Daily Comment (April 19, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities are off to a great start following optimism that tensions in the Middle East might be easing. On the lighter side, NHL fans rejoice — the playoffs begin this Sunday! Today’s Comment examines the potential effects of rising interest rates on repo markets, explores signs of a slowdown in semiconductor demand, and discusses the growing anxiety among central banks outside the US regarding the resurgent strength of the dollar. As usual, our report concludes with a summary of domestic and international data releases.

Another Repo-calypse? The recent rise in Treasury yields has led to concerns about a squeeze in the short-term lending market.

- Recent hawkish comments from Federal Reserve officials have driven yields upwards on the 10-year US Treasury bond. While New York Fed President John Williams signaled a cautious approach by suggesting rate cuts are improbable in the near term, he didn’t entirely rule out the possibility of future hikes. Atlanta Fed President Raphael Bostic later offered a contrasting view, indicating that a rate cut in the final quarter is still a possibility. These remarks have further bolstered the market’s perception that interest rates may stay elevated for a longer period than previously expected.

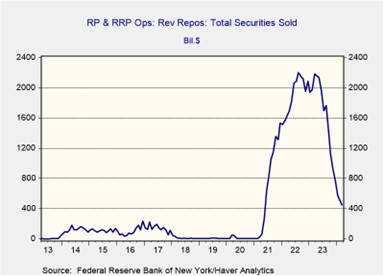

- The recent rise in interest rates has sparked concerns about a potential yield curve steepening, which could lead to funding stress. Higher interest rates incentivize investors to shift their funds towards higher-yielding, safer assets, such as the short-term Treasurys the government is issuing to meet its funding needs. This shift has consequently absorbed much of the excess liquidity, leading to a decline in the use of the reverse repo (RRP) facility, which has fallen to its lowest level since 2021, and is currently at $433 billion. Moreover, a sustained decline in RRP usage could lead to an excess reserve problem, potentially posing systemic risks in the financial system.

- The 2019 repo crisis serves as a stark reminder that disruptions in the short-term wholesale market can be a warning sign of an impending recession, even though they don’t directly cause one. Notably, each of the last four recessions was preceded by such disruptions. As the usage of the RRP continues to decline, we could see an increase in bond volatility. This, in turn, could raise the likelihood of a market correction. At this time there is no evidence of any sign of trouble, but investors could seek protection in commodities if conditions worsen unexpectedly.

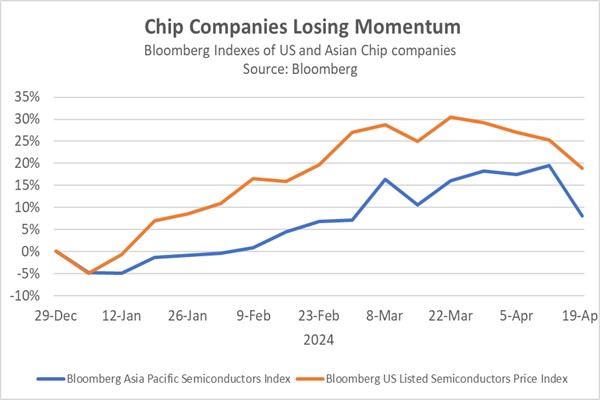

Chip Hype Fades: Semiconductor stocks are slumping amid growing concerns about future demand, particularly for consumer goods.

- On Thursday, Taiwan Semiconductor Manufacturing Company (TSMC) the world’s largest chipmaker, cut its 2024 chip market outlook due to a slowdown in the purchasing of smartphones and PCs. Excluding memory chips, they now expect the semiconductor market to grow around 10% this year. This revision highlights a widening gap between chipmakers supplying consumer electronics and those focused on AI-related services. The decline in Apple’s consumer products, exemplified by weak iPhone sales in China, contrasts sharply with Microsoft’s projected strong revenue growth in cloud computing, which fuels its AI efforts. This trend highlights the growing divide between hardware-focused companies and those leveraging cloud services for AI.

- The uncertain macroeconomic and geopolitical climate is likely to exacerbate the weakness in chip demand. While the US has shown some resilience this year, the global outlook remains precarious. The European Union and UK are struggling to stimulate economic growth, and China’s slowdown continues to be a drag on the world’s economy. This will likely disproportionately impact chip companies compared to other sectors due to their greater reliance on global markets. This lack of optimism is likely why Dutch chip equipment maker ASML posted lower-than-expected orders, as chipmakers are hesitant to ramp up production.

- TSMC’s earnings report underscores the waning enthusiasm for tech stocks in this volatile market. Rising interest rates, driven by the Fed’s tighter monetary policy, are prompting investors to seek alternative assets with higher yields than US Treasurys. This shift could trigger a sell-off in AI-related companies like Nvidia, particularly if earnings disappoint. Investors are increasingly questioning the sustainability of the AI boom. Even the “Magnificent Seven” tech giants, which started the year strong, may be forced to relinquish some of those gains in the coming weeks. Nevertheless, this doesn’t negate the potential value proposition of stocks beyond the traditional tech players.

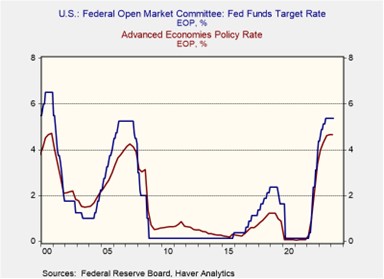

The Super Greenback: Fueled by hawkish rhetoric from Federal Reserve officials and robust US economic growth, the dollar’s surge against its peers has sparked international concern.

- The Bloomberg Dollar Spot Index has climbed to its highest level since October 2023, putting pressure on economies reliant on dollar-denominated imports. South Korea and Japan recently met with the US to address the issue. Their worries stem from currency depreciation, with the yen (JPY) trading around 154 per dollar and the won (KRW) nearing 1400 per dollar earlier this week. Both countries fear a stronger dollar could exacerbate inflationary pressures. While no immediate policy coordination was agreed upon, the group has committed to “close consultation.”

- A strengthening dollar is prompting central banks to reassess their policies. The People’s Bank of China has threatened currency intervention to deter speculative bets against the yuan (CNY). The Bank of Japan is also considering intervention and a potential interest rate hike later this year to curb the yen’s depreciation. In Europe, the European Central Bank (ECB), which previously anticipated a rate cut in June, may be forced to reconsider its dovish stance. Similarly, Sweden’s Riksbank has hinted that its potential rate cut in May might be jeopardized.

- The strong dollar and tightening global monetary policy have become key drivers of international markets in 2024, creating headwinds for many countries. While the global economic climate remains improved compared to last year, the outlook has somewhat dimmed. Interest rates are likely to stay higher than initially anticipated, potentially weighing on international equities, especially if the Fed maintains its hawkish stance. However, central bank interventions could mitigate some of these challenges by injecting more liquidity into the market, potentially offering some resistance to the dollar’s appreciation and supporting foreign equities.

In Other News: Israel launched a limited counterstrike against Iran on Friday. Tehran downplayed the retaliation, calling it insufficient, but the measured response may help prevent further escalation. The US Congress is nearing a vote on approving aid for allies, including Ukraine and Israel. In a separate development, Apple removed WhatsApp and Threads from its App Store in China due to pressure from Beijing. These issues highlight the growing geopolitical tension in the world.