Letter to Investors | PDF

Every four years, investors contemplate the upcoming presidential election and begin to worry in earnest that it will turn their world upside down. I hear from clients that their financial plans will all come crashing down if the “wrong” person is elected. Now, I realize that elections have consequences, and that many of those consequences are very important, even if they have little or nothing to do with your investment plans. Yet, it is my experience that most of us tend to overestimate the impact of presidential elections on our investment portfolios, often by a lot. While the upcoming election, like all presidential elections, is indeed momentous, and while the level of partisanship in America is at the highest decibel-level I’ve heard in many decades, I am rather optimistic for the stock market over the next several years for four reasons.

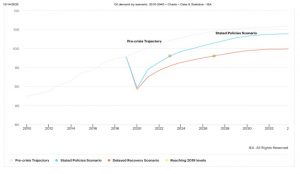

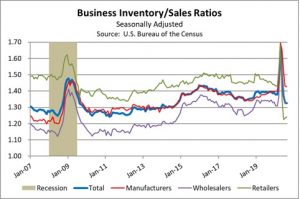

First, the American economy is now in recovery, having just experienced a recession. Our economists believe that the U.S. economy peaked and began to decline last February, but, in one of the shortest recessions on record, it appears to have hit bottom in July and is now on the way back up. The economy will likely take up to two years to exceed its pre-recession level of output, but it is obvious to us that it is now moving in a positive direction. There is rarely a better time to be an equity investor than during a recovery. While there is plenty of negative news during such a time (especially about employment, a lagging indicator), the market climbs its “wall of worry” during precisely such a time. This recession (due to pandemic) would have occurred regardless of who was in the White House, and I believe it will also recover regardless of who calls 1600 Pennsylvania Avenue home.

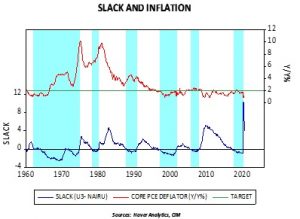

Second, the Fed is taking extraordinary action to support the U.S. financial system. As we saw in 2008, recessions turn into Great Recessions when economic troubles trigger collapses in the financial system. Such collapses almost always result from policy errors made by key financial system regulators, and we saw several such errors in the summer and fall of 2008. Regarding 2020, a wise friend recently said to me, “It’s as if the Powell Fed read the history of 2008 and was determined not to make any of those mistakes.” Many are worried that such Fed policies will produce inflation. We heard this 12 years ago also. But, in the context of our current economic state, especially enormous globalization, high inflation of goods prices is unlikely. Instead, like the aftermath of 2008, we are more likely to see inflation of asset prices, especially financial assets such as equities.

Third, the lethality of COVID-19 is likely to subside and come under control over the next two years. I say this not as a medical expert, but as an observer of past epidemics. Viral pandemics run their course due to mutation, to herd immunity, and, in the modern world, to effective medical weaponry such as vaccines and anti-virals. In fact, we are already seeing lower mortality around the world. Since the economic recession was induced by this virus, its almost certain subsidence should bring increasing economic activity, which is good for stock prices.

The problems noted above rose and began to fall with no regard to whom the president was. This is not unusual. This is how most cyclical bear markets in stocks begin and end. Our noisy political news environment would like you to believe that everything bad that happens, from recessions to hurricanes, and everything good that happens, from booming economies to beautiful spring days, occur because of who is in the White House. One of the most important lessons to be learned in investing is that almost none of that is true. And, right now, the above three trends are moving positively regardless of political activity.

I said there was a fourth positive factor: soon the presidential election will be behind us. I’m not being facetious. After all the yelling and screaming is over, the nation’s attention will go back to work again. Now, I’m aware that this year there is a heightened potential for not having a result on election night, primarily (again) due to the pandemic. As in November 2000, this scenario would probably frighten the markets and lead to a short-term sell-off in stock prices, a decline that would probably continue until a result is achieved. Once achieved, the positive factors noted above (recovering economy, supportive Fed, and subsiding pandemic) would likely immediately command the market’s attention and, in my opinion, the cyclical recovery in stocks would resume.

The above opinions are not borne from “cock-eyed” optimism, but from decades of observations of both economic and presidential cycles. The stock market is neither Republican nor Democrat but is solely interested in making money. In my opinion, the current environment is well-suited to doing just that, regardless of who wins the election.

We appreciate your confidence in us.

Gratefully,

Mark A. Keller, CFA

CEO and Chief Investment Officer