Daily Comment (April 10, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are digesting the latest inflation figures while Lionel Messi’s double-strike propelled Inter Miami past LAFC into the CONCACAF semifinals. Today’s Comment will focus on President Trump’s decision to roll back tariffs, insights from the latest Fed minutes, and other major market-moving news. As always, we’ll include comprehensive summaries of today’s domestic and international economic releases.

Trump Reversal: US stocks experienced a rally following the administration’s tariff reductions on most nations, excluding China, which saw an increase to 125%. Despite the market’s positive initial response, persistent uncertainty remains.

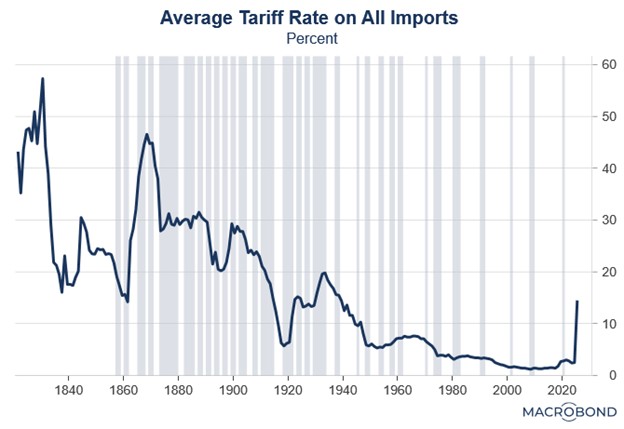

- The US agreed to postpone new tariffs for 90 days while pursuing trade negotiations with partner nations. Markets responded positively to the decision, where the average tariff rate would fall from 23% to 10% — a development that alleviated concerns about supply chain instability and potential economic contraction. The policy shift triggered a significant market rally, sending the S&P 500 up 9.5% and propelling each “Magnificent 7” stock to gains exceeding 10%.

- While markets welcomed the policy reversal, uncertainty persists over the trade war’s trajectory. The president’s baseline tariffs remain in effect, pushing the average import tax rate for non-China trade partners to 15.7%. This includes the 25% tariffs still applied to Canadian and Mexican goods not covered by USMCA provisions. According to White House data, only 38% of Canadian imports and 50% of Mexican imports currently comply with the agreement’s standards.

- It seems that the administration is seeking to condition markets to become less reactive to tariff announcements. The current pause may serve two key purposes by demonstrating presidential flexibility while also normalizing the recently imposed 10% tariffs as a sustainable baseline. This calculated approach should help stabilize markets as the price impact of these import taxes gradually filters through the economy. A major unknown is how consumers will respond to the eventual price shock.

Trade Friends Not Enemies: While the White House has shown limited interest in bringing down newly implemented tariff rates, it does seek to use trade tensions to form an alliance against China.

- The US decision to pause the increase in tariffs has been widely viewed as a step in the right direction, though questions remain about how far the White House is willing to go in implementing reciprocal tariffs. Kevin Hassett, one of the White House’s economic advisors, suggested potential tariff rates below 10% might be possible, though he cautioned this would require an “extraordinary” trade deal to justify such reductions.

- While this decision has provided some market reassurance, uncertainty persists regarding whether other nations will refrain from retaliatory measures. The EU has agreed to delay its metal tariffs by 90 days, and while Canadian Prime Minister Mark Carney welcomed the announcement, Canada has not yet committed to any tariff relief.

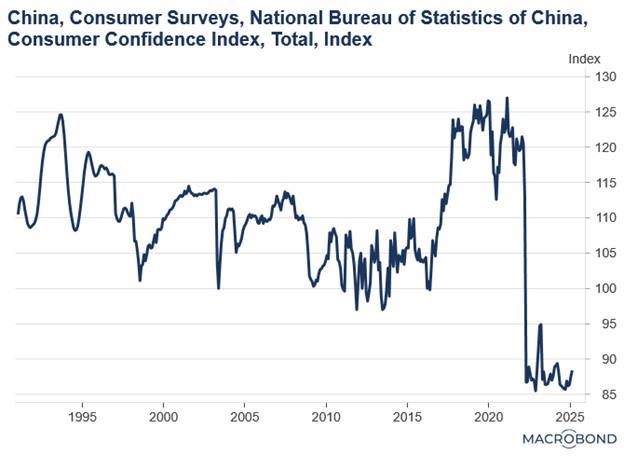

- China is bracing for tariff fallout, with leaders meeting today to discuss stimulus measures. The package will target housing, consumer spending, and tech innovation to protect growth. Since growth has slowed in China, speculation has swirled about Beijing deploying its “stimulus bazooka,” large-scale measures to revive an economy facing prolonged sluggish growth.

- Treasury Secretary Scott Bessent hinted that the White House may pursue a collective approach with allies to coordinate their approach toward China. His remarks seem to reflect a long history of the US trying to coalesce its allies into joining its efforts to isolate China. It also comes as Spain has been urging the EU to deepen economic ties with Beijing, aiming to reduce reliance on the United States.

