Author: Rebekah Stovall

Daily Comment (July 2, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning, all! U.S. equities appear to be headed for a higher open this morning. Today’s Comment begins with a discussion about Chinese President Xi Jinping’s speech. International news follows, with an update on the global minimum tax proposal and the EU’s decision to end caged farming. U.S. Economics and policy news are next, including an update on the infrastructure package. China news follows, and we end with our pandemic coverage.

China will not be bullied: Thursday marked the 100-year anniversary of the Chinese Communist Party. During the celebration, President Xi gave a speech that alluded to a possible war over Taiwan. In the speech, he stated that an attempt by “foreign forces” to bully China would result in “heads bashed bloody against a Great Wall of steel forged by 1.4 billion Chinese people.” He went on to pledge that China would regain full control over Taiwan. The speech comes within weeks of China flying fighter jets and bombers through Taiwan’s air space.

His latest remarks were in steep contrast with comments he made to diplomats a month ago. In June, Xi advised officials to create a “trustworthy, lovable and respectable” image of the country abroad. So far, markets have not responded well to the sudden change in tone. We note that investors sold Chinese equities in the wake of Xi’s speech. Although the sell-off may be short-lived, as China’s economy appears to be stable, the probability of war between the West and China, though remote, is elevated.

On Wednesday, Japanese officials warned that Russia and China were coordinating military exercises to threaten not only Taiwan but also Hawaii. Although simulated attacks are quite common during military exercises, it shows that as China ramps up its rhetoric about a possible takeover of Taiwan, it is also preparing for a U.S. response. The U.S. and Japan, who have also been coordinating military exercises, appear to be growing more concerned about the increase in China’s assertiveness over the last few years. Although it appears Japan will likely retaliate if China follows through on its threat to invade Taiwan, the U.S. has been noticeably ambiguous on the matter. President Biden himself appears to be conflicted. People within his administration, such as Secretary of State Antony Blinken, would likely support a retaliation. In the past, Blinken has argued that the U.S. shouldn’t shy away from its role as hegemon and was once quoted as saying “superpowers don’t bluff.” However, it doesn’t appear that Biden believes he could persuade the American public to back a war with China over Taiwan. A survey conducted by the Chicago Council on Global Affairs shows that if China invaded Taiwan, only 41% of Americans would support a U.S. military response. The lack of support could make retaliation politically risky, and given the blowback Biden received after supporting the invasion of Iraq, he may be keen to play it safe.

One of the biggest takeaways from Xi’s speech is that the U.S.-China decoupling appears to be inevitable. Given the rise in tensions, the U.S. has taken a tougher stance against China and some of its labor practices. Earlier this year, the U.S. issued sanctions against China in response to allegations of forced labor being used in Xinjiang cotton fields. Although U.S. companies issued statements expressing their concerns about the use of forced labor, it doesn’t appear that these companies were willing to sever ties with China over the matter. During a call with Wall Street analysts, Nike (NKE, $158.00) CEO John Donahue claimed that “Nike is a brand that is of China and for China.” In response, Commerce Secretary Gina Raimondo hinted that U.S. companies should take a more active role in speaking out against human rights violations. Although we don’t expect laws to deter companies from working with China to be forthcoming, we are starting to see this administration hint that companies may want to consider other options first.

International news: Protests in Myanmar, support for a global minimum tax, and a ban on raising farm animals in cages.

- Since taking power in February, the Myanmar army has struggled to contain the nationwide protests. On Thursday, protesters set fire to army uniforms and chanted pro-democracy hymns.

- Over 130 countries have signed on to the 15% global minimum corporate tax on multinational corporations. Following heavy lobbying by the U.S., all G20 countries have backed the plan. There are a few holdouts, including Ireland, who claimed that it isn’t in a position to back the proposal. Ireland’s corporate tax rate is 12.5%.

- Venezuela is preparing to slash six zeroes from the bolivar, its national currency, as the country has struggled to contain the rampant inflation. Although the country has adopted the dollar for many of its transactions, the bolivar is still needed for everyday items such as bus fare.

- The European Union has decided to back a ban on raising farm animals in cages. The new regulation is expected to be introduced in 2023 and will likely not be put into place until 2027.

Economics and policy: The House passes a spending bill, the International Monetary Fund revises U.S. growth expectations, and U.S. plains maintain air strike capabilities in Afghanistan.

- On Thursday, the House passed a bill that would approve $715 billion of spending on transportation and drinking water. The bill would likely need to meld with the infrastructure deal struck by a bipartisan group of Senators.

