Author: Rebekah Stovall

Bi-Weekly Geopolitical Report – Prospects for the Dollar in a Fracturing World (September 9, 2024)

by Patrick Fearon-Hernandez, CFA | PDF

As investment managers and strategists, we are often asked by clients about our outlook for the United States dollar. Very often, our clients have heard some worrisome news about a rival currency becoming more attractive than the greenback or global investors selling off the dollar because of economic or political problems in the US. Their concern is often about the US’s growing debt or political polarization. As the world continues to fracture into relatively separate geopolitical and economic blocs, another concern is that China, Russia, Iran, and some of their authoritarian allies want to stop using the dollar for trade and investment. If those countries cut their demand for the greenback, the fear seems to be that the currency will lose value, its purchasing power will decline, and consumer price inflation will rise.

In this report, we provide some guideposts for thinking about exchange rates. We then examine the main global forces that could theoretically reduce demand for the dollar and cut its value. We conclude with a discussion of the prospects for the dollar and the implications for investment strategy.

Don’t miss our accompanying podcasts, available on our website and most podcast platforms: Apple | Spotify

Daily Comment (September 9, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with an important new speech by former Australian Prime Minister Kevin Rudd, who warns that Chinese leaders are more ideologically driven than most in the West realize and also more apt to use military aggression. We next review several other international and US developments with the potential to affect the financial markets today, including an important new report on European competitiveness and a note on last week’s record-breaking corporate bond issuance in the US.

China: Kevin Rudd, the former Australian prime minister and Canberra’s current ambassador to the US, warned in a must-read speech in Washington last week that Chinese leaders are more driven by ideology than most Westerners believe. Rudd, a Mandarin speaker with an extensive background dealing with Beijing, emphasized that because of Chinese leaders’ Marxist-Leninist view of the US and their conception of deterrence, they could soon launch what they would view as a “small war” to deter the US and its allies from further efforts to contain China.

- In Rudd’s view, Chinese General Secretary Xi has fully embraced the Marxist-Leninist view that China is at the vanguard of historically determined social revolution, and that the “East is rising, while the West is falling.” According to Rudd, this makes Xi prone to over-confidence in dealing with the US and its allies.

- Although we have been warning for some time that the worsening US-China rivalry could potentially spill into military conflict of one sort or another, it hasn’t happened yet. Rudd’s warning suggests that investors should remain aware of the risks. That mindset is consistent with our current positioning in our asset allocation strategies of keeping exposure to gold, commodities, and defense firms, which are designed to act as hedges against a potential conflict.

China-Southeast Asia: As the US and other developed countries rush to impose tariffs against the new wave of subsidized Chinese exports, new reporting shows many cheap Chinese goods are being diverted to the relatively poor, developing countries of Southeast Asia. With prices kept extremely low by Beijing’s subsidies and the massive excess capacity in China’s industrial sector, the flood of Chinese goods is putting companies out of business and destroying jobs in countries such as Thailand, Malaysia, and Indonesia.

- Just as in the developed countries, several Southeast Asian nations have responded by imposing new tariffs and other trade barriers against Chinese goods, but the effort is constrained by regional free-trade agreements and fear of retaliation from China.

- Importantly, Chinese firms are also undercutting local logistics companies, such as trucking and warehouse firms. Once Chinese competition has driven a Southeast Asian manufacturer or logistics firm into bankruptcy, a Chinese company will often swoop in to buy the business at fire-sale prices. The Chinese buyer will sometimes use a local front company to hide its ownership, and it may leverage funds from Chinese organized crime groups (a very underappreciated problem throughout the region).

- As Chinese firms take over more local producers and logistics firms, they are reportedly forming “zero dollar” supply chains in which both imports from China and exports to China and beyond are warehoused and carried by Chinese firms with no reliance on the US currency.

- This growing Chinese influence over Southeast Asia is consistent with our view that Beijing will seek to control its evolving geopolitical and economic bloc using a form of neo-colonialism, as discussed in our Bi-Weekly Geopolitical Report from January 9, 2023. In this system, Beijing will offer the countries in its bloc the opportunity to export commodities, basic materials, and low-value factory components to China, but it will treat those countries as a captive market for Chinese exports.

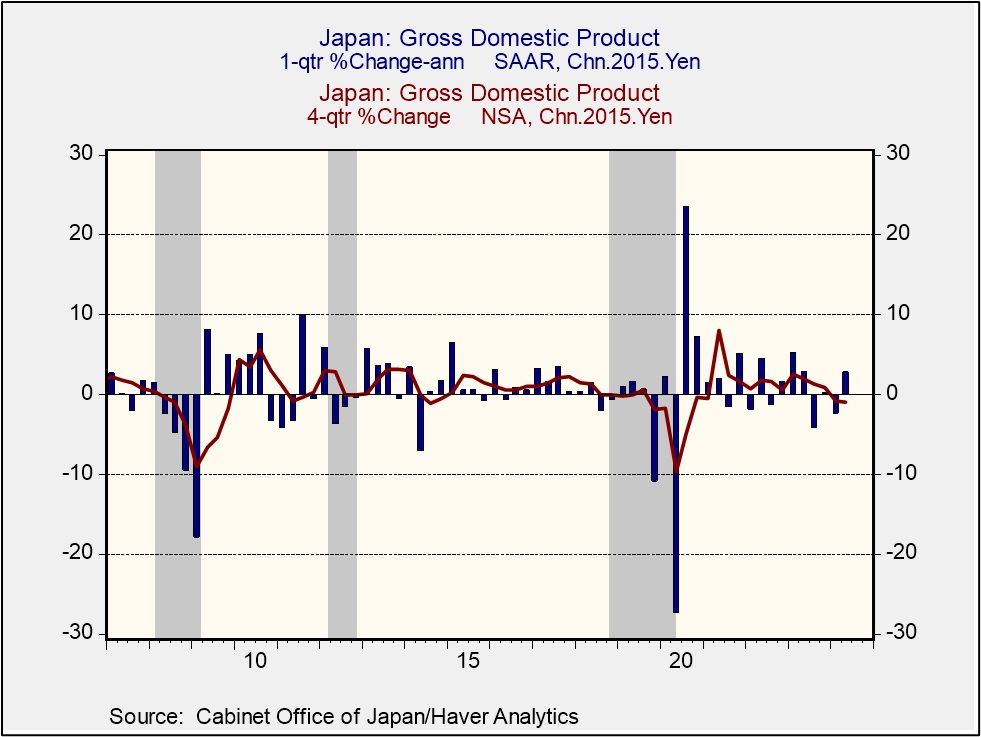

Japan: After stripping out price changes and seasonal impacts, second quarter gross domestic product grew at a robust annualized rate of 2.9%, just enough to offset the 2.4% decline in the first quarter. Japan’s GDP in April through June was still lower than in the same period one year earlier, but the rebound, which was driven by consumer spending and corporate investment, is an encouraging sign that the economy is regaining momentum. The rebound will probably also keep the Bank of Japan on track to keep raising interest rates later this year.

European Union: Former European Central Bank chief Mario Draghi, who was tapped by the European Commission last year to study the EU’s lagging economy, today issued his analysis and recommendations. According to Draghi, the EU needs a massive increase in public and private investment, financed in part by joint EU debt. To spur private investment and innovation, he calls for aggressive industrial policies and subsidies, financial market deregulation, and easier competition rules to let companies grow bigger and more powerful.

- Reporting so far suggests Draghi’s recommendations are consistent with the growing trend toward industrial policies around the world, including measures such as protectionist tariffs and tax breaks or other subsidies for favored industries.

