Daily Comment (April 25, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is still analyzing the latest earnings reports while adjusting to other developments. In sports news, the Tennessee Titans made Cam Ward their number one draft pick. Today’s Comment will focus on growing speculation about a potential June Fed rate cut, discuss the easing of trade tensions between the US and China, and review other notable market-moving stories. As always, we’ll conclude with a comprehensive summary of domestic and international economic data releases.

Rate Cut Hopes Alive? While Fed officials have been adamant about being patient about the pace of rate cuts, they have not ruled it out completely.

- While the Fed is expected to hold rates steady in May, momentum appears to be building for a potential rate cut in June. Cleveland Fed President Elizabeth Hammack suggested that officials could act in June if there is “clear and convincing” evidence about the economy’s trajectory. Her remarks hint at the Fed’s willingness to respond to signs of an impending recession. On the same day, Fed Governor Christopher Waller noted that evidence of job losses due to tariffs could also influence policy decisions.

- The decision to delay action by a month stems from the central bank’s desire to assess the economic impact of recent tariffs. Survey data indicates growing pessimism among consumers and businesses, which is likely to dampen spending and investment. However, real-time indicators, including weekly jobless claims, have yet to signal an imminent economic crisis.

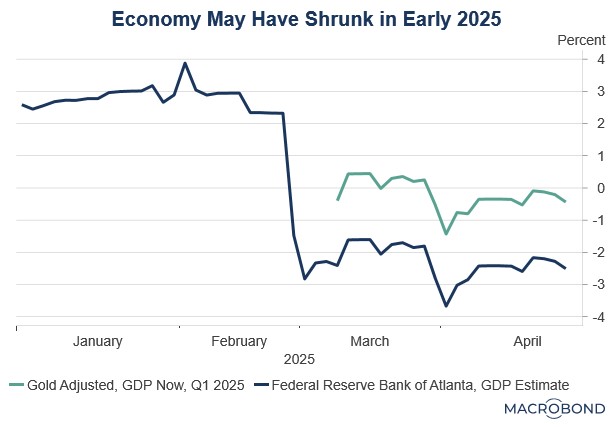

- A shift toward rate cuts would likely appease the president, who has repeatedly argued that the Fed should take stronger action to support economic stability. Despite limited concrete evidence, recession risks remain elevated. Just one week ahead of the official report, the Atlanta Fed’s GDPNow model has signaled that there may have been an economic contraction in the first quarter of the year.

- The Fed is likely to remain patient for the foreseeable future, ensuring that inflation and unemployment trends align with its mandate. Its cautious approach reinforces market confidence in its data-dependent stance, avoiding perceptions of discretionary or politically influenced decisions. By maintaining this credibility, the Fed enhances the effectiveness of its policy tools, ensuring that future rate cuts transmit more efficiently to intermediate and long-term rates.

US-China: The world’s two largest economies are carefully decoupling and reducing mutual dependence while striving to avoid severe market disruptions.

- On Friday, Chinese officials unveiled emergency contingency plans designed to buffer the economy against potential external shocks from escalating trade tensions. While emphasizing that these measures remain precautionary for now, policymakers have rolled out a comprehensive stimulus package featuring monetary easing tools and targeted financing mechanisms. This move follows Beijing’s recent commitment to a record-high budget deficit.

- Additionally, China appears to be taking steps to address US concerns about its historical overreliance on export-driven growth, as highlighted by Treasury Secretary Scott Bessent earlier this week. In response to these remarks, China’s Commerce Ministry has prioritized moves to better integrate domestic and foreign trade development. Supporting this initiative, Walmart has launched a program to help Chinese suppliers shift their sales focus from the US market to domestic channels.

- US companies are increasingly demonstrating their willingness to diversify supply chains beyond China. Apple has announced plans to shift the majority of its iPhone production to India as early as next year. This strategic move aligns with deepening US-India trade relations and helps Apple circumvent the punishing 145% US tariffs on Chinese imports.

- As tensions ease and both sides adapt to the new economic landscape, this progress may encourage discussions about targeted tariff exemptions to alleviate bilateral economic pressures. The constructive shift could establish a foundation for productive negotiations toward a mutually beneficial agreement. While these developments appear favorable for risk assets, the true economic impact will only become clear once existing tariffs fully work their way through the system.

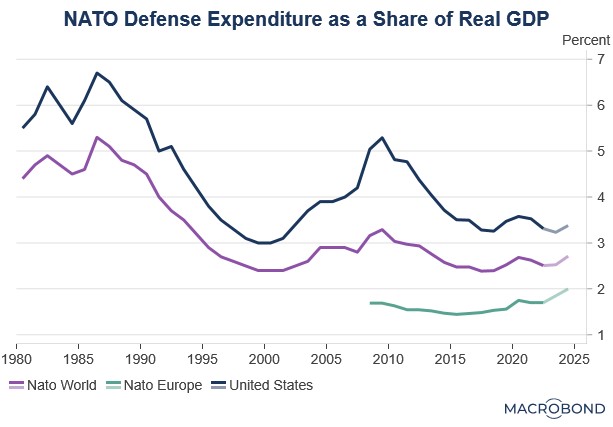

EU Defense Spending: An increasing number of EU member states are boosting defense expenditures to counter external security threats, aligning with the bloc’s plans to establish a dedicated European defense fund.

- Several EU member states have already begun increasing their military expenditures in response to growing security concerns. Poland and Portugal are both expected to formally request exemptions from EU deficit rules to accommodate higher defense spending, while Spanish Prime Minister Pedro Sánchez confirmed that his country expects to reach NATO’s 2% GDP defense target this year.

- European leaders are accelerating defense spending initiatives as the EU prepares to introduce jointly backed bonds to fund military modernization. This financing mechanism would support both EU member states and allied nations, with Brussels recently announcing that non-EU countries may access these funds through new Security Action for Europe (SAFE) agreements, which are subject to participation fees and bilateral security commitments.

- Defense spending has emerged as a key catalyst for European equities, with the EU’s decision to permit deficit-funded military investments expected to provide fiscal stimulus to the region. This development comes amid ongoing trade tensions with the United States, creating a potential counterbalance that should continue to support European markets. The structural shift toward increased defense expenditures is likely to deliver sustained tailwinds for equities across the continent.

Canada Elections: Canadian Prime Minister Mark Carney is entering the final stretch of the campaign as the apparent frontrunner, though late shifts in voter sentiment could still change the outcome.

- Recent polls show that Liberal leader Mark Carney is holding a narrow four-point lead over Conservative rival Pierre Poilievre. Carney’s edge was bolstered by backlash to President Trump’s controversial trade actions against Canada and his inflammatory comment likening the country to a “51st state.” However, the gap appears to be tightening as Conservatives gain ground, fueled by rising voter anxiety over the cost of living — an issue that traditionally plays to Conservative strengths.

- The election’s outcome may prove decisive in shaping the future of US-Canada trade relations. This development follows President Trump’s recent remarks challenging Canada’s role in the US automotive industry, including threats of escalated tariffs on Canadian vehicle exports. In response, Carney has proposed economic stimulus measures to reduce Canada’s dependence on US trade, while Poilievre has focused on deregulation as his preferred solution to boost competitiveness.

- Next Tuesday’s election will likely determine Canada’s approach in upcoming trade negotiations with the United States, talks that could significantly impact Canada’s automotive sector. Whichever candidate prevails will face the immediate challenge of convincing automakers to maintain their Canadian operations despite growing pressure from US tariffs, particularly for access to one of the world’s largest consumer markets.