- The Biden Administration warned 17 countries for not doing enough to combat human trafficking. The list included major countries, such as Russia, Iran, and China. Failing to act on human trafficking could result in sanctions.

- The Congressional Budget Office (CBO) projected that the U.S. deficit would expand to $3 trillion in 2021 and average $1 trillion over the next ten years. This deficit reached its second-highest level since 1945.

- The International Monetary Fund raised its U.S. growth projections to 7.0% in 2021, up from 4.6%. The projection assumes that Congress passes the infrastructure spending bill. The supranational organization also stated that the Fed would likely need to raise rates by late 2022 or early 2023, as it believes spending will keep inflation above its long-term trajectory.

- The Federal Trade Commission has announced it will begin to crack down on companies that inaccurately use the “Made in the U.S.A.” Violators will be fined as much as $43,280.

- The U.S. plans to keep airstrike capabilities in Afghanistan following its withdrawal from the country. The U.S. will keep some of its troops and artillery at the Hamid Karzai International Airport in Kabul. The U.S. decision to maintain airstrike capabilities within the region is in response to an increase in attacks and reports that the government could fall within six months of its withdrawal.

China: Students are harassed, and there’s a change in electricity prices

- Pro-democracy Chinese students who are attending Australian universities have been harassed and threatened by the Chinese government.

- In response to declining utilization rates at coal-fired plants, Chinese state planners have decided to change the way it sets residential electricity prices. The change will make household electricity more expensive.

COVID-19: The number of reported cases is 182,653,642 with 3,955,835 fatalities. In the U.S., there are 33,679,489 confirmed cases with 605,019 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 382,283,990 doses of the vaccine have been distributed, with 328,152,304 doses injected. The number receiving at least one dose is 181,339,416, while the number of second doses, which would grant the highest level of immunity, is 155,884,601. The FT has a page on global vaccine distribution.

- A new mass testing technique has improved the efficiency of COVID testing. In a paper published in Nature Biotechnology, this new technique can detect about 100 times lower amounts of the virus than the traditional test. The new method should help pave the way for school reopening in the fall.

- The digital COVID-19 certification went into effect in the European Union on Thursday. The certificate allows for people who have received vaccines made by Pfizer-BioNTech (PFE, $39.48), Moderna (MRNA, $234.73), Johnson & Johnson (JNJ,$165.50 ), and AstraZeneca(AZN, $60.30) to travel throughout the bloc without restrictions.

- Although the Delta variant has emerged as the dominant strain in England, it has not led to a surge in hospitalizations. This is a welcoming sign as there have been growing fears the variants could be immune to vaccines.

- The World Health Organization has stated that gatherings to watch the UEFA EURO 2020 in stadiums and bars contribute to the increase in infections. Although this is an unwelcome sign, we would like to remind our clients that it is safe to root for “La Roja” from the comfort of their own homes.

The Biden Administration will send “surge teams” to communities with low vaccination rates to help combat the spread of the Delta variant of the coronavirus.

Asset Allocation Weekly (July 2, 2021)

by the Asset Allocation Committee | PDF

(Due to the Independence Day holiday, there will not be an accompanying podcast and chart book this week. The multimedia offerings associated with this report will resume next week, July 9.)

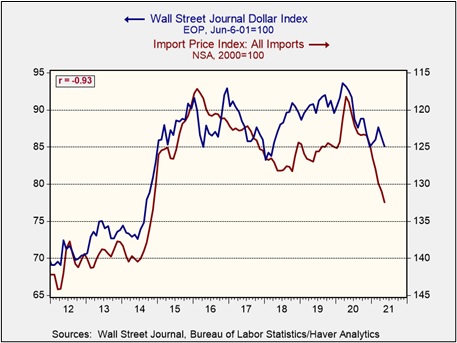

The Wall Street Journal Dollar Index, which tracks the dollar’s value relative to seven major currencies, has fallen nearly 10% since March 2020. Generally, when the dollar weakens it leads to an increase in the price of U.S. imports and a decrease in the price of U.S. exports. The drop in export prices may be good for U.S. exporters in the long term, but the rise in import prices may have a negative impact on consumers. For example, the recent rise in gasoline prices can at least be partially explained by the depreciation in the dollar. The rise in import prices has posed a dilemma for many U.S. firms that rely on imports. They can choose to raise prices and risk losing market share or they can maintain prices and accept smaller profit margins. In this report, we discuss how a weaker dollar may contribute to inflationary pressures.

