Business Cycle Report (January 26, 2023)

by Thomas Wash | PDF

The business cycle has a major impact on financial markets; recessions usually accompany bear markets in equities. The intention of this report is to keep our readers apprised of the potential for recession, updated on a monthly basis. Although it isn’t the final word on our views about recession, it is part of our process in signaling the potential for a downturn.

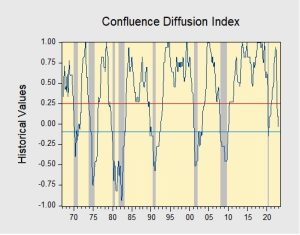

The Confluence Diffusion Index fell further into contraction territory in December. The latest report showed that seven out of 11 benchmarks are in contraction territory. The diffusion index declined from +0.091 to -0.03, below the recession signal of +0.2500.

- Hawkish Fed policy weighed on financial indicators

- Most of the manufacturing indicators have dipped into contraction territory

- The labor market remains tight despite a slowdown in hiring

The chart above shows the Confluence Diffusion Index. It uses a three-month moving average of 11 leading indicators to track the state of the business cycle. The red line signals when the business cycle is headed toward a contraction, while the blue line signals when the business cycle is in recovery. The diffusion index currently provides about six months of lead time for a contraction and five months of lead time for recovery. Continue reading for an in-depth understanding of how the indicators are performing. At the end of the report, the Glossary of Charts describes each chart and its measures. In addition, a chart title listed in red indicates that the index is signaling recession.