Daily Comment (April 4, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Russia-Ukraine war, where the big news is the apparent discovery of widespread atrocities carried out by Russian troops in the areas they are currently withdrawing from. We next review a range of international and U.S. developments with the potential to affect the financial markets today. We wrap up with the latest news on the coronavirus pandemic.

Russia-Ukraine: Multiple reports over the weekend appeared to confirm that Russian forces are withdrawing from around the capital city of Kyiv and other major urban centers to focus their attacks on the Donbas and other areas in eastern and southern Ukraine. As the Russians pull back from the western and northern areas of the country, Ukrainian authorities are finding extensive evidence of war crimes, especially in the city of Bucha. The bodies of civilians were found with their hands tied behind their backs and shot in the head, as well as dead women who had been raped and had their bodies burned. Other reports have indicated massive looting by Russian soldiers as they pulled out of the area. Meanwhile, British Prime Minister Johnson told ministers he wants to arm Ukraine with anti-ship missiles to prevent Russian bombardment and attacks on the southeastern port city of Odesa, which was the target of Russian missile strikes over the weekend.

- The well-verified reports of civilian massacres, summary executions, and rapes have given the major European countries a taste of what they’re in for if Russian aggression is left unchecked. The reports have prompted a range of European countries to consider additional sanctions against Russia, possibly including a ban on Russian energy imports. For example, French President Macron today said he would be in favor of an EU ban on Russian oil and coal imports.

- Evidence of heinous acts approaching those of Nazi Germany during World War II will likely spur additional weapons transfers to Ukraine as well.

- Ultimately, if the fighting intensifies and Russian brutalities expand, it would not be surprising to see increased calls for outright intervention in the conflict.

- Notably, even the widespread evidence of these brutal acts of violence hasn’t been enough to sway China from its support for Russia. Indeed, as of this writing, the Chinese government has made no statement regarding the apparent war crimes in Ukraine. On Chinese social media, posts containing images of the atrocities remained available today, with a few users expressing horror at the news, but the Chinese microblogging platform Weibo was filled with posts by prominent bloggers questioning the veracity of the photos of corpses and blaming the violence on Ukrainian “Nazi” fighters.

- Chinese President Xi is trying to strike a balance between his “limitless” support for Russian President Putin and looking neutral enough to avoid being tied too closely to the Ukrainian invasion and atrocities.

- Despite Xi’s balancing act, however, his refusal to condemn Russia, despite the ongoing violence, suffering, and war crimes, could well draw increasing opprobrium and help build pressure in the West to impose economic and financial costs on China as well.

- In other words, by refusing to distance China from Russia, Xi is risking further isolation and a faster fracturing of the global economy into separate blocs, as we’ve been warning. If so, it would suggest that investors in Chinese securities will face even more risk of a clampdown on capital flows and loss of value, despite recent signs of thawing in the U.S.-China dispute over audits for Chinese firms listed in the U.S.

- Regarding the economic impacts of the war, the sanctions on Russia and the shutoff of Russian mineral supplies continue to push key commodity prices up, even though energy prices have moderated a bit in response to Western countries’ decision to release oil from their reserves and China’s demand-sapping coronavirus clampdowns. A new report by Farasis Energy says the cost of the nickel, lithium, and cobalt needed for a 60KWh battery, enough for a large SUV, rose from $1,395 a year ago to more than $7,400 in early March.

Hungary: In elections yesterday, a coalition led by Prime Minister Viktor Orban’s party evidently won 135 of the 199 seats in parliament, giving the Russia-supporting Orban a fifth four-year term in power. With Orban’s victory, Hungary is likely to put a brake on further EU sanctions against Russia and complicate NATO’s response to the Russia-Ukraine war.

Serbia: In its elections yesterday, Serbia re-elected hardline populist President Aleksandar Vucic and gave his party the largest number of seats in parliament. Vucic has come under strong international pressure over his refusal to impose economic sanctions on Russia for its attack on Ukraine. Even with his re-election, he is not expected to change course dramatically on that stance, given many of his voters sympathize with Russia’s campaign against Kyiv and resent the West, which bombed Belgrade during the Yugoslav wars in 1999.