- All the same, it is unlikely that Draghi’s entire list of recommendations will be implemented. At the very least, EU countries that are smaller and more open to trade for growth will likely resist those policies that favor bigger countries and companies or threaten trade wars that could hurt their exports.

Greece: In the latest pushback against tourists in Europe, the Greek government has proposed a series of measures to reduce visits from foreigners, including limits on cruise ship dockings, hefty increases in cruise ship disembarkation fees, and increases in lodging taxes. The moves follow similar restrictions put in place by Italy and Spain as post-pandemic wanderlust and a strong dollar encouraged waves of tourism in recent years. According to locals, excess tourism has driven up prices and disrupted communities in certain areas.

United Kingdom: Prime Minister Starmer’s government today admitted it is mulling ways to soften the blow from Starmer’s plan to reduce fuel subsidies for millions of Britons this winter. Although the government hasn’t yet decided how to soften the impact, any modification to the original plan would likely mean more spending and make it harder for the prime minister to rein in the UK’s expanding budget deficit.

Venezuela: Opposition presidential candidate Edmundo González, whom the US and other key countries consider the rightful winner of July’s election, left Venezuela on a Spanish military plane over the weekend after a Venezuelan court issued a warrant for his arrest. Venezuelan security forces have also surrounded the Argentine embassy’s residential compound, where six Venezuelan opposition leaders have decamped to avoid arrest.

- The developments show President Maduro is consolidating his power again after falsely claiming he won re-election.

- If Maduro retains power, as now looks likely, US sanctions on Venezuela’s petroleum industry are likely to remain largely in place. In turn, much of Venezuela’s oil resources will remain off the global market.

US Politics: As presidential candidates Donald Trump and Kamala Harris prepare for their televised debate tomorrow night, the Wall Street Journal today carries a detailed and useful comparison of their positions on key issues ranging from taxes to healthcare. The debate on the ABC network is Tuesday, September 10, at 9:00 pm ET.

US Bond Market: New data from LSEG show a record 60 corporate bond deals were completed last week for a total of $82 billion in borrowing. According to market participants, the flurry of deals reflects a desire by company managers to sew up their debt issuance ahead of any market volatility that could come as the economy slows, the Federal Reserve starts cutting interest rates, and the presidential election approaches.

Daily Comment (September 6, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is closely parsing through the latest jobs data. In sports news, Patrick Mahomes of the Kansas City Chiefs surpassed Len Dawson as the team’s all-time passing leader while securing a victory over the Baltimore Ravens. In today’s Comment, we discuss why the recent Services PMI data should relieve recession fears, consider the potential impact of the ECB’s reluctance to address weak GDP figures on the dollar, and explore how the coalition collapse in Canada aligns with a broader trend of dissatisfaction with ruling parties in the West. As always, the report includes a comprehensive overview of domestic and international data.

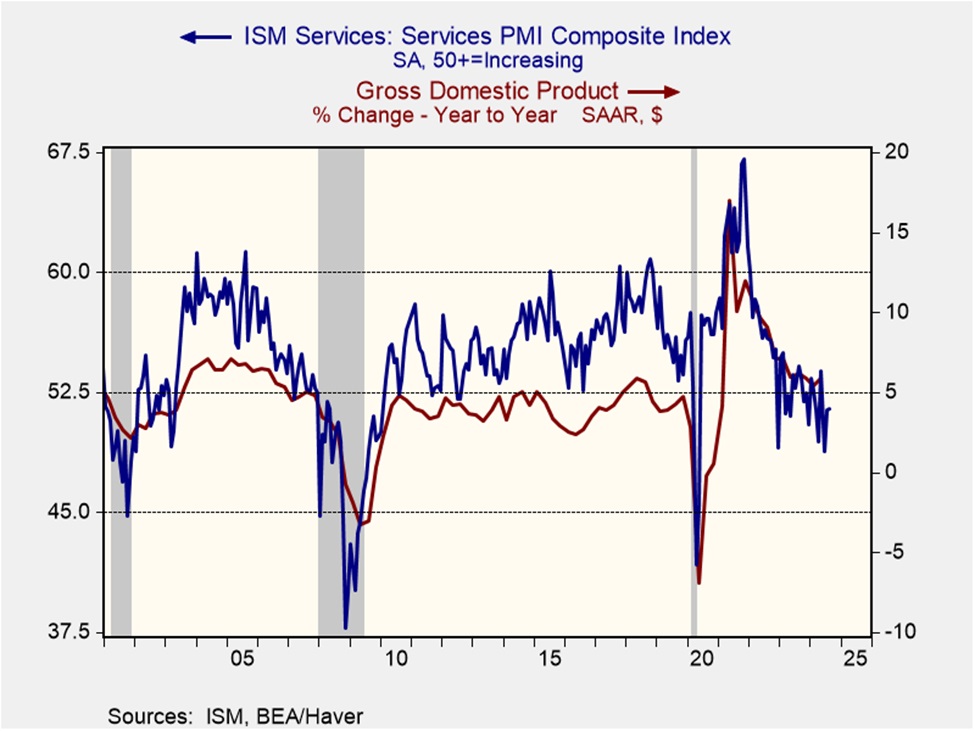

Good News, Finally! Days after the Purchasing Managers’ Index (PMI) for manufacturing raised concerns of a potential economic slowdown, the services component offered reassurance.

- Both the S&P Global and ISM Purchasing Managers’ Indexes (PMIs) for August showed an increase in service sector activity, challenging the narrative of an impending recession. The S&P Global PMI rose from 55.4 to 55.7, while the ISM PMI increased slightly from 51.4 to 51.5. The stronger pace of new orders, indicating continued demand for firms’ offerings, was the primary driver of the overall improvement. However, both PMIs showed declines in their employment components, reaffirming concerns about the cooling labor market.

- The rise in the PMI services index strongly indicates that the economy remains in expansion. Unlike manufacturing, service consumption represents nearly half of all economic output, making the economy particularly sensitive to shifts in this sector. The ISM services index, specifically, has proven to be a reliable economic predictor, explaining about half of the GDP variation over the past three decades. As a result, the latest reading suggests that, despite market concerns about an imminent downturn, the economy has enough momentum to avoid a recession.

- While recent data suggests slowing growth, it’s important to consider the historical context. The past four recessions were all triggered by unforeseen events: the 2020 pandemic, the 2008 Lehman Brothers collapse, the 9/11 attacks in 2001, and the Gulf War in 1990. Hence, a slowdown doesn’t necessarily foreshadow an immediate downturn. While the economy faces challenges, we remain cautiously optimistic that it can weather these headwinds, absent any major disruptions such as a mass mobilization war, commodity supply shock, or pandemic.

