment would equal only about 40% of the country’s median income. As shown in the following chart, that’s similar to the level seen during most of the last decade. It’s also much lower than in the 1980s and 1990s. Naturally, housing costs can be much higher in major metropolitan areas. However, even in those locales, affordability has improved over the last few years. That’s because the recent price hikes have been largely offset by falling interest rates and rising incomes. Between 2017 and 2019, price gains were also held in check by tightened regulations, like a new tax on foreigners buying property in Vancouver and Toronto and “stress test” rules requiring loan applicants nationwide to show they could afford their mortgage even if interest rates were 2% higher than when they applied. Current affordability levels suggest Canadian home sellers can still find plenty of buyers.

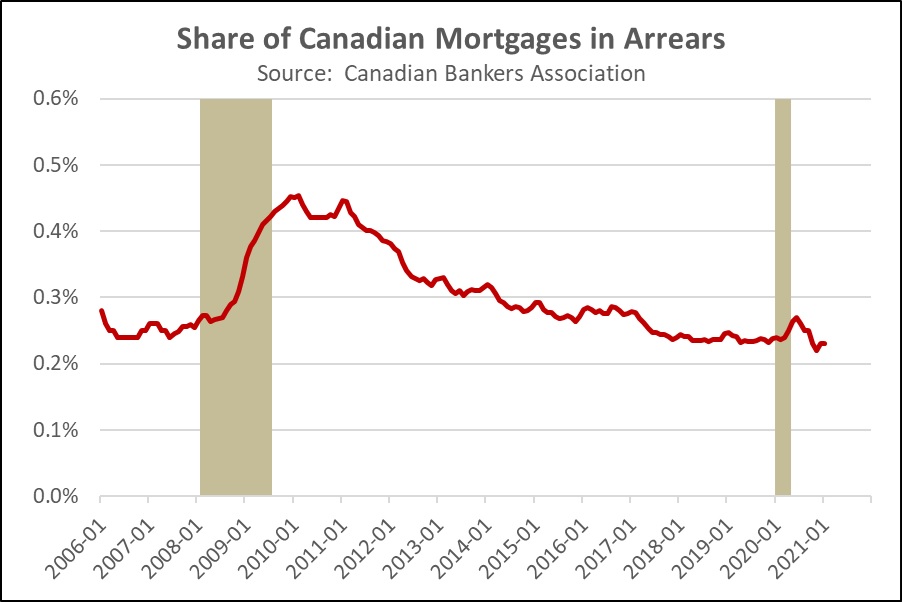

Finally, it’s important to remember that Canadian bank regulations and mortgage terms are much more conservative than in the U.S. The typical Canadian mortgage payment is calculated based on an amortization period of 25 years, and the loan matures in five years, with steep penalties for early refinancing. Long-term homeowners in Canada expect to roll over their mortgage on a strict five-year schedule. Even when homeowners sell their property to buy another, the outstanding balance on the original mortgage is usually applied to the new house. This system helps protect Canadian banks from falling interest rates. In addition, the new stress tests help ensure that borrowers are good credit risks, while government rules discourage banks from selling or securitizing their mortgage loans. The Canadian system therefore tends to keep lenders and homeowners “married” for extended periods, which appears to improve underwriting standards. As evidence of that, the chart below shows that there has been no discernable rise in Canada’s mortgage delinquencies. Canadian mortgage delinquencies remain just a fraction of U.S. delinquencies, despite the recent jump in home prices and increased mortgage debt.

In sum, it appears that the Canadian housing market is responding to the same kinds of pandemic-driven trends facing the U.S. market. Increased desire for personal space, falling mortgage rates, and ample savings have boosted housing demand, even as job fears or health concerns have limited new listings. The boom in Canadian home prices simply doesn’t seem to reflect loose mortgage standards or irresponsible lending, so we are not currently concerned about a housing bubble bursting or causing widespread financial problems north of the border.