Daily Comment (April 22, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with the latest bout of apparent capital flight from the US financial markets, which drove stocks sharply lower yesterday. We next review several other international and US developments with the potential to affect the financial markets today, including an ominous statement from China suggesting it will not accede to the demands underlying the US trade war against it and a new scandal involving US Secretary of Defense Hegseth.

US Capital Flight: As global investors continue to unload Treasury obligations and other US assets, data yesterday showed that foreigners in March posted a record $15.5 billion in net purchases of Japanese government bonds with maturities of 10 years or more. Along with the appreciation of the yen this year, the figures suggest that lower-risk Japanese assets have become an important safe haven now that investors are becoming increasingly negative on US economic growth and economic management.

- In a post on X yesterday, President Trump again pressured Federal Reserve Chair Powell to cut interest rates, arguing that, “There is virtually no [price] inflation.”

- Investors continue to fret that Trump could try to replace Powell with a Fed chair who would keep interest rates too low and fuel inflation. Those concerns are weighing heavily on US bond values and driving up yields. The result, as shown in the markets yesterday, has been weakening US stock prices, a falling dollar, and surging gold prices. In fact, gold prices are currently up another 1.2%, having earlier reached a new intraday record above $3,500 per ounce.

China-United States: The Chinese Ministry of Commerce yesterday released a statement saying that appeasement to the US in the face of the Trump administration’s tariff war would never be an option. The statement underlines China’s likely strong resistance to Trump’s demand for trade concessions, given the Chinese Communist Party’s decades-long commitment to burying the “Century of Humiliation” and achieving the “Great Rejuvenation of the Chinese People.” The statement suggests a very high risk that US-China tensions will continue to escalate.

- Beijing also signaled that it would retaliate against third countries that boost their tariffs or other trade barriers against China to mollify Washington.

- This suggests that Chinese leaders are sensitive to the risk that China could be isolated by coordinated Western trade barriers against it, even though Trump’s attacks on traditional US allies suggest that such a coordinated strategy would be hard to achieve.

China-South Korea: A new report in the Financial Times says China is building massive new fish farming facilities in the Yellow Sea between the Chinese mainland and South Korea. Officials in Seoul have become alarmed that the structures could be a new example of Chinese “gray zone” tactics to gradually seize control over South Korea’s territorial waters. If so, it would further heighten Chinese-South Korean tensions, likely pushing Seoul to be more amenable to the US’s new tariff policy to stay on the Trump administration’s good side.

United States-China-Southeast Asia: The US Commerce Department yesterday slapped massive new import tariffs on solar cells from Chinese-owned factories in Vietnam, Malaysia, Thailand, and Cambodia. Added to the Biden administration’s continuing broad tariffs of up to 300% on those countries, the total duty on the targeted facilities will exceed 3,500% (not a typo). The new duties are based on an analysis showing that heavily subsidized Chinese firms have been using their Southeast Asia facilities to export to the US at reduced tariff rates.

United States-India: Vice President Vance has been in India early this week, where he met with Prime Minister Modi to discuss ways to increase US exports to the country. Any trade deal would likely help India avoid the “reciprocal” tariff of 26% that the US imposed on it earlier this month before pausing it for 90 days. The discussions address not only Indian tariffs, but also a range of non-tariff barriers to US exports.

Spain: Prime Minister Sanchez today announced a new defense plan under which the country will boost its military budget to 2% of gross domestic product this year, up from just 1.4% last year. However, Sanchez warned that much of the new spending won’t be traditional defense investment in weapons, equipment, and troops. Rather, much of it would be quasi-civilian, such as upgrades to the Spanish telecommunications network to improve its resilience to cyberattacks.

- Given that the Soviet Union, China, and other heavily militarized countries long used a range of tactics to hide defense spending in ostensibly civilian budget accounts and off budget, we have often thought that the non-US members of the North Atlantic Treaty Organization could do the same in reverse, simply to counter US demands that they spend more on their own defense.

- For example, they could deem billions of euros of health, education, or other outlays as “defense related” and roll them into their defense budget, easily hitting the 2% defense burden demanded by President Trump.

- Nevertheless, the new Spanish defense plan will likely produce some real increases in traditional defense spending. As we have noted before, this is consistent with our view that European defense firms are likely to see continued new business, bigger profits, and higher stock prices as their countries rebuild their defenses against the increasing threat from Russia.

US Defense Policy: Adding to investor concerns about the Trump administration, Defense Secretary Hegseth is now embroiled in a new scandal on top of the one in which he discussed sensitive military operations on an unclassified Signal chat. It now appears that he also discussed those operations in a private chat involving his wife and personal lawyer. President Trump yesterday expressed his continued confidence in Hegseth, but Axios reports that the White House is already looking for a replacement.

US Pharmaceutical Industry: Swiss drug giant Roche yesterday said it will invest $50 billion in building new US factories over the next five years, including a new plant for weight-loss drugs and a facility to make glucose-monitoring devices. Separately, Regeneron said it will spend $3 billion to double its US manufacturing capacity.

- As with other similar announcements recently, it isn’t clear whether the investments have been spurred by the Trump administration’s tariff policies or whether they had been planned internally all along.

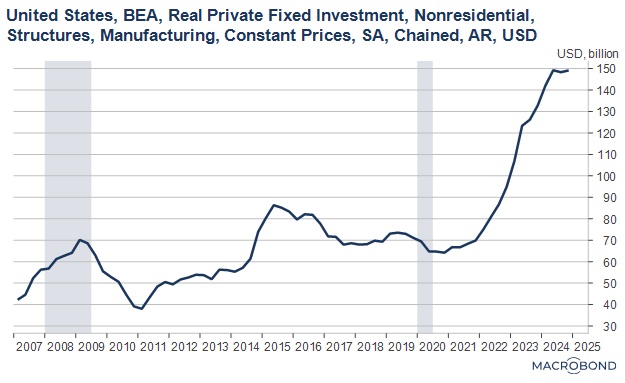

- In any case, the announcements confirm that new investment in US manufacturing facilities is currently very strong, even if it has plateaued a bit in recent quarters.