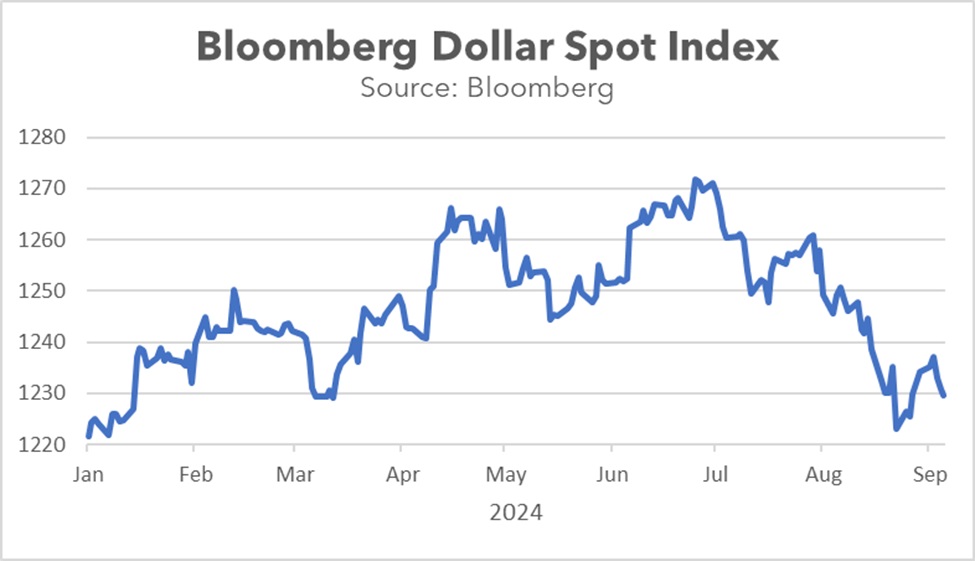

The Flat Dollar: As the global economy anticipates a convergence in interest rate differentials, the US dollar has begun to depreciate against foreign currencies.

- The Eurozone’s second quarter GDP was revised downward to 0.2% from 0.3%, indicating continued economic stagnation. This latest data is likely to fuel concerns that the region’s tight monetary policy is beginning to dampen economic activity. Household consumption and investment spending both declined, with investment spending falling by a more significant 2.2%. Germany, the bloc’s largest economy, contracted by 0.1% as its industrial sector remains under pressure. However, there were some bright spots: France and Italy both grew by 0.2%, and Spain’s economy expanded by a robust 0.8%.

- Despite growing economic concerns, there is skepticism that recent economic data will prompt the European Central Bank (ECB) to accelerate its easing policy. A survey of economists indicates that respondents anticipate the ECB will maintain its current monetary policy stance, even in the face of weakening economic indicators. As growth slowed, the region’s unemployment rate fell to a new low in July, and core inflation has shown signs of stalling. The ECB’s reluctance to respond to the slowdown mirrors the Bank of Japan’s decision to maintain its current policy path.

- The reluctance of central banks to respond to economic changes is likely to accelerate interest rate convergence. Historically, global developed central banks have been hesitant to follow the US Federal Reserve in raising rates and they have also been less willing to cut rates as aggressively. This narrowing interest rate differential, coupled with growing concerns about the US economy, is expected to weigh on the US dollar in the short to medium term. This trend has already begun to manifest itself this year, with the Bloomberg Dollar Spot Index falling from its 2024 peak in June to levels close to its value at the start of the year.

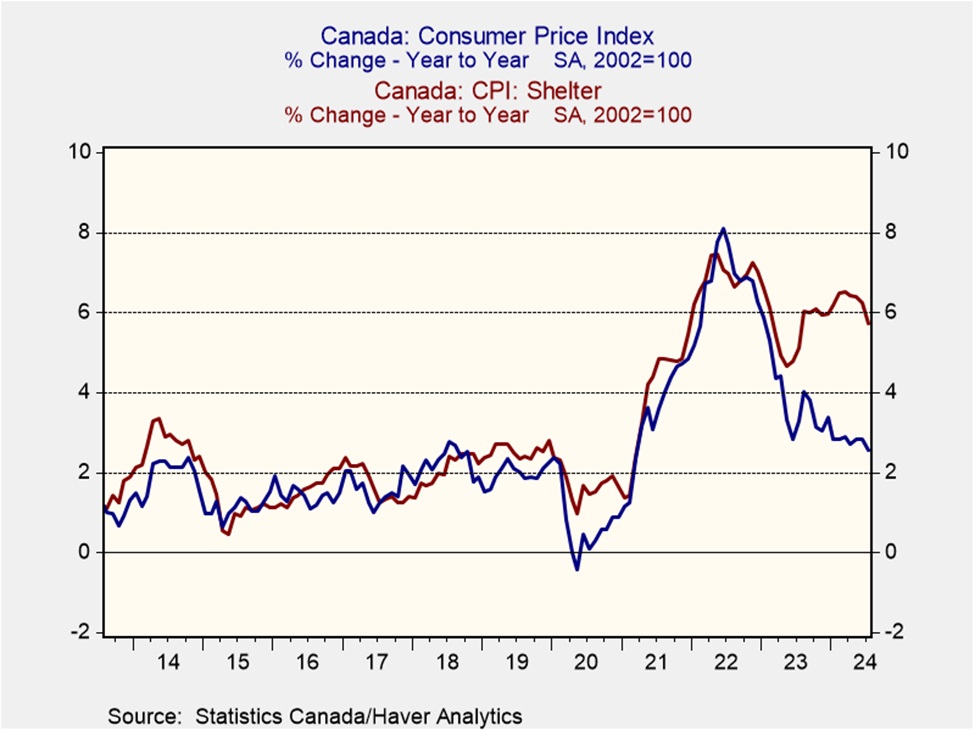

Trudeau in Trouble: As voters across the West express increasing discontent with incumbent leaders, the impending collapse of Trudeau’s coalition threatens to end his party’s nine-year reign.

- Jagmeet Singh, leader of Canada’s New Democratic Party, has ended the agreement to support the minority Liberal government, raising the likelihood of snap elections. While this doesn’t technically strip the Liberals of their position, his refusal to uphold the deal could leave PM Justin Trudeau vulnerable to a no-confidence vote, potentially triggering an early election. Additionally, Singh still requires his party’s approval to formally withdraw from the arrangement. That said, federal elections must be held by October 2025, with current polls showing the ruling Liberals trailing the Conservatives by 17 points.

- The Liberal Party is facing increasing criticism over the rising cost of living, particularly housing. While overall inflation is 2.5%, which is within the Bank of Canada’s target range of 1-3%, shelter inflation remains stubbornly high at 5.7%. Unlike in the US, where 30-year fixed mortgage rates are common, most Canadian mortgages are locked in for five years or less. This difference directly impacts inflation as mortgage interest costs account for 13% of Canada’s shelter inflation. In contrast, the US removed housing costs from its CPI measure in 1983, opting instead for owner-equivalent rent.

- One of the key issues facing Western nations as they approach elections in the coming months is public sentiment regarding inflation. While price increases have moderated substantially in recent years, consumers have found it challenging to adjust to current price levels as many had anticipated a decline. This dissatisfaction with prices is likely to influence election outcomes as voters may attribute the problem to their current leadership. As a result, we should not be surprised if opposition parties see a strong performance this election season.

In Other News: The US is growing less confident in a Gaza peace plan and is looking for alternatives, another example of the difficulty of resolving disputes in the Middle East. Republican presidential candidate Donald Trump proposes a 15% corporate tax rate as he looks to bolster his support from big business. The pledge is another sign that neither candidate will be able to solve the deficit matter. Japanese prime minister candidate Yoshimasa Hayashi is holding out hope that the Nippon Steel acquisition of US Steel can be salvaged.

Daily Comment (August 26, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with some new research confirming our positive view on the global defense industry going forward. We next review several other international and US developments with the potential to affect the financial markets today, including some notes on the Israel-Hezbollah attacks over the weekend, a shut-off of petroleum exports from Tunisia, and a wrap-up of the Federal Reserve’s conference at Jackson Hole, Wyoming.

