Daily Comment (April 24, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are keenly focused on the latest economic data. In sports, the Washington Capitals hold a strong 2-0 series lead over the Canadiens. Today’s Comment will examine resilient economic growth despite the headwinds and analyze the White House’s new trade exemptions. We’ll also highlight other key market movers. As always, we’ll provide a detailed roundup of domestic and international data releases.

Down But Not Out: While survey data points to a sustained deceleration in US economic activity, no clear signs of a recession have yet to emerge.

- The latest Beige Book indicated that most Federal Reserve districts are experiencing sluggish growth, with respondents expressing heightened uncertainty surrounding tariffs. Of the 12 districts, five reported modest growth, three remained flat, and four saw moderate contractions. Several regions also adopted a more cautious stance on hiring and investment due to shifting trade policies. Additionally, many districts raised concerns about rising input costs squeezing profit margins and pushing consumer prices higher.

- The weakness highlighted in the Beige Book was also reflected in recent business sentiment surveys, which pointed to a marked slowdown in the services sector. The latest S&P Global Purchasing Managers Index (PMI) remained above the growth threshold of 50 but moderated from the previous month, falling from 53.5 to 51.7. While manufacturing activity unexpectedly improved, rising from 50.7 to 51.2, this was offset by a sharp deceleration in the services sector, where the index dropped from 54.4 to 51.4.

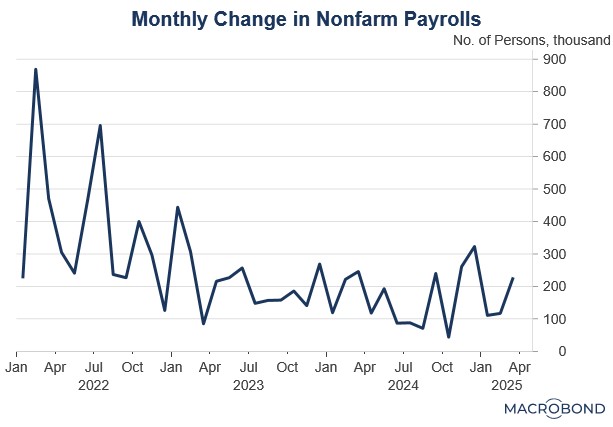

- While survey data suggests economic softening, these concerns have yet to manifest in hard data. The March payroll report showed resilient job growth of 228,000, with unemployment remaining at a relatively low 4.2%. This labor market strength underscores that current caution among businesses doesn’t necessarily reflect fundamental weakness. Consequently, the economy appears likely to maintain its momentum in the near term, with significant tariff-related impacts still on the horizon rather than immediately threatening growth.

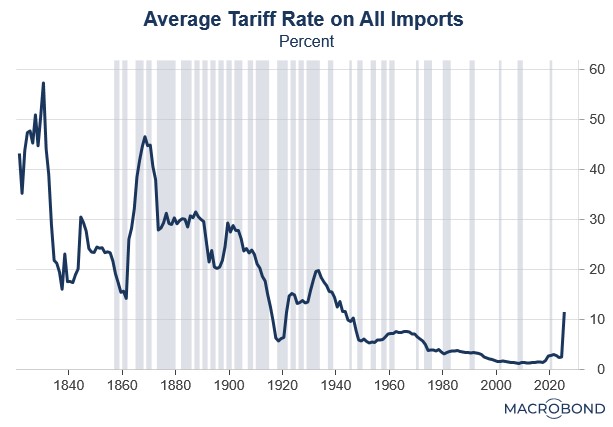

New Exemptions: Under pressure from lobbyists and state officials to scale back recent import tariffs, President Trump is mulling new exemptions.

- The Trump administration is considering tariff relief for automakers that are dependent on foreign-made parts. The expected exemptions are likely to cover tariffs initially imposed to curb fentanyl production, as well as those on steel and aluminum imports. However, fully assembled foreign vehicles would remain subject to the 25% duty, and automakers would still face separate 25% tariffs on auto parts set to take effect May 3.

- The decision to scale back tariffs appears to be another concession to business leaders and states, many of whom have expressed skepticism about recent trade restrictions. Prior to signaling potential reductions in Chinese tariffs, the president reportedly held discussions with US executives about the economic impact. One business leader warned that the current tariffs could trigger significant supply chain disruptions within weeks, potentially leading to product shortages and empty store shelves.

- Trump’s policy shift suggests a strategic move toward compromise amid rising trade tensions, which were sparked by the April 2 imposition of reciprocal tariffs. Even after levying tariffs as high as 145% on Chinese imports, the US has been unable to coax Beijing back to the negotiating table. Although Chinese officials have signaled a willingness to engage in talks, they are demanding that Washington first roll back its unilateral tariffs, while also calling for relief from US sanctions and concessions on Taiwan.

