by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Today’s Comment opens with a review of the Federal Reserve policy meeting that begins this morning (spoiler alert: no policy change is expected). We then review several important new items from overseas, including signs that the Chinese government is taking even more steps to reign in private technology companies. We end with the latest developments on the coronavirus pandemic.

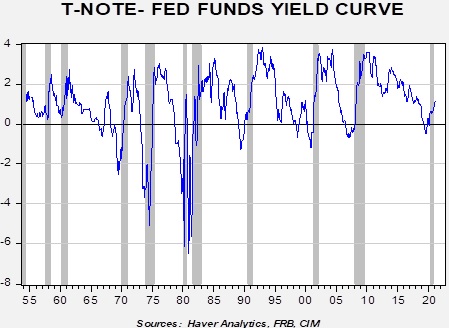

U.S. Monetary Policy: The Fed opens a two-day policy meeting today. No significant change in policy is expected, especially since policymakers over the last couple of weeks have insisted that the U.S. economic outlook is still very uncertain, and both unemployment and inflation remain far from their goals. All the same, investors will be looking for any hint of an earlier-than-expected monetary tightening when the decision is released on Wednesday. One topic that might be addressed is the rapid runup in corporate bond yields, which could potentially pose a hurdle for economic recovery down the line.

United States-China: In a potential new source of friction between the U.S. and China, some of China’s biggest technology companies, including ByteDance and Tencent (TCEHY, 82.62), are testing a tool to bypass new privacy safeguards being developed by Apple (AAPL, 123.99) for use on its iPhones. With the new tools, the Chinese firms’ apps would be able to continue tracking iPhone users without their consent to serve them targeted mobile advertisements.

Chinese Tech Sector: In a sign that Beijing is redoubling its effort to rein in the country’s powerful technology firms, a Communist Party leadership meeting chaired by President Xi issued a warning that “Some platform companies are growing in an inappropriate manner and therefore bear risks.” As if to illustrate what the government will do in response, Chinese internet companies were apparently forced to take down the popular UC Browser offered by Alibaba (BABA, 230.28). Separately, messaging app Signal became unusable for many people, stifling one of the last widely used apps that could send and receive encrypted messages in the country without a virtual private network.

Chinese Agriculture Sector: A resurgence of African swine fever is putting a new strain on China’s efforts to rebuild its herds and threatening U.S. farmers’ hopes to sell more soybeans there this year. Because of the recent outbreak, analysts say China’s sow herd has been falling 3% to 5% each month since December.

China-Russia: The Chinese and Russian governments last week signed an agreement to work together to develop a lunar research station on or orbiting the Moon. After decades of Russian cooperation with the U.S. in space, the move allies Moscow with a nation that is increasingly competing against the U.S. in the extraterrestrial realm. It also marks a warming of ties between Beijing and Moscow.

United States-North Korea: The Biden administration announced that it has reached out to North Korea to launch a dialogue on Pyongyang’s nuclear-weapons and ballistic-missile programs, but it has yet to receive a response.

Libya: The country’s first unity government in seven years was sworn in before parliament yesterday. The new government, which replaces two rival administrations, offers the chance to end the chaos that has engulfed Libya since Muammar Gaddafi was overthrown following a NATO-backed uprising in 2011.

COVID-19: Official data show confirmed cases have risen to 120,320,804 worldwide, with 2,662,878 deaths. In the United States, confirmed cases rose to 29,496,142 with 535,657 deaths. Vaccine doses delivered in the U.S. now total 135,847,835, while the number of people who have received at least their first shot totals 71,054,445. Finally, here is the interactive chart from the Financial Times that allows you to compare cases and deaths among countries, scaled by population.

Virology

- Newly confirmed U.S infections rose to approximately 55,000 yesterday, surpassing the seven-day moving average but still below the 14-day average and far lower than the rates seen at the beginning of the year. The figures reflect a general plateauing of new infections following the steep declines in February and early March. Meanwhile, new deaths related to the virus totaled only 741. Hospitalization rates and intensive-care cases also remain far below their levels at the turn of the year.

- In New York City, the percentage of people testing positive for COVID-19 over an average of seven days has hovered between 6% and 7% for the past several weeks, a plateau that epidemiologists warn will be difficult to push down. People are fatigued with isolating, more of the city has opened and continues to open, and some people are less scared of the virus and changing their behavior.

- Mississippi and Connecticut announced plans to expand vaccine availability to virtually their entire adult populations, as Alaska and Michigan did last week. CDC data show 14.8% of U.S. adults are now fully vaccinated against the disease.