Global Defense Industry: New research by Vertical Research Partners suggests the world’s top 15 defense contractors will log total free cash flow of $52 billion by 2026, double the amount they generated in 2021. Half the free cash flow in 2026 will come from five top US defense firms (excluding Boeing), while much of the rest will come from top European producers. The analysis is consistent with our often-stated view that today’s increased geopolitical tensions will prompt higher defense budgets around the world in the coming years.

- Separately, the head of the International Atomic Energy Agency, Rafael Grossi, warned in a Financial Times interview that more countries are feeling pressure to develop their own nuclear weapons. According to Grossi, “There are all these tensions, this possibility of alliances being weakened and countries having to fend for themselves. This is where the nuclear weapon factor, and attraction, comes back in a very unexpected way.”

- Grossi’s analysis echoes our view that factors such as the geopolitical aggressiveness of key authoritarian countries and weakening alliances within the US bloc could spark a new, global nuclear arms race in the coming years. From an investment standpoint, that suggests that there could be opportunities not only in defense stocks, but in commodities such as uranium.

Israel-Hezbollah: On Sunday, after US and Israeli intelligence suggested the Hezbollah militants were preparing a major attack on Israel, the Israel Defense Forces launched a large number of airstrikes against the militant group’s rocket launchers in southern Lebanon. Hezbollah later said it had gotten off about 300 missile launches against Israel, but it tried to signal no more attacks would be coming for now.

- It’s not yet clear if the Hezbollah attack was meant to be the main retaliation for Israel’s recent assassinations of Islamist militants in Lebanon and Iran. If it was, it may suggest that Iran wanted to limit its direct involvement to insulate it from further hostilities with Israel. In any case, reports say Hezbollah’s rank-and-file were disappointed with the relatively small scale of the attack.

- In any case, it’s still impossible to rule out further attacks on Israel by Hezbollah, Hamas, or their Iranian benefactors. With Israel’s war on the Hamas government in Gaza continuing, the risk of dangerous escalation into a broader regional conflict remains.

China-United States: Some artificial-intelligence developers in China are reportedly getting around the US ban on selling advanced AI computer chips to the country by remotely and secretly accessing computer power based on top-of-the-line Nvidia chips in foreign facilities. These “decentralized GPU” services apparently aren’t illegal right now, but the US government may well take steps to clamp down on the practice as the US-China technology rivalry continues.

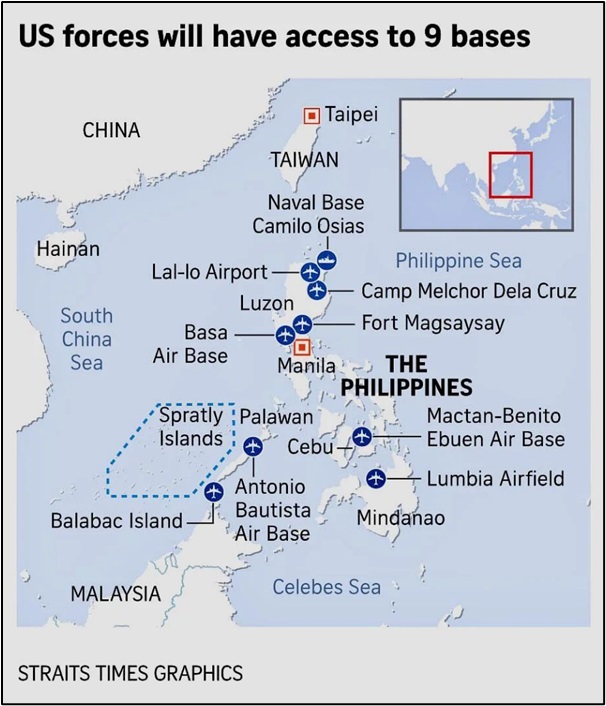

China-Philippines: Yesterday, Chinese navy and coast guard vessels again harassed a Philippine government ship bringing supplies to Philippine fishermen near Sabine Shoal, an area inside Manila’s exclusive economic zone claimed by both countries. The Philippine ship may have been intending to bring supplies to one of Manila’s coast guard ships, which has been anchored in the area since April, much to the chagrin of Beijing.

- As we’ve noted previously, Sabine Shoal is developing into another potential flashpoint between China and the Philippines, after the two sides recently agreed to cool tensions over the disputed Second Thomas Shoal.

- To reiterate, any Chinese-Philippine military confrontation has the potential to draw in the US, which has a mutual defense treaty with Manila.

China: New data from Dealogic shows the world’s top private-equity firms have virtually given up on new acquisitions in China as the country hits structural economic headwinds and geopolitical tensions with the West are making such deals riskier. The data is consistent with our view that slowing growth, worsening international tensions, and the world’s fracturing into relatively separate geopolitical blocs will make Chinese investments riskier going forward.

Tunisia: The government controlling Tunisia’s eastern half today said it will stop all petroleum production and exports to retaliate for the rival western government’s effort to take over the country’s central bank. The eastern government has declared force majeure over all oil fields, terminals, and export facilities, closing them down. The news has pushed global oil prices sharply higher today, with near WTI futures currently up 3.0% to $77.06 per barrel and Brent up 2.5% to $80.13.

Canada-China: Canadian Prime Minister Trudeau today said his government will impose new anti-dumping tariffs on a range of imports from China, including a 100% tariff on Chinese electric vehicles and 25% tariffs on Chinese steel and aluminum. The tariffs, which Trudeau said were aimed at “leveling the playing field” for Canadian workers, are another example of how the US geopolitical bloc is decoupling from China and its bloc. The spread of anti-Chinese tariffs is bound to anger Beijing and complicate its effort to re-ignite economic growth.

US Monetary Policy: As we previewed in our Comment on Friday, Fed Chair Powell used his speech at the opening of the central bank’s summer conference in Jackson Hole to confirm the policymakers will begin cutting interest rates in September. In a line for the ages, Powell said, “We do not seek or welcome further cooling in labor market conditions . . . The time has come for policy to adjust.” The most likely scenario is for the Fed to cut the benchmark fed funds rate by a modest 25 basis points to a range of 5.00% to 5.25%.

- Even though investors had long been expecting an interest-rate cut in September, the confirmation by Powell gave a boost to stocks and bonds on Friday. The S&P 500 price index jumped 1.15% to a near-record 5,634.61, while the yield on the 10-year Treasury note fell to 3.8070%.

- Going forward, there is still some question about the pace of any further cuts. Unless there are more signs of real stress in the economy, the policymakers could well prefer a slow, steady series of 25-basis-point cuts extending into 2025. With investors holding massive amounts in money market accounts, an erosion of the yield on those accounts coupled with a soft landing in the economy could potentially prompt a massive rotation back into stocks and a melt-up in equity prices.

Asset Allocation Quarterly (Third Quarter 2024)

by the Asset Allocation Committee | PDF

- Domestic economic growth is expected to be solid on continued supply chain rearrangement, the resulting domestic industrial production, and supportive fiscal stimulus. There is no recession in our forecast.

- With the Fed remaining data-dependent regarding the fed funds rate, we believe the likelihood is diminishing for multiple rate cuts this year.

- Economic growth is likely to support credit conditions and domestic equities. Mid-cap equities offer attractive valuations and growth profiles. We have moved to an even weight in our growth/value style tilt.

- Volatility is likely to increase in economic readings as well as market movements as we head into the elections and beyond.

- We maintain the exposure to gold as a geopolitical hedge, and silver is also utilized where risk appropriate.