- While the easing of tariffs offers some market relief, it creates new uncertainty for businesses deciding whether to expand or retrench. These concessions could be reversed — or additional firms might secure further exemptions — making the policy trajectory difficult to predict. This unpredictability risks dampening economic activity and could foster increased market rigidity in the weeks ahead.

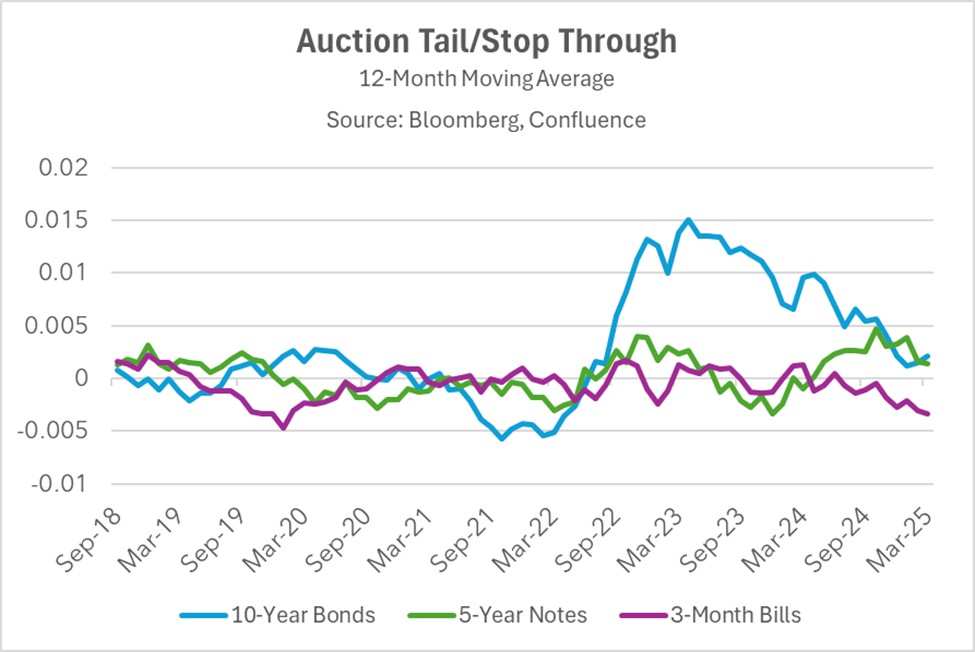

Good Auction, Lingering Questions: While the latest government bond auctions demonstrated solid overall demand, concerns persist about weakening foreign appetite for US Treasurys.

- Wednesday’s Treasury auctions demonstrated continued strong demand for US government debt, particularly in the closely watched five-year note sale, which closed with a modest tail. The auction cleared at a yield of 3.995%, slightly below the 4.005% yield indicated before issuance. This robust performance helped alleviate concerns that trade tensions might be weakening primary market appetite for US debt.

- While the auction results appeared strong at first glance, underlying data suggests a potential shift in market dynamics. The five-year note, typically favored by foreign investors, showed a marked change in buyer composition as domestic participants accounted for 24.8% of allocations, significantly above the 17.7% average, while foreign buyers took just 64.0%, below their typical 70.0% share. The remaining allocations went to primary dealers.

- This single auction’s allocation shift likely warrants little concern in isolation. However, should this pattern persist, it could pose significant challenges. Reduced participation from international buyers — typically less sensitive to interest rate fluctuations — may weaken a crucial stabilizing force in Treasury markets. With government debt supply continuing to grow, such a trend could ultimately complicate efforts to maintain stability in 10-year Treasury yields.

- While we acknowledge that interest rates remain susceptible to shifting global forces, we retain a favorable bias toward bonds, especially in the intermediate-to-long duration space. Our outlook reflects anticipated demand from investors likely to use Treasurys as a hedge against mounting economic uncertainty. Should macroeconomic conditions deteriorate further, these securities would likely see additional upside.

Iran Talks: Nuclear talks between the US and Iran continue to make progress as both sides look to make a deal to avoid a military conflict.

- Secretary of State Marco Rubio has signaled Washington’s openness to permitting Iran’s civilian nuclear program to continue, provided Tehran ceases all domestic uranium enrichment. Under such an arrangement, Iran would need to rely on imported uranium to offset its restricted production capacity. This proposal comes as Iran currently possesses uranium enriched to 60% purity — just one technical step below the 90% threshold that is considered weapons-grade.

- To date, Iran has demonstrated no readiness to curtail its uranium enrichment program, asserting its right to civilian nuclear development under the Non-Proliferation Treaty. Tehran has further insisted that negotiations be strictly limited to nuclear matters, explicitly excluding discussions about its support for regional militant groups or ballistic missile program.

- While the two sides remain unlikely to reach an agreement in the near term, negotiations are expected to continue, with the next round scheduled for Saturday. Continued dialogue reduces the immediate risk of military confrontation — a positive development for risk assets. However, should talks collapse, the US or Israel may consider military action to prevent Iran from acquiring nuclear weapons capability.