Business Cycle Report (August 29, 2024)

by Thomas Wash | PDF

The business cycle has a major impact on financial markets; recessions usually accompany bear markets in equities. The intention of this report is to keep our readers apprised of the potential for recession, updated on a monthly basis. Although it isn’t the final word on our views about recession, it is part of our process in signaling the potential for a downturn.

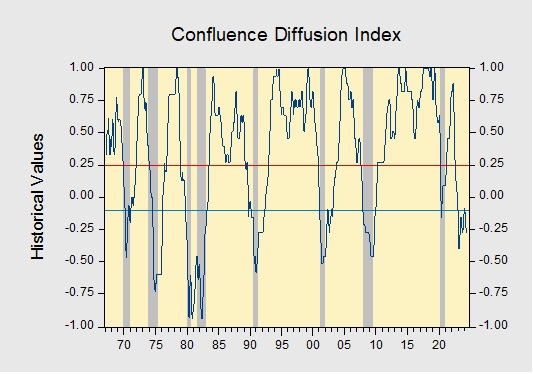

The Confluence Diffusion Index remained in contraction. The July report showed that seven out of 11 benchmarks are in contraction territory. Last month, the diffusion index fell slightly from -0.2727 to -0.2818, below the recovery signal of -0.1000.

- Fed rate cut speculation helped push down interest rates.

- The goods-producing sector showed slight improvement but remains weak.

- The labor market showed signs of deterioration.

The chart above shows the Confluence Diffusion Index. It uses a three-month moving average of 11 leading indicators to track the state of the business cycle. The red line signals when the business cycle is headed toward a contraction, while the blue line signals when the business cycle is in recovery. The diffusion index currently provides about six months of lead time for a contraction and five months of lead time for recovery. Continue reading for an in-depth understanding of how the indicators are performing. At the end of the report, the Glossary of Charts describes each chart and its measures. In addition, a chart title listed in red indicates that the index is signaling recession.