ECONOMIC VIEWPOINTS

Our three-year forecast period includes expectations for continued healthy economic growth, a constructive environment for risk markets, and support for all capitalizations of domestic equities. Lacking an external shock to the system, our expectations do not include a recession. Market participants have been surprised by the economic resilience despite the prolonged high level of the federal funds overnight rate. Conventional economic wisdom teaches us that rapidly tightening monetary policy should slow the credit cycle and dampen demand, pushing the economy into a contraction. Yet the economy has remained resilient.

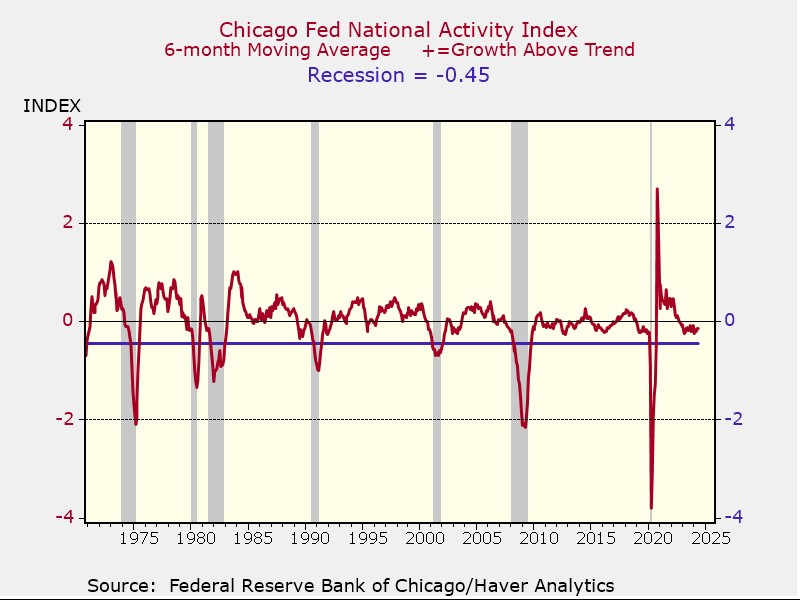

In our view, the economic resilience will persist on the back of structural changes driven by geopolitical shifts, private sector strength, and fiscal spending. Heightened geopolitical tensions and deglobalization will continue to foster a restructuring of supply chains, which is supportive for the domestic economy. At the same time, aging demographics and immigration uncertainty are likely to keep labor markets tight. These are longer-term trends which are not as sensitive to monetary policy and thus have boosted the economy. Despite the strength of aggregate economic activity, certain sectors are likely to experience pressures from high interest rates. For instance, we have already seen slowing residential construction, and higher borrowing costs are impacting smaller companies. This is confirmed by the Chicago Fed National Activity Index (shown in the first chart), which has fallen but is still well above recessionary levels.

We are expecting the private sector to remain strong in the current higher rate environment as many businesses took advantage of low rates over the past decade. Consequently, the impact of higher rates will be felt gradually as debt matures and is refinanced over the next several years. Meanwhile, the trend of reshoring continues to bolster investments in domestic capacity construction. Manufacturing capacity building is a multi-year process that will result in increased domestic manufacturing capability, buoying the economy when construction spending wanes.

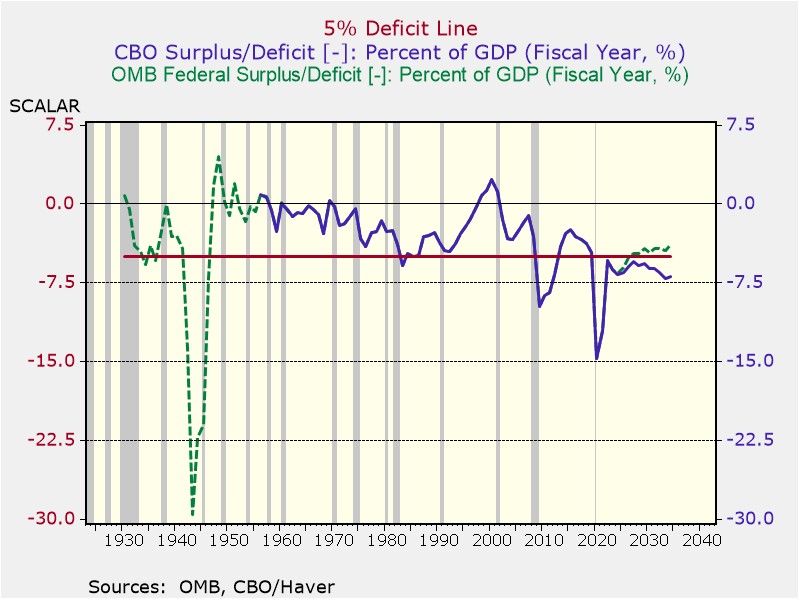

Fiscal spending is another key factor sustaining continued economic growth. This second chart shows the government deficit, which has largely expanded due to non-discretionary spending. Due to the non-discretionary nature of the increase and political gridlock, deficit spending is likely to continue in the near term which should support corporations as well as consumers. We note that, with the exception of the 1945 recession, the economy has never slipped into an official downturn when the fiscal deficit has been 5% or more of GDP.

We are likely to see inflation volatility in the near and medium term. In the medium to long term, due to structural reasons, inflation is likely to remain higher than we have generally experienced over the past decade. We expect the monetary policy response to be well-telegraphed and data-dependent. If inflation moves closer to the 2% target, the Fed could ease before year-end. Although we are now in the midst of the US election season, our expectation is that Fed policymakers will continue to be agnostic regarding the party in power among the branches of government and rely on economic data to guide them in their monetary policy decisions regarding the target fed funds rate and changes to the balance sheet.

STOCK MARKET OUTLOOK

Our outlook calls for solid domestic economic growth during the forecast period. Economic growth leads to demand and healthy margins, which benefit earnings, and also bolsters investor sentiment and valuations. This environment is typically supportive of risk assets and will generally be positive for all capitalizations. The mid-cap space, in particular, offers attractive valuations and therefore we continue to overweight US mid-cap equities. However, current higher interest rates do not equally affect all capitalizations. Small capitalization equities hold a larger proportion of floating rate debt, thus higher rates affect them disproportionately. Although we reduced our exposure to small caps slightly this quarter, we still find valuations attractive. To mitigate concerns about high interest rates affecting some small caps, we introduced a quality factor position, which screens for indicators such as profitability, leverage, and free cash flow.

While we remain cautious about the concentration risk in a handful of prominent growth equities, we believe economic conditions will support growth stocks, in general. Furthermore, the shift to passive investing should continue to spur growth stocks as long as the economy remains healthy. As a result, we shifted our growth/value style bias to even-weight.

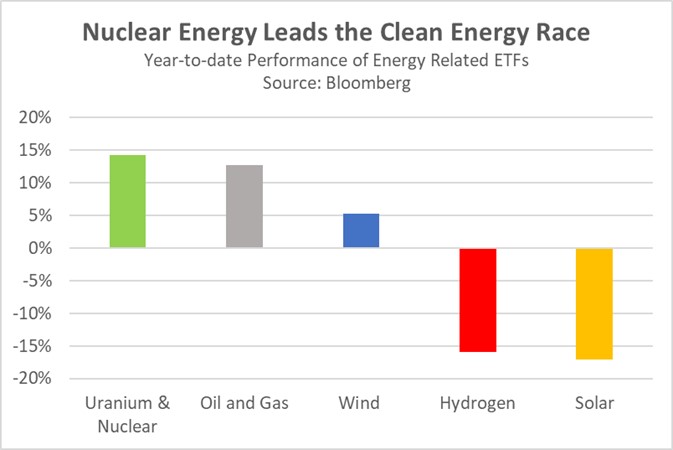

We maintain an overweight position in the Energy sector and Uranium Miners due to geopolitical tensions in the Middle East and sustainable energy transition policies. Additionally, we maintain our exposure to the military-industrial complex through investments in military hardware and cyber-defense.

