Daily Comment (April 16, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The markets are weighing the latest retail sales. In sports, both the Golden State Warriors and Orlando Magic have clinched playoff berths in the NBA. Today’s Comment will focus on interpreting what import prices indicate about inflation pressures, examine the White House’s growing openness to tax increases, and analyze other key market developments. As usual, the report will include a summary of domestic and international economic data releases.

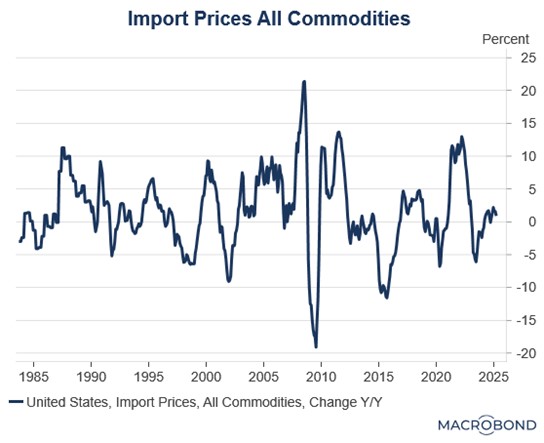

Tariff Update: Recent import price data suggests that tariffs have not yet translated into increased inflation. Nevertheless, trade concerns remain.

- The latest trade price figures revealed a 0.1% decline in import prices during the first complete month following the new tariff implementations. This was the first monthly decrease since September 2024. The downward movement was principally fueled by a significant 2.3% drop in petroleum prices. When excluding petroleum, import prices were unchanged from the previous month. Export prices also showed no meaningful change from the previous month’s levels.

- The muted inflationary impact of recent tariffs has provided temporary relief to policymakers, though uncertainty lingers regarding the Fed’s next moves. Boston Fed research shows import prices account for 10% of core PCE, comprising 6% from direct passthrough effects and 4% through secondary channels. This structural relationship has intensified market worries that sustained trade restrictions may keep monetary policy on hold through year-end, potentially delaying anticipated rate cuts.

- Nevertheless, several Fed officials continue to highlight lingering risks. Richmond Fed President Thomas Barkin cautioned that while businesses have managed to maintain inventories thus far, consumers could still face price increases by June. He further warned that ongoing tariff-related uncertainty may delay the timeline for potential rate cuts. Atlanta Fed President Raphael Bostic highlighted that the Federal Reserve would adjust its policy once it has a better understanding of where trade policy is going.

- This month’s import price data is significant because it indicates that the impact of trade restrictions on price pressures is currently lagging. This delay could be due to factors like discounts for bulk orders placed before tariffs or absorption of some tariff costs. Consequently, we caution that while tariffs will likely lead to higher costs for consumers and suppliers, the overall effects remain uncertain.

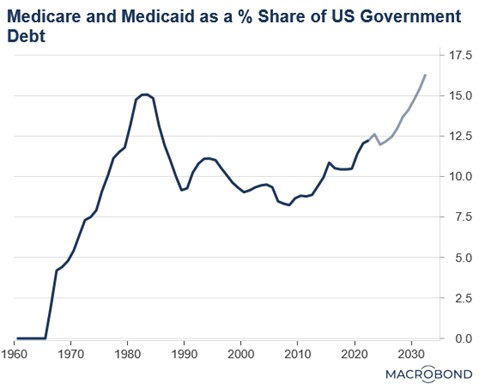

More Taxes: Raising taxes on wealthy individuals and corporations is gaining momentum within the Trump administration as it aims to offset the costs of proposed middle-class tax cuts.

- While no final decision has been made, President Trump is reportedly considering corporate tax rate increases as a potential revenue source to offset proposed payroll tax cuts. Simultaneously, Republican lawmakers are drafting legislation that would introduce a new 40% tax bracket for individuals earning over $1 million annually. These discussions emerge as the administration faces challenges in financing its new tax package.

- The proposal to increase the top marginal tax rate from 37% to 40% reflects growing Republican concerns about the deficit’s impact on national debt. While some GOP members worry that the new tax bill could exacerbate fiscal shortfalls, attempts to offset costs through cuts to Medicare, Medicaid, and Social Security face significant political resistance due to potential backlash.

- The GOP’s openness to tax increases represents a striking break with party orthodoxy, challenging its decades-long commitment to tax reduction — especially for top earners. This ideological evolution reflects the rising sway of populism in Republican economic policy. The shift coincides with a broader realignment of political coalitions, as affluent suburban districts increasingly favor Democrats while working-class areas trend Republican, a transformation years in the making.

- Proposals to raise taxes on corporations and high earners should be viewed skeptically until formally enacted into law. Even if included, such measures would likely be offset by other tax provisions and may primarily serve as political insulation against Democratic claims that Republicans favor the wealthy. That said, successful passage could establish a precedent for future wealth-focused tax increases, potentially reshaping the party’s fiscal approach to align with its evolving populist base.

Tech Concerns: A clouded outlook from ASML as well as new trade restrictions on chips has weighed on the tech sector.

- Dutch semiconductor equipment leader ASML has warned that persistent tariff uncertainty is significantly obscuring its visibility for 2025-2026. The company’s disappointing first-quarter net bookings — a critical forward-looking metric — fell short of analyst expectations, suggesting potential headwinds for the global semiconductor sector. Compounding these challenges, management acknowledged difficulty in quantifying the potential earnings impact of escalating trade tensions.

- Nvidia faces intensified regulatory challenges as the Trump administration expands its semiconductor export controls, adding the company’s flagship H20 AI processor to the China trade blacklist. The new restrictions, which require special licensing for all future China exports with no defined expiration, could force Nvidia to absorb a significant $5.5 billion Q1 write-down on previously approved shipments. This represents one of the largest financial hits yet from the ongoing US-China tech decoupling.

- One critical consideration throughout this trade war is monitoring companies with substantial foreign revenue exposure. These multinational firms face heightened risks as global markets adapt to escalating tariffs. Consequently, investors may find defensive opportunities in domestically oriented businesses that are less vulnerable to international trade disruptions.

Japan Test Case? The US has prioritized Japan as it seeks to establish a framework for trade negotiations with major global economies.

- Japanese negotiators are scheduled for direct talks with President Trump to address bilateral trade imbalances and ongoing military cooperation. While the Trump administration has indicated that it intends to maintain at least 10% baseline tariffs, Tokyo is reportedly advocating for their complete elimination. These discussions follow the US president’s recent push to impose 24% reciprocal tariffs on Japanese goods.

- Trade negotiations between the two will provide a lot of insight into the flexibility of the Trump administration, which has been known to drive a hard bargain. If they are able to show more leniency in response to getting some concessions from trade partners, then the market could regain the optimism that it had at the beginning of the year.

- Notably, the 10% baseline tariffs may be more negotiable than the Trump administration’s public position indicates. As we previously reported, President Trump’s chief economic advisor Kevin Hassett has suggested that exceptional trade concessions could justify rates falling below the 10% threshold. Should any trading partner successfully secure such terms, it would represent a significant policy shift.

- Market expectations have evolved significantly — where investors once demanded complete tariff elimination, they now view moderated tariffs as an acceptable outcome. This shift suggests cautious optimism that the Trump administration can balance its dual objectives of generating tariff revenue without the market disruption.