China-Hong Kong: As we suggested last week, Hong Kong Chief Executive Carrie Lam said she won’t seek a second five-year term in office in the municipal elections this spring. Sources say Lam’s deputy, hardline former security minister John Lee, will probably seek the position. In any case, Lam’s absence from the race will allow Beijing to impose a tougher, security-focused official who would more likely hew the central government’s line on policy.

Pakistan: Over the weekend, Prime Minister Khan survived an attempted no-confidence vote in parliament, after which the country’s president dissolved parliament to prepare for new elections to be held within 90 days.

Costa Rica: In elections yesterday, former World Bank economist Rodrigo Chaves came out ahead with 53% of the vote. Chaves has vowed to renegotiate last year’s $1.8 billion loan from the IMF aimed at supporting the country’s economic recovery from the pandemic, and he has indicated that he wants to strengthen trade ties in the Asia-Pacific region and attract more Chinese tourists.

- Chaves’s party will only have 10 seats in the country’s 57-seat congress, so he will have to rely on coalitions to pass legislation.

- Nevertheless, his plans to strengthen ties with the Asia-Pacific region, and China, in particular, could be a test of how much investor-friendly globalization survives now that the war in Ukraine has accelerated the forces of deglobalization around the world.

U.S. Economy: In his widely followed annual stockholder letter, Jamie Dimon, CEO of JPMorgan (JPM, $135.31), offered an upbeat read on the U.S. economy, saying consumers and businesses are flush with cash, wages are rising, and the economy is growing rapidly after its pandemic slowdown. Nevertheless, he also warned that the war in Ukraine could collide with rising inflation to slow the pandemic recovery and, consistent with our concerns, potentially alter global alliances for decades to come.

- Separately, high-frequency spending data shows consumers are starting to cut costs on mainstays from toothpaste to baby formula as inflation finally hits consumer staples.

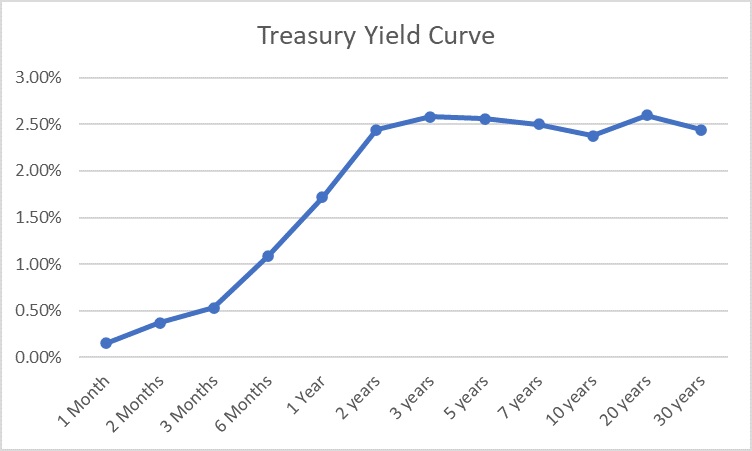

- Meanwhile, investors continue to bet that the Federal Reserve’s panic over inflation will prompt it to hike interest rates aggressively in the coming months, potentially pushing the economy into recession. As a result, the yield curve solidly inverted late last week (see chart below), and it remains in inversion so far this morning. At this writing, the yield on the 10-year Treasury note stands at 2.375%, while the yield on the 2-year Treasury note has risen to 2.416%.

Source: SeekingAlpha.com

Global Government Debt: As governments around the globe try to shield their citizens from galloping inflation by offering subsidies and other support, their efforts are boosting already high government debt just as borrowing costs are rising. For some countries, the increase may prove too much to afford, raising the specter of political unrest and the risk of debt crises in the future.

COVID-19: Official data show confirmed cases have risen to 491,498,231 worldwide, with 6,153,320 deaths. In the U.S., confirmed cases rose to 80,155,446, with 982,566 deaths. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) Meanwhile, in data on the U.S. vaccination program, the number of people who are considered fully vaccinated now totals 217,834,304, equal to 65.6% of the total population.

In the U.S., the seven-day average of people hospitalized with a confirmed or suspected case of COVID-19 came in at 15,949 yesterday, down 28% from two weeks earlier.

- The new coronavirus wave continues to worsen in some parts of Europe and Asia, particularly in China. Today, Shanghai began testing all 25 million of its residents for COVID-19, aided by thousands of medical workers who arrived over the weekend from across the country. The entire city is now effectively under a lockdown that was meant to be in its final days.