International developed equities remain attractive due to valuation discounts. Many large global market leaders in the developed world ETF are trading at lower valuations relative to domestic large cap companies. We maintain our country-specific exposure to Japan due to ongoing shareholder-friendly reforms and continued capital inflows, which could potentially lead to multiple expansion.

BOND MARKET OUTLOOK

According to a 2018 report by the San Francisco Fed, since 1955 the two-to-10-year segment inverted six to 36 months before the onset of each of the last six recessions. Though the bond market recently marked 24 months since the two-to-10-year portion of the Treasury curve inverted (the longest streak on record), many are now questioning the validity of whether it still serves as a harbinger for recession. With the Fed remaining data-dependent regarding the fed funds rate, the likelihood is diminishing for multiple rate cuts this year. As a result, the yield curve has the potential to remain inverted for an extended period. Underscoring this potential is our expectation regarding heightened inflation volatility throughout the forecast period. Note that we are not expecting the absolute level of inflation to necessarily remain elevated, rather the volatility of the measure from one period to the next. Finally, the net issuance of Treasurys to finance the federal deficit, and notable declines in the proportion of Treasurys held by foreign central banks, indicates growing risk on the long end of the curve, which we find to be uncompensated. Consequently, our positioning is geared to intermediate-term maturities, which we find hold the most allure due to modest stability of rates and resultant limits to market risk.

Among sectors, mortgage-backed securities (MBS) are attractive. Most fixed-rate MBS prices are now well below par, which help address prepayment risk; at the same time, refinancing trends are low enough to limit incremental extension risk. In addition, the Fed’s intentions to dampen its MBS runoff from its $7.3 trillion balance sheet should also help limit spread widening.

Investment-grade corporate bonds are currently trading at relatively tight spreads of +93 basis points to Treasurys, lessening their appeal. Therefore, we find little reason to overweight investment-grade corporates in the strategies with an income component. Speculative grade corporates, however, still offer an attractive spread of +325 basis points. The backstop programs put in place over the past few years by the Fed and US Treasury, notably during COVID and the Silicon Valley Bank run, provide an implied element of support for lesser-rated bonds during crises. Nevertheless, caution dictates our preference for the higher BB-rated bonds in this asset class.

OTHER MARKETS

The position of gold within the commodities asset class is retained as a hedge against elevated geopolitical risks. Gold also presents an opportunity given increased price-insensitive purchasing by international central banks. As in quarters past, we note that international central banks are increasingly positioning gold as a reserve asset in fear of continued weaponization of the US dollar. In the more risk-tolerant portfolios, silver is maintained as an additional precious metal holding. As has been the case for over three years, real estate remains absent in all strategies as demand remains in flux and REITs continue to face a difficult financing environment.

Daily Comment (July 11, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! S&P 500 futures have cooled this morning following favorable inflation data. In sports news, England defeated the Netherlands in the semifinals and will now play Spain in the Euro final. Today’s Comment will begin by examining the significant role that momentum has played in the market rally, followed by a discussion on why uranium remains a commodity with substantial upside potential for investors. We will also provide an update on the UK in the wake of the Labour Party’s recent victory. As usual, the report will conclude with a roundup of international and domestic data releases.

Momentum Propels Large Cap: The S&P 500 leapt past 5,600 for the first time ever on Wednesday, as investors piled into large-cap stocks in anticipation of a Federal Reserve policy shift.

- The market surged following comments made by Fed Chair Powell during his second day of testimony on Capitol Hill. While speaking with lawmakers, Powell stated that although he does not believe the central bank is ready to cut interest rates, Fed officials will not wait for inflation to fall to the 2% target before making a cut and will do so regardless of the upcoming election. Risk assets rose following his remarks, with the S&P 500 climbing 1.0% on the day and the Magnificent Seven stocks increasing by 1.2%.

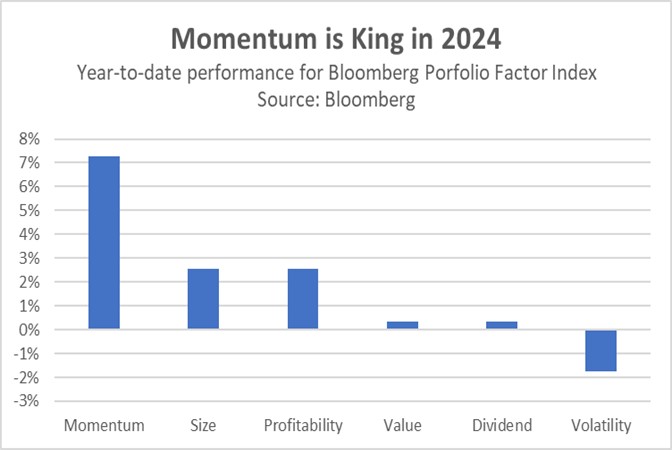

- The S&P 500’s record high might mask a troubling truth: many underlying companies lack the fundamentals to justify the rally. Bloomberg data confirms this, showing momentum chasing and a focus on large caps have dominated investment returns in 2024. Investors have been relentlessly buying a limited pool of large-cap stocks at any hint of good news, inflating their portfolios. In an uncertain economic climate with rising interest rates and inflation, investors are seeking stability and believe larger, established companies with growth potential will be better positioned to weather these headwinds.

- The S&P 500’s momentum dependence exposes it to steeper losses in the future. Mega-cap tech stocks, leading the large-cap surge, appear particularly inflated, making them more vulnerable if investor sentiment weakens. This concern is amplified as earnings season approaches and firms such as Nvidia are expected to meet lofty expectations. However, while we remain optimistic about equities overall, mid-cap and small-cap stocks might be better suited for this environment. They offer not only a lower correction risk but also the potential for more upside if interest rates fall.

Uranium Popularity: While renewables gain momentum, nuclear energy from uranium remains a powerful tool for countries transitioning away from fossil fuels.

- On Wednesday, President Biden signed legislation aimed at promoting the development of advanced nuclear reactors. The new law will cut licensing times and processing fees, making it easier for companies to bring these clean energy sources online. While nuclear power currently generates about 20% of US electricity, development has been hampered by cost concerns and unpredictable permitting timelines. The passage of this legislation should make it easier for firms to capitalize on clean energy incentives and offer potential solutions to concerns over the rising energy use of artificial intelligence (AI) technology.

- Fueled by the insatiable energy demands of AI, big tech giants are leading the charge in adopting nuclear power. A Wall Street Journal report reveals that one-third of US nuclear plant owners are in talks with tech firms to discuss the powering of data centers, with Amazon on the cusp of a deal with the nation’s largest nuclear company. This surge in demand is prompting utility companies like Dominion Energy Virginia and Bill Gates’ TerraPower to develop the first of their own commercially viable small modular reactor (SMR) in the US.

- Uranium and nuclear power stocks have skyrocketed this year, eclipsing the broader market. This surge is likely driven by a widening supply-demand gap for uranium. Booming AI and the global push for clean energy are fueling demand, while uranium production capacity lags behind. To bridge this gap, countries are expected to invest heavily in SMRs due to their lower cost and faster deployment timelines. While a near-term correction can’t be ruled out, we believe nuclear companies remain a compelling long-term investment.