- Moderna (MRNA, 143.66) announced that it is studying its COVID-19 vaccine in children aged six months to 11 years in the U.S. and Canada. The new trials mark the latest effort to broaden the mass-vaccination campaign beyond adults and could help ensure that schools can open and stay open.

- In another setback for the EU’s vaccination program, Germany, France, Italy, and Spain joined a number of smaller EU countries in pausing the use of the vaccine from AstraZeneca (AZN, 48.77) due to concerns about serious blood clotting in a small number of those vaccinated with it.

- The European Medicines Agency is reviewing the reported cases and is expected to give its verdict by Thursday regarding the safety and potential risks of that vaccine.

- The agency yesterday repeated an advisory from last week that, for now, it is recommending countries continue to use the vaccine, saying the benefits outweigh possible risks.

- The U.K.’s medicines regulator, the first to green-light the shot for mass use in late December, maintains that stance as well, telling Britons to get their shots as planned.

- The World Health Organization also recommended vaccinations go forward as normal to avoid unnecessary deaths. The WHO is also probing the blood-clotting reports but so far has found no evidence the conditions are linked to the vaccine.

- According to AstraZeneca, the number of blood-clotting cases among the roughly 17 million people in the EU and U.K. who have received the shot is lower than for the general population. Large-scale human trials also didn’t raise flags about blood clotting as a risk.

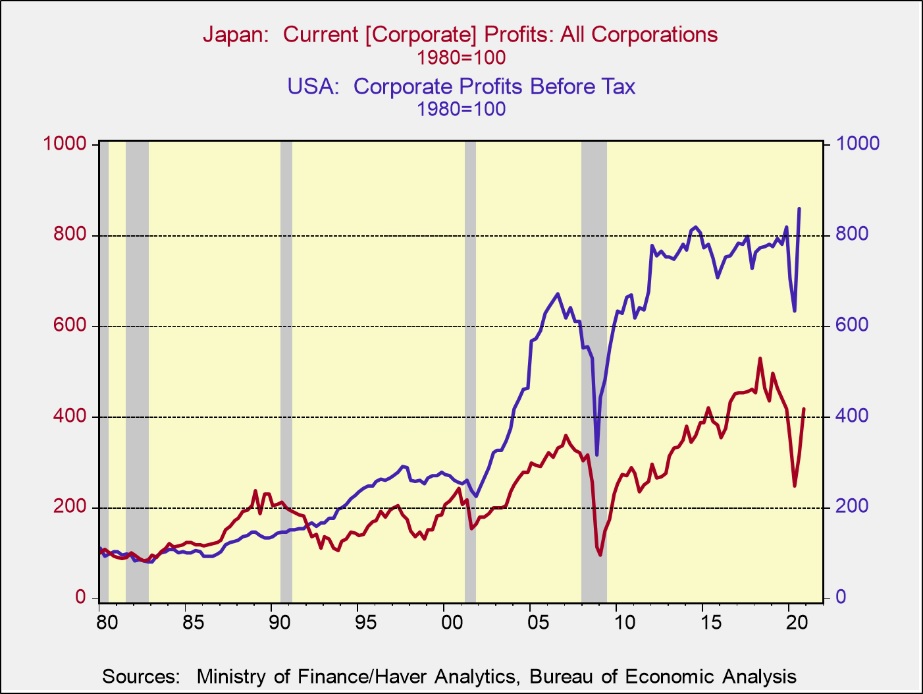

- Fearing that the strong U.S. push for vaccinations could lead it to restrict the export of critical vaccine inputs, the EU is taking steps to establish its own domestic manufacturing capacity for medical products ranging from specialized plastic bags used in drug factories to vaccine vials and certain chemicals. The move highlights how the pandemic is undermining the global supply chains that have helped drive down inflation and boosted corporate profits over the last several decades.

- Japanese Prime Minister Suga finally received his first dose of a COVID-19 vaccine. The shot was provided as part of Suga’s preparations to visit President Biden next month at the White House.

- In Brazil, President Bolsonaro announced he will replace the country’s health minister for the third time since the pandemic started. Army General Eduardo Pazuello, who has been criticized for record-high deaths and a plodding immunization effort, will be replaced by cardiologist Marcelo Queiroga.

Economic and Financial Market Impacts

- Even though the pandemic and government policies to combat it have helped spark a new housing boom, a review of the housing market’s fundamentals shows this boom is much different from the one right before the Great Financial Crisis.

- Reports over the last few days indicate airline bookings and traffic through airports are on the upswing. Two major airlines said they may stop bleeding cash as early as this month. In addition, many hotels are now reopening, hiring back workers, and welcoming guests again. The news gave a big boost to airline and other travel stocks yesterday. If the service sector continues to open up, it could have a major impact on overall hiring and economic activity, which should support continued firmness in equity prices.