Most trade is contracted and settled in U.S. dollars. As a result, it is relatively easy for Americans to purchase foreign goods and services from abroad. In the year ended in March, the value of imported consumer goods, automobiles, and food and beverage was equivalent to more than a quarter of all U.S. consumption spending. That being said, this dynamic does not always favor U.S. trade partners. Because trades are primarily transacted in U.S. dollars, exporters to the U.S. bear most of the currency risk. This is especially true in the initial stages of currency depreciation as contracts prevent foreign exporters from adjusting their prices in response to the weakening dollar. Exporters are initially forced to absorb the currency depreciation through narrower profit margins, all else being equal. As sales are implemented over time, however, the foreign exporters are able to adjust their prices. In other words, import prices are sticky in the short-run but flexible in the long-run. The impact currency has on trade can be seen in changes to a country’s balance of trade.

In the initial stages of currency depreciation, U.S. importers are incentivized to buy more goods and services before the contract ends, thus leading to an increase in imports. At the same time, U.S. exports remain stable as it takes time for firms to expand production to meet the new demand. The trade balance therefore tends to weaken. Over time, however, the decline in the trade balance reverses as consumers find alternatives to the more expensive imports and exporters are able to expand their capacity to meet the increase of foreign demand. The initial decline followed by an upward swing in the trade balance is referred to as the J-curve effect.

Despite the correlation between the dollar and import prices, firms don’t always have the leeway to push the adjustment onto consumers. During the Great Recession of 2008-2009 and the period immediately following, merchandise import prices significantly outpaced the rise in consumer prices. The discrepancy is possibly related to economic conditions. In the months leading up to the recession, there weren’t many signs of significant supply chain disruptions. As a result, many firms were hesitant to push the increase in import prices onto their consumers out of fear of losing market share. Today, that isn’t the case. Supply chain disruptions and strong demand due to post-pandemic reopenings have made it easier for firms to push the rise in import prices onto their consumers. As a result, the rise in consumer prices closely matches the rise in import prices.

Although we are confident that the dollar’s depreciation has contributed to the rise in inflation, we still believe supply shortages and stronger demand are the primary drivers. However, if we are wrong, this would likely mean that elevated levels of inflation may be around longer than we have anticipated. In this case, the Fed would likely be forced to raise rates earlier than it has forecast, which would be bullish for the dollar and bearish for commodities.

Business Cycle Report (June 30, 2021)

by Thomas Wash | PDF

The business cycle has a major impact on financial markets; recessions usually accompany bear markets in equities. The intention of this report is to keep our readers apprised of the potential for recession, updated on a monthly basis. Although it isn’t the final word on our views about recession, it is part of our process in signaling the potential for a downturn.

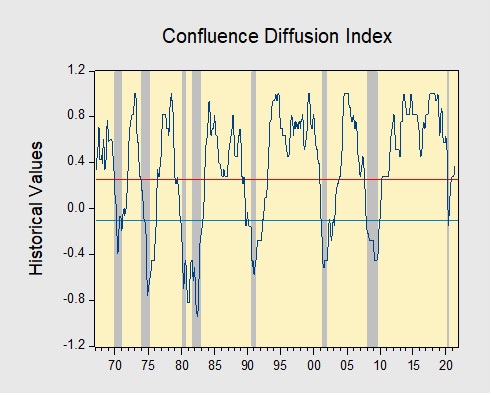

In May, the diffusion index rose further above the recession indicator, signaling that the recovery continues. In the financial markets, a sharp rise in inflation expectations led to a modest sell-off in equities in the middle of the month. Meanwhile, construction and manufacturing activity slowed as increasing costs for materials are becoming a problem for homebuilders and factories. Lastly, the labor market showed signs of strengthening as hiring increased and the unemployment rate dropped. As a result, eight out of the 11 indicators are in expansion territory. The diffusion index rose from +0.333 to +0.3939, above the recession signal of +0.2500.

The chart above shows the Confluence Diffusion Index. It uses a three-month moving average of 11 leading indicators to track the state of the business cycle. The red line signals when the business cycle is headed toward a contraction, while the blue line signals when the business cycle is headed toward a recovery. On average, the diffusion index is currently providing about six months of lead time for a contraction and five months of lead time for a recovery. Continue reading for a more in-depth understanding of how the indicators are performing and refer to our Glossary of Charts at the back of this report for a description of each chart and what it measures. A chart title listed in red indicates that indicator is signaling recession.

Weekly Geopolitical Report – The Mid-Year Geopolitical Outlook (June 28, 2021)

by Bill O’Grady & Patrick Fearon-Hernandez, CFA | PDF

(Due to the Independence Day holiday and a short summer hiatus, the next report will be published July 12.)