The UK Comeback: A surprise surge in economic growth has likely eased concerns about the UK’s debt burden, but also strengthens the case for keeping interest rates high.

- The UK economy defied expectations with a robust 0.4% expansion in May. This is a significant improvement over the previous month’s flat growth and double the forecasted rate for the period. The surge was fueled by a rebound in construction activity, which had been lagging for three months, and an increase in manufacturing production. This positive data strengthens the Labour Party’s position as they navigate economic policy. They can potentially avoid austerity measures while still promoting growth, all within the constraints of fiscal rules that require a balanced budget.

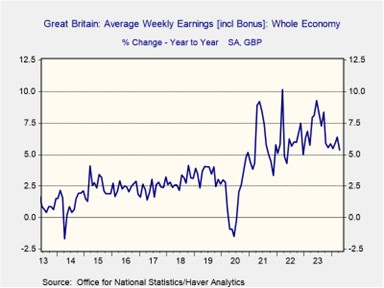

- However, the stronger-than-expected economic data likely diminishes the prospect of an interest rate cut at the next Bank of England meeting. The central bank had previously anticipated a slowdown to 0.2% growth in the second quarter, down from 0.7% in the first. The recent data suggests the quarter will exceed the estimates. Further complicating a rate cut, some voting members, including Huw Pill, have reportedly expressed concerns about high services inflation and wage growth leading to further price pressures.

- Strong economic growth is poised to bolster the attractiveness of UK assets, especially for value investors seeking bargains. British companies currently trade at a discount compared to their US peers, presenting a potential opportunity. Furthermore, the prospect of the Bank of England maintaining higher interest rates for longer than the market anticipated at the start of the year should help stabilize the pound (GBP) against the US dollar. While we remain skeptical of the UK market due to the Labour Party’s proposals, the overall sentiment towards the pound is improving.

Other News: Prominent Democrats and donors continue to urge Joe Biden to step aside, highlighting ongoing uncertainty about the party’s presidential nominee. In other news, Apple will not face fines from the EU after deciding to allow other providers to use its wallet technology for free. This decision underscores the impact of regulations on Big Tech earnings. Meanwhile, US officials are frustrated with India and Saudi Arabia for maintaining relationships with both sides of the conflict in Ukraine. This development illustrates how some countries can avoid aligning exclusively with either the US or China.

Daily Comment (July 10, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Equity futures are off to a great start ahead of Federal Reserve Chair Powell’s second day of testimony. In sports news, Spain has successfully knocked out France in the Euro semifinal. Today’s Comment discusses how Powell has opened the door for a policy shift, the reasons emerging markets are likely to continue building up their gold reserves, and why Brazilian President Lula may be forced to make uncomfortable decisions to protect the country’s currency. As usual, the report includes a roundup of international and domestic news.

Powell Talks to Congress: The Fed Chair mostly stuck to the script during his testimony, but he gave subtle hints that the central bank might be considering goals beyond its inflation mandate.

- Fed Chair Jerome Powell expressed growing concern about the labor market for the first time on Tuesday. During his testimony, he mentioned that recent employment data prompted him to reconsider his views on the economy, as unemployment rose to 4.1% in June, slightly above the median year-end estimate outlined in the Fed’s summary of economic projections. While he acknowledged that further measures are necessary to achieve the Fed’s 2% inflation target, he cautioned that an excessive focus on inflation could negatively impact the economy.

- While Powell did not specify a timeline, the market still anticipates a rate cut from the central bank in September. The latest CME Fedwatch tool shows that investors believe there is a 75% chance the central bank will lower interest rates before the election. This is a sharp increase from over a month ago, when the indicator suggested a less than 50% chance. The boost in confidence appears to be a response to a string of weaker-than-expected economic data over the last couple of months. In addition to a rising unemployment rate, retail sales and personal consumption have also been disappointing.

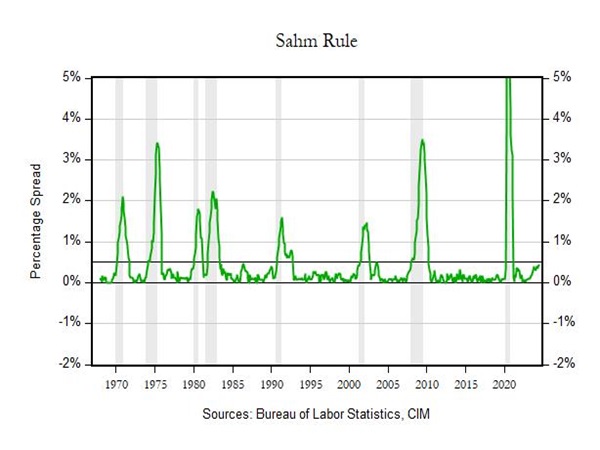

- Powell’s testimony before Congress reinforces our earlier view from May that the Fed is preparing for a rate cut based on labor market conditions rather than inflation. Since we made that call, the unemployment rate has risen for the fourth consecutive month and is now approaching the Sahm Rule threshold, an indicator of recession. The Sahm Rule is triggered when the three-month moving average of the unemployment rate climbs 0.5% above the lowest rate of the past 12 months. If the unemployment rate reaches 4.2% within the next two months, it may be sufficient to prompt a rate cut.

Bullion on the Rise: More emerging market countries are showing a preference for holding gold as they look to diversify their reserve holdings.

- Nigerian lawmakers are drafting legislation that would empower the Central Bank of Nigeria to hold a larger share of its reserves in gold. The bill prioritizes domestically produced gold for acquisition and proposes raising the minimum gold reserves from 4% to at least 30% of total external reserves. The decision to ramp up the holdings comes as the country struggles to contain its inflation and repay its debts, since a rising US dollar has made imports more expensive and interest payments more burdensome.

- Emerging markets are increasingly diversifying their foreign reserves, reflecting concerns about the West’s use of the dollar as a financial weapon after Russia’s invasion of Ukraine. This trend is likely to continue as these countries aim to increase their gold holdings, which currently represent only 6% of their reserves, roughly half the level in developed markets. Notably, India repatriated 100 tons of gold from the UK just before its recent elections, and China had been actively accumulating gold for 18 months, adding 300 tons before pausing purchases in May.

- While Nigeria’s actions alone might not significantly impact global markets, emerging markets as a whole have the potential to do so. Their increasing holdings of reserve currencies reflect a broader trend likely to be followed by other central banks in these economies. However, the People’s Bank of China (PBoC) will likely be the most watched central bank during this transition as it seeks to reduce its reliance on the US dollar. As a result, we expect gold prices could be on the verge of an upward trend over the next few years.

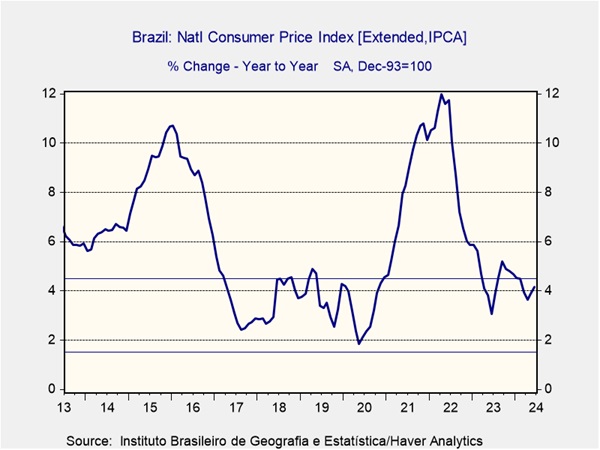

Lula and the Currency: Brazilian President Luiz Inácio Lula da Silva’s plan to deliver renewed economic prosperity is under threat as the Brazil real continues to plummet against the dollar.