- Markets may be underestimating the psychological strategy at play. By first imposing 10% tariffs and then escalating to far higher levels, the initial increase appears modest by comparison. The use of “reciprocal tariffs” was designed to encourage global tariff reductions in exchange for US concessions. Yet, America’s traditionally low tariffs offered little bargaining power.

- The updated tariff framework strengthens Washington’s leverage, pressuring allies to align their trade policies with its China strategy. Notably, US tariffs on Chinese goods are now so high that they will likely redirect Chinese exports away from the US and toward Europe — further fueling protectionist sentiment on the Continent. Ultimately, this policy may reinforce Europe’s perception that it must collaborate with the US to counter China.

- The key unknown is the size and scope of China’s stimulus measures. A substantial spending package could help restore consumer confidence, which has remained weak since the pandemic. It could also boost domestic demand, reducing the economy’s reliance on foreign consumption of its goods.

Fed Stagflation Worries: Fed minutes showed officials’ fears about stagflation, while balance sheet reduction faced strong opposition despite broad support.

- Nearly all FOMC members expressed concerns that inflation risks remain skewed to the upside, while employment risks also appear elevated. This outlook will likely compel policymakers to adopt a cautious, wait-and-see approach when adjusting monetary policy. These concerns arise as central bankers wrestle with the potential economic fallout from the Trump administration’s trade war.

- Despite the Fed’s reluctance to commit to rate cuts amid ongoing uncertainty, markets are still pricing in three potential rate cuts this year, exceeding the two projected in the Fed’s latest economic outlook. This divergence suggests investors see elevated recession risks due to the ongoing trade war, which therefore keeps expectations for further monetary easing alive.

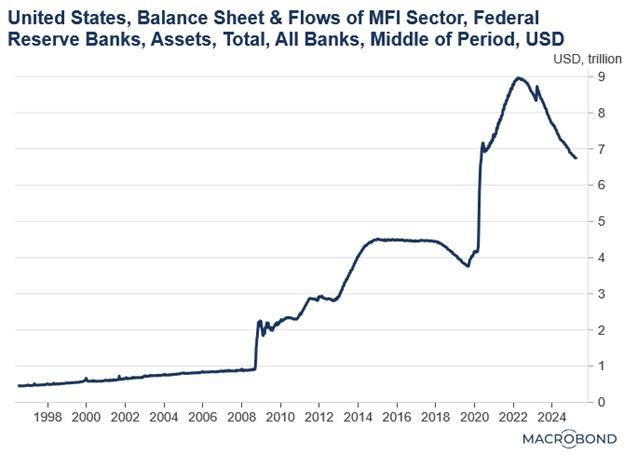

- Regarding the balance sheet, policymakers appear divided on whether the reduced pace of unwinding was appropriate. The decision stemmed from concerns about preserving sufficient reserve buffers after Congress suspended the debt ceiling. Since January, Treasury’s drawdown of its General Account (TGA) to fund government operations — while Congress negotiated the debt limit — has created distortions in reserve markets, as these flows directly impact liquidity in the commercial banking sector.

- While Fed Governor Christopher Waller was the only dissent, several others pushed to maintain the original pace of balance sheet unwinding. Their reluctance was due to concerns that it could compromise the Fed’s balance sheet normalization efforts. They believed alternative tools would have been sufficient to address reserve concerns. Specifically, an adjustment to the reverse repo facility rate could have provided an effective alternative, injecting needed liquidity to prevent a problem.

- Thus far, market impacts appear contained despite elevated uncertainty. While recent bond market volatility reflects trade war concerns, Cleveland Fed President Beth Hammack noted that while financial markets are under strain, they continue to function effectively. That said, we should emphasize that the Fed stands ready to intervene if necessary — either through balance sheet expansion to address liquidity shortages or by cutting the federal funds rate to mitigate solvency risks.

Chinese Troops in Ukraine: Two Chinese nationals were caught fighting for the Russian army, in a sign that the war may be broadening.

- Ukrainian officials have accused China of not taking sufficient measures to stop its citizens from enlisting in the Russian military, with estimates suggesting up to 150 Chinese fighters may be involved. If confirmed, this would represent the strongest indication yet of Chinese support for Russia’s invasion and will likely call into question the country’s claim of being neutral in the war. Following the allegation, the White House threatened to take action.

- The discovery of Chinese military involvement is poised to significantly escalate US-China tensions, particularly as Washington seeks to broker an end to the war in Ukraine. This support could substantially strengthen Russia’s negotiating position by demonstrating its capacity to prolong the conflict with Beijing’s backing. Moreover, it serves as stark evidence that American attempts to isolate Moscow and draw it away from Chinese influence may ultimately prove unsuccessful.

- A critical unknown remains how the EU will respond to these developments. Over the last few years, the bloc has repeatedly urged China to intervene and restrain Russia’s aggression in Ukraine. European leaders have even cautioned that Beijing’s support for Moscow risks triggering a fundamental divergence in their bilateral relations.