As is our custom, we update our geopolitical outlook for the remainder of the year as the first half comes to a close. This report is less a series of predictions as it is a list of potential geopolitical issues that we believe will dominate the international landscape for the rest of the year. It is not designed to be exhaustive; instead, it focuses on the “big picture” conditions that we believe will affect policy and markets going forward. They are listed in order of importance.

Issue #1: A New Hegemonic Model

Issue #2: China Increasingly Dominating the Hong Kong Stock Market

Issue #3: China and Inflation

Quick Hits: This section is a roundup of geopolitical issues we are watching that haven’t risen to the level of concern described above but should be monitored.

Asset Allocation Weekly – #43 (Posted 6/25/21)

Asset Allocation Weekly (June 25, 2021)

by the Asset Allocation Committee | PDF

Every quarter, the Federal Reserve publishes the Financial Accounts of the U.S., previously referred to as the Flow of Funds report. The report is huge and provides a balance sheet and income statement of sorts for the economy. The data offer interesting insights into the financial situation of the economy. In this week’s report, we will highlight some of our favorite charts.

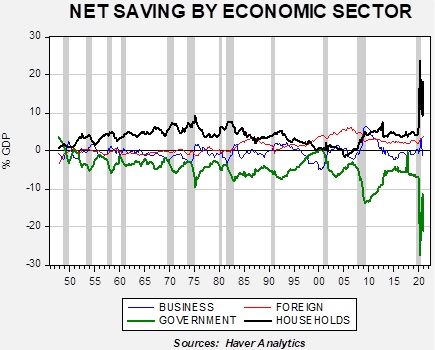

This first chart shows net saving for the economy.

Net saving is a balance sheet concept; saving in one sector must, by design, be offset by dissaving in another. The pandemic has clearly led to a historic accumulation of household saving, mostly created by a similar increase in government dissaving. How these household savings are used will be the key to the economy and markets for the next few years. If it goes to consumption, inflation will likely accelerate. It could also go toward debt reduction, which would lead to slower immediate growth but lay the groundwork for better future consumption. It could also go to financial assets; later this month, the Fed will update the distribution data and we will update the allocation of this saving by income group. Although the household saving and government dissaving does dominate the chart, the foreign and business saving data are also important. Foreign saving is the inverse of the current account; since the U.S. runs a current account deficit, essentially, it is acquiring foreign saving. That number has started to rise as well. On the other hand, business saving has turned negative, which often supports increases in business investment.

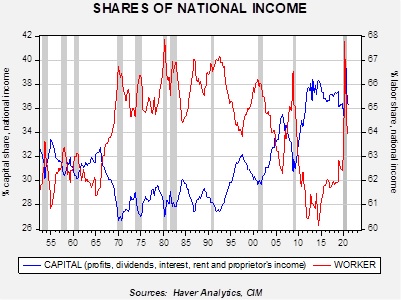

This chart shows the shares of national income by capital and labor as a percentage of national income. Since 1990, when communism fell, we have seen capital income rising against labor in each business cycle. There is a tendency for labor to gain on capital during recessions, mostly because capital income tends to fall more than wages during recessions. At some point, we suspect this trend will be reversed as it isn’t politically sustainable. But that change probably won’t occur until much later this decade.

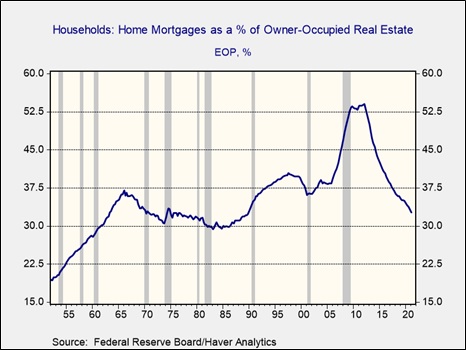

Finally, the last chart that caught our attention was one that shows we are nearing a normalization of housing finance.

This chart shows home mortgages as a percentage of the value of real estate. At the peak of the housing crisis, home mortgages were more than 50% of the value of housing. This was partly due to leverage and partly due to falling home prices. The combination of conservative housing finance and rising home prices has led to rising home equity (and, consequently, lower leverage as this chart shows). We are not at the level of the mid-1980s, but we are approaching it. As home finance improves, it should bolster further expansion in the housing sector.

Weekly Geopolitical Report – The Geopolitics of the Colonial Pipeline Ransomware Attack: Part II (June 21, 2021)

by Bill O’Grady | PDF

In Part I, we provided an overview of the Colonial Pipeline ransomware attack, followed by reflections on organized crime and why ransomware has become so attractive to criminals. We also described Darkside, the firm involved in the attack. This week, we will conclude with a discussion of why this attack was a mistake and who will suffer from it. As always, we will conclude with market ramifications.