- On Tuesday, Gabriel Galipolo, the overseer of currency intervention in Brazil, stated that he does not plan to prop up the currency without the full support of the central bank board. His comments come as the currency has fallen 10% since the start of the year, making it the second-worst-performing currency in Latin America behind only the Argentine peso. While he has the power to use over 2.5% of the country’s international reserves to protect the currency, his reluctance appears to be driven by concerns that the market could undermine his efforts.

- The currency’s weakness stems from concerns about the country’s fiscal and monetary future. Earlier this year, Brazil relaxed its fiscal target for 2025, aiming for a balanced primary budget, which excludes interest payments, instead of the previous year’s goal of achieving a surplus. Additionally, there are concerns that Lula will replace the current central bank head, Roberto Campos Neto, with the aforementioned Galipolo. Although inflation remains within the 1.5% tolerance range of the 3% target, there are fears that Galipolo might cut rates prematurely to help boost growth.

- The attractiveness of Brazilian assets hinges on Lula’s ability to convince investors of his commitment to central bank independence and fiscal responsibility. His past criticism of the central bank has undermined its credibility as an independent institution. Additionally, a higher-than-expected increase in public spending has fueled concerns about his adherence to budget goals. In the short term, this trend is unlikely to change. However, a shift toward central bank independence and fiscal discipline could make Brazil a more attractive investment destination.

In Other News: Colorado Senator Michael Bennet has officially requested President Joe Biden to end his bid for re-election. This shows that Biden is still facing intense pressure to pass the torch. BP raised its outlook on demand for oil and gas as it sees a moderation in the clean energy transition. This could lead to higher energy prices.

Daily Comment (July 9, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with new color on the dangerous China-Philippines standoff in the South China Sea. We next review several other international and US developments with the potential to affect the financial markets today, including an impending shift in investment strategy by a major Japanese pension fund and several notes on US politics and economic policy.

China-Philippines: Amid the worsening tensions between China and the Philippines over disputed territory in the South China Sea, we are increasingly struck by the strong domestic political winds that appear to be pushing on Philippine President Ferdinand Marcos Jr. Popular opinion appears to be pushing Marcos to be more assertive against Beijing. Still, the president’s sister, Imee Marcos, in recent days has warned that her brother’s growing closeness to the US and strong moves against China could prompt Beijing to attack.

- Imee Marcos is a senator in the Philippine legislature. She is known to be close to Sara Duterte, the daughter of former President Rodrigo Duterte, whose foreign policy was initially much more deferential to China and uncooperative with the US.

- Rodrigo Duterte and Ferdinand Marcos Jr. eventually became allies in the country’s 2022 elections. When Marcos won the presidency, Sara Duterte was named as his vice president. Since then, former President Rodrigo Duterte has continued to express a view that the country must be stronger in protecting its sovereignty against China.

- However, it now appears Imee Marcos and Sara Duterte may be trying to undermine President Marcos’s stronger alliance with the US and efforts to bolster Philippine sovereignty, which has included a new defense cooperation agreement with the US in which Washington gained expanded access to Philippine military bases.

- Last week, Philippine Armed Forces Chief Gen. Romeo Brawner claimed the US offered to aid his country in its dispute with China, implying US willingness to help resupply the Philippine marines posted on a disputed shoal in the South China Sea. However, Brawner insisted Manila turned down the offer. Given the Biden administration’s extreme caution, Brawner could well be blowing smoke. Still, if his claim is true, it implies President Marcos may be sensitive to charges that he is getting too close to the US.

- Even if Imee and Sara have helped retard President Marcos’s embrace of the US so far, it isn’t clear that they can soften the broader public’s strong support for a more aggressive stance toward Beijing. That would keep alive the risk of a Philippine miscalculation that could draw the US into a direct conflict with China.

Hungary-Ukraine-Russia-China: Just a week into Hungary’s six-month stint chairing the Council of the European Union, Prime Minister Orban has ruffled feathers in Brussels with trips to Kyiv, Moscow, and Beijing, ostensibly seeking to facilitate peace talks between Russia and Ukraine. As noted in our Bi-Weekly Geopolitical Report from July 1, the chair of the Council has no authority to represent the EU in international affairs. Therefore, Orban’s theatrics appear aimed at bolstering his own image, embarrassing the EU, or both.

Japan: As the massive Government Pension Investment Fund starts prepping for its regular five-year strategy review in 2025, analysts say the recently improved performance of domestic assets implies a substantial shift back into Japanese stocks and bonds. Since the fund has more than $1.5 trillion in assets, any such shift could push prices for those assets upward, while taking some air out of the US and other foreign stocks or bonds to be sold. Analysts think the likely shift could also buoy the weak yen.

United Kingdom: In her first speech since the Labour Party took power, Chancellor Rachel Reeves said she had already seen data suggesting the UK is now in its worst fiscal position since World War II. She also announced that she has directed the Treasury to launch a review of the UK budget position, a move many observers fear could be a prelude to tax hikes when the new budget is introduced in the autumn.

United States-China: At the Hudson Institute yesterday, Republican Speaker of the House Johnson vowed his chamber would soon pass a series of new bills empowering the government to take even stronger economic measures against China. For example, Johnson said the House would vote on bills imposing new curbs on US investment in China and imposing tariffs on low-value imports that currently enter the US duty-free. Johnson’s vow is consistent with our view that US-China relations will likely continue to spiral in the near term.

US Fiscal and Trade Policy: Following up on Johnson’s remarks, the Republican Party yesterday released its platform for the November elections. The document clearly indicates the party would continue to pursue former President Trump’s “America First” foreign policy, protectionist trade policies, tax cuts, and deregulation. For example, the platform says the Republicans would:

- Impose base-line tariffs on foreign goods, using the income raised to cut taxes;

- Punish foreign countries that practice unfair trade;

- Revoke China’s “Most Favored Nation” trade status;

- Revive the US auto industry by cutting regulations; and

- Ban imports of Chinese vehicles.

US Politics: As many in the Democratic Party keep trying to convince President Biden to end his re-election bid because of his age, a new poll shows Biden’s national support down to 42% versus 43% for former President Trump. In a head-to-head matchup, the poll also puts Vice President Harris’s support at 42% versus 41% for Trump. Even though former Secretary of State Hillary Clinton isn’t being seriously considered, the poll puts her support at 43% versus 41% for Trump, while a hypothetical Harris-Clinton ticket would have the advantage at 43% versus 40%.

US Monetary Policy: Federal Reserve Chair Powell today begins his semiannual testimony to Congress. At 10:00 ET today, he addresses the Senate Banking Committee, and at the same time tomorrow, he’ll address the House Financial Services Committee. Powell is expected to say that while progress has been made in bringing down consumer price inflation, policymakers want to be more certain that price pressures are under control before they start cutting interest rates.

US Artificial Intelligence Frenzy: Corning, the maker of glass screens for televisions and smartphones, saw its stock price jump approximately 12% yesterday after boosting its guidance for second quarter revenues and profits. A key reason for the upward shift was good uptake of the company’s new optical connectivity products for generative artificial intelligence. The jump in the stock price suggests investors remain excited about AI and are still looking for new ways to participate in the frenzy.